undefined

undefined

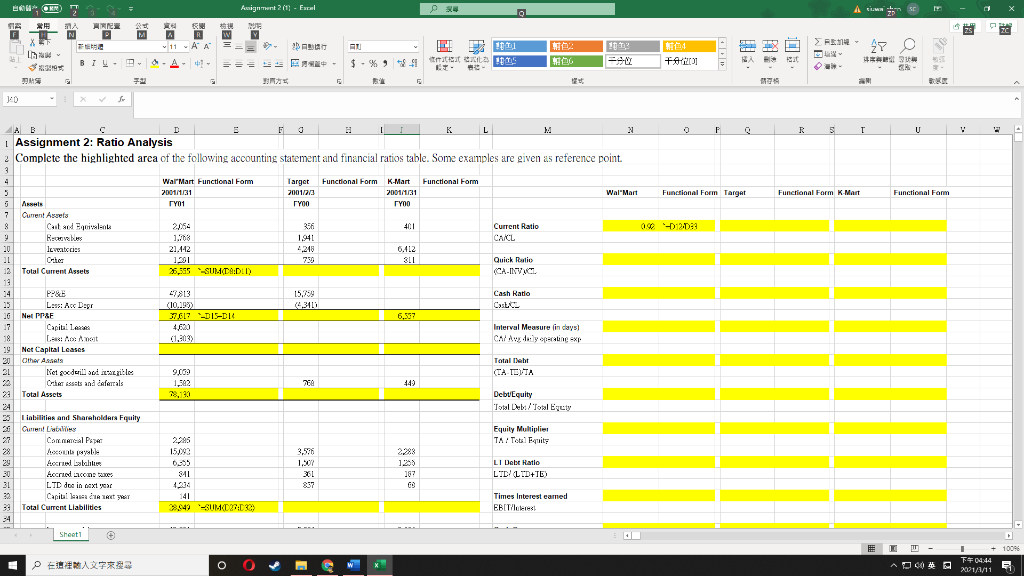

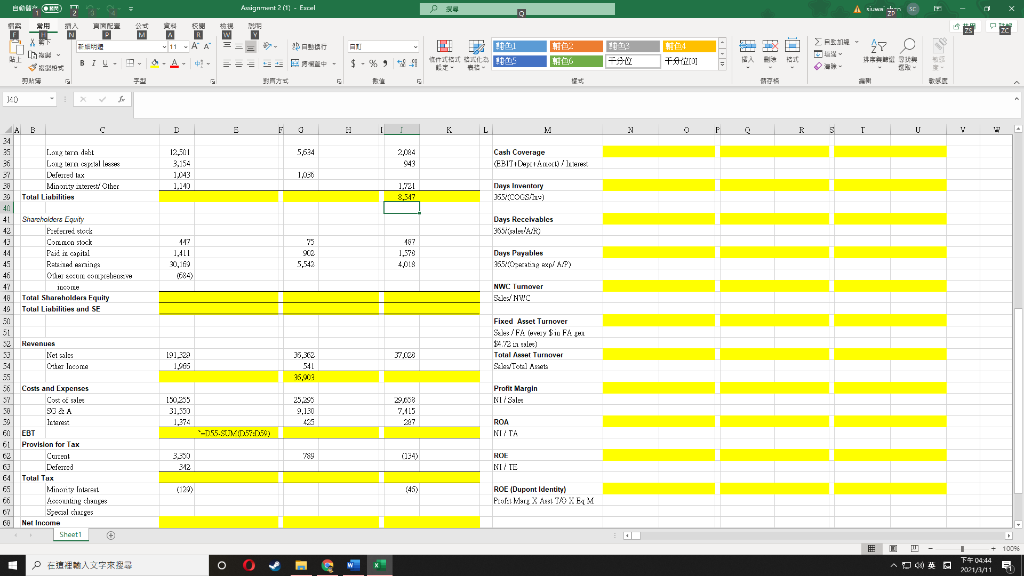

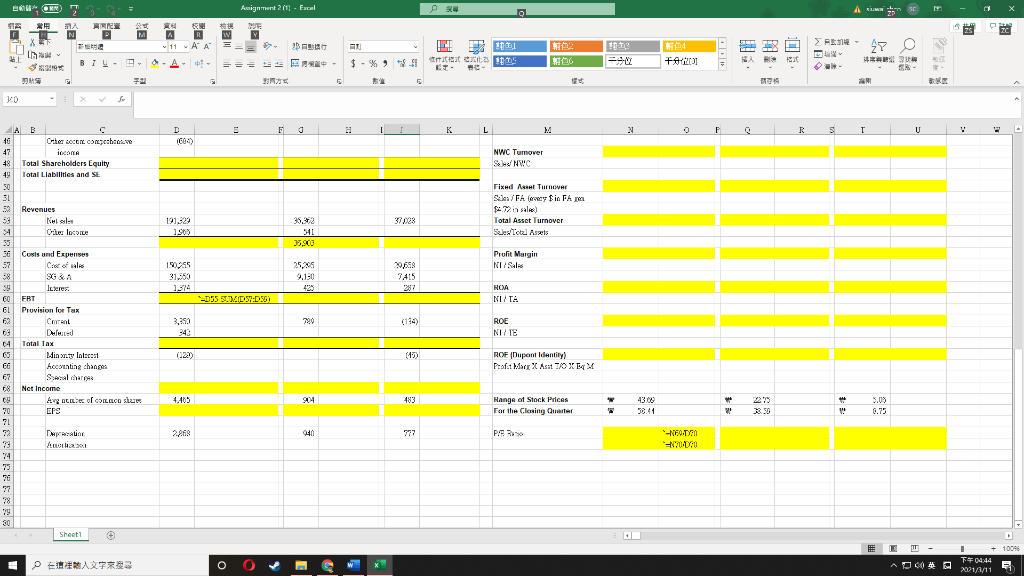

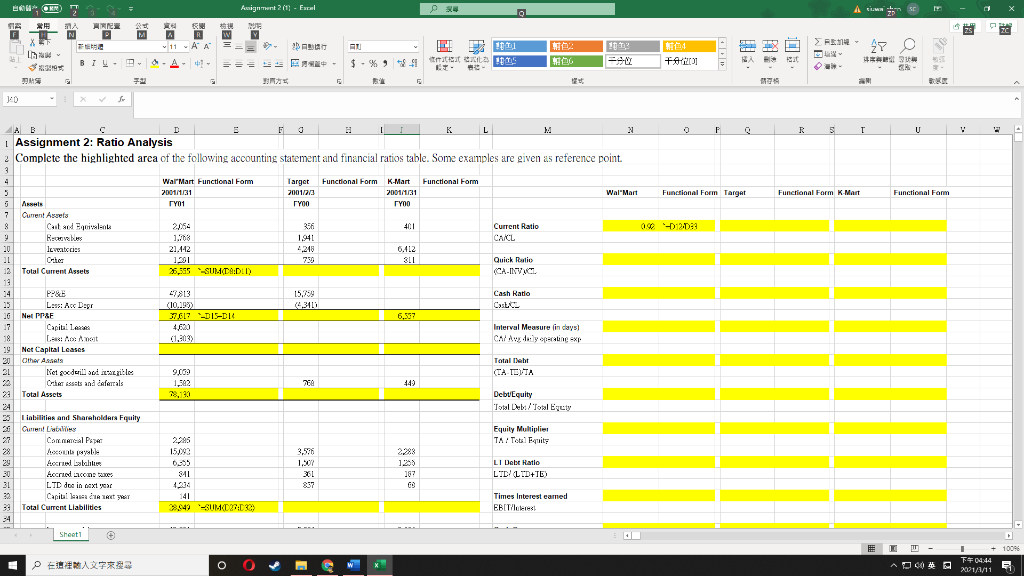

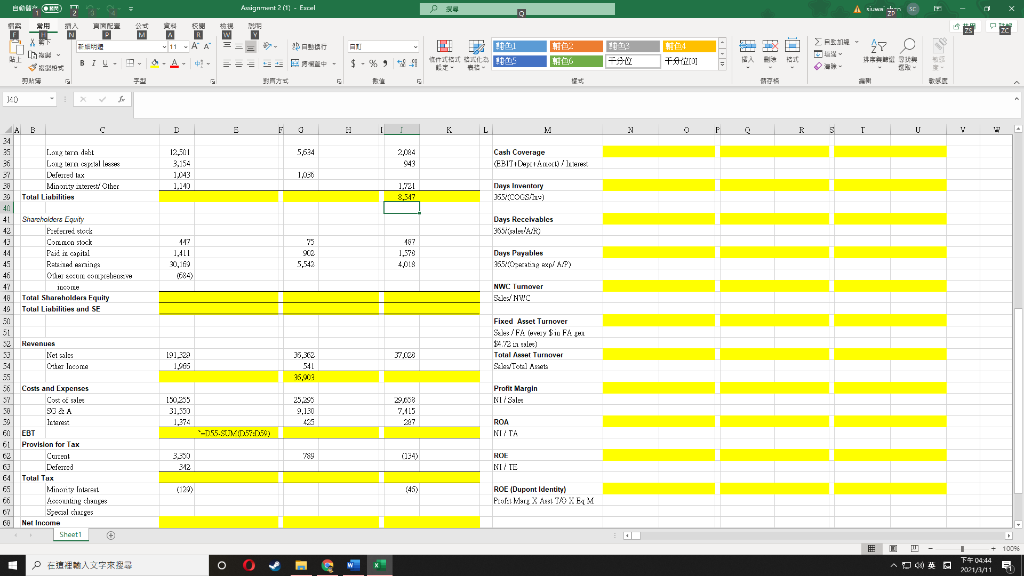

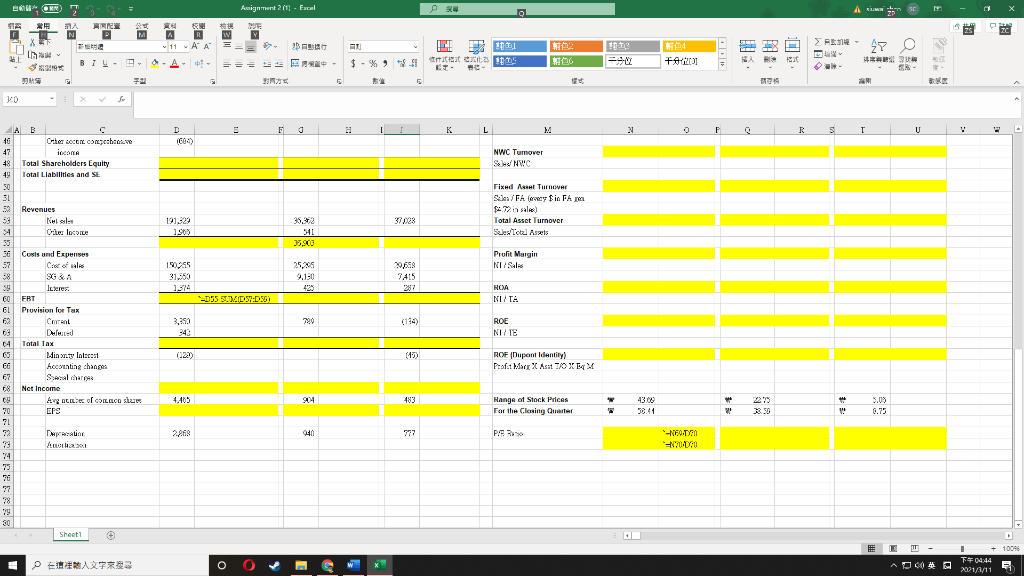

OK 10 A VILA s * KRER 2C F N Aignment2(1) - Facel & 22 A R W 11 AA = EE A === 111 TY 1 E 1 is 15 - - 27 We tha : ] B1- $ -% 91 RA O 6 JAD F R 5 T U D 51 K L i Assignment 2: Ratio Analysis Complete the highlighted area of the following accounting statement and financial ratios table. Some examples are given as reference point 3 4 5 WarMart Functional Form 2001/1/31 01 Target Functional Form K- Mart Functional Form 2001271 2001/1/31 00 00 Wal-Mart Functional Form Target Functional Form K-Mart Functional Farm 401 052-12 Current Ratio CAICL 2,254 1.708 21.142 1291 25,555 SUMTADLI) 356 1.941 4,218 750 6.412 311 Quick Ratio Cash Ratio 7 Current Area 8 Cast and Bills 9 Riscover 20 le cacces 21 12 Total Current Assets 13 14 P&E 25 Loss: Acc Dopr 2G Net Pr&E Capisl laila L-es! At 19 Net Capital Leases 20 Other Assets 31 Net soc drill so well Cherests and deferrals Total Assets 15,759 (4.3111 CLC- 47813 (10.1993 37.617 DIS-DI 4.620 (1.30) 6.537 Interval Measure in days) CH Acting p Total that CATETA 9,009 1,542 782 449 DebuEquity Total Deb:/ Total Eyety Equity Multiplier TA: Tots Equity SUNNSNRRASTI Iibilities and Shareholders Fully Current Lates Commercial Pepe Lexos alde 29 Locriad balais Locried success 31 LTD do in cext year 22 Capital 39 Total Current Liabilities 34 15092 0.305 341 3,935 1.500 361 125) 187 LI Debt Ratio LTD/LTD+TE) Times Interest comed EBIT/letres 2.943 SUB12:03) Sheet1 10096 O X AD00# F#0944 2001/3/11 OKN Aignment2(1) - Facel 10 A VILA KRER F 2C N & A R w 11 AA 22 V ABAD 111 1 TY 27 th We tha : BI. $ -% 91 sta - - A RA " ] O F J:D B F K L 2 F R 5 T U 5634 Cash Coverage KEBIT.DIA/CHIK 3.154 143 1.721 8,547 Days Inventory 35 Cocs *% Days Recetables C 34 25 Laro dahit 26 LOLU Defend tax dintyret Other Totul Liabilities 40 4 Shareholders Equity Parceristic CILICA xk 44 Peid in capital 45 Rabining 46 OAHUIL COIL 47 10OILE 16 Total Shareholders Fquity 49 Totul Liubilities und SE 50 147 1,411 2019 6.84) 1,576 4018 Days Payables 355/p/AP) 5,542 NWC I umover Sew NWC Fixed Asset Turnover Ses/FAy Si FAMI $4721) Total Assal Tunnavar See Total Asset 191,32 1.505 1 541 Proti Margin NI/Sals / 31.500 9,130 7.115 -D55.SUMID:11.90) ROA NITA 52 Havenues Net als 54 Che local .55 30 Costs and expenses 57 Cost of sales 58 50 Icare 60 EBT O Provision for Tax 02 Curent Exford 64 Total Tox 65 Minoty Interest 66 Acco Secal chunges 60 Net Income Sheet1 789 3300 312 RCE NITE (129) 145) ROE (Dupont Identity Ful: IL & SM4 780 EM 10096 AD00# F04:44 2001/3/11 OKN Aignment2(1) - Facel 10 A VILA KRER F 2C 22 V N & A R w 11 AA A | 1 27 th We tha $ -% 91 BIU. sta - - RA ] " O F F J:D D E F K L 2 o F R 5 T U C Che BOCOL Compet: NWC Tumover Total Shareholders Equity Total Liabilities and SE 48 49 50 SL 5 Revenues [ Nella Oie locore Fixed Asset Turnover Sales/ FA y sio Fh 72 in sale Total Asset Turnover Sales total Ass 54 1908 541 33.903 Profit Murgin NI/S 1.50785 31.559 1.314 9.150 7415 ROA NITA 2-D55 3. D:) 720 ROE NI/TE (43) Costs und Expenses .57 Car of als 28 luteres: 60 EBT 61 Provision for Tax 62 Current 03 Dul 64 Total Tax Llinary Interest EG hocotating changes 67 68 Net Income 43 BEELD of COILED un 70 EFS 7L 32 ALL2301 14 75 ROF Dupont Identity) Prof: Mac Asit TOXX 4.465 904 483 Range of Stock Prices For the Clersing Quarter 9.03 6.73 32.41 040 777 PS3 FOTO 900.0 37 38 Sheet1 10096 AD00# F04:44 2001/3/11 OK 10 A VILA s * KRER 2C F N Aignment2(1) - Facel & 22 A R W 11 AA = EE A === 111 TY 1 E 1 is 15 - - 27 We tha : ] B1- $ -% 91 RA O 6 JAD F R 5 T U D 51 K L i Assignment 2: Ratio Analysis Complete the highlighted area of the following accounting statement and financial ratios table. Some examples are given as reference point 3 4 5 WarMart Functional Form 2001/1/31 01 Target Functional Form K- Mart Functional Form 2001271 2001/1/31 00 00 Wal-Mart Functional Form Target Functional Form K-Mart Functional Farm 401 052-12 Current Ratio CAICL 2,254 1.708 21.142 1291 25,555 SUMTADLI) 356 1.941 4,218 750 6.412 311 Quick Ratio Cash Ratio 7 Current Area 8 Cast and Bills 9 Riscover 20 le cacces 21 12 Total Current Assets 13 14 P&E 25 Loss: Acc Dopr 2G Net Pr&E Capisl laila L-es! At 19 Net Capital Leases 20 Other Assets 31 Net soc drill so well Cherests and deferrals Total Assets 15,759 (4.3111 CLC- 47813 (10.1993 37.617 DIS-DI 4.620 (1.30) 6.537 Interval Measure in days) CH Acting p Total that CATETA 9,009 1,542 782 449 DebuEquity Total Deb:/ Total Eyety Equity Multiplier TA: Tots Equity SUNNSNRRASTI Iibilities and Shareholders Fully Current Lates Commercial Pepe Lexos alde 29 Locriad balais Locried success 31 LTD do in cext year 22 Capital 39 Total Current Liabilities 34 15092 0.305 341 3,935 1.500 361 125) 187 LI Debt Ratio LTD/LTD+TE) Times Interest comed EBIT/letres 2.943 SUB12:03) Sheet1 10096 O X AD00# F#0944 2001/3/11 OKN Aignment2(1) - Facel 10 A VILA KRER F 2C N & A R w 11 AA 22 V ABAD 111 1 TY 27 th We tha : BI. $ -% 91 sta - - A RA " ] O F J:D B F K L 2 F R 5 T U 5634 Cash Coverage KEBIT.DIA/CHIK 3.154 143 1.721 8,547 Days Inventory 35 Cocs *% Days Recetables C 34 25 Laro dahit 26 LOLU Defend tax dintyret Other Totul Liabilities 40 4 Shareholders Equity Parceristic CILICA xk 44 Peid in capital 45 Rabining 46 OAHUIL COIL 47 10OILE 16 Total Shareholders Fquity 49 Totul Liubilities und SE 50 147 1,411 2019 6.84) 1,576 4018 Days Payables 355/p/AP) 5,542 NWC I umover Sew NWC Fixed Asset Turnover Ses/FAy Si FAMI $4721) Total Assal Tunnavar See Total Asset 191,32 1.505 1 541 Proti Margin NI/Sals / 31.500 9,130 7.115 -D55.SUMID:11.90) ROA NITA 52 Havenues Net als 54 Che local .55 30 Costs and expenses 57 Cost of sales 58 50 Icare 60 EBT O Provision for Tax 02 Curent Exford 64 Total Tox 65 Minoty Interest 66 Acco Secal chunges 60 Net Income Sheet1 789 3300 312 RCE NITE (129) 145) ROE (Dupont Identity Ful: IL & SM4 780 EM 10096 AD00# F04:44 2001/3/11 OKN Aignment2(1) - Facel 10 A VILA KRER F 2C 22 V N & A R w 11 AA A | 1 27 th We tha $ -% 91 BIU. sta - - RA ] " O F F J:D D E F K L 2 o F R 5 T U C Che BOCOL Compet: NWC Tumover Total Shareholders Equity Total Liabilities and SE 48 49 50 SL 5 Revenues [ Nella Oie locore Fixed Asset Turnover Sales/ FA y sio Fh 72 in sale Total Asset Turnover Sales total Ass 54 1908 541 33.903 Profit Murgin NI/S 1.50785 31.559 1.314 9.150 7415 ROA NITA 2-D55 3. D:) 720 ROE NI/TE (43) Costs und Expenses .57 Car of als 28 luteres: 60 EBT 61 Provision for Tax 62 Current 03 Dul 64 Total Tax Llinary Interest EG hocotating changes 67 68 Net Income 43 BEELD of COILED un 70 EFS 7L 32 ALL2301 14 75 ROF Dupont Identity) Prof: Mac Asit TOXX 4.465 904 483 Range of Stock Prices For the Clersing Quarter 9.03 6.73 32.41 040 777 PS3 FOTO 900.0 37 38 Sheet1 10096 AD00# F04:44 2001/3/11

undefined

undefined