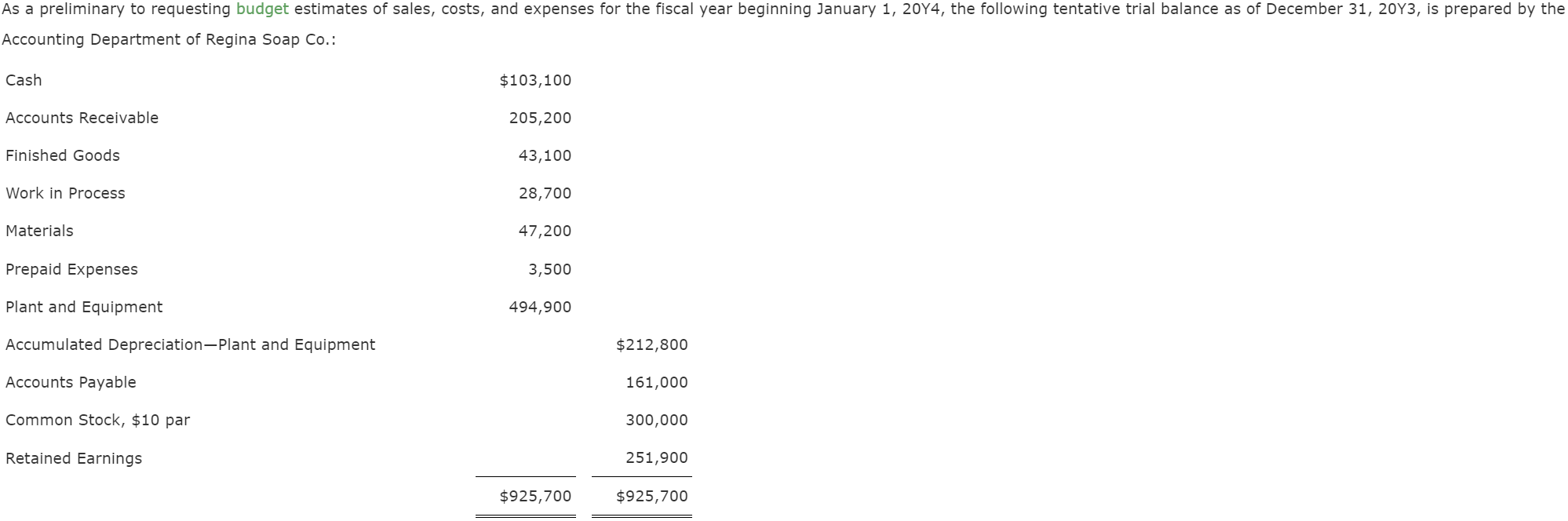

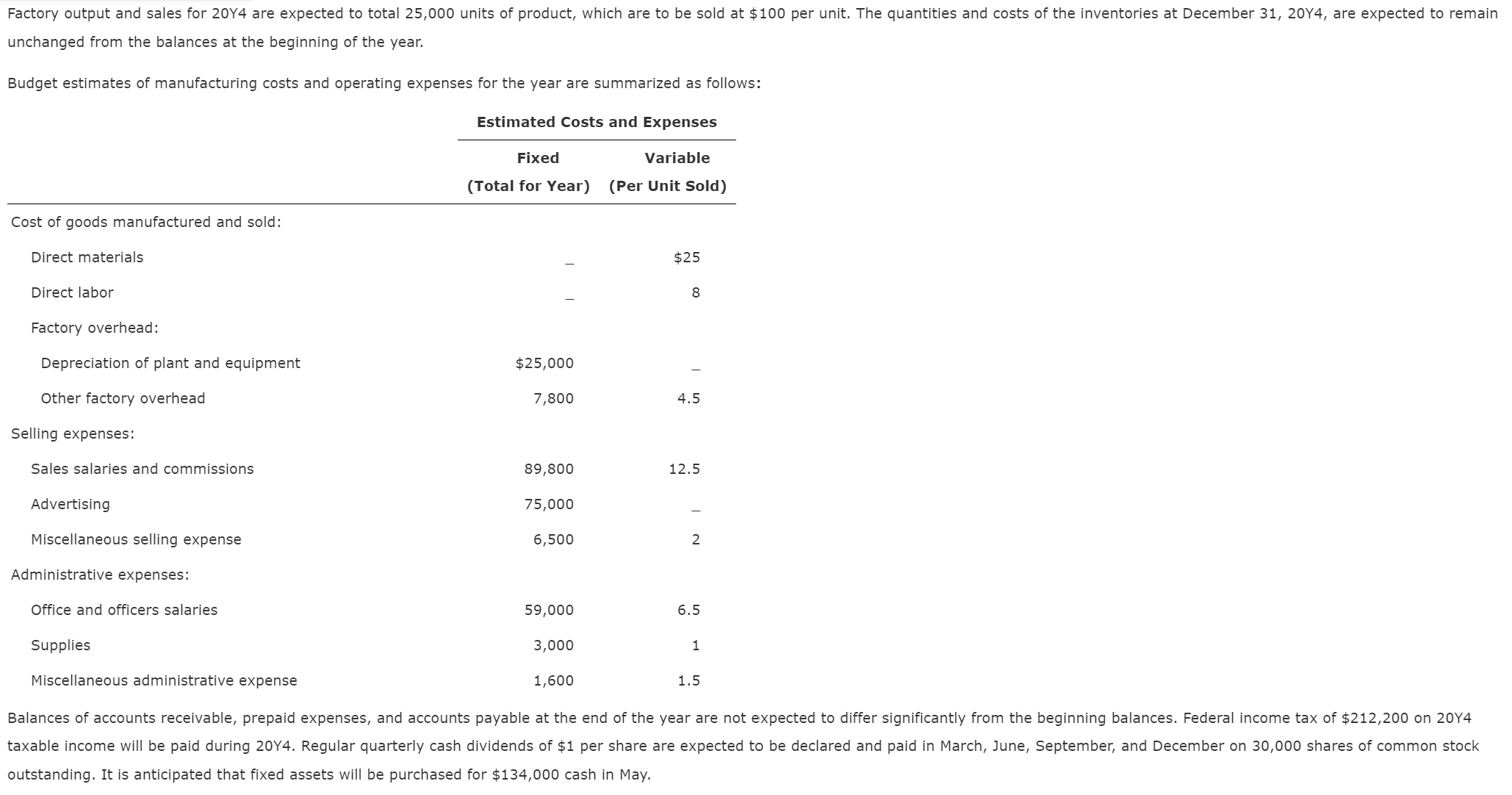

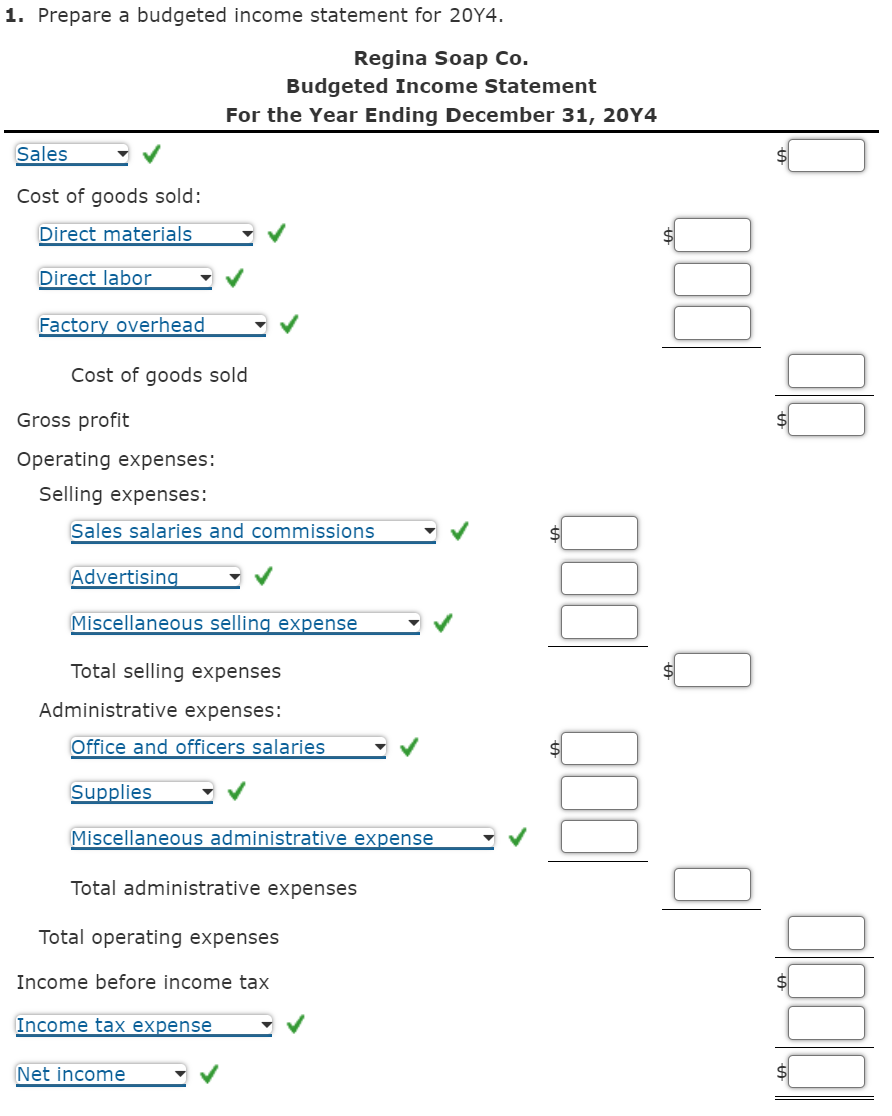

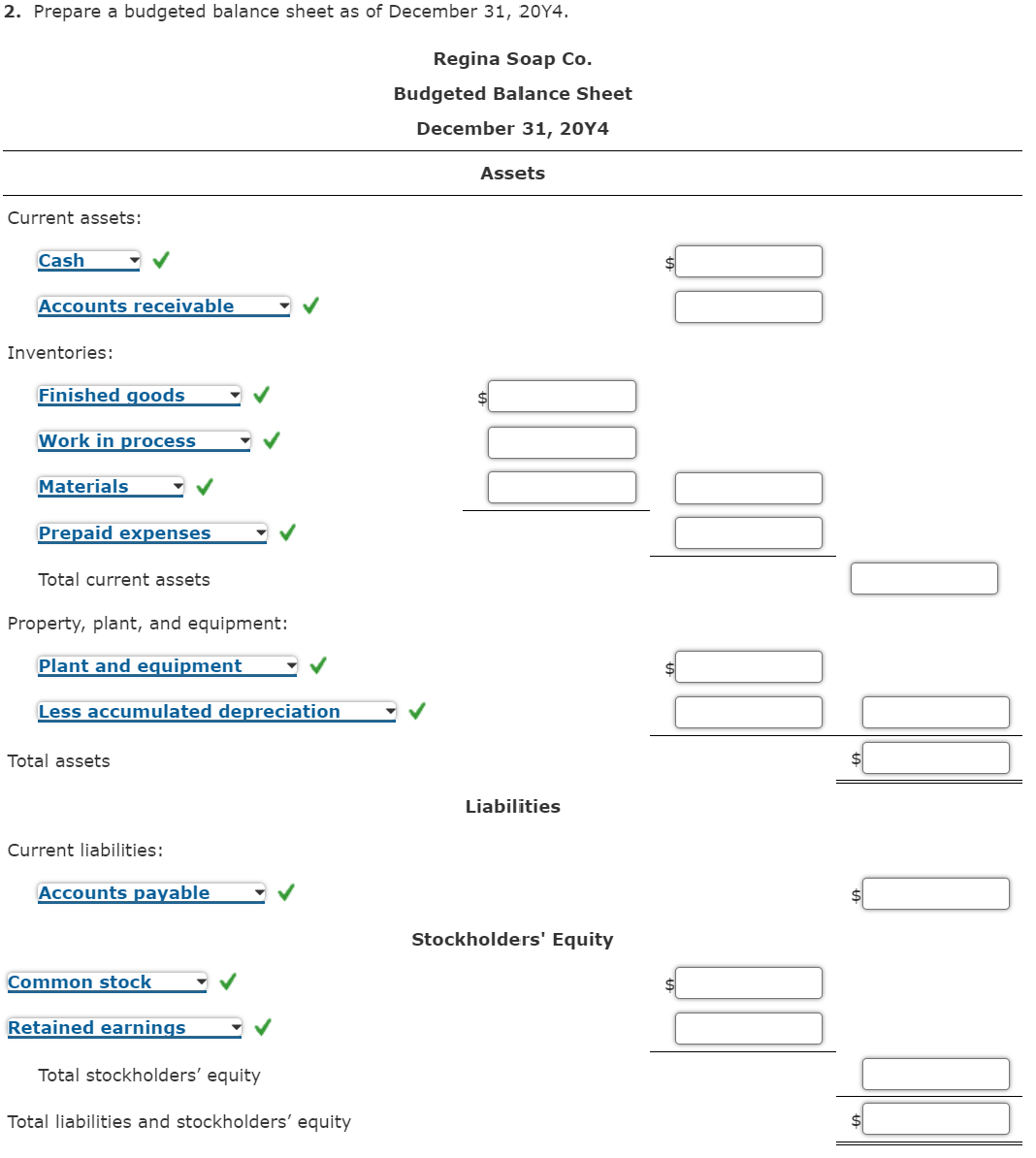

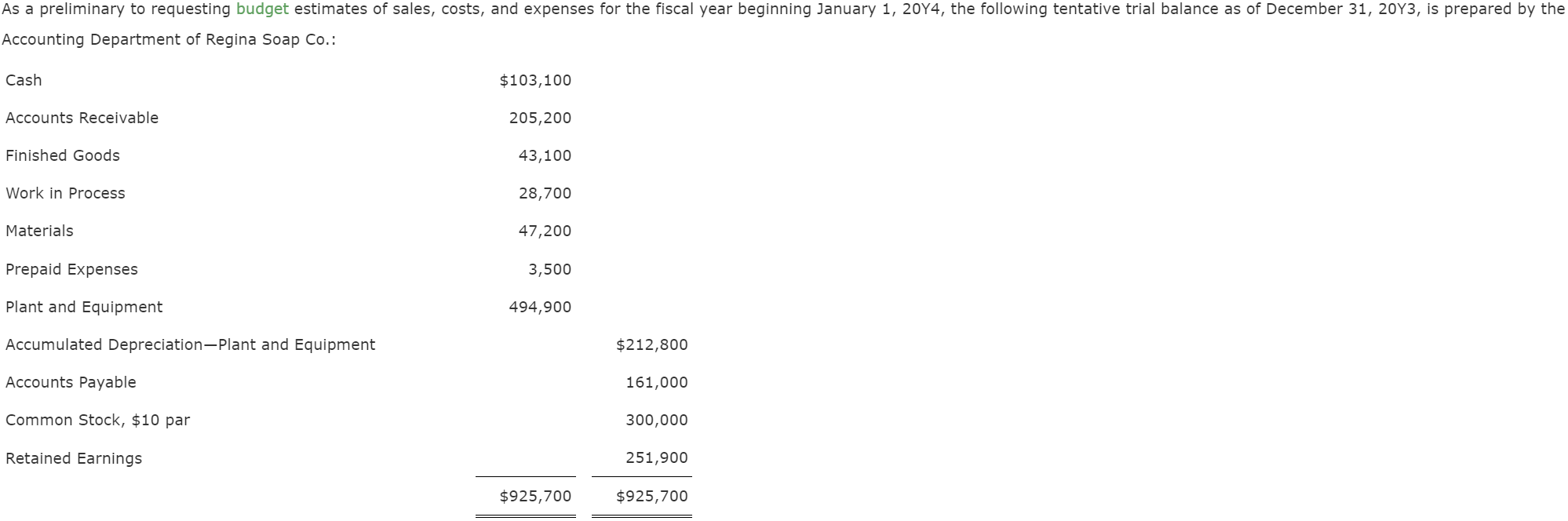

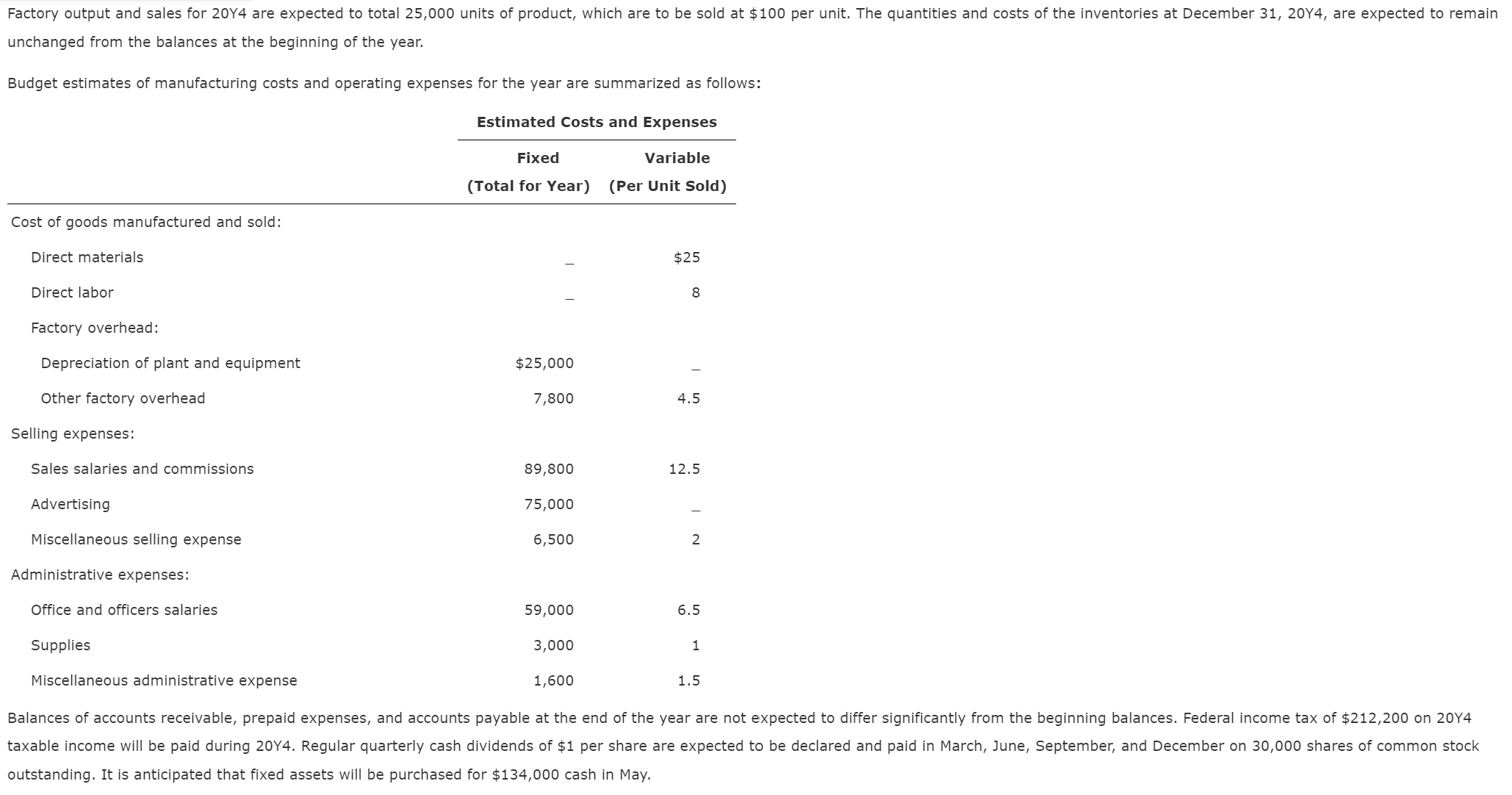

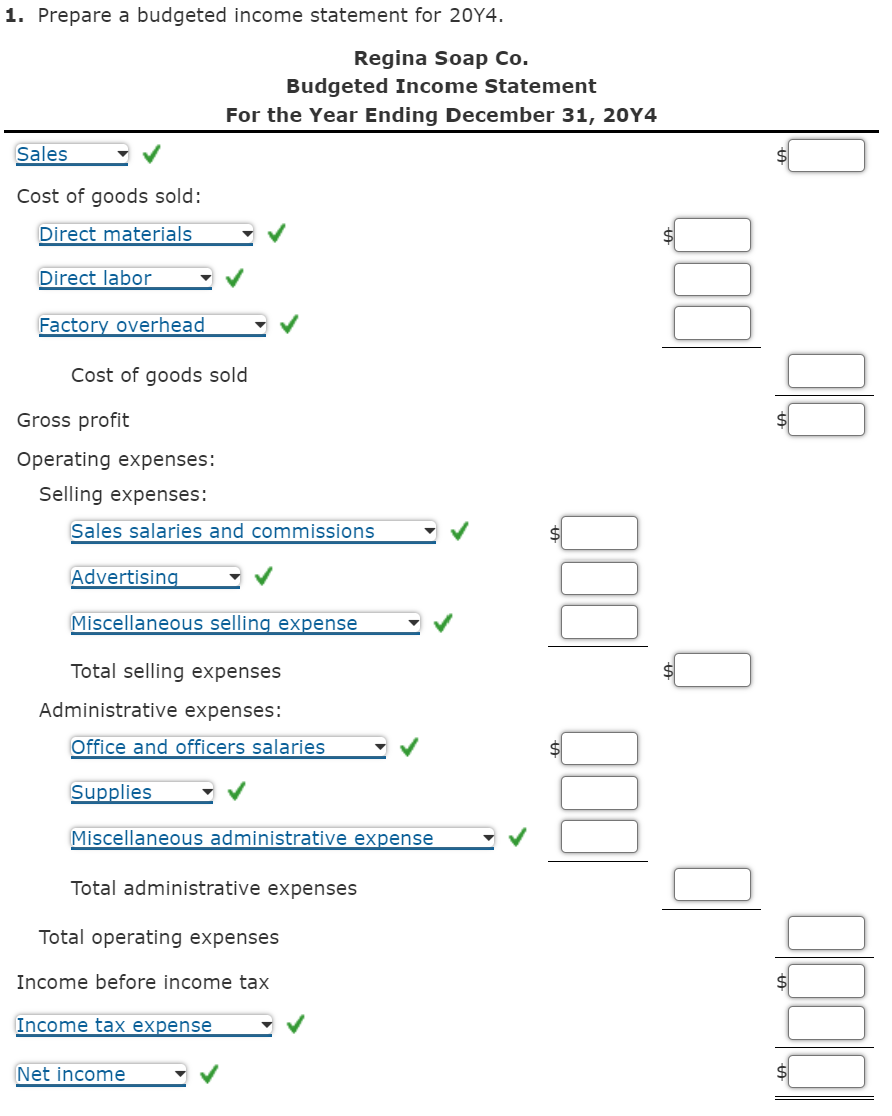

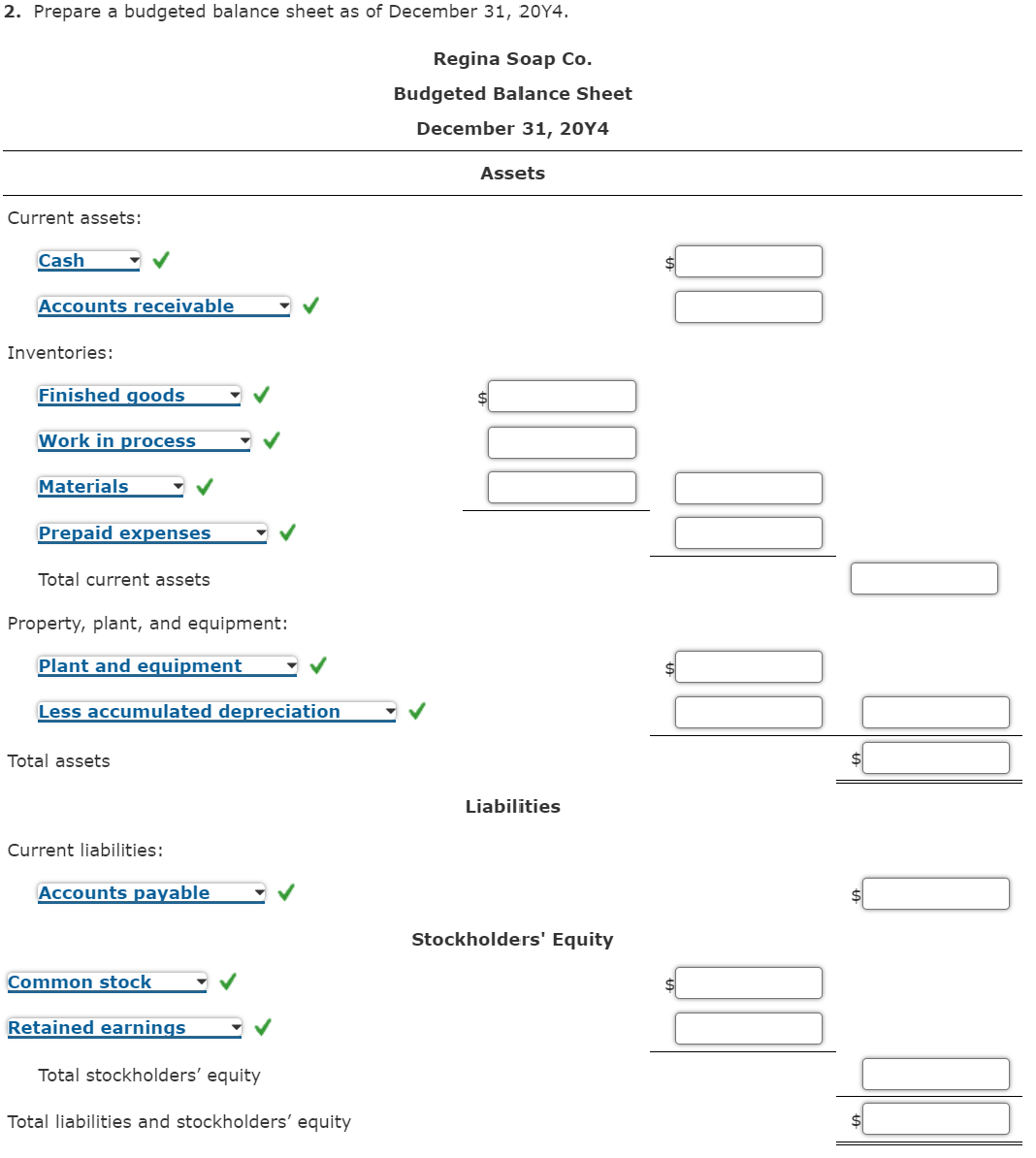

unchanged from the balances at the beginning of the year. Budget estimates of manufacturing costs and operating expenses for the year are summarized as follows: outstanding. It is anticipated that fixed assets will be purchased for $134,000 cash in May. . Accounting Department of Regina Soap Co.: Cash Accounts Receivable Finished Goods Work in Process Materials Prepaid Expenses Plant and Equipment Accumulated Depreciation-Plant and Equipment Accounts Payable Common Stock, \$10 par Retained Earnings \begin{tabular}{rr} $103,100 & \\ 205,200 & \\ 43,100 & \\ 28,700 & \\ 47,200 & \\ 3,500 & \\ 494,900 & \\ & $212,800 \\ & 161,000 \\ & 300,000 \\ & $925,700 \\ \hline \hline \end{tabular} 1. Prepare a budgeted income statement for 20Y4. Regina Soap Co. Budgeted Income Statement For the Year Ending December 31, 20 Y4 Sales Cost of goods sold: Direct materials Direct labor Factory overhead Cost of goods sold Gross profit Operating expenses: Selling expenses: Sales salaries and commissions Advertising Miscellaneous selling expense Total selling expenses Administrative expenses: Office and officers salaries Supplies Miscellaneous administrative expense Total administrative expenses Total operating expenses Income before income tax Income tax expense Net income $ $ unchanged from the balances at the beginning of the year. Budget estimates of manufacturing costs and operating expenses for the year are summarized as follows: outstanding. It is anticipated that fixed assets will be purchased for $134,000 cash in May. . Accounting Department of Regina Soap Co.: Cash Accounts Receivable Finished Goods Work in Process Materials Prepaid Expenses Plant and Equipment Accumulated Depreciation-Plant and Equipment Accounts Payable Common Stock, \$10 par Retained Earnings \begin{tabular}{rr} $103,100 & \\ 205,200 & \\ 43,100 & \\ 28,700 & \\ 47,200 & \\ 3,500 & \\ 494,900 & \\ & $212,800 \\ & 161,000 \\ & 300,000 \\ & $925,700 \\ \hline \hline \end{tabular} 1. Prepare a budgeted income statement for 20Y4. Regina Soap Co. Budgeted Income Statement For the Year Ending December 31, 20 Y4 Sales Cost of goods sold: Direct materials Direct labor Factory overhead Cost of goods sold Gross profit Operating expenses: Selling expenses: Sales salaries and commissions Advertising Miscellaneous selling expense Total selling expenses Administrative expenses: Office and officers salaries Supplies Miscellaneous administrative expense Total administrative expenses Total operating expenses Income before income tax Income tax expense Net income $ $