Answered step by step

Verified Expert Solution

Question

1 Approved Answer

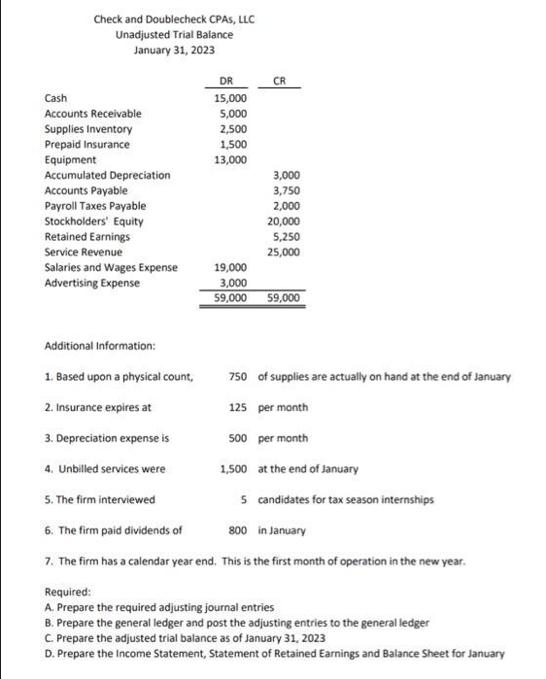

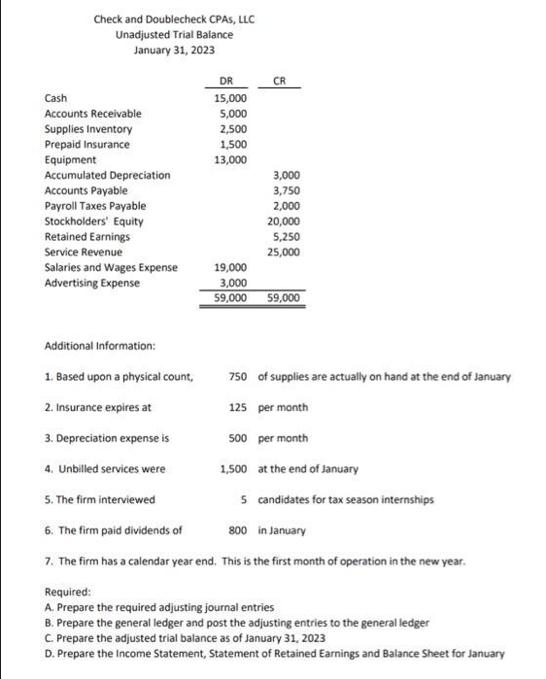

Unadjusted trial balance of the company is given below Check and Doublecheck CPAS, LLC Unadjusted Trial Balance January 31, 2023 Cash Accounts Receivable Supplies Inventory

Unadjusted trial balance of the company is given below

Check and Doublecheck CPAS, LLC Unadjusted Trial Balance January 31, 2023 Cash Accounts Receivable Supplies Inventory Prepaid Insurance Equipment Accumulated Depreciation Accounts Payable Payroll Taxes Payable Stockholders' Equity Retained Earnings Service Revenue Salaries and Wages Expense Advertising Expense DR 15,000 5,000 2,500 1,500 13,000 19,000 3,000 59,000 3,000 3,750 2,000 20,000 5,250 25,000 59,000 Additional Information: 1. Based upon a physical count, 2. Insurance expires at 3. Depreciation expense is 4. Unbilled services were 5. The firm interviewed 5 candidates for tax season internships 6. The firm paid dividends of 800 in January 7. The firm has a calendar year end. This is the first month of operation in the new year. Required: A. Prepare the required adjusting journal entries B. Prepare the general ledger and post the adjusting entries to the general ledger C. Prepare the adjusted trial balance as of January 31, 2023 D. Prepare the Income Statement, Statement of Retained Earnings and Balance Sheet for January 750 of supplies are actually on hand at the end of January 125 per month 500 per month 1,500 at the end of January

Step by Step Solution

★★★★★

3.46 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

A Prepare the required adjusting journal entries Supplies Expense Supplies Inventory 2500Supplies Expense 750 Reason Supplies decreased by the amount ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started