undefined

undefined

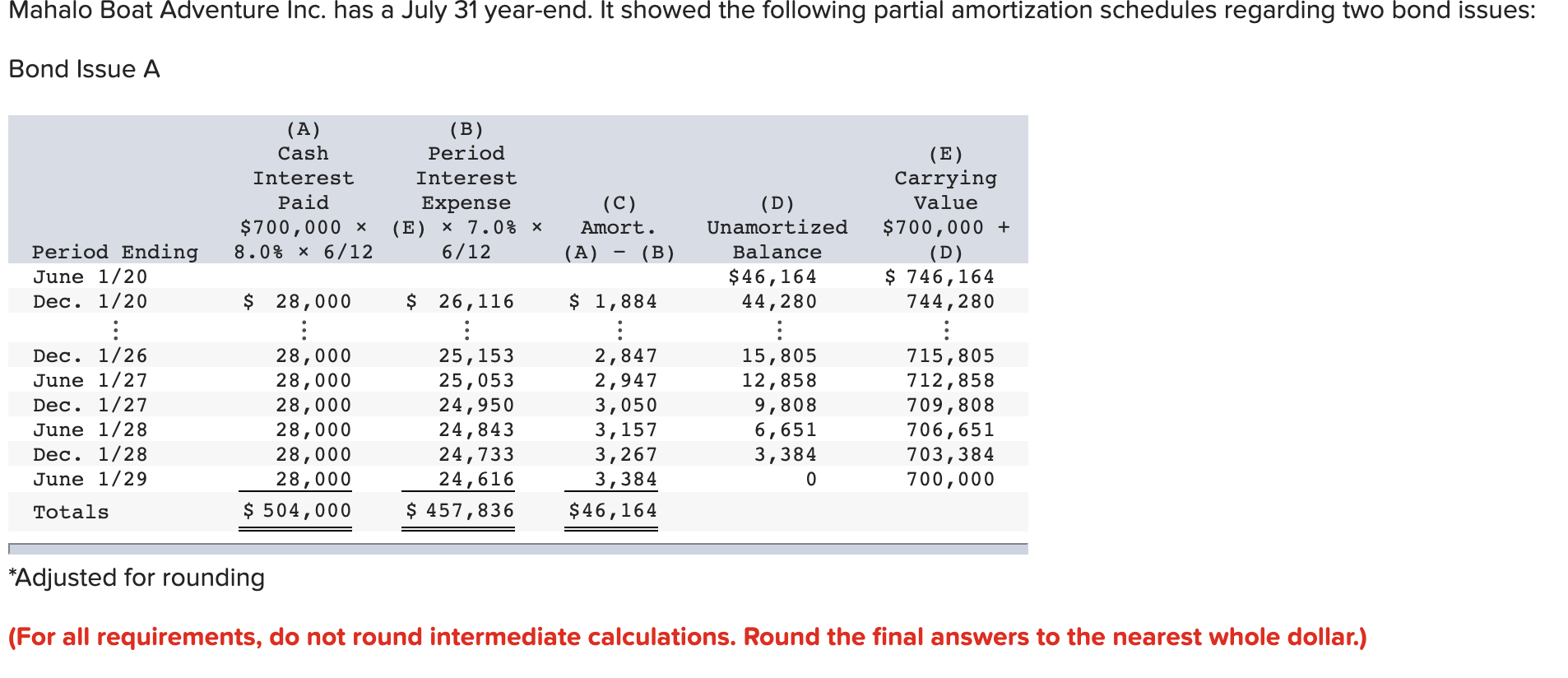

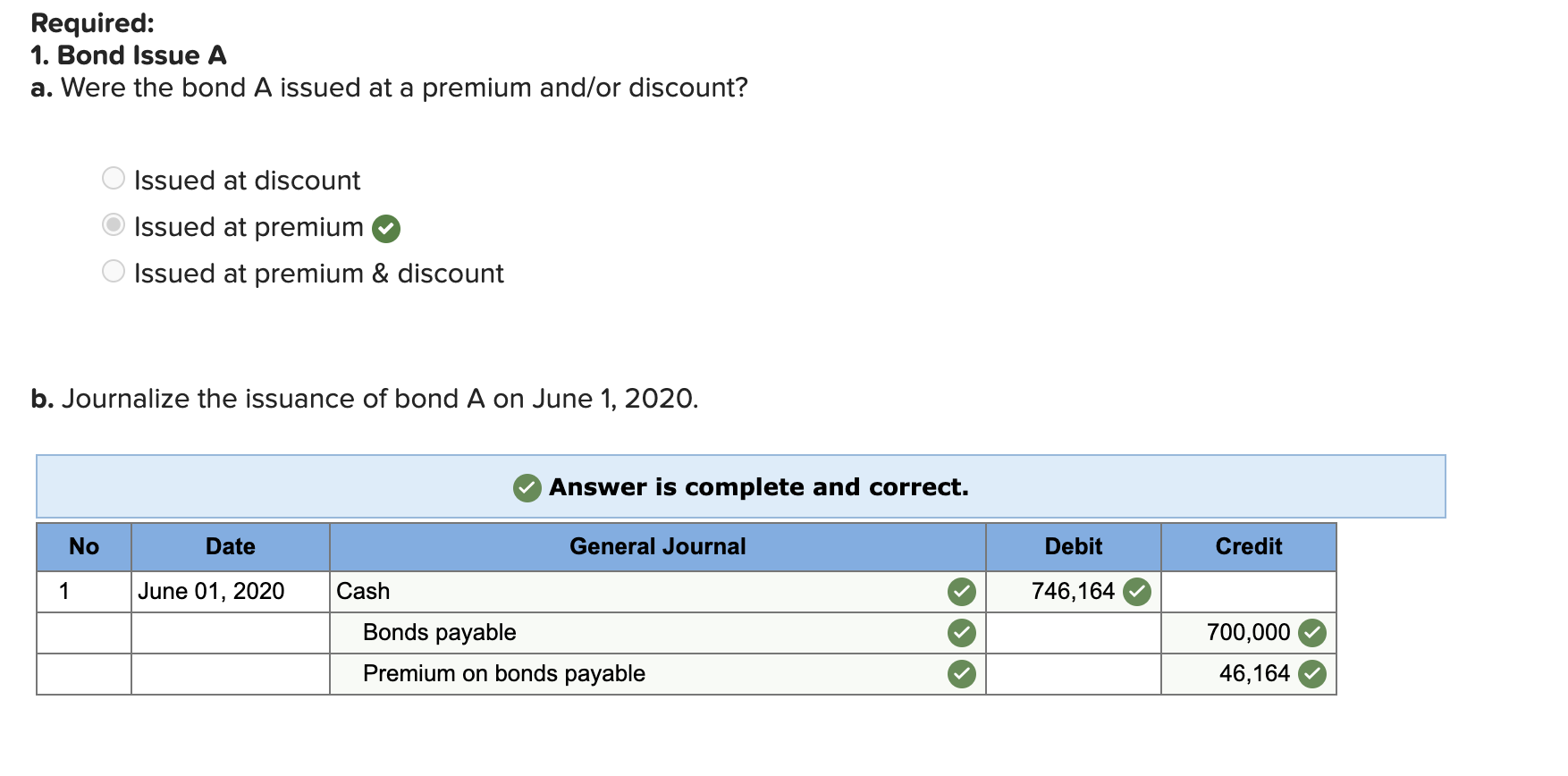

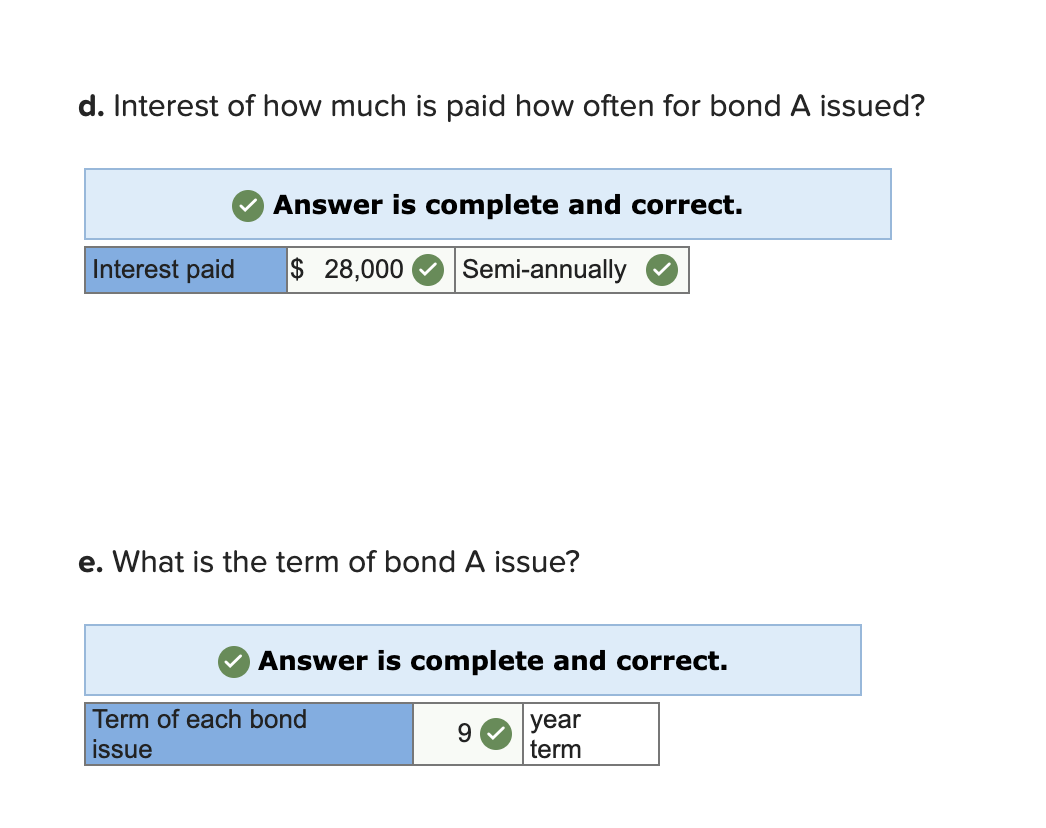

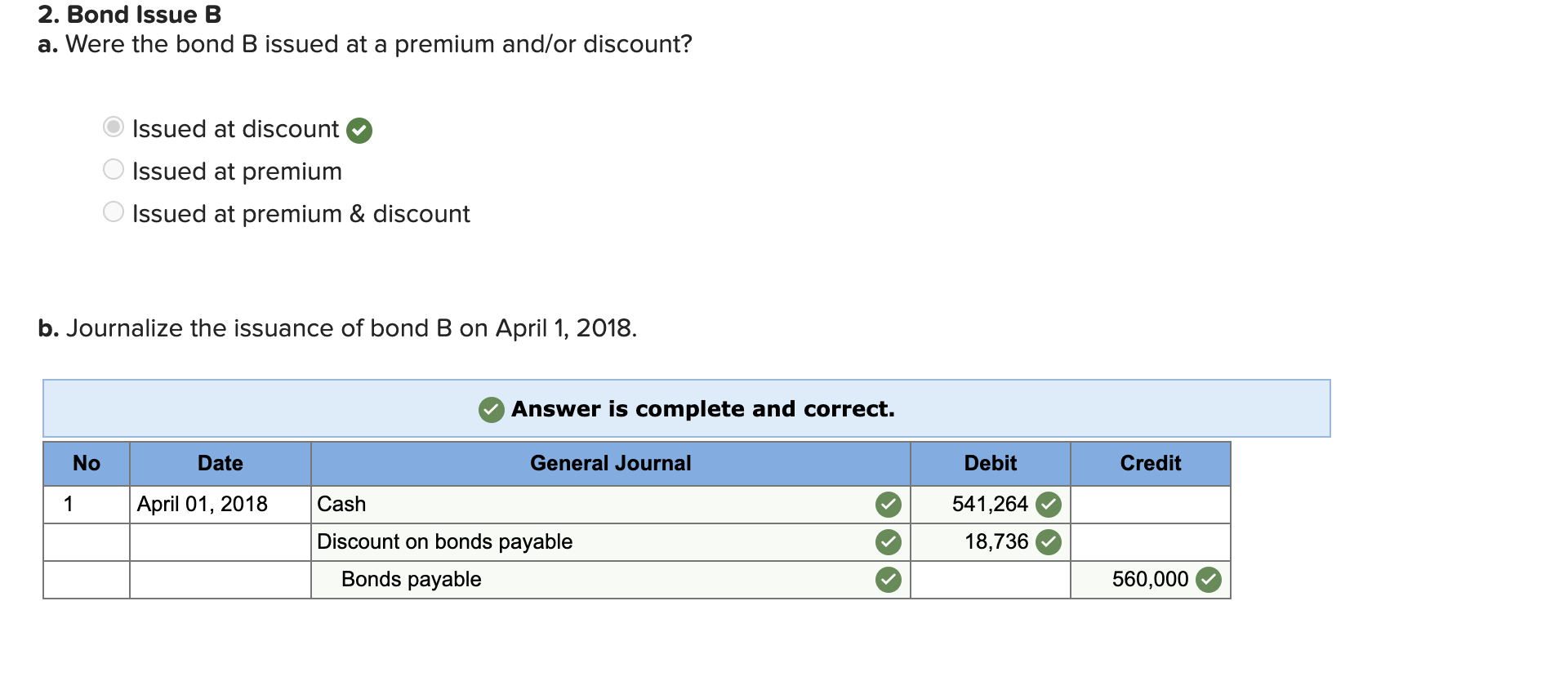

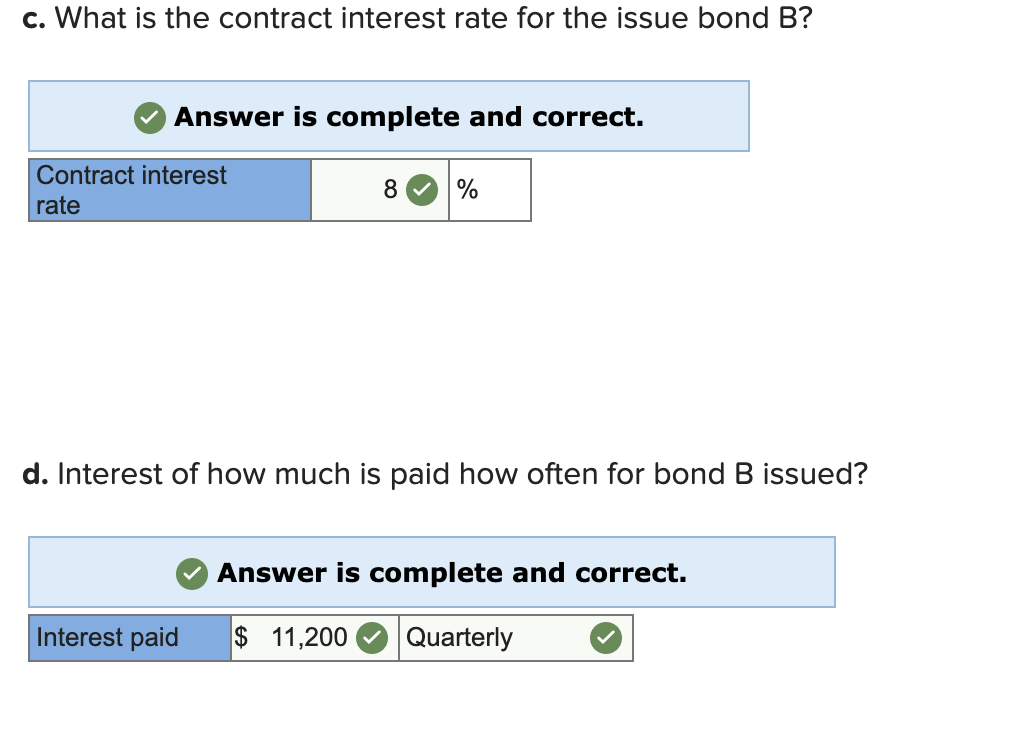

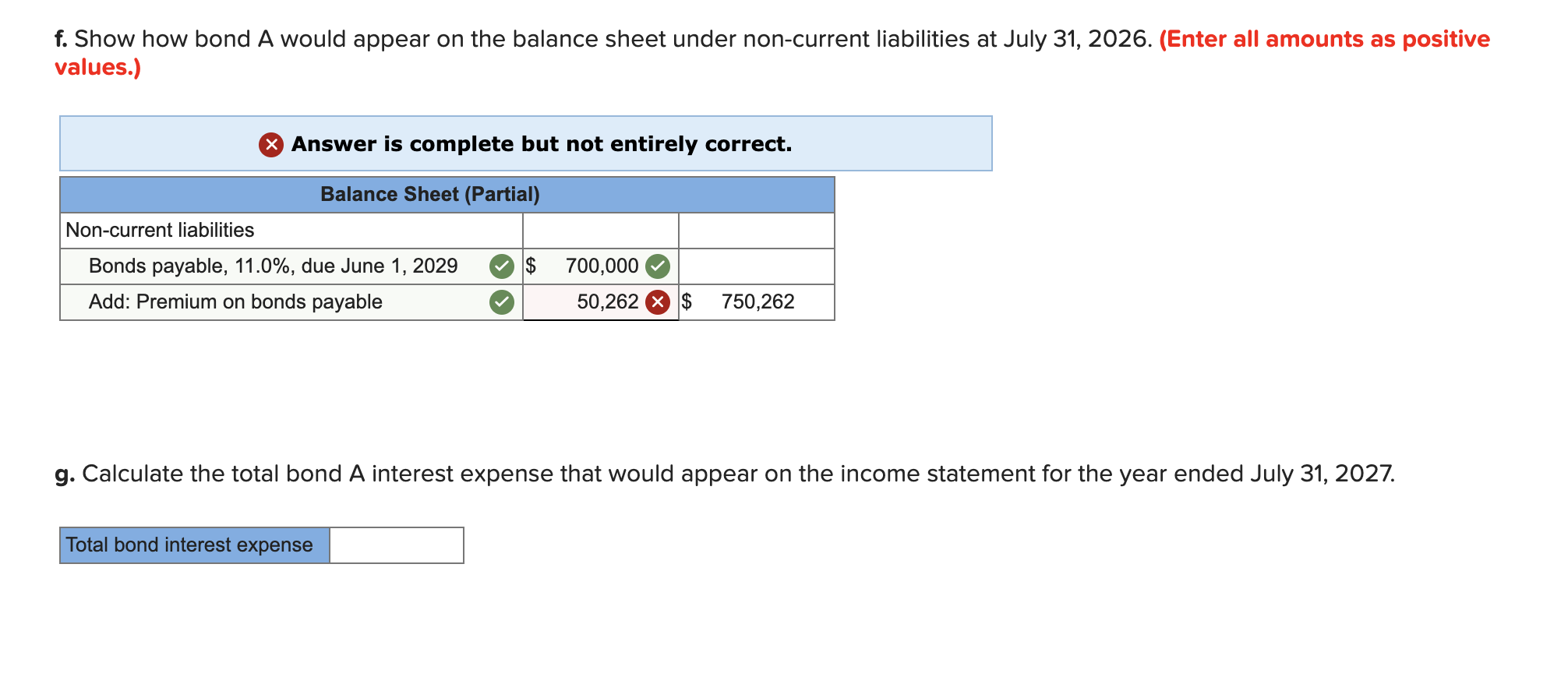

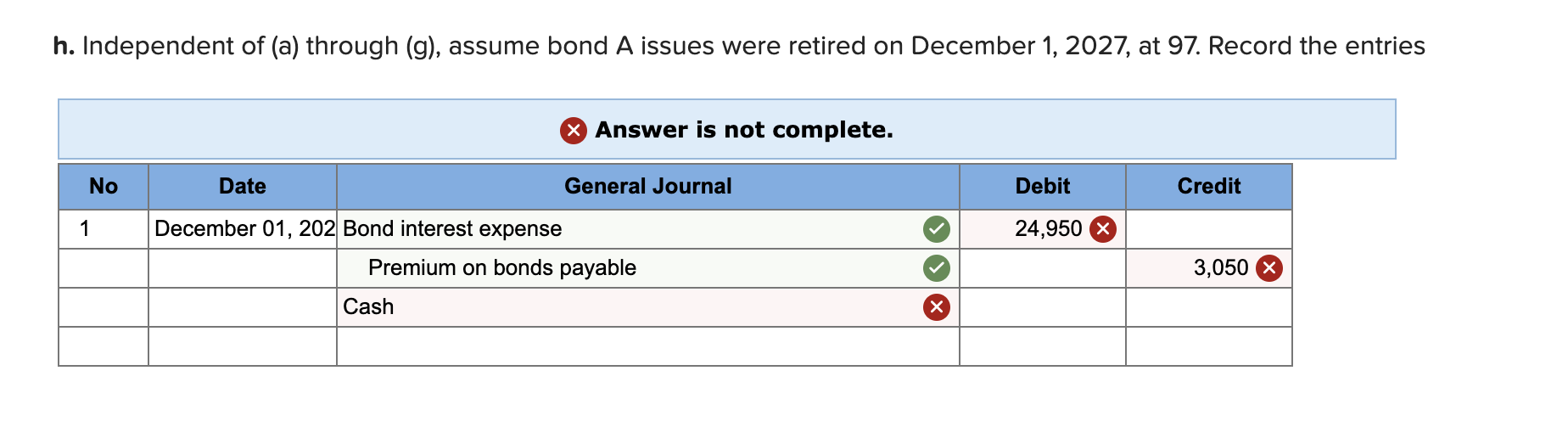

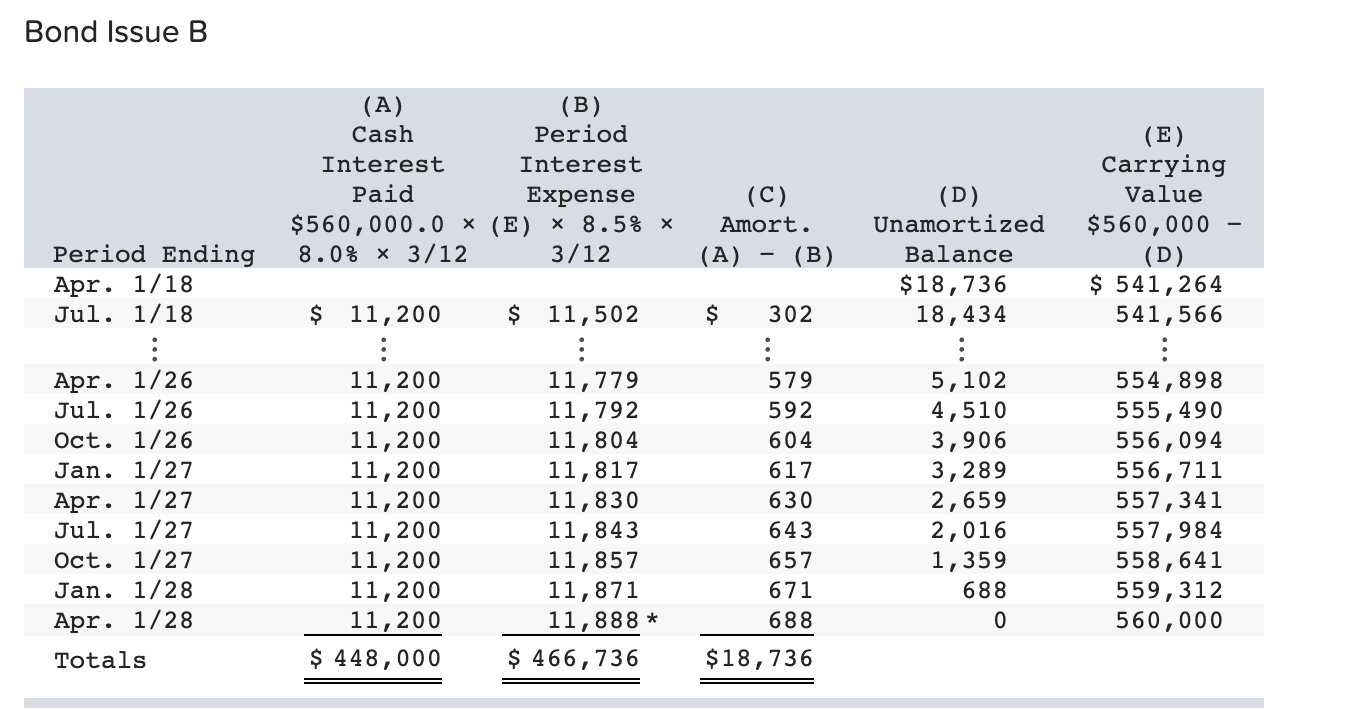

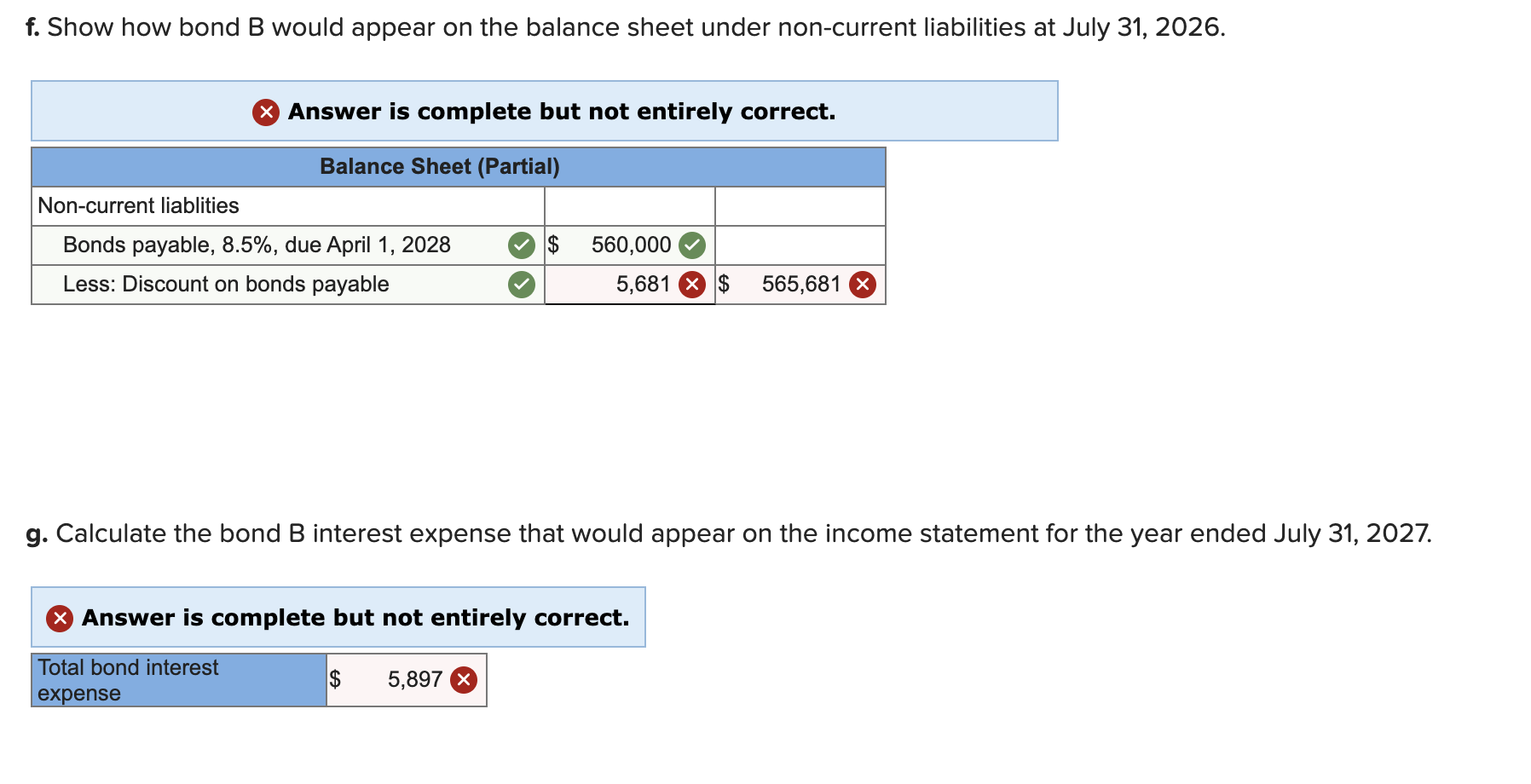

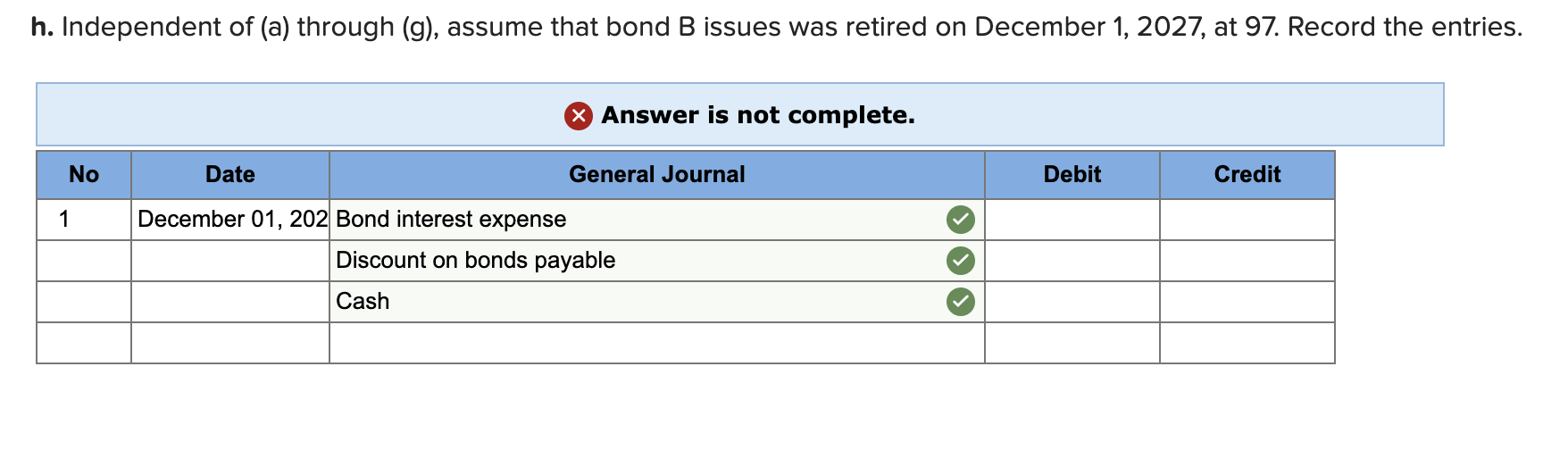

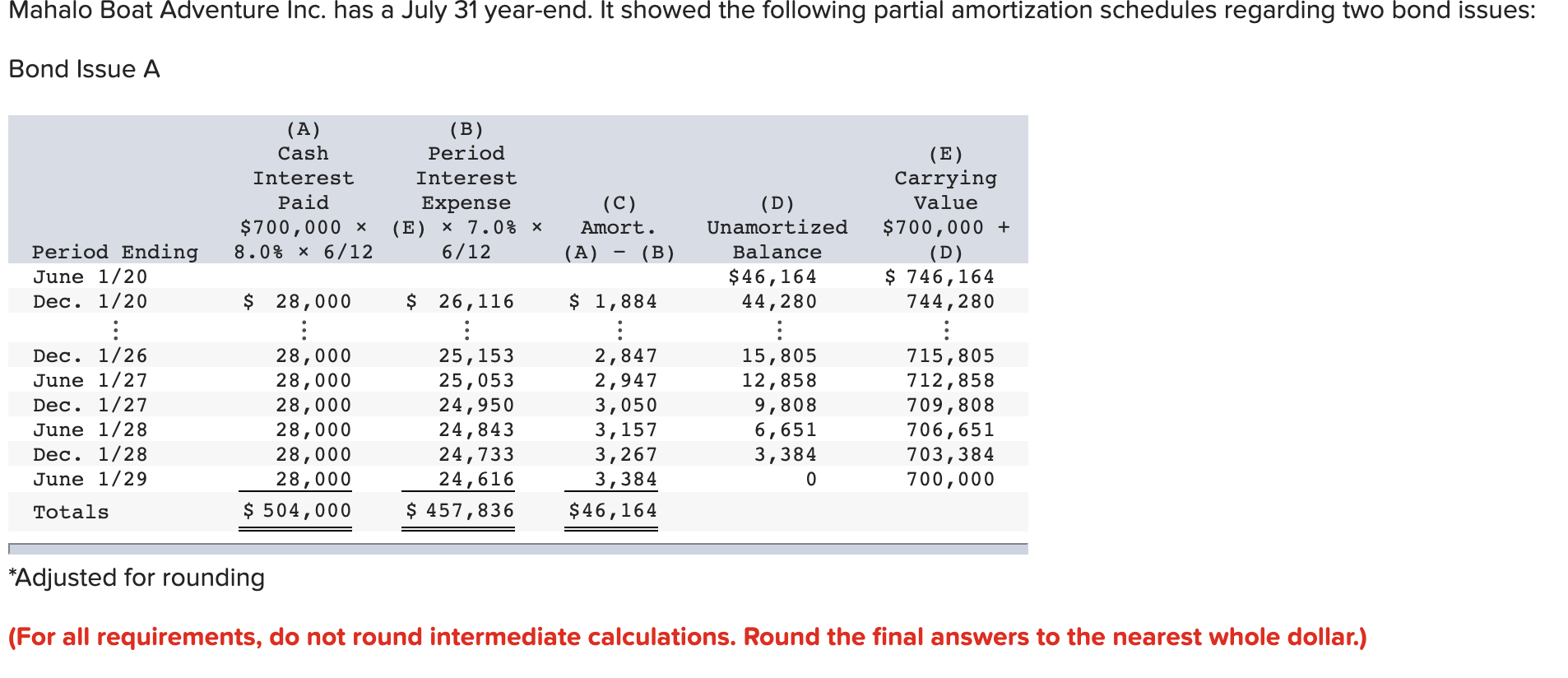

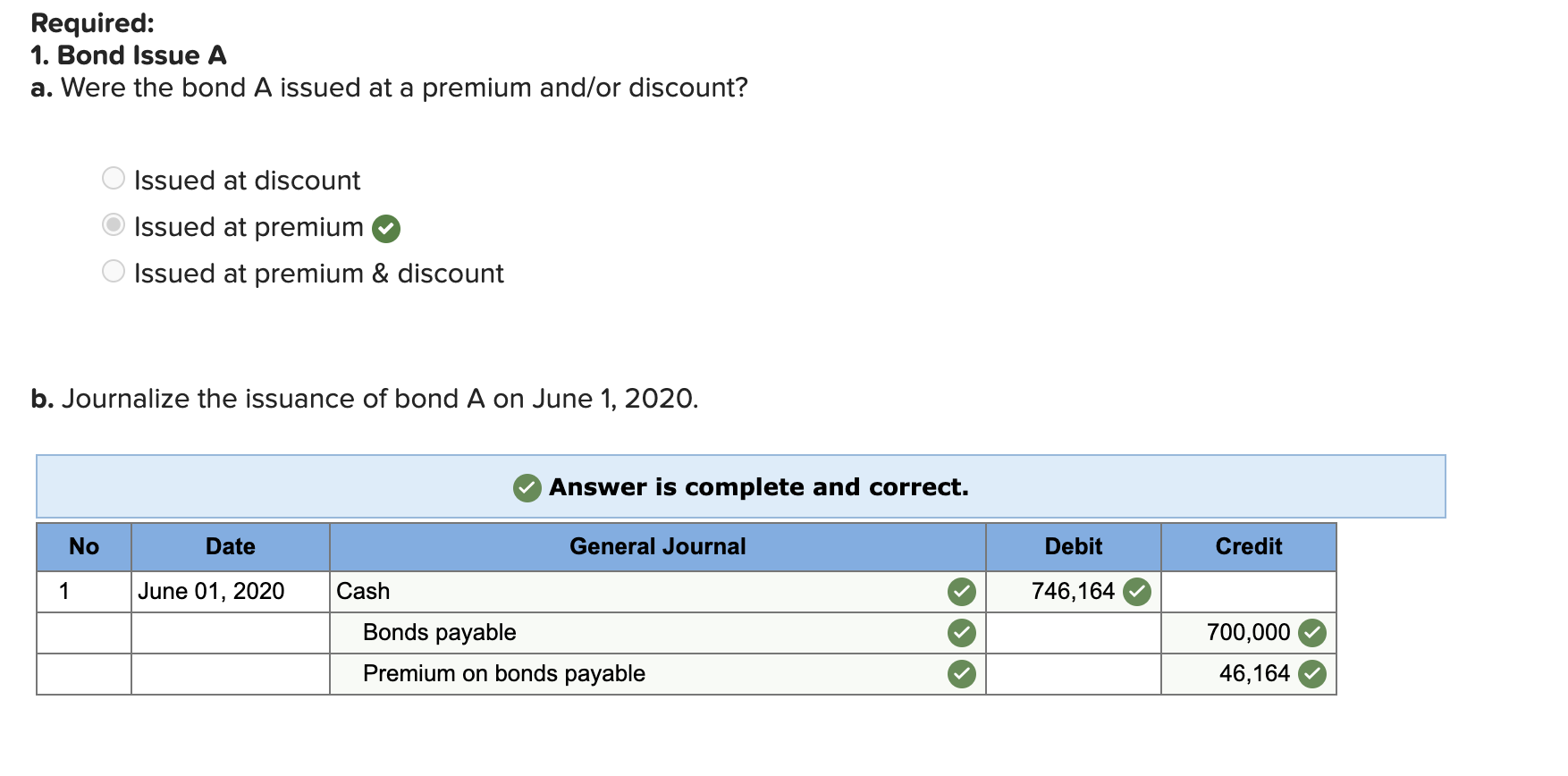

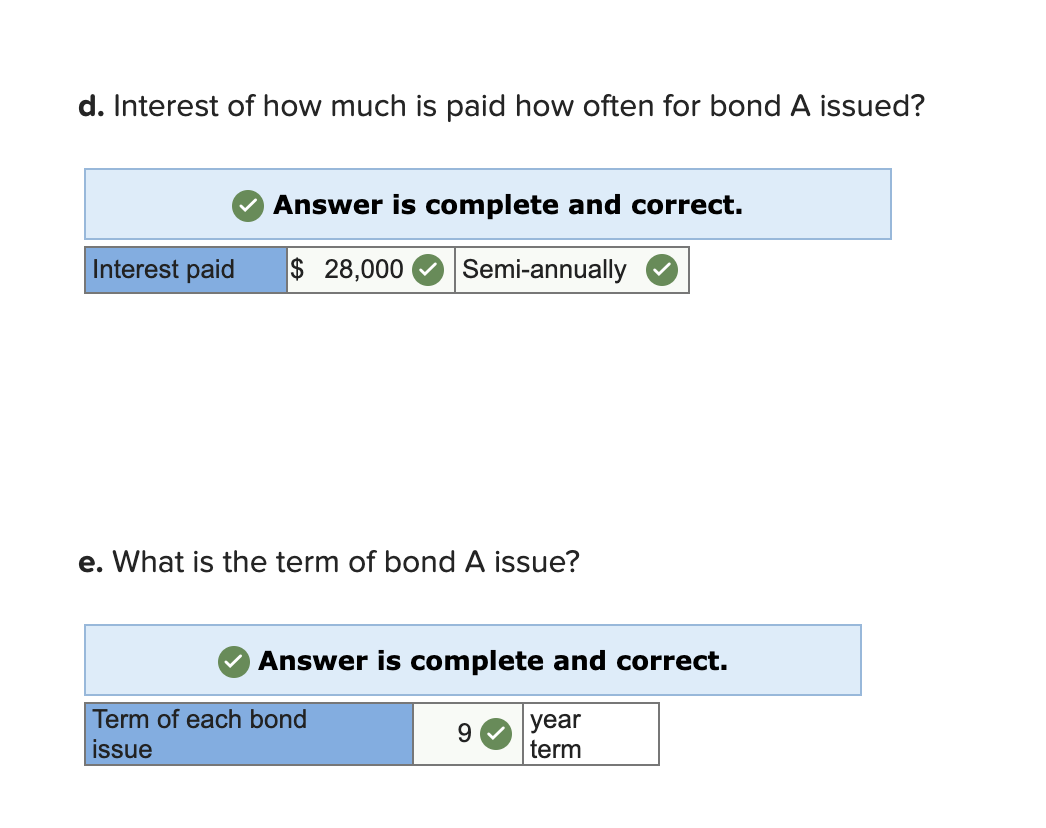

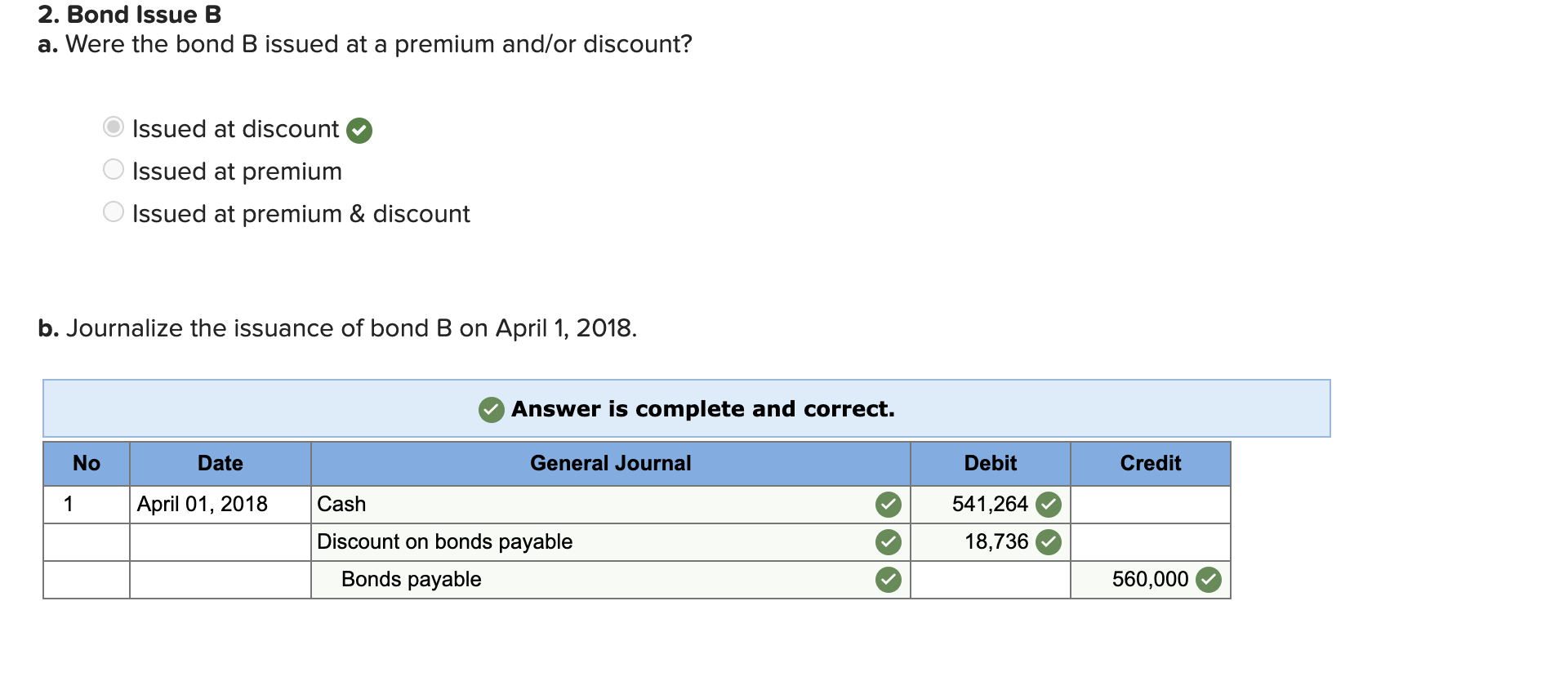

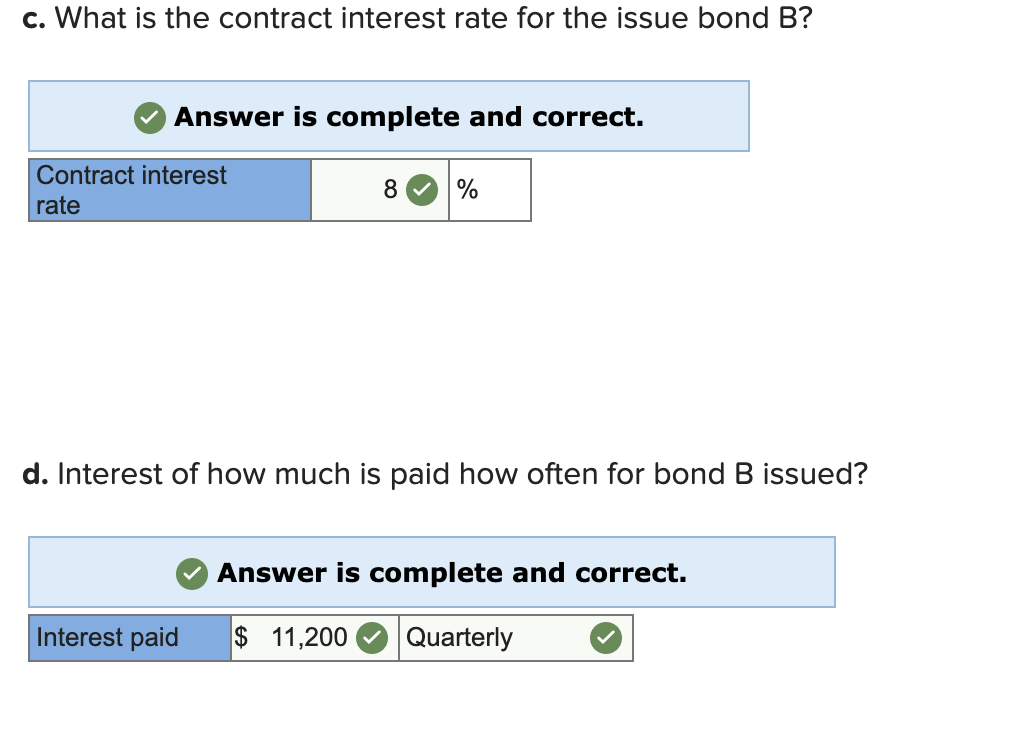

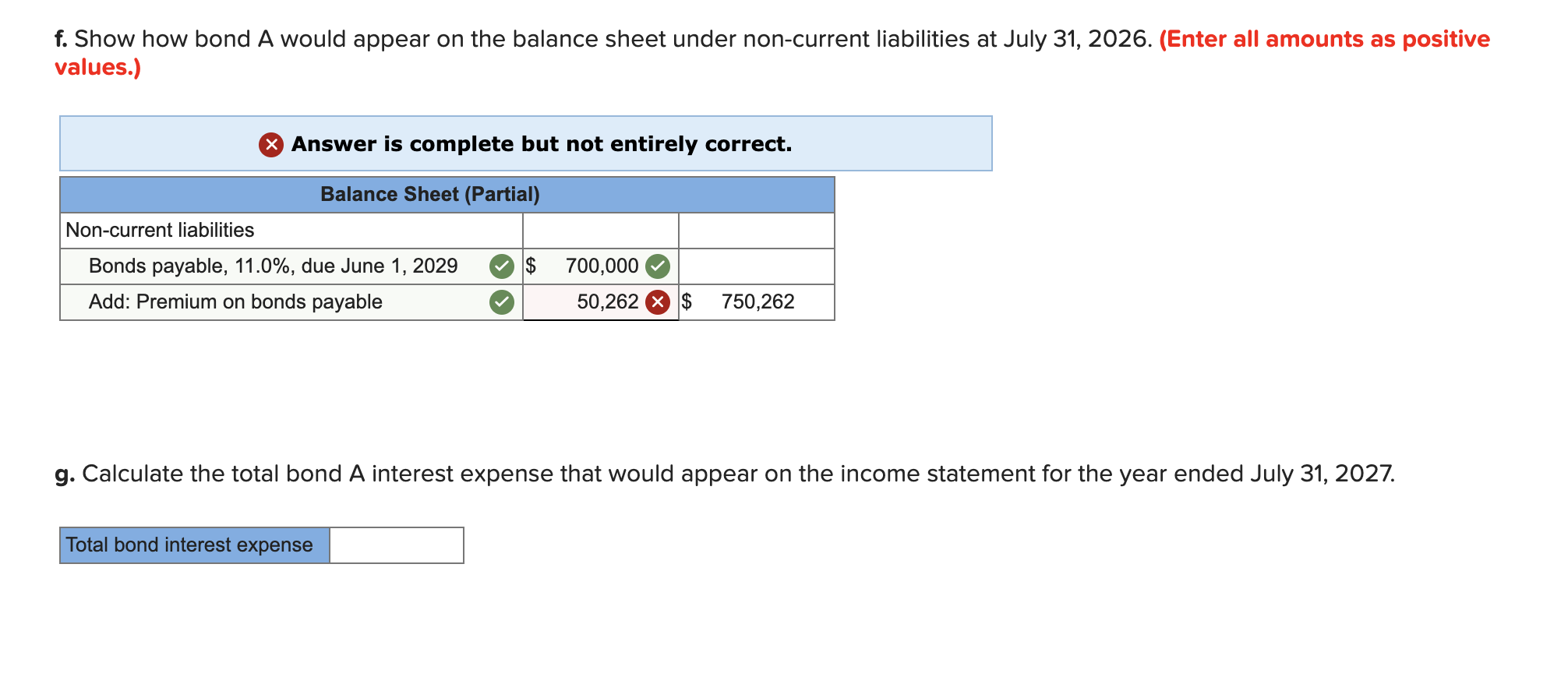

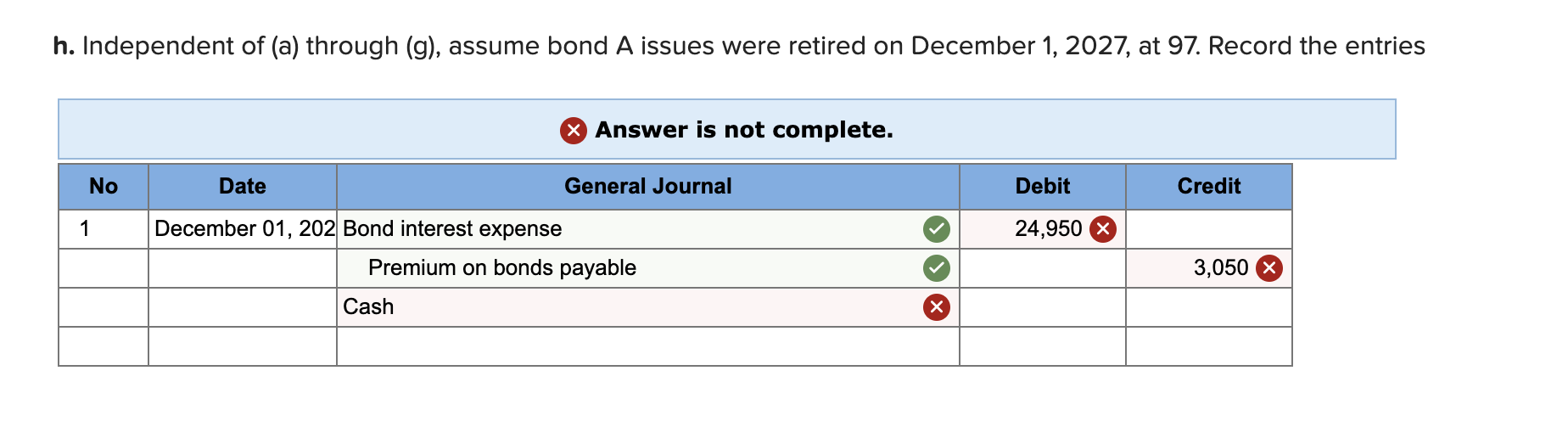

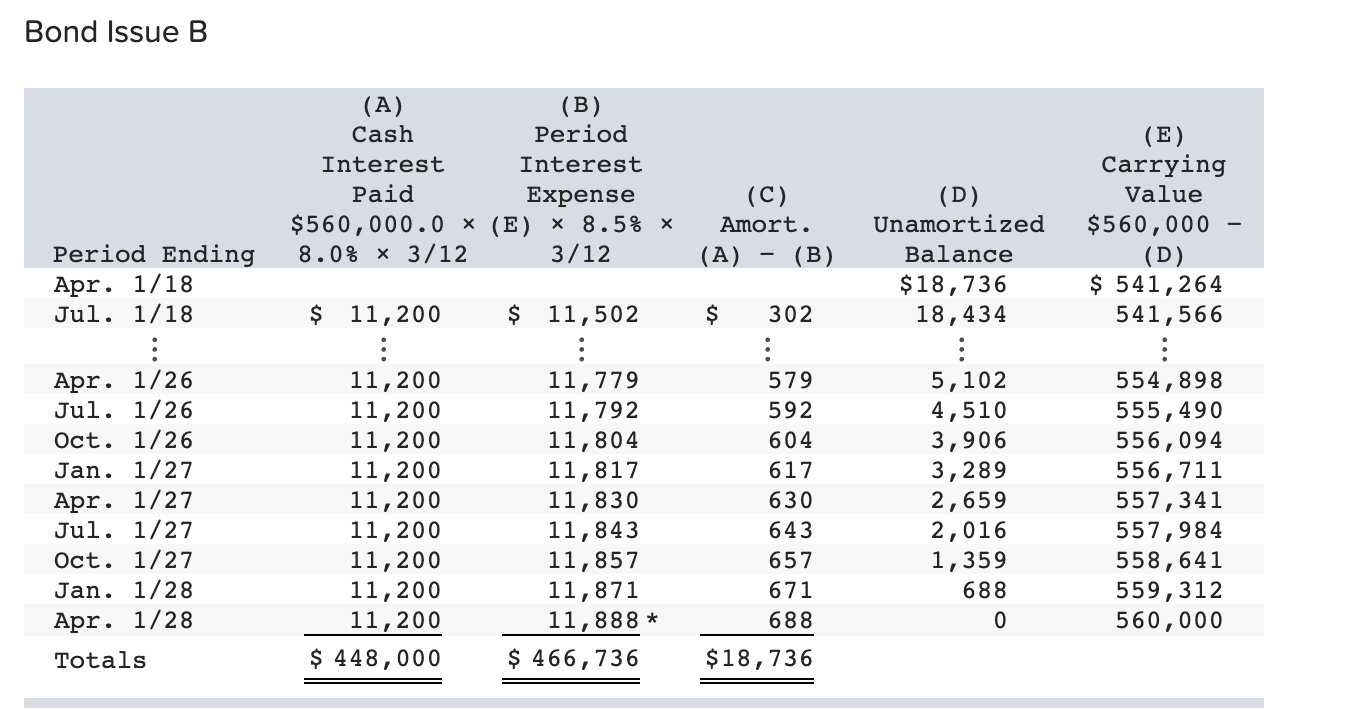

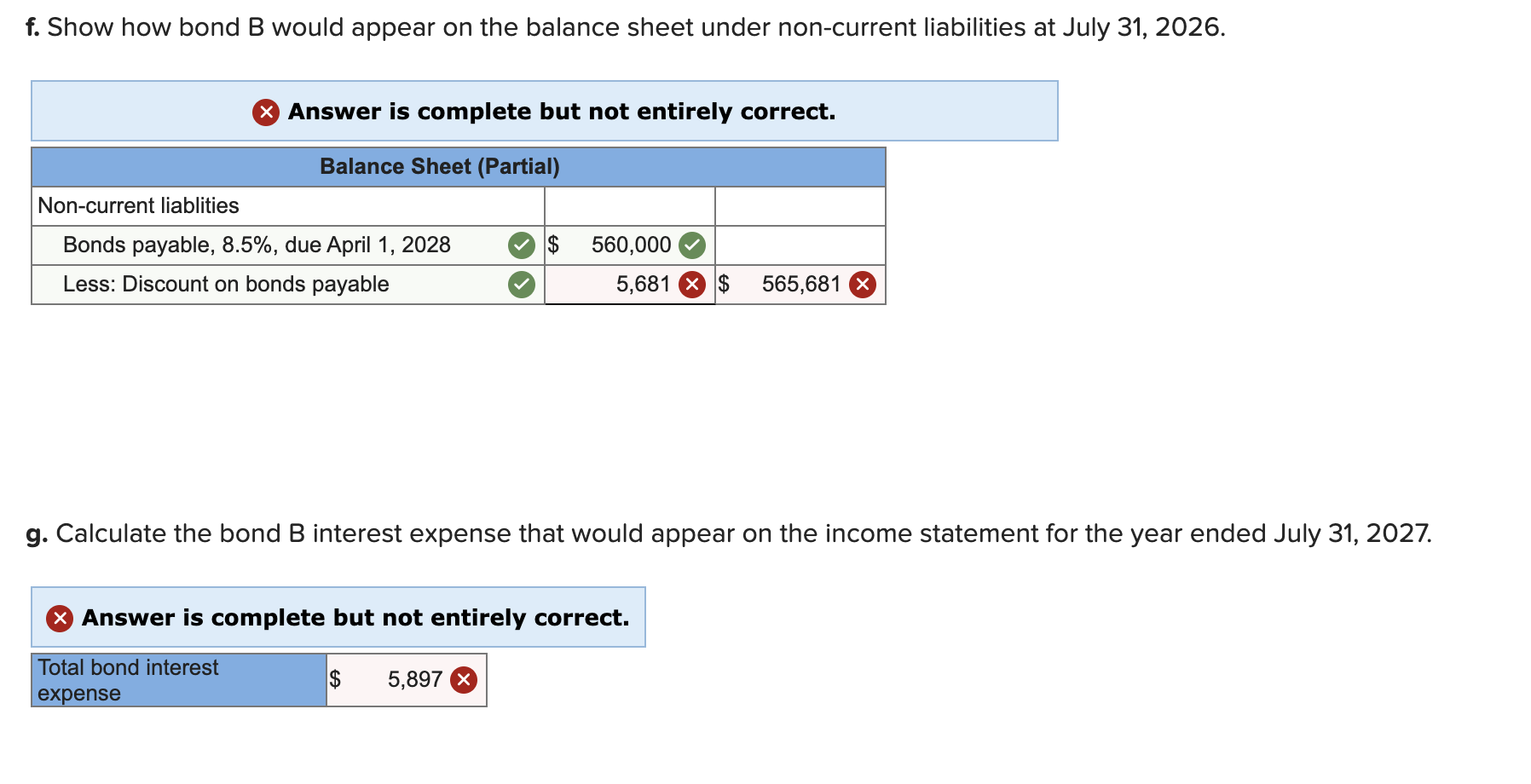

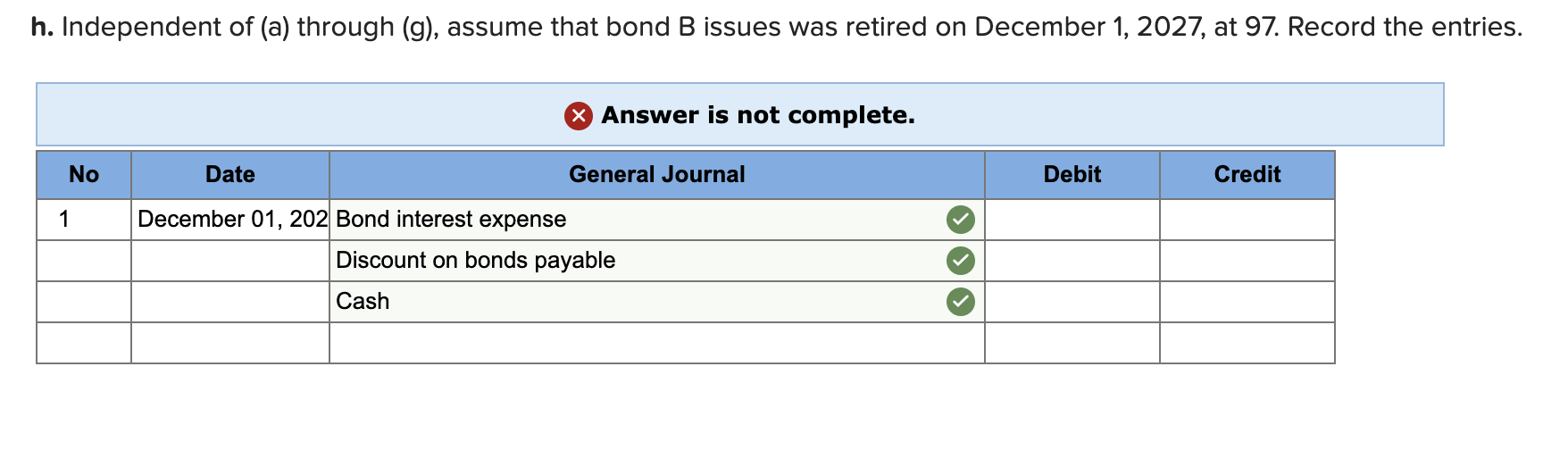

Mahalo Boat Adventure Inc. has a July 31 year-end. It showed the following partial amortization schedules regarding two bond issues: Bond Issue A (A) Cash Interest Paid $700,000 x 8.0% * 6/12 (B) Period Interest Expense (E) x 7.0% 6/12 (C) Amort. (A) (B) (E) Carrying Value $700,000 + (D) $ 746,164 744,280 - (D) Unamortized Balance $ 46,164 44,280 Period Ending June 1/20 Dec. 1/20 $ 26,116 $ 1,884 Dec. 1/26 June 1/27 Dec. 1/27 June 1/28 Dec. 1/28 June 1/29 Totals $ 28,000 : 28,000 28,000 28,000 28,000 28,000 28,000 $ 504,000 25,153 25,053 24,950 24,843 24,733 24,616 $ 457,836 2,847 2,947 3,050 3,157 3,267 3,384 $46,164 15,805 12,85 9,808 6,651 3,384 0 715,805 712,858 709,808 706,651 703,384 700,000 *Adjusted for rounding (For all requirements, do not round intermediate calculations. Round the final answers to the nearest whole dollar.) Required: 1. Bond Issue A a. Were the bond A issued at a premium and/or discount? Issued at discount Issued at premium Issued at premium & discount b. Journalize the issuance of bond A on June 1, 2020. Answer is complete and correct. No Date General Journal Debit Credit 1 June 01, 2020 Cash 746,164 Bonds payable Premium on bonds payable 700,000 46,164 d. Interest of how much is paid how often for bond A issued? Answer is complete and correct. Interest paid $ 28,000 Semi-annually e. What is the term of bond A issue? Answer is complete and correct. Term of each bond issue 9 year term 2. Bond Issue B a. Were the bond B issued at a premium and/or discount? Issued at discount Issued at premium Issued at premium & discount b. Journalize the issuance of bond B on April 1, 2018. Answer is complete and correct. No Date General Journal Debit Credit 1 April 01, 2018 Cash 541,264 18,736 Discount on bonds payable Bonds payable 560,000 c. What is the contract interest rate for the issue bond B? Answer is complete and correct. Contract interest rate 8 % d. Interest of how much is paid how often for bond B issued? Answer is complete and correct. Interest paid $ 11,200 Quarterly f. Show how bond A would appear on the balance sheet under non-current liabilities at July 31, 2026. (Enter all amounts as positive values.) X Answer is complete but not entirely correct. Balance Sheet (Partial) Non-current liabilities Bonds payable, 11.0%, due June 1, 2029 $ Add: Premium on bonds payable 700,000 50,262 X $ 750,262 g. Calculate the total bond A interest expense that would appear on the income statement for the year ended July 31, 2027. Total bond interest expense h. Independent of (a) through (g), assume bond A issues were retired on December 1, 2027, at 97. Record the entries X Answer is not complete. No Date General Journal Debit Credit 1 24,950 December 01, 202 Bond interest expense Premium on bonds payable 3,050 X Cash Bond Issue B (A) (B) Cash Period Interest Interest Paid Expense $560,000.0 * (E) X 8.5% x 8.0% 3/12 3/12 (C) Amort. (A) (B) (E) Carrying Value $560,000 (D) $ 541,264 541,566 Period Ending Apr. 1/18 Jul. 1/18 : Apr. 1/26 Jul. 1/26 Oct. 1/26 Jan. 1/27 Apr. 1/27 Jul. 1/27 Oct. 1/27 Jan. 1/28 Apr. 1/28 Totals $ 11,200 : 11,200 11,200 11,200 11,200 11,200 11,200 11,200 11,200 11,200 $ 448,000 $ 11,502 : 11,779 11,792 11,804 11,817 11,830 11,843 11,857 11,871 11,888 * $ 466,736 $ 302 : 579 592 604 617 630 643 657 671 688 $18,736 (D) Unamortized Balance $18,736 18,434 : 5,102 4,510 3,906 3,289 2,659 2,016 1,359 688 0 554,898 555,490 556,094 556,711 557,341 557,984 558,641 559,312 560,000 f. Show how bond B would appear on the balance sheet under non-current liabilities at July 31, 2026. X Answer is complete but not entirely correct. Balance Sheet (Partial) Non-current liablities $ Bonds payable, 8.5%, due April 1, 2028 Less: Discount on bonds payable 560,000 5,681 $ 565,681 X g. Calculate the bond B interest expense that would appear on the income statement for the year ended July 31, 2027. Answer is complete but not entirely correct. Total bond interest expense 5,897 X h. Independent of (a) through (g), assume that bond B issues was retired on December 1, 2027, at 97. Record the entries. Answer is not complete. No Date General Journal Debit Credit 1 December 01, 202 Bond interest expense Discount on bonds payable Cash

undefined

undefined