undefined

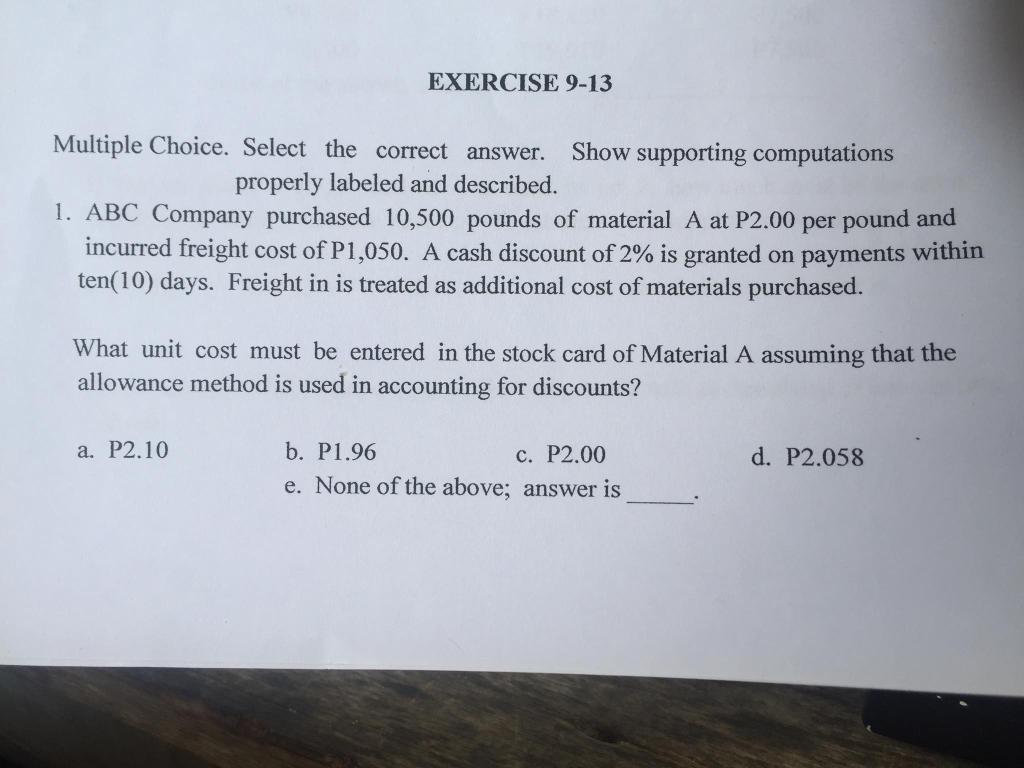

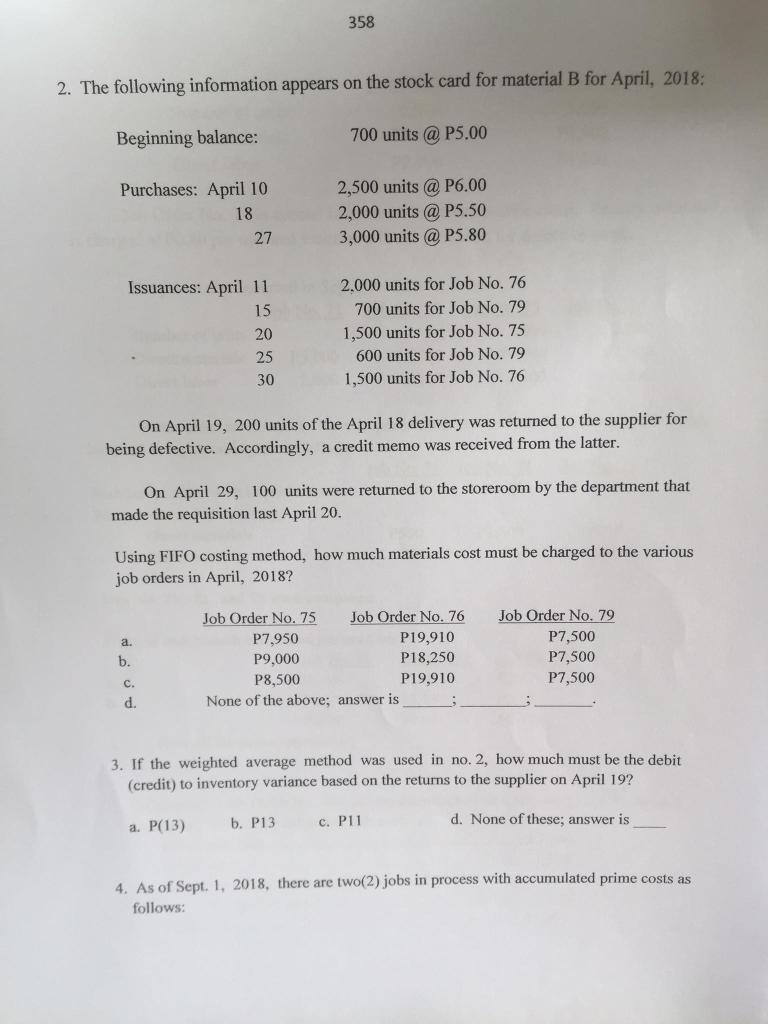

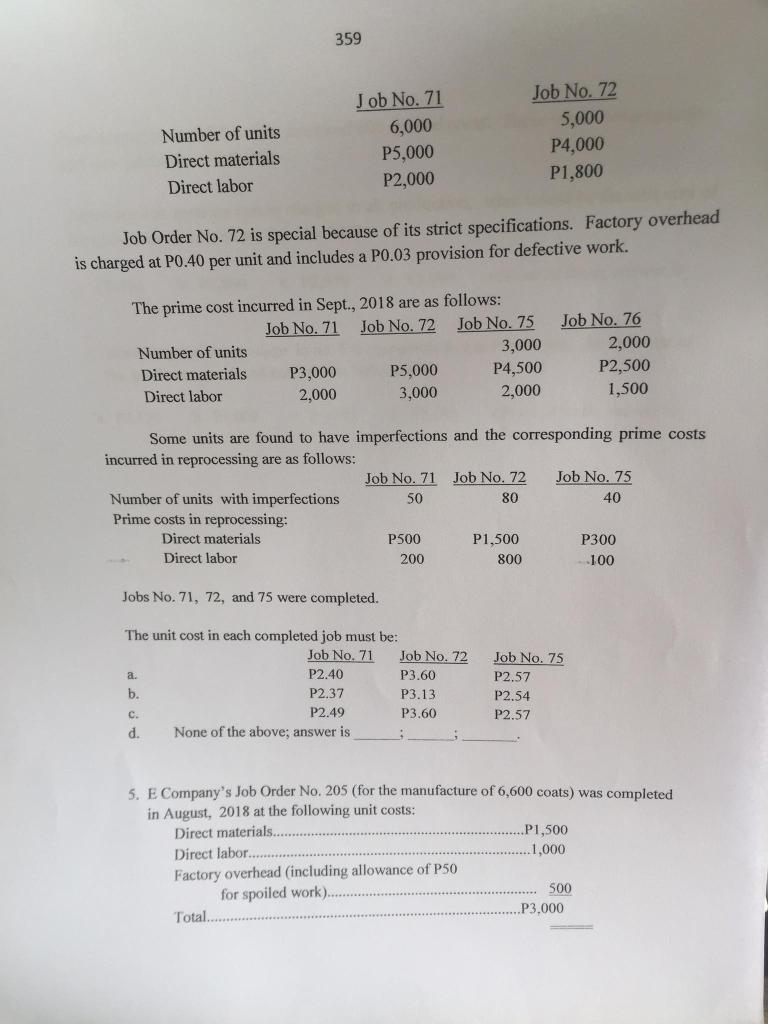

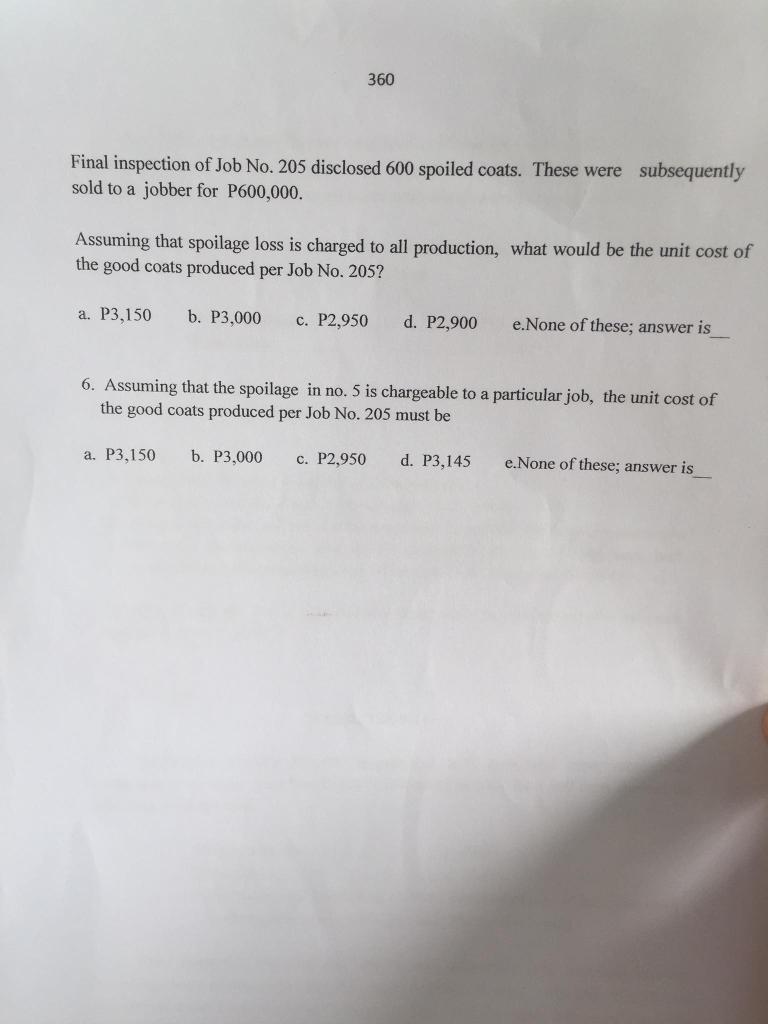

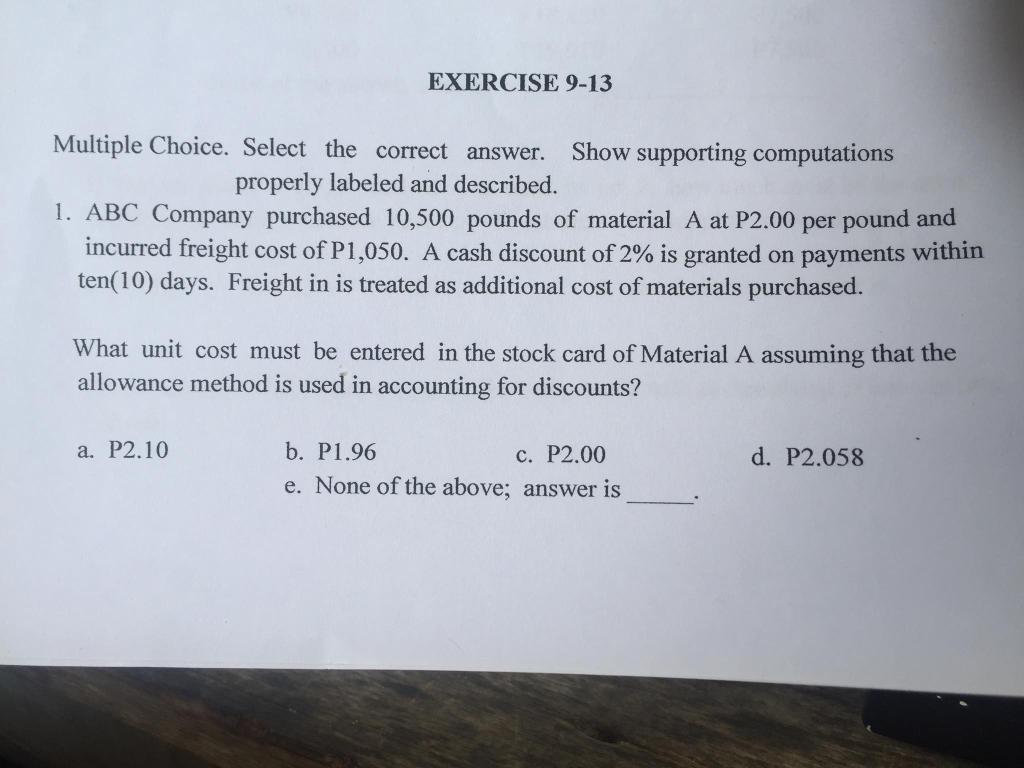

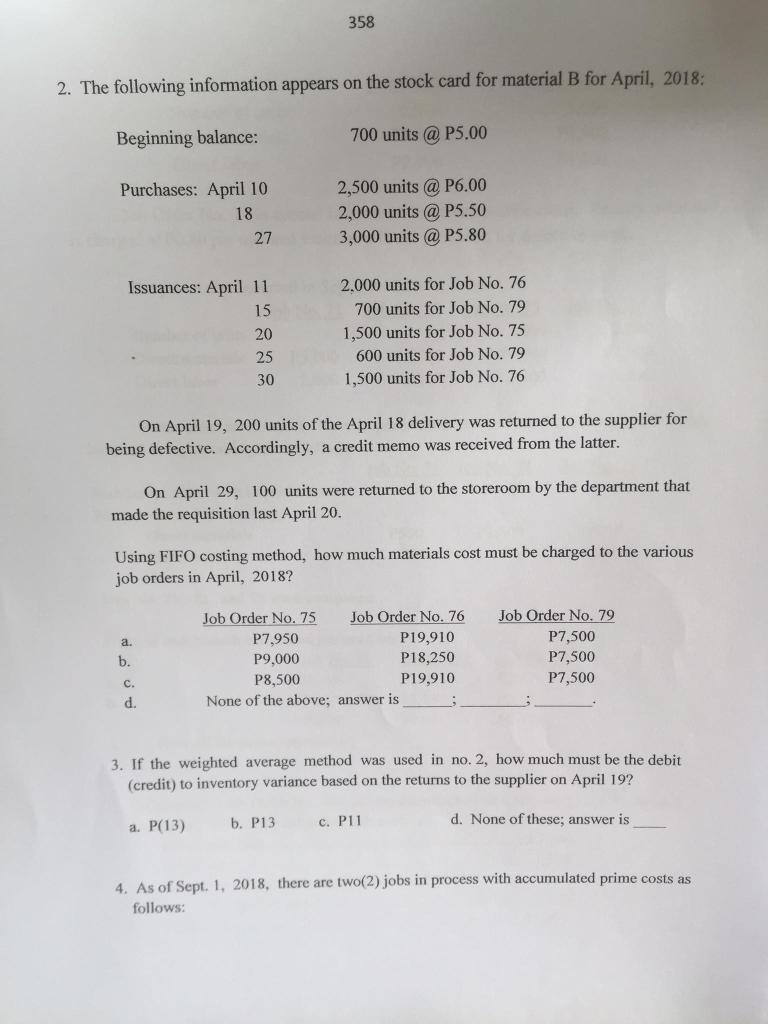

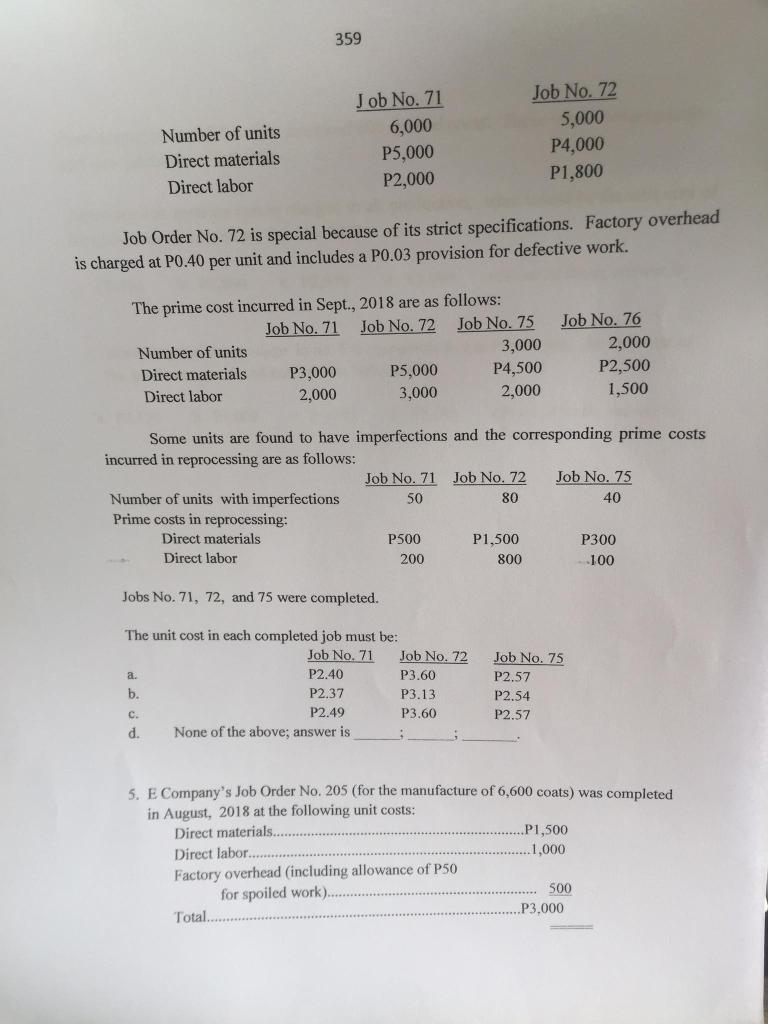

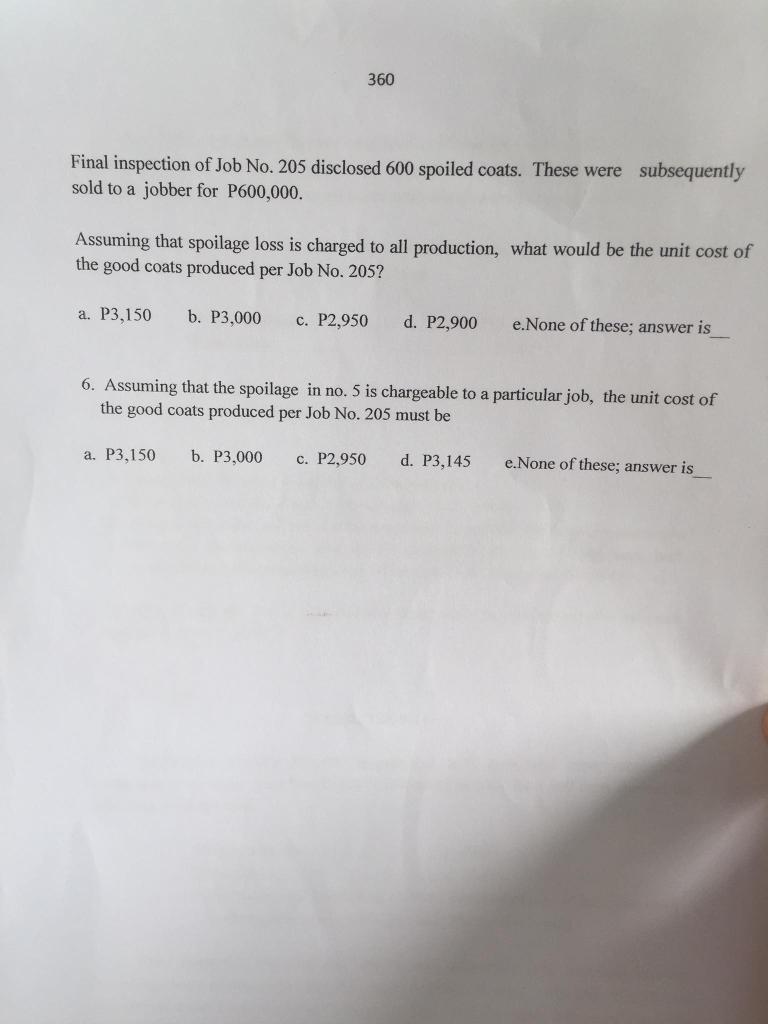

EXERCISE 9-13 Multiple Choice. Select the correct answer. Show supporting computations properly labeled and described. 1. ABC Company purchased 10,500 pounds of material A at P2.00 per pound and incurred freight cost of P1,050. A cash discount of 2% is granted on payments within ten(10) days. Freight in is treated as additional cost of materials purchased. What unit cost must be entered in the stock card of Material A assuming that the allowance method is used in accounting for discounts? a. P2.10 c. P2.00 d. P2.058 b. P1.96 e. None of the above; answer is 358 2. The following information appears on the stock card for material B for April, 2018: Beginning balance: 700 units @ P5.00 Purchases: April 10 18 27 2,500 units @ P6.00 2,000 units @ P5.50 3,000 units @ P5.80 Issuances: April 11 15 20 25 30 2.000 units for Job No. 76 700 units for Job No. 79 1,500 units for Job No. 75 600 units for Job No. 79 1,500 units for Job No. 76 On April 19, 200 units of the April 18 delivery was returned to the supplier for being defective. Accordingly, a credit memo was received from the latter. On April 29, 100 units were returned to the storeroom by the department that made the requisition last April 20. Using FIFO costing method, how much materials cost must be charged to the various job orders in April, 2018? a. Job Order No. 75 Job Order No. 76 P7,950 P19,910 P9,000 P18,250 P8,500 P19,910 None of the above; answer is Job Order No. 79 P7,500 P7,500 P7,500 b. c. d. 3. If the weighted average method was used in no. 2, how much must be the debit (credit) to inventory variance based on the returns to the supplier on April 19? a. P(13) b. P13 c. P11 d. None of these; answer is 4. As of Sept. 1, 2018, there are two(2) jobs in process with accumulated prime costs as follows: 359 Number of units Direct materials Direct labor Job No. 71 6,000 P5,000 P2,000 Job No. 72 5,000 P4,000 P1,800 Job Order No. 72 is special because of its strict specifications. Factory overhead is charged at P0.40 per unit and includes a P0.03 provision for defective work. The prime cost incurred in Sept., 2018 are as follows: Job No. 71 Job No. 72 Job No. 75 Number of units 3,000 Direct materials P3,000 P5,000 P4,500 Direct labor 2,000 3,000 2,000 Job No. 76 2,000 P2,500 1,500 Some units are found to have imperfections and the corresponding prime costs incurred in reprocessing are as follows: Job No. 71 Job No. 72 Job No. 75 Number of units with imperfections 50 80 40 Prime costs in reprocessing: Direct materials P500 P1,500 P300 Direct labor 200 800 -100 Jobs No. 71, 72, and 75 were completed. The unit cost in each completed job must be: Job No. 71 Job No. 72 a. P2.40 P3.60 b. P2.37 P3.13 c. P2.49 P3.60 d. None of the above; answer is Job No. 75 P2.57 P2.54 P2.57 5. E Company's Job Order No. 205 (for the manufacture of 6,600 coats) was completed in August, 2018 at the following unit costs: Direct materials .P1,500 Direct labor.. 1,000 Factory overhead (including allowance of P50 for spoiled work)..... 500 Total P3,000 360 Final inspection of Job No. 205 disclosed 600 spoiled coats. These were subsequently sold to a jobber for P600,000. Assuming that spoilage loss is charged to all production, what would be the unit cost of the good coats produced per Job No. 205? a. P3,150 b. P3,000 c. P2,950 d. P2,900 e.None of these; answer is 6. Assuming that the spoilage in no. 5 is chargeable to a particular job, the unit cost of the good coats produced per Job No. 205 must be a. P3,150 b. P3,000 c. P2,950 d. P3,145 None of these; answer is