undefined

undefined

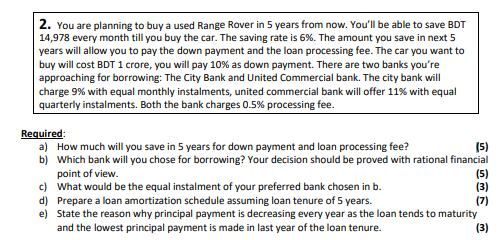

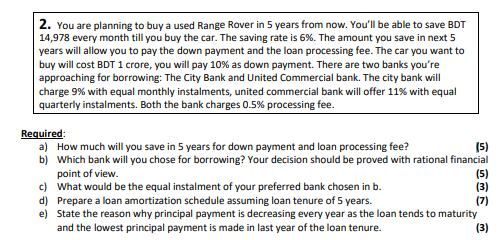

2. You are planning to buy a used Range Rover in 5 years from now. You'll be able to save BDT 14,978 every month till you buy the car. The saving rate is 6%. The amount you save in next 5 years will allow you to pay the down payment and the loan processing fee. The car you want to buy will cost BDT 1 crore, you will pay 10% as down payment. There are two banks you're approaching for borrowing: The City Bank and United Commercial bank. The city bank will charge 9% with equal monthly instalments, united commercial bank will offer 11% with equal quarterly instalments. Both the bank charges 0.5% processing fee. Required: a) How much will you save in 5 years for down payment and loan processing fee? (5) b) Which bank will you chose for borrowing? Your decision should be proved with rational financial point of view. (5) c) What would be the equal instalment of your preferred bank chosen in b. (3) d) Prepare a loan amortization schedule assuming loan tenure of 5 years. (7) e) State the reason why principal payment is decreasing every year as the loan tends to maturity and the lowest principal payment is made in last year of the loan tenure. (3) 2. You are planning to buy a used Range Rover in 5 years from now. You'll be able to save BDT 14,978 every month till you buy the car. The saving rate is 6%. The amount you save in next 5 years will allow you to pay the down payment and the loan processing fee. The car you want to buy will cost BDT 1 crore, you will pay 10% as down payment. There are two banks you're approaching for borrowing: The City Bank and United Commercial bank. The city bank will charge 9% with equal monthly instalments, united commercial bank will offer 11% with equal quarterly instalments. Both the bank charges 0.5% processing fee. Required: a) How much will you save in 5 years for down payment and loan processing fee? (5) b) Which bank will you chose for borrowing? Your decision should be proved with rational financial point of view. (5) c) What would be the equal instalment of your preferred bank chosen in b. (3) d) Prepare a loan amortization schedule assuming loan tenure of 5 years. (7) e) State the reason why principal payment is decreasing every year as the loan tends to maturity and the lowest principal payment is made in last year of the loan tenure. (3)

undefined

undefined