undefined

undefined

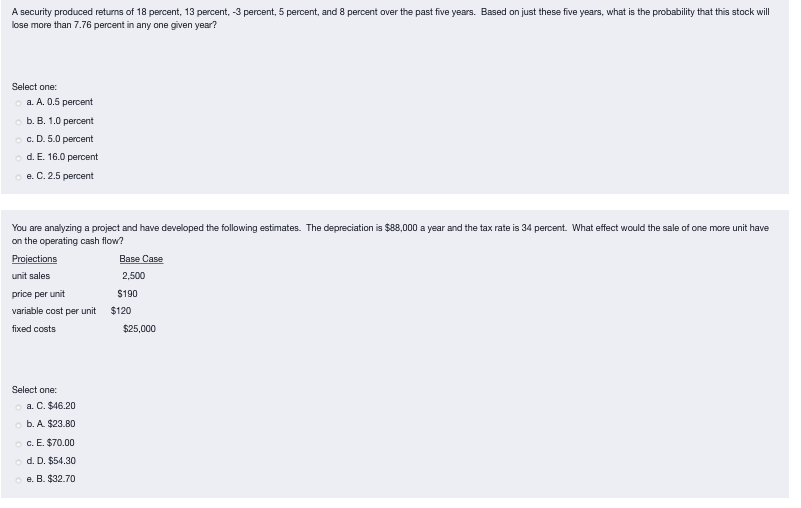

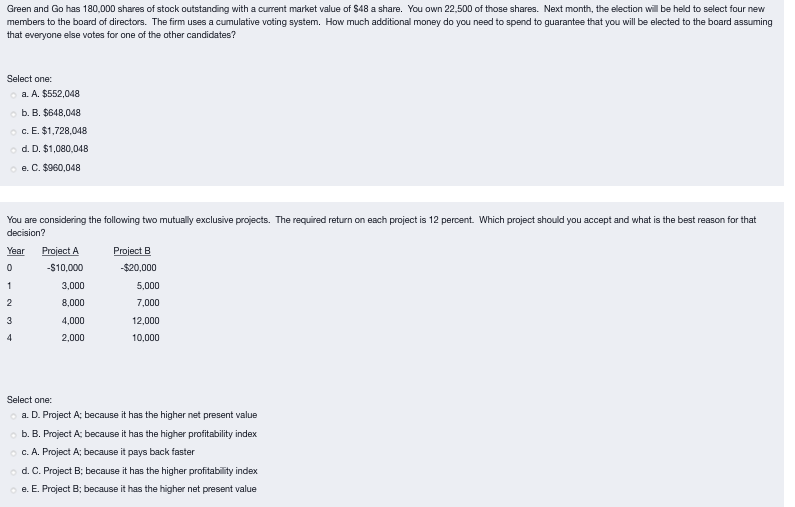

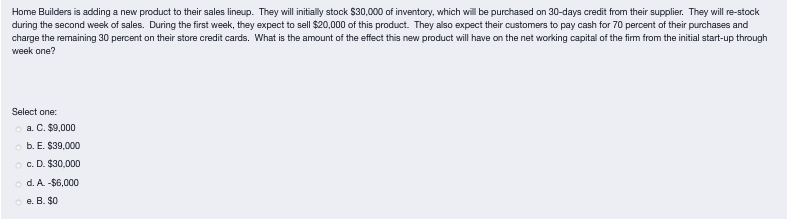

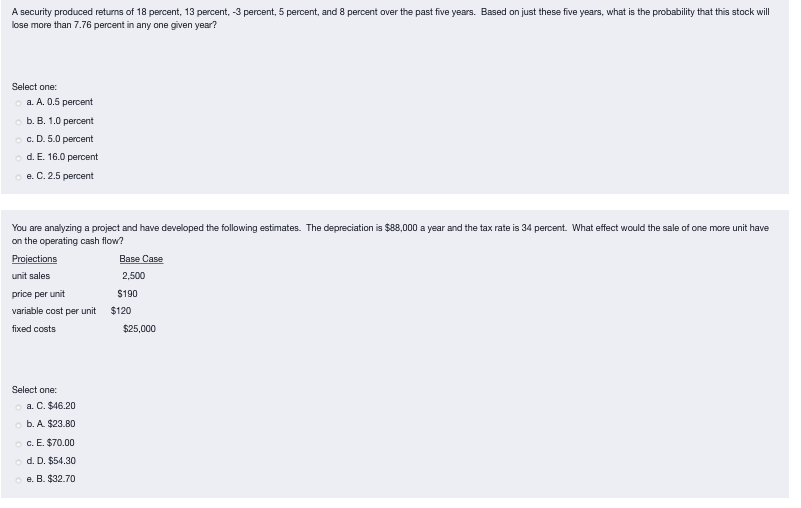

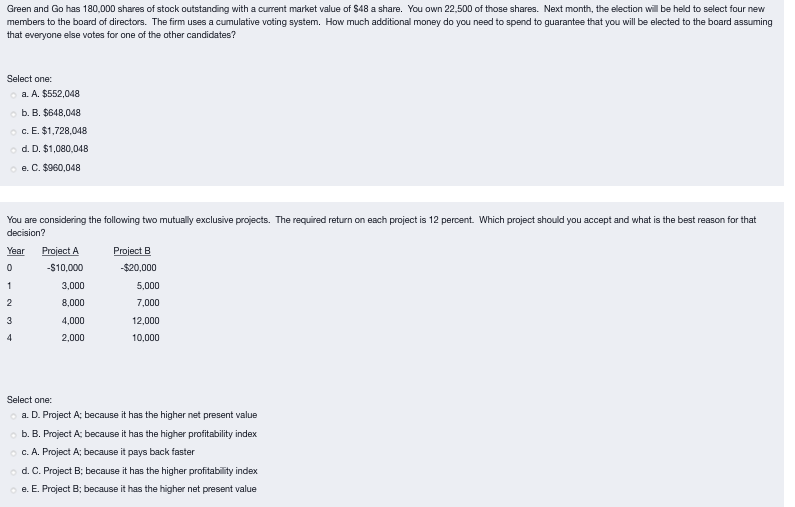

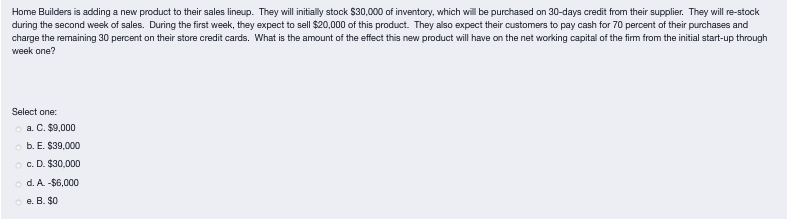

A security produced returns of 18 percent, 13 percent, -3 percent, 5 percent, and 8 percent over the past five years. Based on just these five years, what is the probability that this stock will lose more than 7.76 percent in any one given year? Select one: a. A. 0.5 percent b. B. 1.0 percent c. D.5.0 percent d. E. 16.0 percent e.C.2.5 percent You are analyzing a project and have developed the following estimates. The depreciation is $88,000 a year and the tax rate is 34 percent. What effect would the sale of one more unit have on the operating cash flow? Projections Base Case unit sales 2,500 price per unit $190 variable cost per unit $120 fixed costs $25,000 Select one: a. C. $46.20 b. A. $23.80 c. E. $70.00 d. D. $54.30 e. B. $32.70 Green and Go has 180,000 shares of stock outstanding with a current market value of $48 a share. You own 22.500 of those shares. Next month, the election will be held to select four new members to the board of directors. The firm uses a cumulative voting system. How much additional money do you need to spend to guarantee that you will be elected to the board assuming that everyone else votes for one of the other candidates? Select one: a. A. $552,048 b. B. $648,048 c. E. $1,728,048 d. D. $1,080.048 e. C. $960,048 0 You are considering the following two mutually exclusive projects. The required return on each project is 12 percent. Which project should you accept and what is the best reason for that decision? Year Project A Project B -$10,000 -$20,000 3,000 5,000 2 8,000 7,000 4,000 12.000 2,000 10,000 1 3 4 Select one: a. D. Project A; because it has the higher net present value b. B. Project A; because it has the higher profitability index c. A. Project A, because it pays back faster d. C. Project B; because it has the higher profitability index e. E. Project B; because it has the higher net present value Home Builders is adding a new product to their sales lineup. They will initially stock $30,000 of inventory, which will be purchased on 30-days credit from their supplier. They will re-stock during the second week of sales. During the first week, they expect to sell $20,000 of this product. They also expect their customers to pay cash for 70 percent of their purchases and charge the remaining 30 percent on their store credit cards. What is the amount of the effect this new product will have on the net working capital of the firm from the initial start-up through week one? Select one: a. C. $9.000 b. E. $39.000 c. D. $30,000 d. A. -$6,000 e. B. SO A security produced returns of 18 percent, 13 percent, -3 percent, 5 percent, and 8 percent over the past five years. Based on just these five years, what is the probability that this stock will lose more than 7.76 percent in any one given year? Select one: a. A. 0.5 percent b. B. 1.0 percent c. D.5.0 percent d. E. 16.0 percent e.C.2.5 percent You are analyzing a project and have developed the following estimates. The depreciation is $88,000 a year and the tax rate is 34 percent. What effect would the sale of one more unit have on the operating cash flow? Projections Base Case unit sales 2,500 price per unit $190 variable cost per unit $120 fixed costs $25,000 Select one: a. C. $46.20 b. A. $23.80 c. E. $70.00 d. D. $54.30 e. B. $32.70 Green and Go has 180,000 shares of stock outstanding with a current market value of $48 a share. You own 22.500 of those shares. Next month, the election will be held to select four new members to the board of directors. The firm uses a cumulative voting system. How much additional money do you need to spend to guarantee that you will be elected to the board assuming that everyone else votes for one of the other candidates? Select one: a. A. $552,048 b. B. $648,048 c. E. $1,728,048 d. D. $1,080.048 e. C. $960,048 0 You are considering the following two mutually exclusive projects. The required return on each project is 12 percent. Which project should you accept and what is the best reason for that decision? Year Project A Project B -$10,000 -$20,000 3,000 5,000 2 8,000 7,000 4,000 12.000 2,000 10,000 1 3 4 Select one: a. D. Project A; because it has the higher net present value b. B. Project A; because it has the higher profitability index c. A. Project A, because it pays back faster d. C. Project B; because it has the higher profitability index e. E. Project B; because it has the higher net present value Home Builders is adding a new product to their sales lineup. They will initially stock $30,000 of inventory, which will be purchased on 30-days credit from their supplier. They will re-stock during the second week of sales. During the first week, they expect to sell $20,000 of this product. They also expect their customers to pay cash for 70 percent of their purchases and charge the remaining 30 percent on their store credit cards. What is the amount of the effect this new product will have on the net working capital of the firm from the initial start-up through week one? Select one: a. C. $9.000 b. E. $39.000 c. D. $30,000 d. A. -$6,000 e. B. SO

undefined

undefined