undefined

undefined

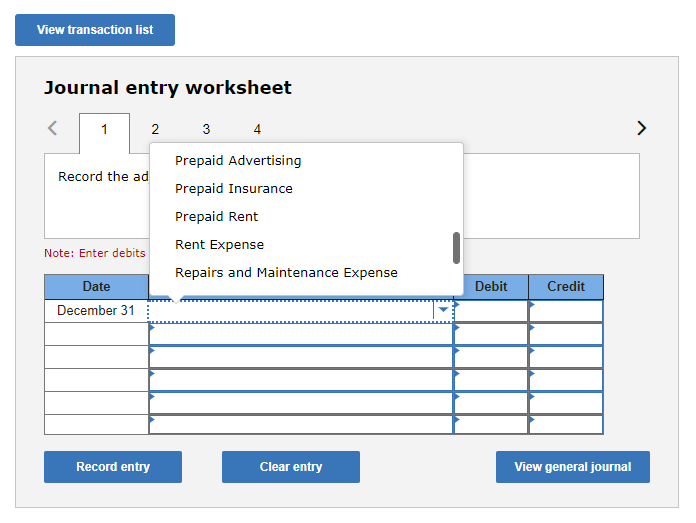

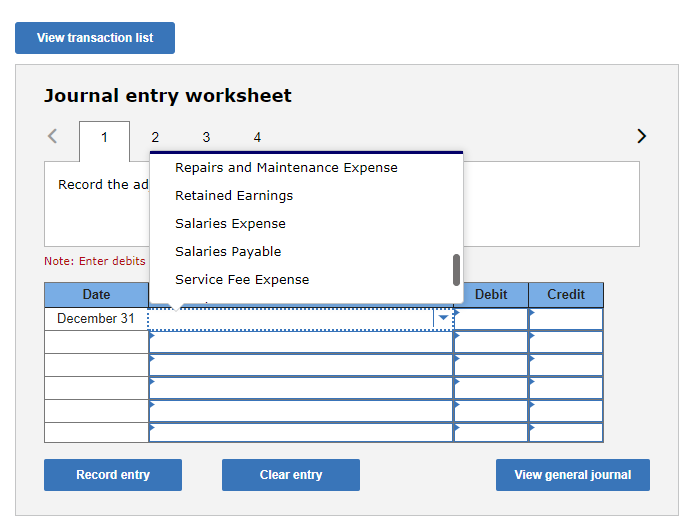

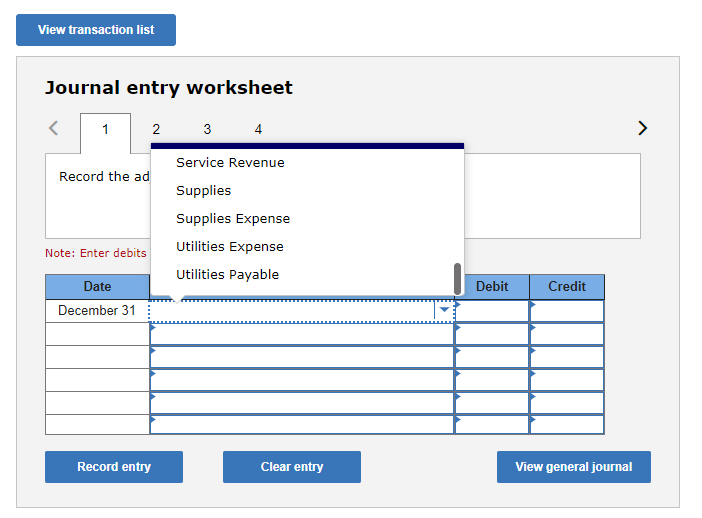

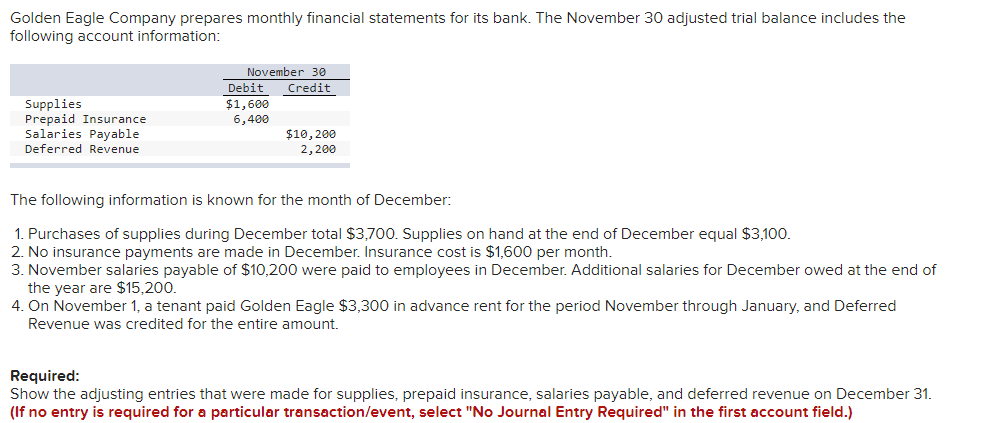

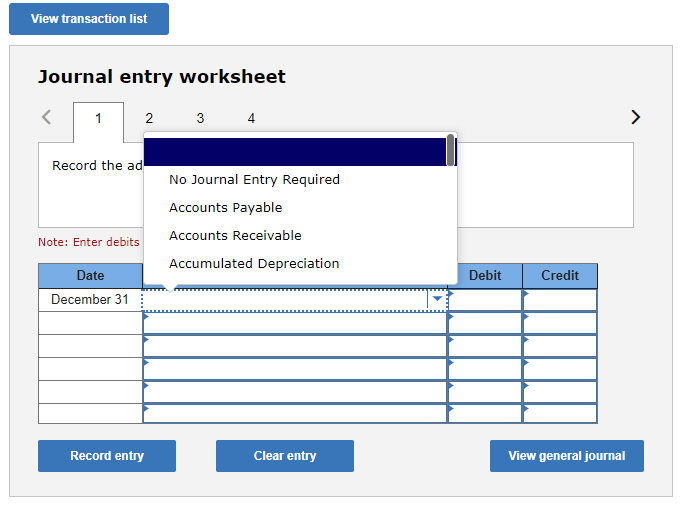

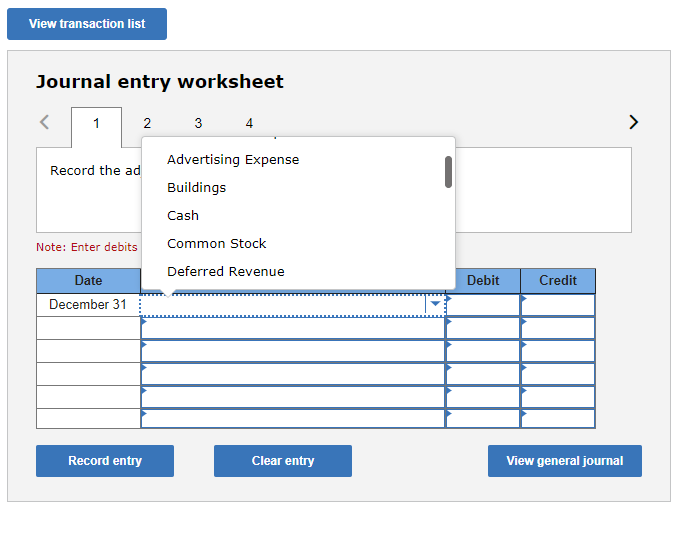

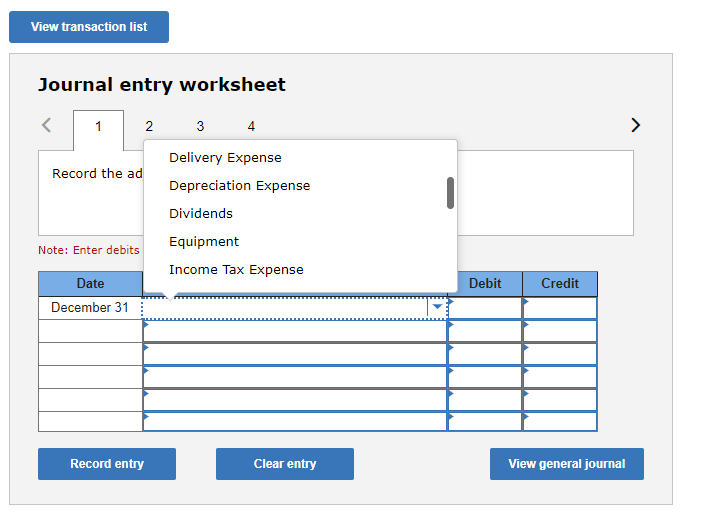

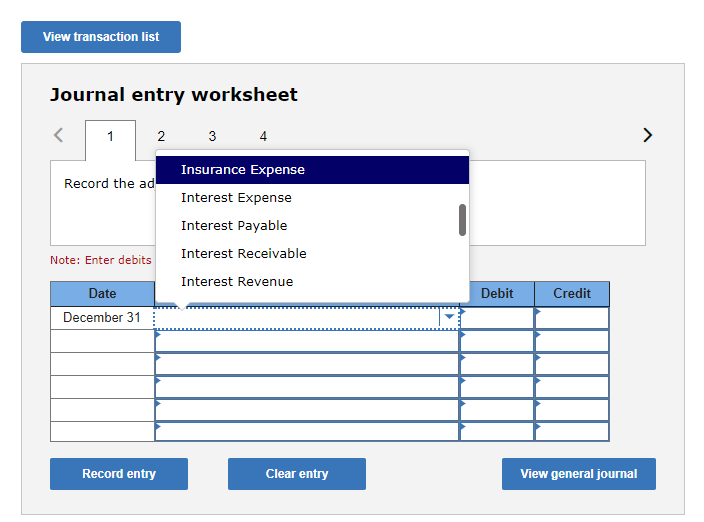

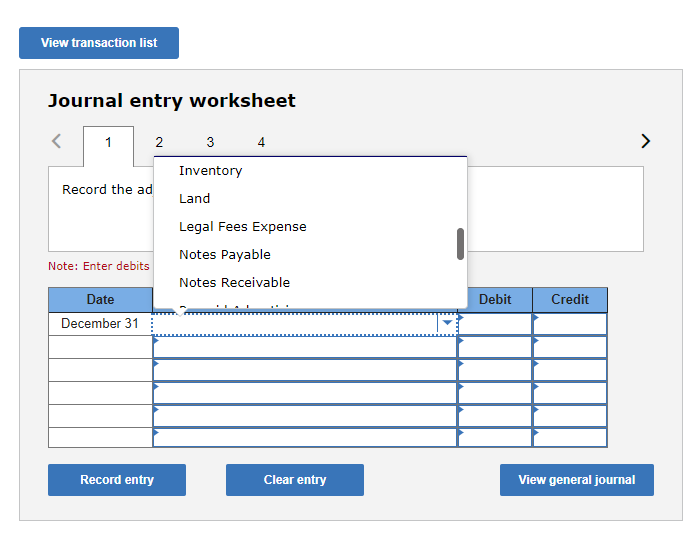

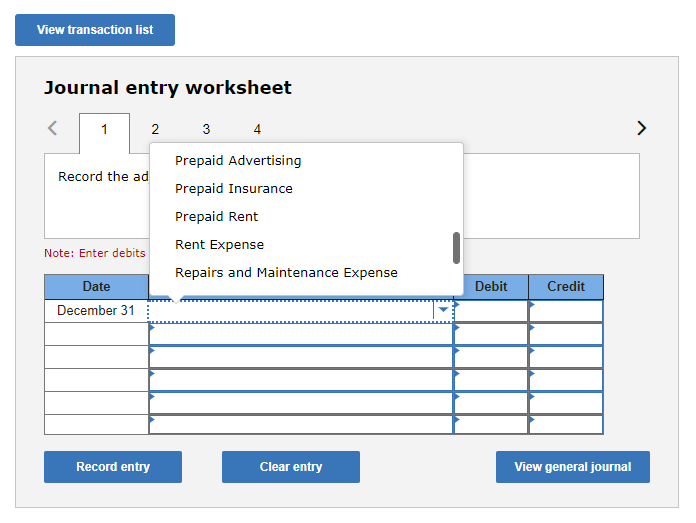

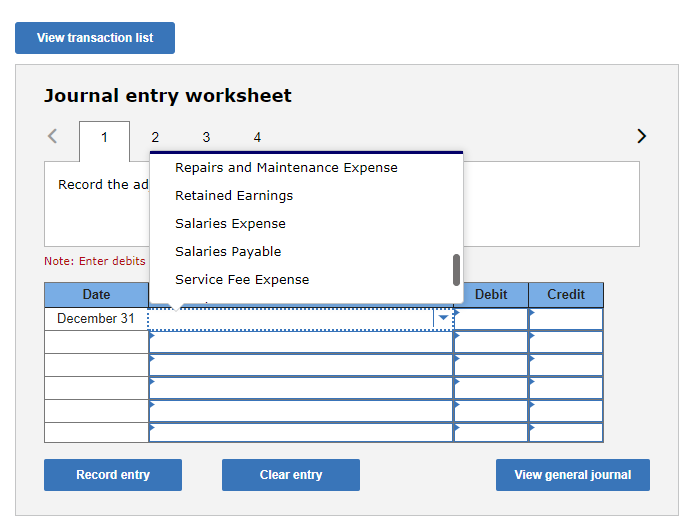

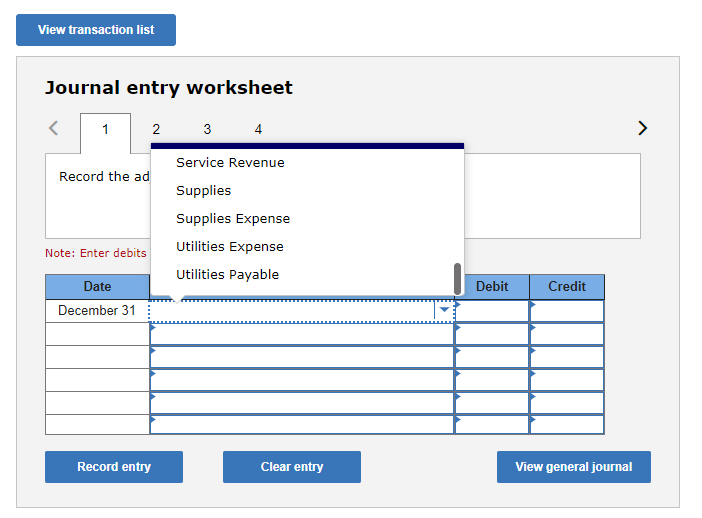

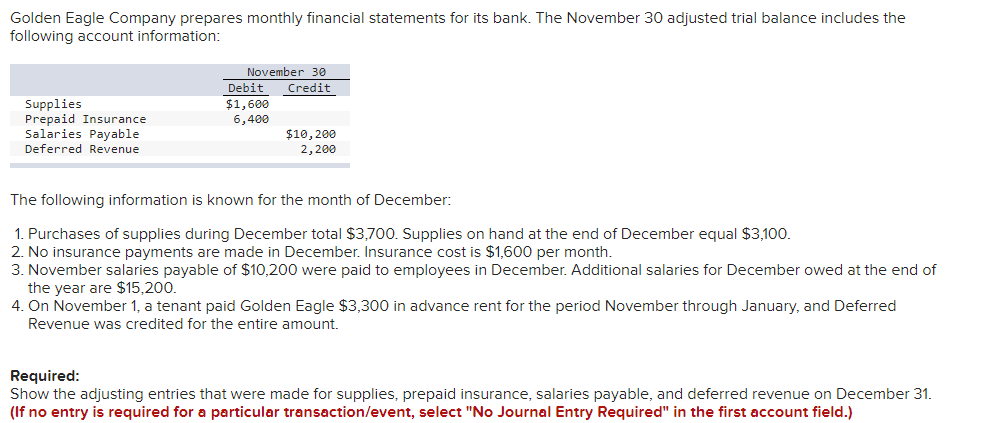

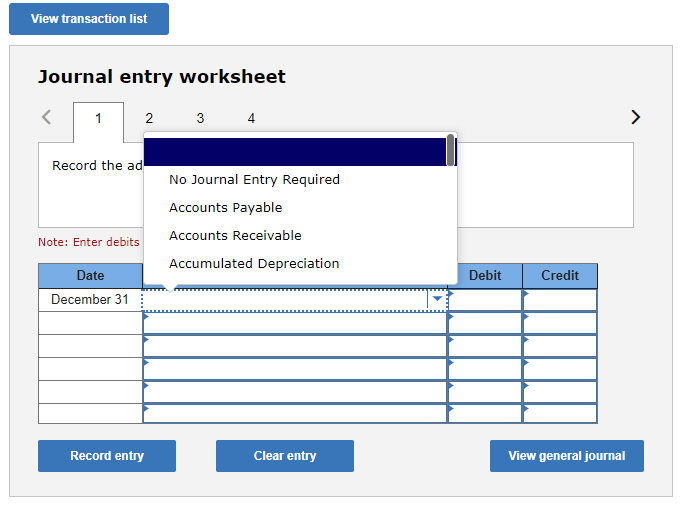

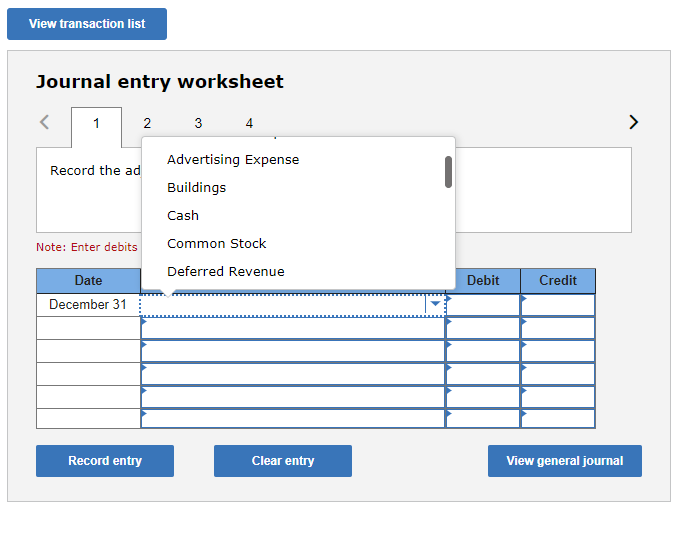

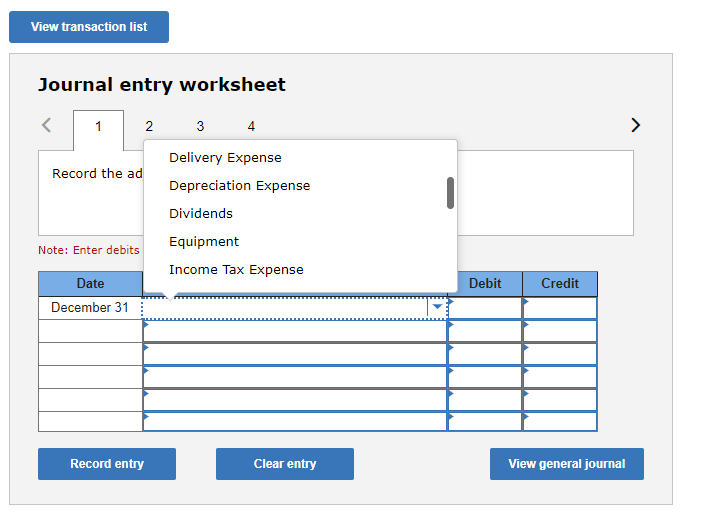

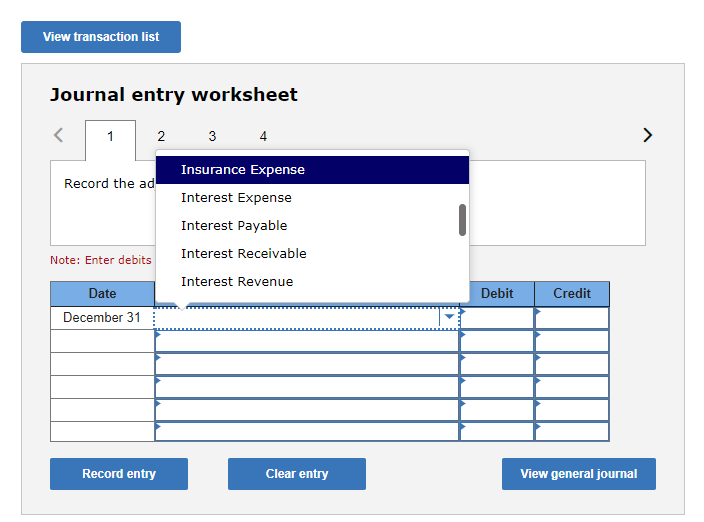

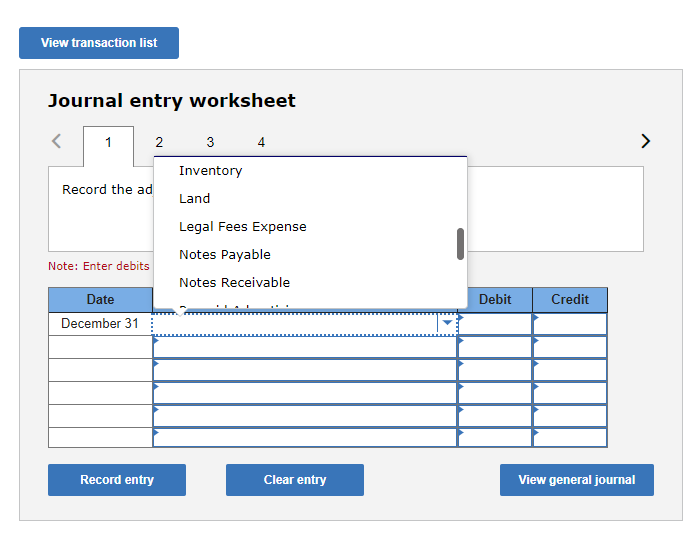

Golden Eagle Company prepares monthly financial statements for its bank. The November 30 adjusted trial balance includes the following account information: Supplies Prepaid Insurance Salaries Payable Deferred Revenue November 30 Debit Credit $1,600 6,400 $10,200 2,200 The following information is known for the month of December: 1. Purchases of supplies during December total $3,700. Supplies on hand at the end of December equal $3,100. 2. No insurance payments are made in December. Insurance cost is $1,600 per month. 3. November salaries payable of $10,200 were paid to employees in December. Additional salaries for December owed at the end of the year are $15,200. 4. On November 1, a tenant paid Golden Eagle $3,300 in advance rent for the period November through January, and Deferred Revenue was credited for the entire amount. Required: Show the adjusting entries that were made for supplies, prepaid insurance, salaries payable, and deferred revenue on December 31. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet 1 2 3 4 > Record the ad No Journal Entry Required Accounts Payable Accounts Receivable Note: Enter debits Accumulated Depreciation Debit Credit Date December 31 Record entry Clear entry View general journal View transaction list Journal entry worksheet 1 2 3 4 Record the ad Advertising Expense Buildings Cash Note: Enter debits Common Stock Deferred Revenue Debit Credit Date December 31 Record entry Clear entry View general journal View transaction list Journal entry worksheet 1 2 2 3 4 > Record the ad Delivery Expense Depreciation Expense Dividends Equipment Income Tax Expense Note: Enter debits Debit Credit Date December 31 Record entry Clear entry View general journal View transaction list Journal entry worksheet 1 2 3 4 Record the ad Insurance Expense Interest Expense Note: Enter debits Interest Payable Interest Receivable Interest Revenue Debit Credit Date December 31 Record entry Clear entry View general journal View transaction list Journal entry worksheet 1 2 3 4 > Inventory Record the ad Land Legal Fees Expense Notes Payable Notes Receivable Note: Enter debits Debit Credit Date December 31 Record entry Clear entry View general journal View transaction list Journal entry worksheet 1 2 Record the ad 3 4 Prepaid Advertising Prepaid Insurance Prepaid Rent Rent Expense Repairs and Maintenance Expense Note: Enter debits Debit Credit Date December 31 Record entry Clear entry View general journal View transaction list Journal entry worksheet 1 2 Record the ad 3 4 Repairs and Maintenance Expense Retained Earnings Salaries Expense Salaries Payable Service Fee Expense Note: Enter debits Debit Credit Date December 31 Record entry Clear entry View general journal View transaction list Journal entry worksheet Service Revenue Record the ad Supplies Supplies Expense Utilities Expense Utilities Payable Note: Enter debits Debit Credit Date December 31 Record entry Clear entry View general journal

undefined

undefined