Question

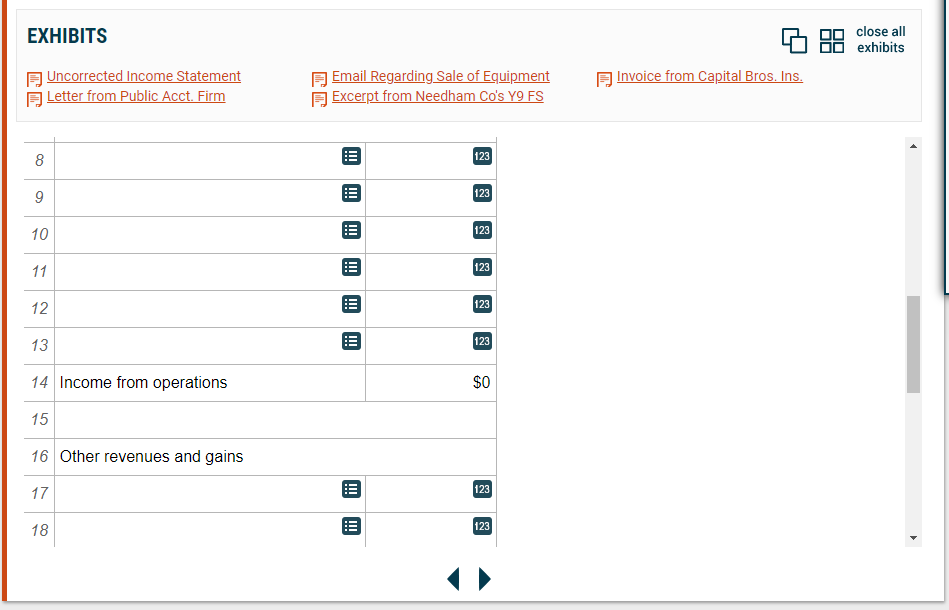

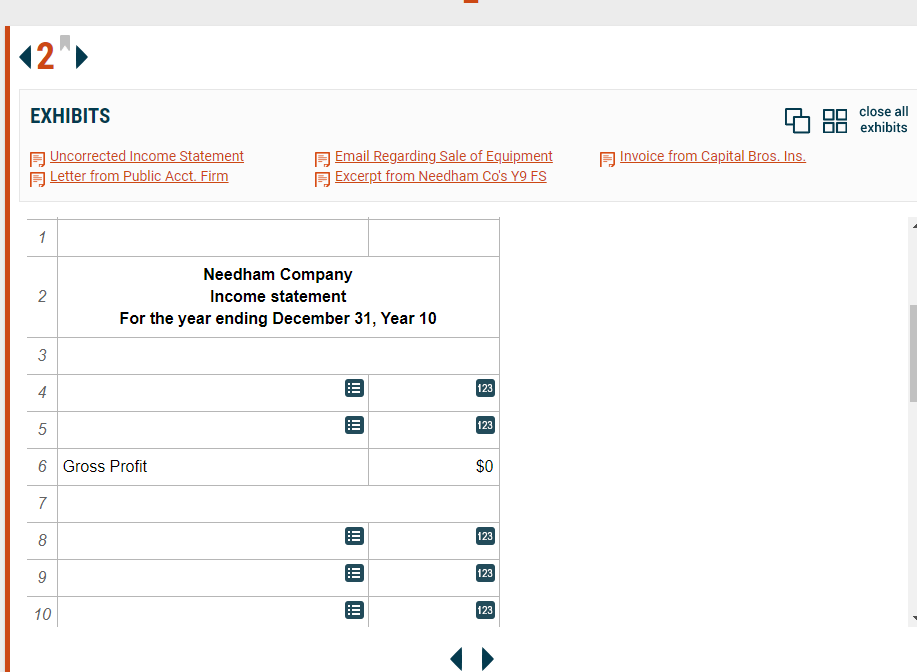

Uncorrected Income Statement Needham Company Uncorrected Income Statement For the year ending December 31, Year 10 Net sales revenue $2,225,000 Cost of goods sold (621,500)Gross

650,000

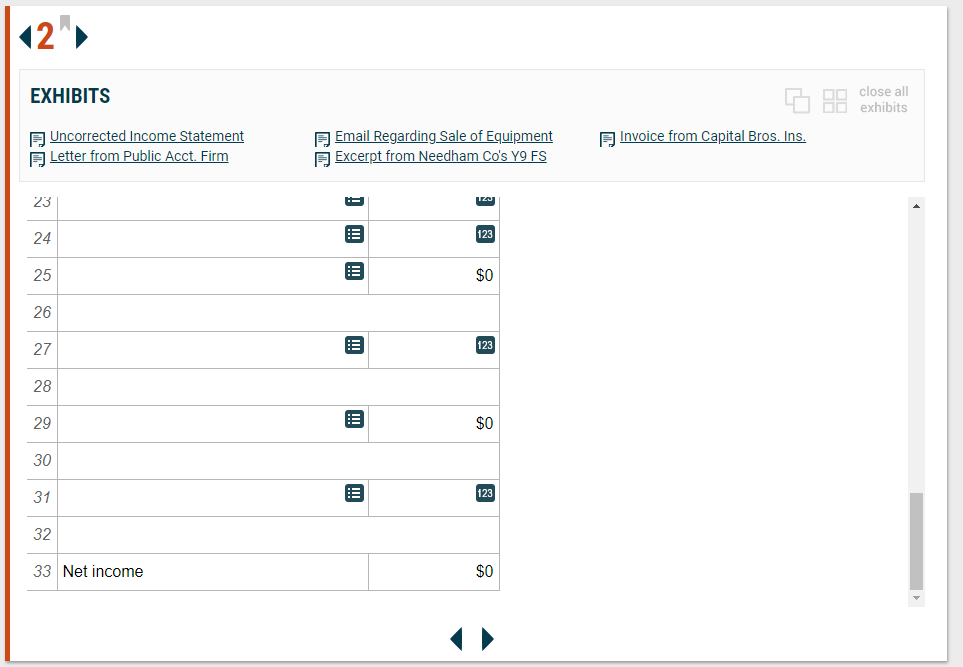

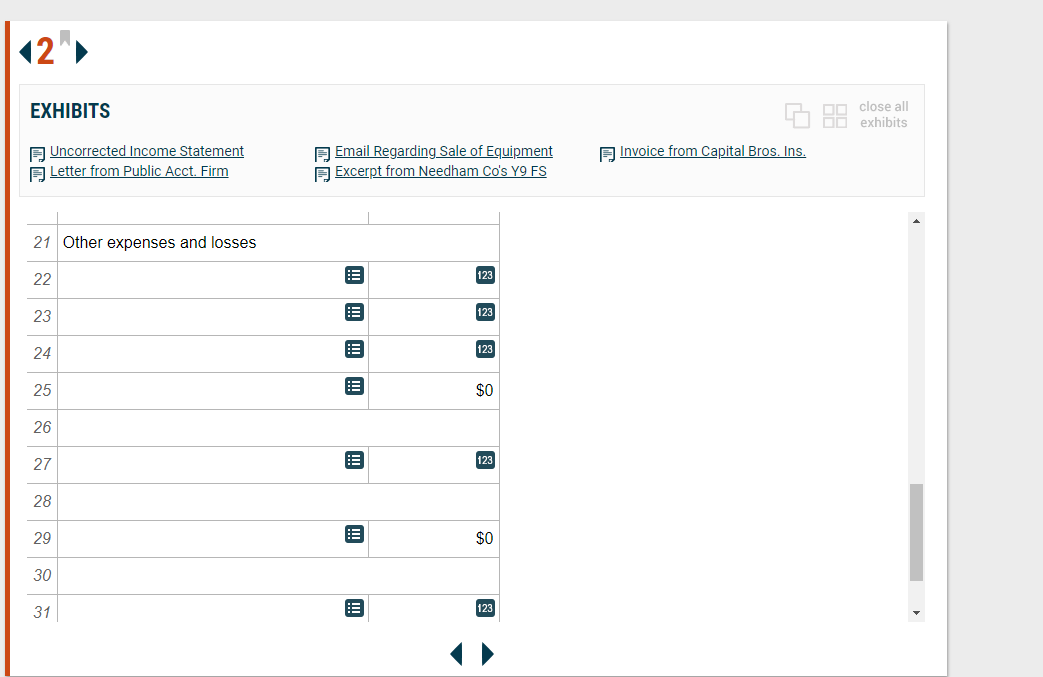

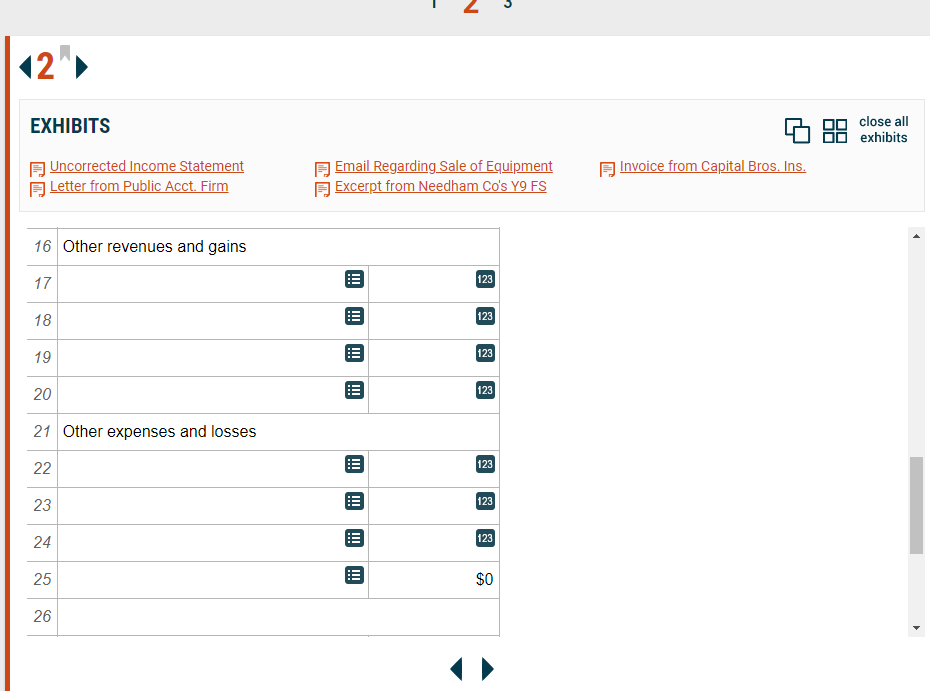

Other expenses and losses Interest expense (15,000)Depreciation expense (23,580) Net income$1,571,800

E-mail Regarding Sale of Equipment From: accountant@needham.com To: controller@needham.com Sent: December 15, Year 10 Subject: Equipment sale Fred, I just received the documentation regarding the sale of our production line equipment that was completed December 1. I wanted to let you know that I have recorded the transaction in the general ledger and therefore it will be reflected in our year-end financial statements. Included is a screen shot of the journal entry I recorded. Have a great weekend and dont forget to cheer on those Dawgs! Roger

Journal entry No. 958 Posted by: Roger AccountantTitle: Record sale of production line equipment Date: December 14, Year 10 Cash 792,000 Accumulated depreciation 728,000 Equipment 1,200,000 Sales revenue 320,000

Invoice from Capital Brothers Insurance

INVOICE

Capital Brothers Insurance

Date: July 5, Year 10 Invoice No. 105 Capital Brothers Insurance 100 Park Avenue New York, NYTO Needham Company 20 Forest Park Way Atlanta, GALetter from Public Accounting Firm To: Controller, Needham Company From: Jeff Brown, Senior Manager, HBB Independent Auditors Re: Adjusting Journal Entries During our audit of your Year 9 financial statements, we discovered the following errors related to dividends. Please ensure that you make the adjustment so that they are properly reflected in the year-end financial statements. Dividend revenue of $15,000 related to Year 9 was not properly accrued in Year 9. These dividends, received in January, Year 10, were recorded as revenue at that point. In addition, in December Year 10, Spokes Inc. declared a dividend of $2 per share to be payable January 10, Year 11. As Needham Co. owns 5,000 shares of stock in Spokes Inc., you must record the appropriate entry in the Year 10 financial statements. As a reminder, you'll need to recalculate the income tax expense related to continuing operations based on 30% of total income from continuing operations. Thanks for your business and we will see you in a few weeks! Sincerely, Jeff Brown

Excerpt from Needham Co.'s Year 9 Financial Statements Discontinued Operations During Year 9, the company decided to dispose of a business segment that represents a strategic shift in operations. Included in Year 9 net income is income from operations of the discontinued segment totaling $870,000 (net of $320,000 of taxes). The sale of the segment is expected to be finalized during the first quarter of Year 10.

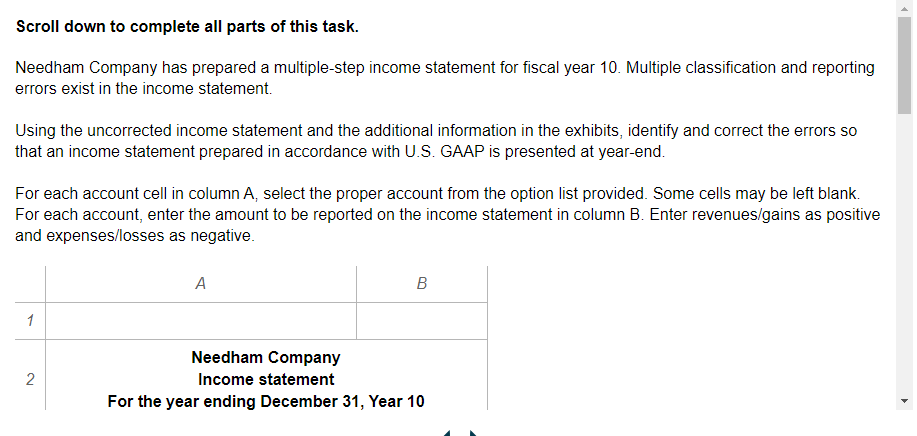

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started