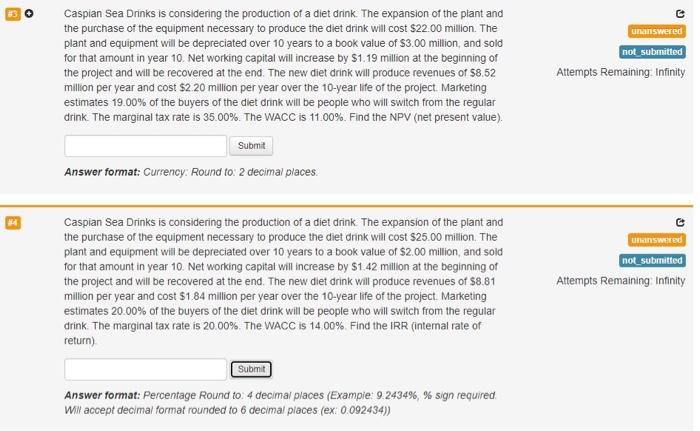

# Unanswered Caspian Sea Drinks is considering the production of a diet drink. The expansion of the plant and the purchase of the equipment necessary to produce the diet drink will cost $22.00 million. The plant and equipment will be depreciated over 10 years to a book value of $3.00 million, and sold for that amount in year 10. Net working capital will increase by 91.19 million at the beginning of the project and will be recovered at the end. The new diet drink will produce revenues of $8.52 million per year and cost $2.20 million per year over the 10-year life of the project. Marketing estimates 19.00% of the buyers of the diet drink will be people who will switch from the regular drink. The marginal tax rate is 35.00%. The WACC is 11.00% Find the NPV (net present value). not submitted Attempts Remaining Infinity Submit Answer format: Currency. Round to: 2 decimal places C Unswered Caspian Sea Drinks is considering the production of a diet drink. The expansion of the plant and the purchase of the equipment necessary to produce the diet drink will cost $25.00 million. The plant and equipment will be depreciated over 10 years to a book value of $2.00 million, and sold for that amount in year 10. Net working capital will increase by $1.42 million at the beginning of the project and will be recovered at the end. The new diet drink will produce revenues of $8.81 million per year and cost $1.84 million per year over the 10-year life of the project. Marketing estimates 20.00% of the buyers of the diet drink will be people who will switch from the regular drink. The marginal tax rate is 20.00% The WACC is 14.00% Find the IRR (internal rate of return) not submitted Attempts Remaining Infinity Submit Answer format: Percentage Round to 4 decimal places (Example: 9.2434%, % sign required Will accept decimal format rounded to 6 decimal places (ex: 0.092434)) # Unanswered Caspian Sea Drinks is considering the production of a diet drink. The expansion of the plant and the purchase of the equipment necessary to produce the diet drink will cost $22.00 million. The plant and equipment will be depreciated over 10 years to a book value of $3.00 million, and sold for that amount in year 10. Net working capital will increase by 91.19 million at the beginning of the project and will be recovered at the end. The new diet drink will produce revenues of $8.52 million per year and cost $2.20 million per year over the 10-year life of the project. Marketing estimates 19.00% of the buyers of the diet drink will be people who will switch from the regular drink. The marginal tax rate is 35.00%. The WACC is 11.00% Find the NPV (net present value). not submitted Attempts Remaining Infinity Submit Answer format: Currency. Round to: 2 decimal places C Unswered Caspian Sea Drinks is considering the production of a diet drink. The expansion of the plant and the purchase of the equipment necessary to produce the diet drink will cost $25.00 million. The plant and equipment will be depreciated over 10 years to a book value of $2.00 million, and sold for that amount in year 10. Net working capital will increase by $1.42 million at the beginning of the project and will be recovered at the end. The new diet drink will produce revenues of $8.81 million per year and cost $1.84 million per year over the 10-year life of the project. Marketing estimates 20.00% of the buyers of the diet drink will be people who will switch from the regular drink. The marginal tax rate is 20.00% The WACC is 14.00% Find the IRR (internal rate of return) not submitted Attempts Remaining Infinity Submit Answer format: Percentage Round to 4 decimal places (Example: 9.2434%, % sign required Will accept decimal format rounded to 6 decimal places (ex: 0.092434))