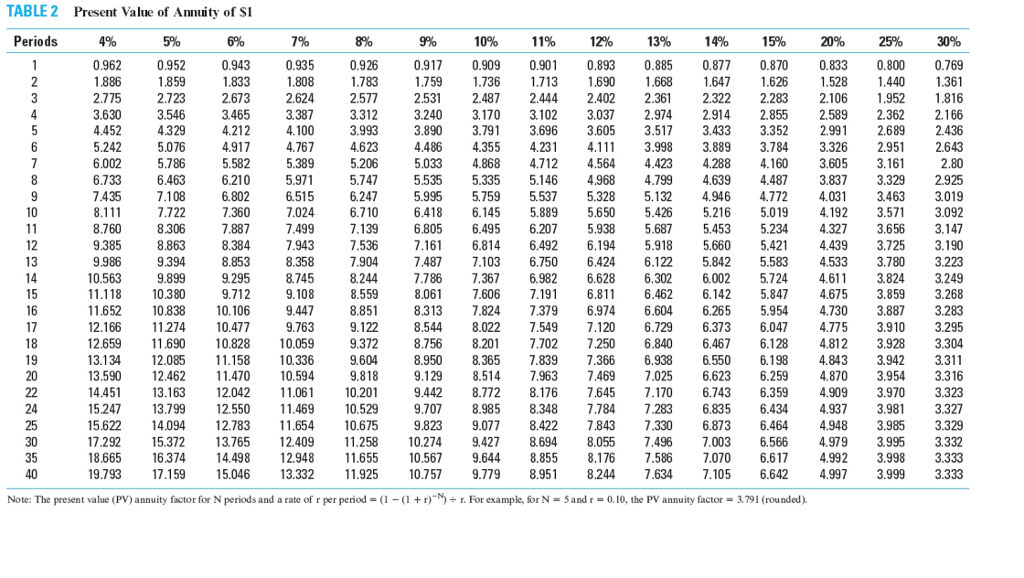

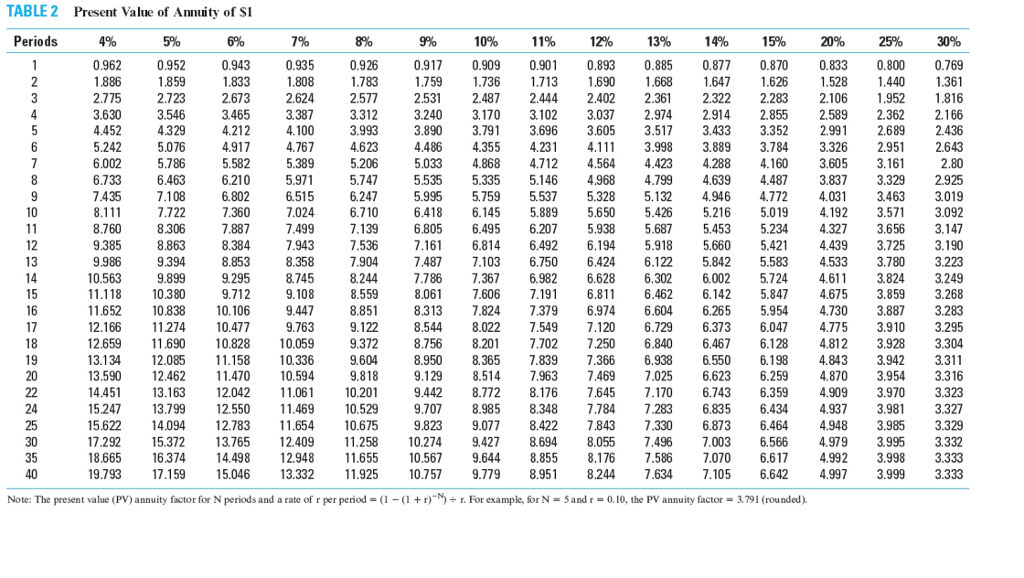

BLE2 Present Value of Annuity of S1 Periods 4% 7% 10% 11% 12% 13% 14% 15% 20% 30% 0.962 0,952 0.943 0.935 0.926 0.917 0.909 0.90 0.893 0.885 0.877 0.870 0.833 0.800 0.769 1.886 ,859 1.833 1.808 1.783 1.759 1.736 713 1.690 668 1.647 1.626 528 1.440 1.361 2.723 2.624 2.775 2.673 2.577 2.53 2.487 2.444 2.402 2.36 2.322 2.283 2.106 1.952 1.816 3.387 3.630 3.546 3.465 3312 3.240 3.170 3102 3.037 2.974 2.914. 2.855 2.589 2.362 2.166 4.452 4.329 4.212 4.100 3.993 3.890 3.79 3.696 3,605 3.517 3.433 3.352 2.99 2.689 2.436 5.242 4.767 2.643 5.076 4.917 4.623 4,486 4.355 4.23 3.998 3.889 3.784 3.326 2.951 6.002 5.786 5.582 5.389 5.206 5.033 4.868 4.712 4.564 4.423 4.288 4.160 3.605 3.161 2.80 6.733 6463 6.210 5.97 5.747 5.535 5.335 5.146 4.799 4.487 3.837 3.329 2.925 4,968 4.639 6.802 6.247 7.435 7.108 6515 5.995 5.759 5.537 5.328 5.132 4.946 4.772 4.031 3463 3.019 7.722 7.360 7.024 6.710 6.418 6.145 5.889 5.650 5.426 5.216 5.019 4.192 3.571 3.092 7.887 7.499 8.760 8.306 7.139 6,805 6.495 6.207 5.938 5.687 5.453 5.234 4.327 3,656 3.147 8.863 8.384 9,385 7.943 7.536 7.16 6.814 6.492 6,194 5.918 5.660 5.421 4.439 3.725 3.190 9.986 9.394 8.853 7.904 7.487 7.103 6.750 6,424 6.122 5.842 5.583 4.533 3,780 3.223 8.358 10.563 9.899 18 0.380 9295 8.745 8.244 7.786 7.367 6.982 6.628 6.302 6.002 5.724 4,611 3824 3.249 15 9.712 9.108 8.559 8.061 7.606 7.19 6.811 6.462 6.142 5.847 4.675 3.859 3.268 11.652 0.838 0.106 9.447 8.851 8,313 7.824 7.379 6,974 6.604 6.265 5.954 4.730 3,887 3.283 8.544 8.022 7.549 7.120 6.729 6.373 6.047 12.166 11.274 9.763 17 10.477 9.122 4.775 3.910 3.295 12.659 11 690 10.828 10.059 9.372 8,756 8.20 7.702 7.250 6.840 6,467 6.128 4.812 3,928 3.304 7.366 6.938 6,550 198 4.843 3942 3.3 13.134 12.085 11.158 10.336 9604 8.950 8.365 7.839 20 13.590 12.462 11.470 0.594 9.818 9.129 8.514 7.963 7.469 7.025 6.623 6.259 4.870 3.954 3.316 14.45 3.163 2.042 1.061 10.201 9.442 8.772 8.176 7,645 7.170 6.743 6.359 4.909 3.970 3.323 24 15.247 13.799 12.550 1.469 10.529 9.707 8.985 8.348 7,784 7.283 6.835 6.434 4.937 3.981 3.327 25 15.622 14.094 12.783 11.654 0.675 9.823 9.077 8.422 7,843 7.330 6.873 6.464 4.948 3.985 3.329 17.292 15.372 13.765 12.409 0.274 9,427 8694 8.055 7,496 7.003 4.979 3995 30 258 6.566 3.332 35 18.665 6.374 4498 2.948 11.655 10.567 9.644 8.855 8.176 7.586 7.070 6.617 4992 3.998 3.333 19.793 7.159 5.046 3.332 11.925 10.757 9.779 8.95 8.244 7.634. 7.105 6.642 4.997 3.999 3.333 Note: The present value (PV) annu factor for N periods and arate of r per period r. For example, forN 5 and r 0.10, the PV annuity factor 3791 (rounded)