Question

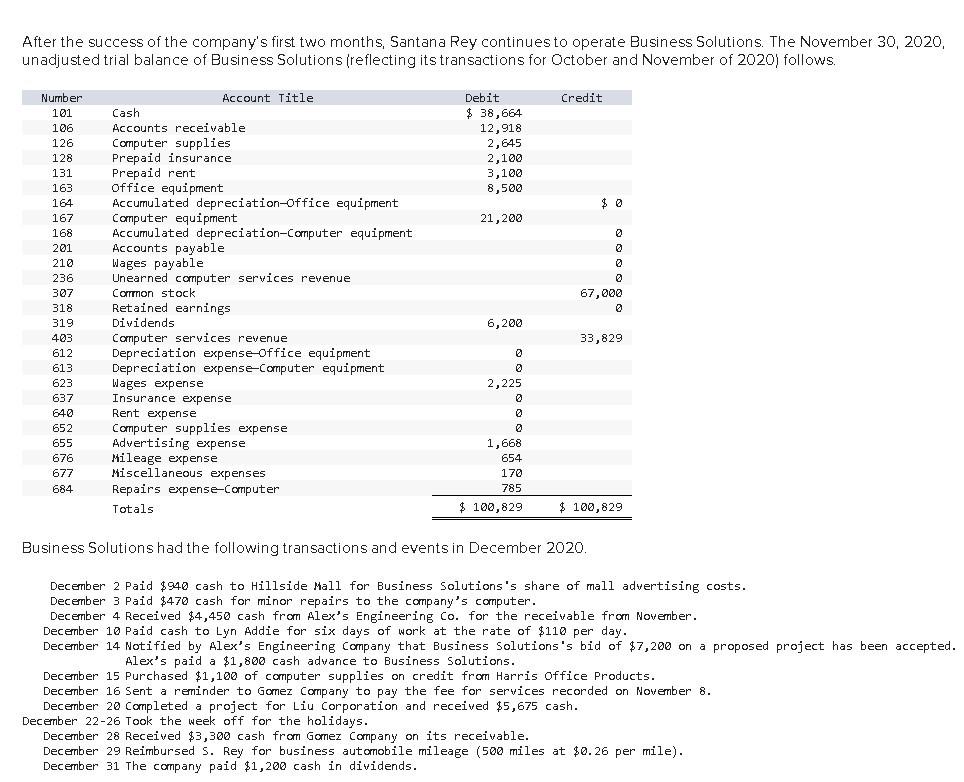

Unadjusted Trial Balance on December 31, 2020, 9 points Part I, Step 1 listed above, contains instructions to prepare the unadjusted trial balance after posting

Unadjusted Trial Balance on December 31, 2020, 9 points

Part I, Step 1 listed above, contains instructions to prepare the unadjusted trial balance after posting the activity transactions to the general ledger. This consists of general ledger balances after the December activity has been posted, but before any adjusting journal entries are posted. Manually complete the unadjusted trial balance on the form you printed or saved.

Adjusted Trial Balance on December 31, 2020, 3 points

During your work in Part I, step 3 in Connect you completed the adjusted trial balance. This is NOT the same as the unadjusted trial balance. Enter your Connect solution on the adjusted trial balance form to upload to Canvas. A picture of your Connect unadjusted trial balance will earn zero points.

Post-Closing Trial Balance on December 31, 2020, 3 points

During your work in Part I, step 8 in Connect you completed a post-closing trial balance. This is NOT the same as the other two previously completed trial balances. Enter your Connect solution onto the post-closing trial balance form. A picture of your Connect post-closing trial balance will earn zero points.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started