undefined

undefined

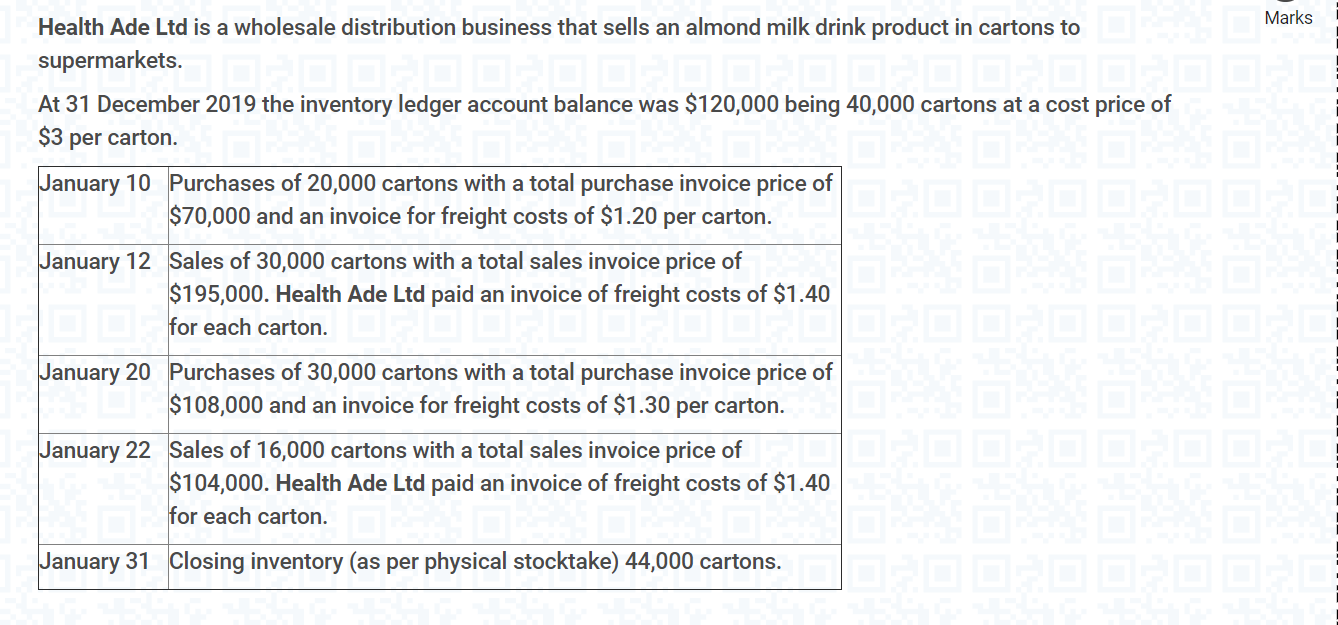

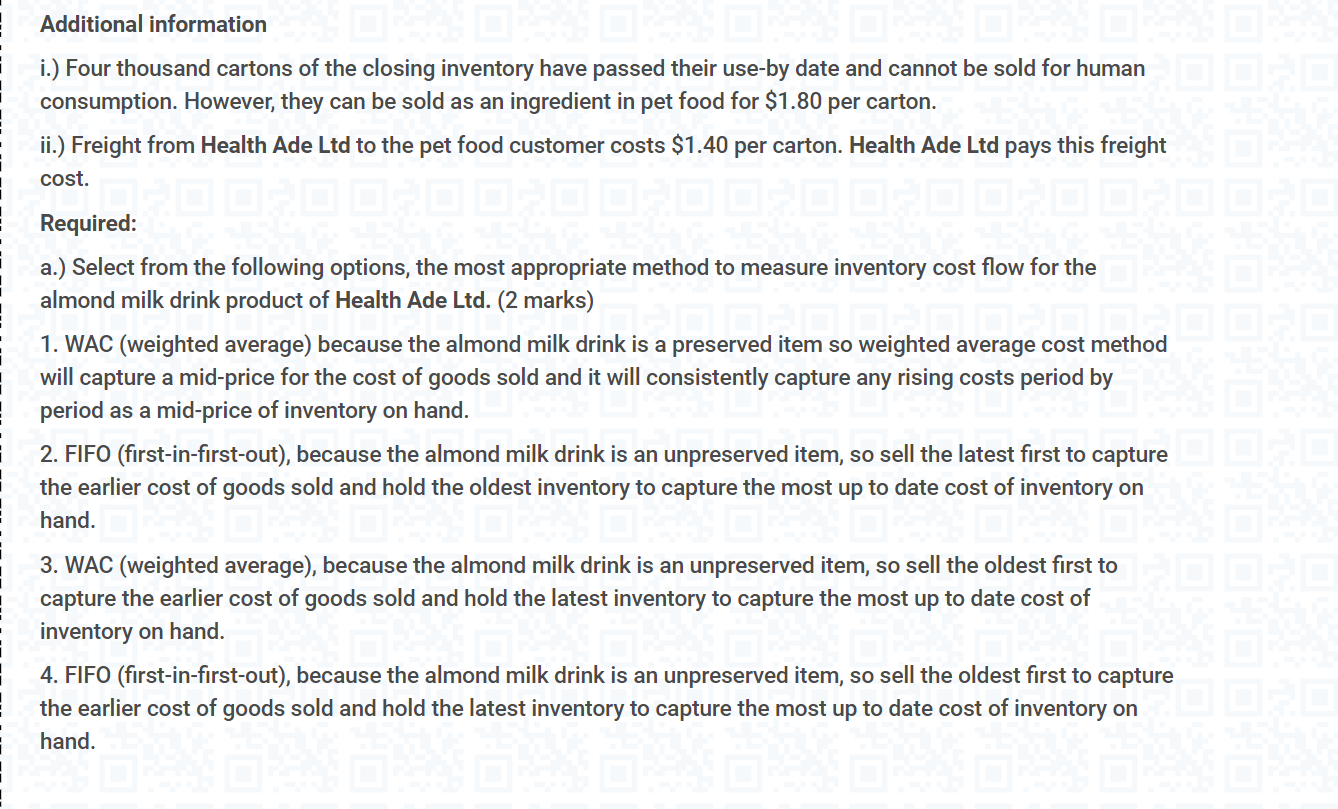

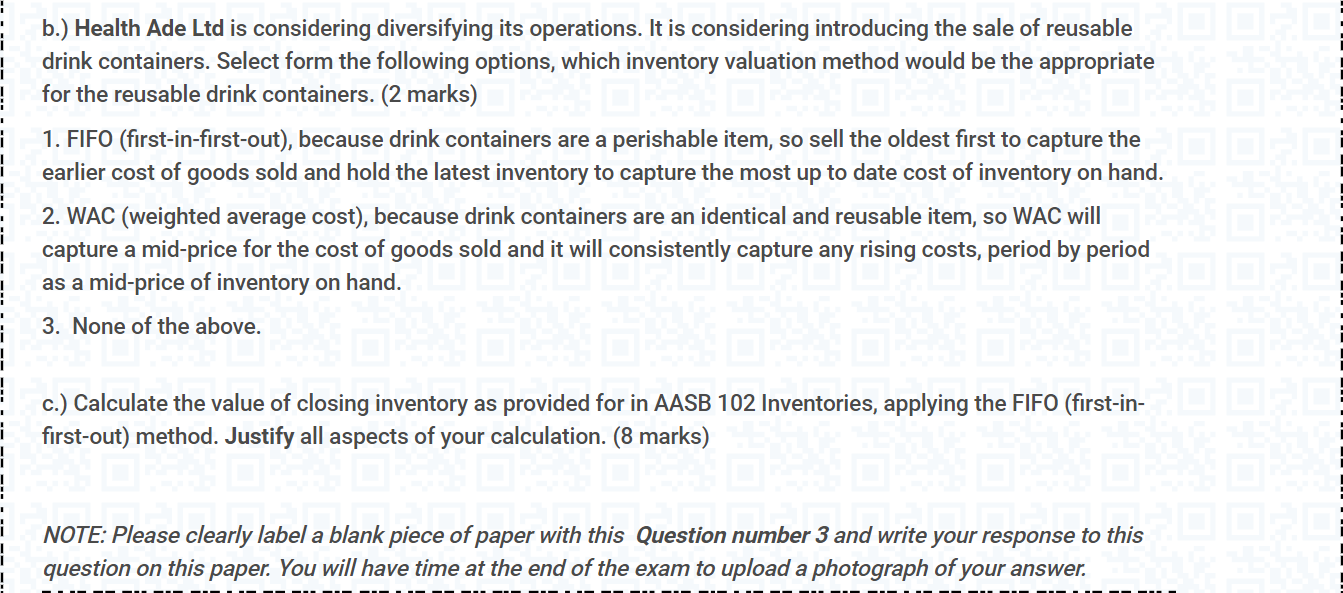

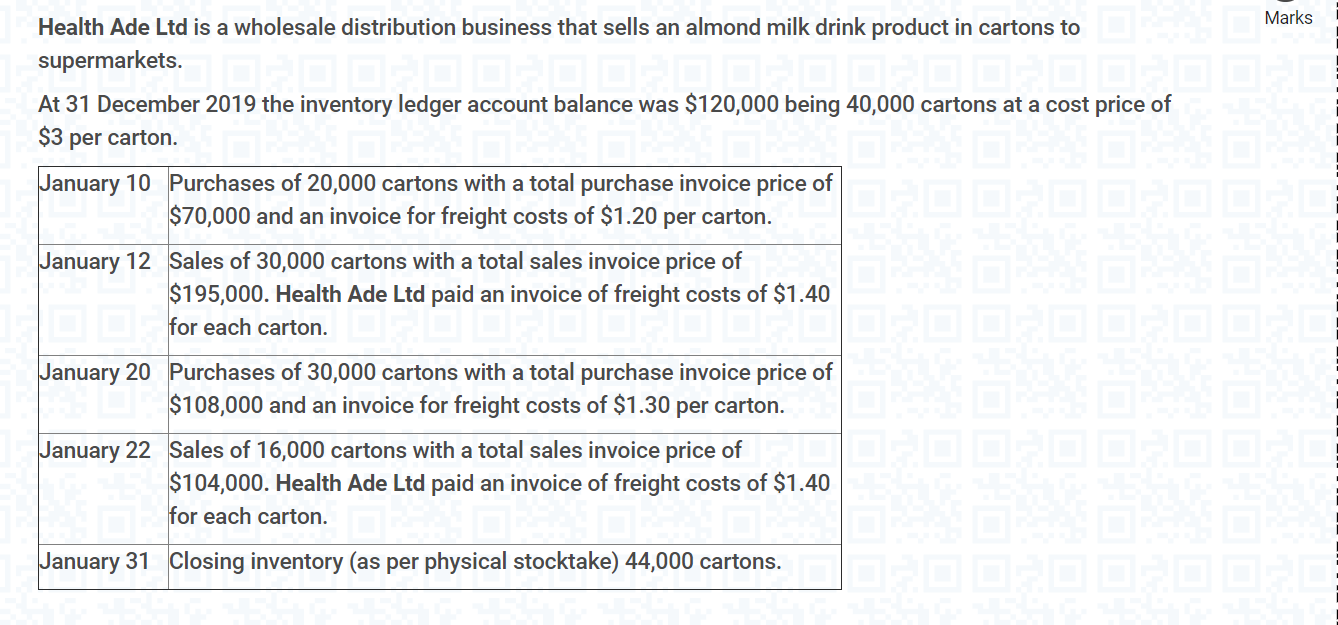

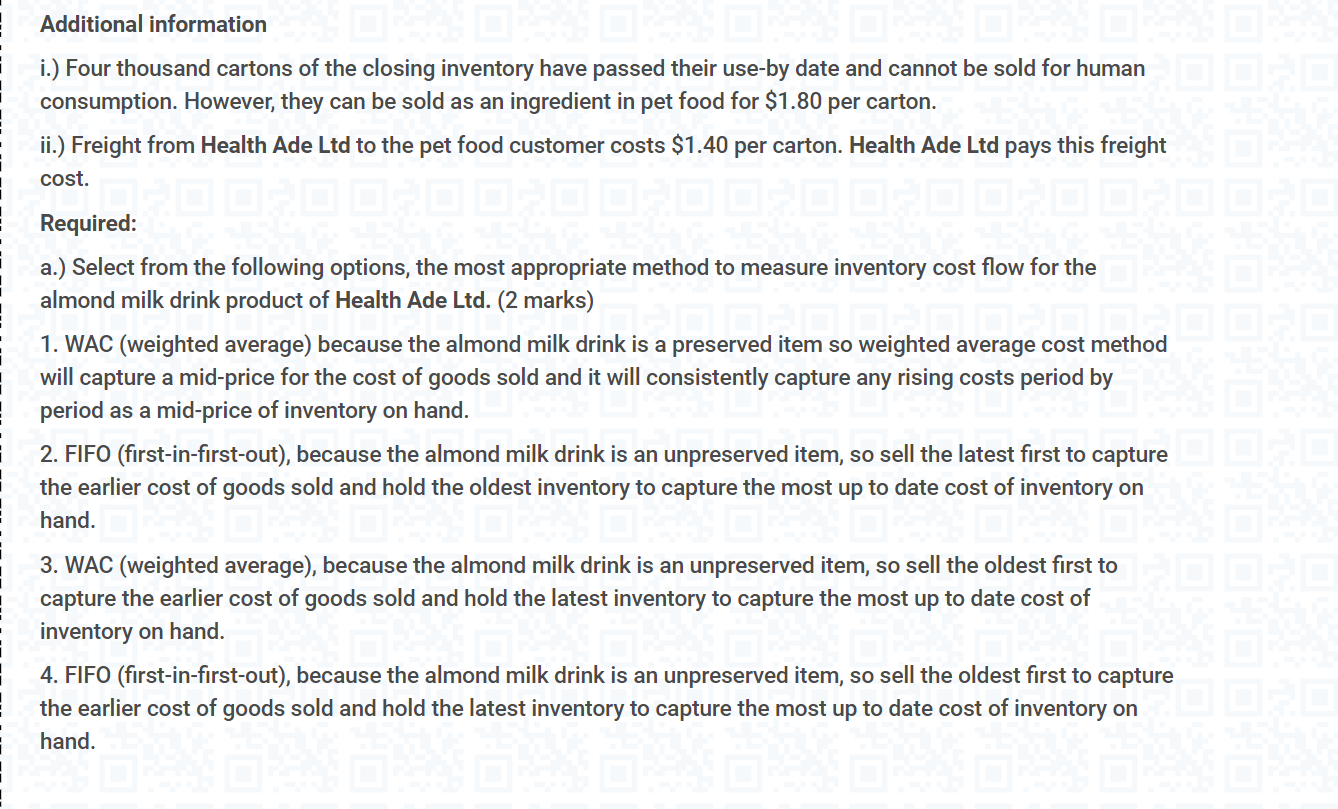

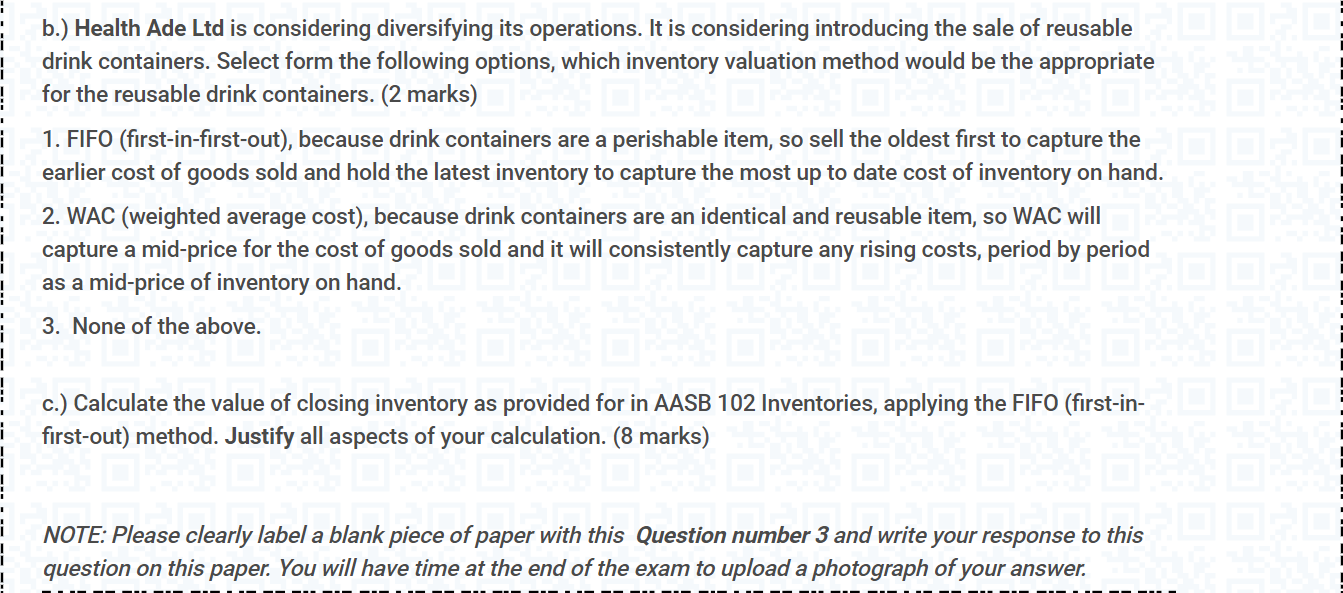

Marks Health Ade Ltd is a wholesale distribution business that sells an almond milk drink product in cartons to supermarkets. At 31 December 2019 the inventory ledger account balance was $120,000 being 40,000 cartons at a cost price of $3 per carton. January 10 Purchases of 20,000 cartons with a total purchase invoice price of $70,000 and an invoice for freight costs of $1.20 per carton. January 12 Sales of 30,000 cartons with a total sales invoice price of $195,000. Health Ade Ltd paid an invoice of freight costs of $1.40 for each carton. January 20 Purchases of 30,000 cartons with a total purchase invoice price of $108,000 and an invoice for freight costs of $1.30 per carton. January 22 Sales of 16,000 cartons with a total sales invoice price of $104,000. Health Ade Ltd paid an invoice of freight costs of $1.40 for each carton. January 31 Closing inventory (as per physical stocktake) 44,000 cartons. Additional information i.) Four thousand cartons of the closing inventory have passed their use-by date and cannot be sold for human consumption. However, they can be sold as an ingredient in pet food for $1.80 per carton. ii.) Freight from Health Ade Ltd to the pet food customer costs $1.40 per carton. Health Ade Ltd pays this freight cost. Required: a.) Select from the following options, the most appropriate method to measure inventory cost flow for the almond milk drink product of Health Ade Ltd. (2 marks) 1. WAC (weighted average) because the almond milk drink is a preserved item so weighted average cost method will capture a mid-price for the cost of goods sold and it will consistently capture any rising costs period by period as a mid-price of inventory on hand. 2. FIFO (first-in-first-out), because the almond milk drink is an unpreserved item, so sell the latest first to captures the earlier cost of goods sold and hold the oldest inventory to capture the most up to date cost of inventory on hand. 3. WAC (weighted average), because the almond milk drink is an unpreserved item, so sell the oldest first to capture the earlier cost of goods sold and hold the latest inventory to capture the most up to date cost of inventory on hand. 4. FIFO (first-in-first-out), because the almond milk drink is an unpreserved item, so sell the oldest first to capture the earlier cost of goods sold and hold the latest inventory to capture the most up to date cost of inventory on hand. b.) Health Ade Ltd is considering diversifying its operations. It is considering introducing the sale of reusable drink containers. Select form the following options, which inventory valuation method would be the appropriate for the reusable drink containers. (2 marks) 1. FIFO (first-in-first-out), because drink containers are a perishable item, so sell the oldest first to capture the earlier cost of goods sold and hold the latest inventory to capture the most up to date cost of inventory on hand. 2. WAC (weighted average cost), because drink containers are an identical and reusable item, so WAC will capture a mid-price for the cost of goods sold and it will consistently capture any rising costs, period by period as a mid-price of inventory on hand. 3. None of the above. c.) Calculate the value of closing inventory as provided for in AASB 102 Inventories, applying the FIFO (first-in- first-out) method. Justify all aspects of your calculation. (8 marks) NOTE: Please clearly label a blank piece of paper with this Question number 3 and write your response to this this question on this paper. You will have time at the end of the exam to upload a photograph of your

undefined

undefined