undefined

undefined

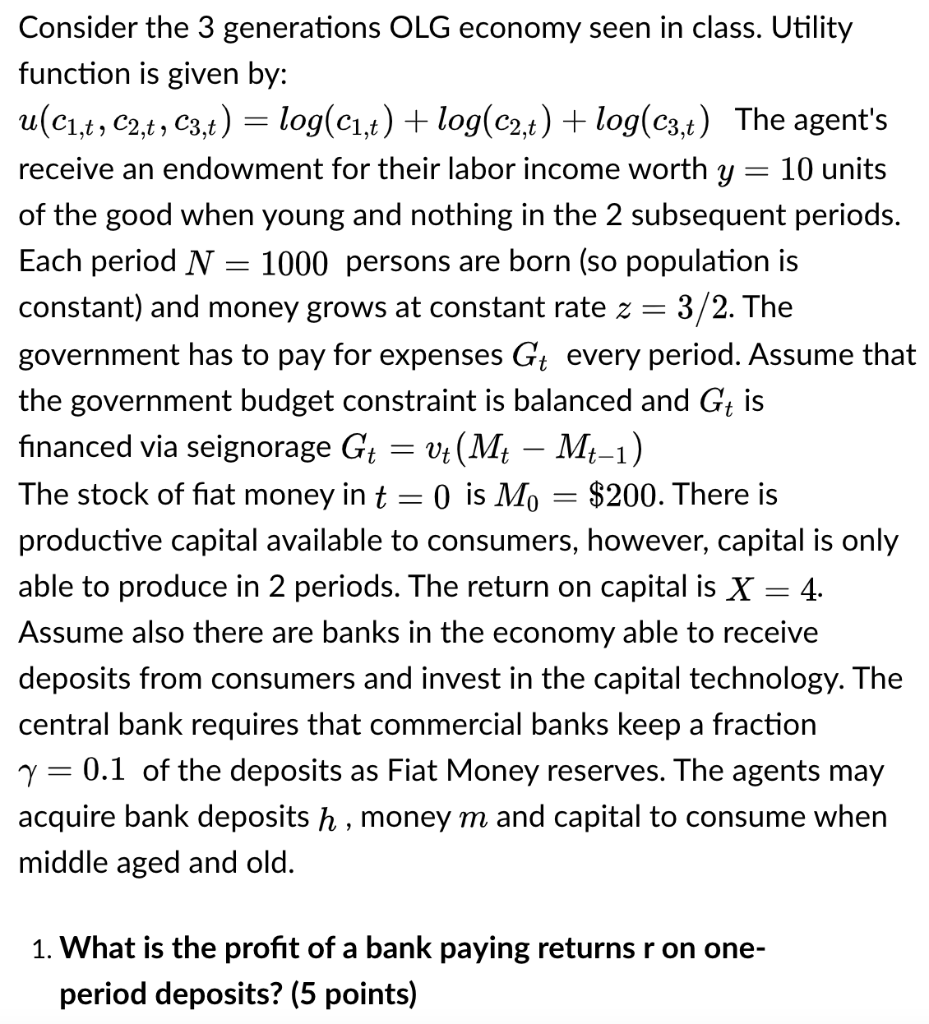

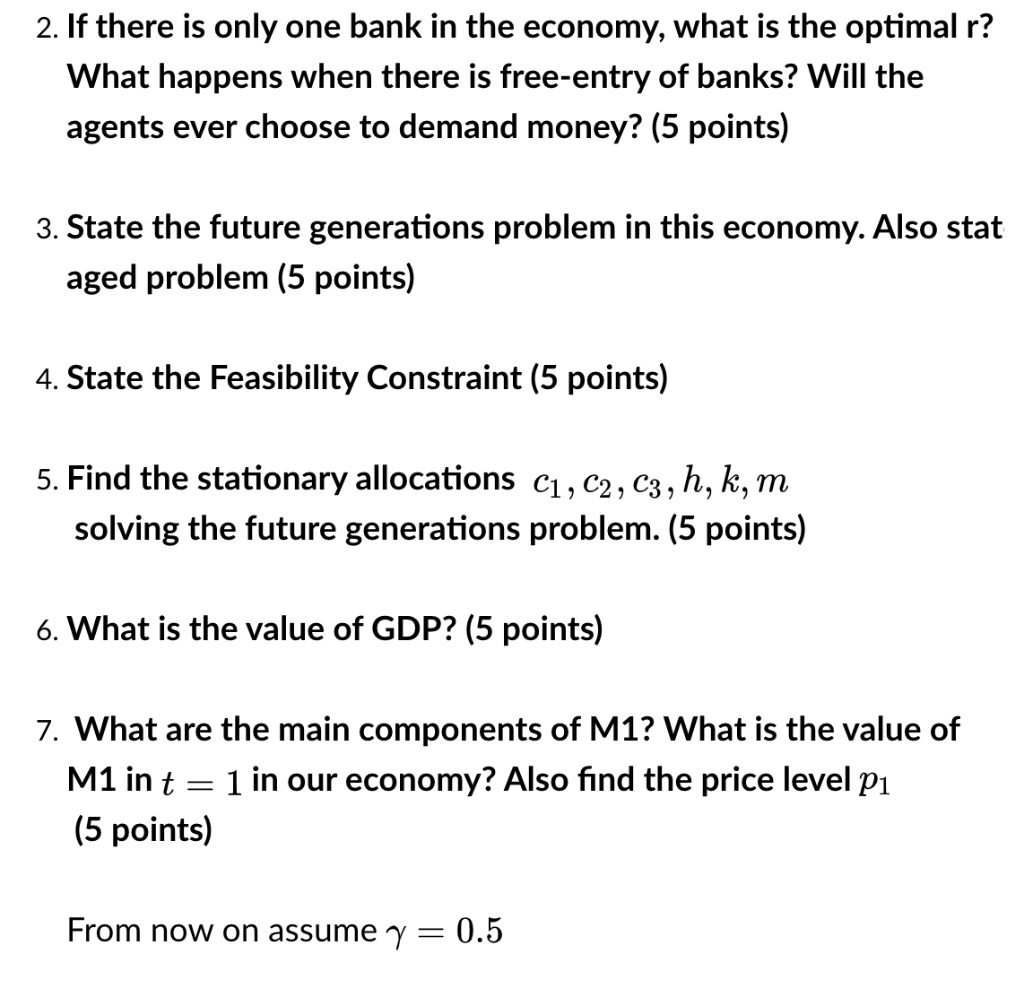

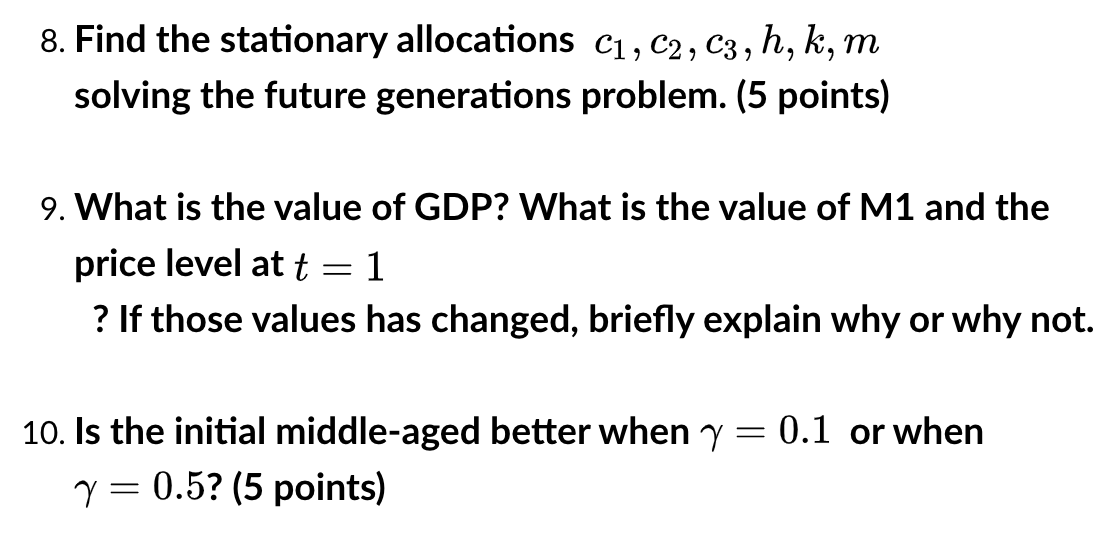

Consider the 3 generations OLG economy seen in class. Utility function is given by: u(C1,t, C2,t , C3,t) = log(C1,t) + log(C2,t) + log(C3,t) The agent's receive an endowment for their labor income worth y 10 units of the good when young and nothing in the 2 subsequent periods. Each period N = 1000 persons are born (so population is constant) and money grows at constant rate z = :3/2. The government has to pay for expenses Gt every period. Assume that the government budget constraint is balanced and Gt is financed via seignorage Gt V+(Mt Mt-1) The stock of fiat money in t=0 is Mo $200. There is productive capital available to consumers, however, capital is only able to produce in 2 periods. The return on capital is X 4. Assume also there are banks in the economy able to receive deposits from consumers and invest in the capital technology. The central bank requires that commercial banks keep a fraction y= 0.1 of the deposits as Fiat Money reserves. The agents may acquire bank deposits h , money m and capital to consume when middle aged and old. 1. What is the profit of a bank paying returns r on one- period deposits? (5 points) 2. If there is only one bank in the economy, what is the optimal r? What happens when there is free-entry of banks? Will the agents ever choose to demand money? (5 points) 3. State the future generations problem in this economy. Also stat aged problem (5 points) 4. State the Feasibility Constraint (5 points) 5. Find the stationary allocations C1, C2, C3, h, k, m solving the future generations problem. (5 points) 6. What is the value of GDP? (5 points) 7. What are the main components of M1? What is the value of M1 in t = 1 in our economy? Also find the price level P1 (5 points) From now on assume y = 0.5 8. Find the stationary allocations Ci, C2, C3, h, k, m solving the future generations problem. (5 points) 9. What is the value of GDP? What is the value of M1 and the price level at t = 1 ? If those values has changed, briefly explain why or why not. - 0.1 or when 10. Is the initial middle-aged better when y y = 0.5? (5 points) Consider the 3 generations OLG economy seen in class. Utility function is given by: u(C1,t, C2,t , C3,t) = log(C1,t) + log(C2,t) + log(C3,t) The agent's receive an endowment for their labor income worth y 10 units of the good when young and nothing in the 2 subsequent periods. Each period N = 1000 persons are born (so population is constant) and money grows at constant rate z = :3/2. The government has to pay for expenses Gt every period. Assume that the government budget constraint is balanced and Gt is financed via seignorage Gt V+(Mt Mt-1) The stock of fiat money in t=0 is Mo $200. There is productive capital available to consumers, however, capital is only able to produce in 2 periods. The return on capital is X 4. Assume also there are banks in the economy able to receive deposits from consumers and invest in the capital technology. The central bank requires that commercial banks keep a fraction y= 0.1 of the deposits as Fiat Money reserves. The agents may acquire bank deposits h , money m and capital to consume when middle aged and old. 1. What is the profit of a bank paying returns r on one- period deposits? (5 points) 2. If there is only one bank in the economy, what is the optimal r? What happens when there is free-entry of banks? Will the agents ever choose to demand money? (5 points) 3. State the future generations problem in this economy. Also stat aged problem (5 points) 4. State the Feasibility Constraint (5 points) 5. Find the stationary allocations C1, C2, C3, h, k, m solving the future generations problem. (5 points) 6. What is the value of GDP? (5 points) 7. What are the main components of M1? What is the value of M1 in t = 1 in our economy? Also find the price level P1 (5 points) From now on assume y = 0.5 8. Find the stationary allocations Ci, C2, C3, h, k, m solving the future generations problem. (5 points) 9. What is the value of GDP? What is the value of M1 and the price level at t = 1 ? If those values has changed, briefly explain why or why not. - 0.1 or when 10. Is the initial middle-aged better when y y = 0.5? (5 points)

undefined

undefined