undefined

undefined

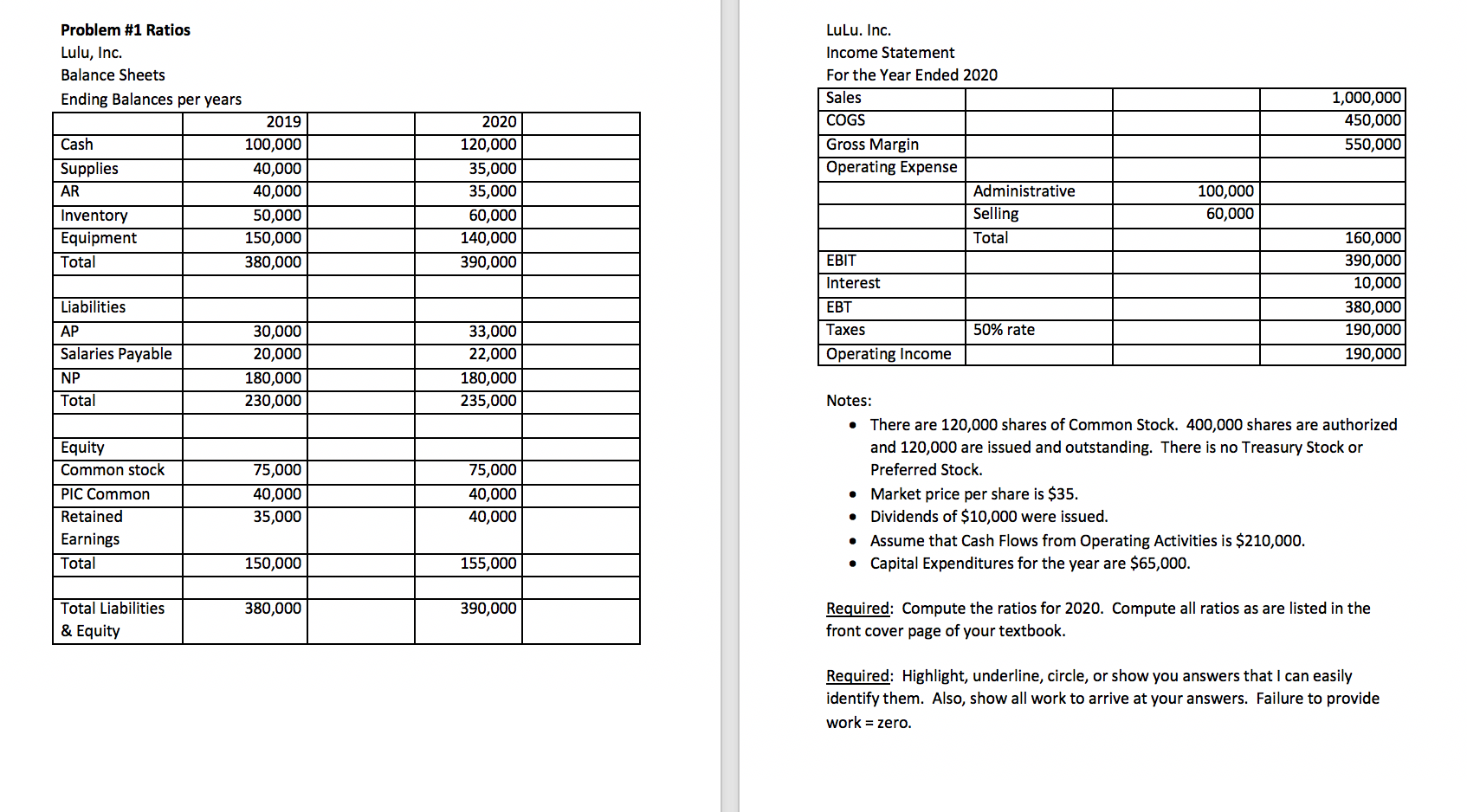

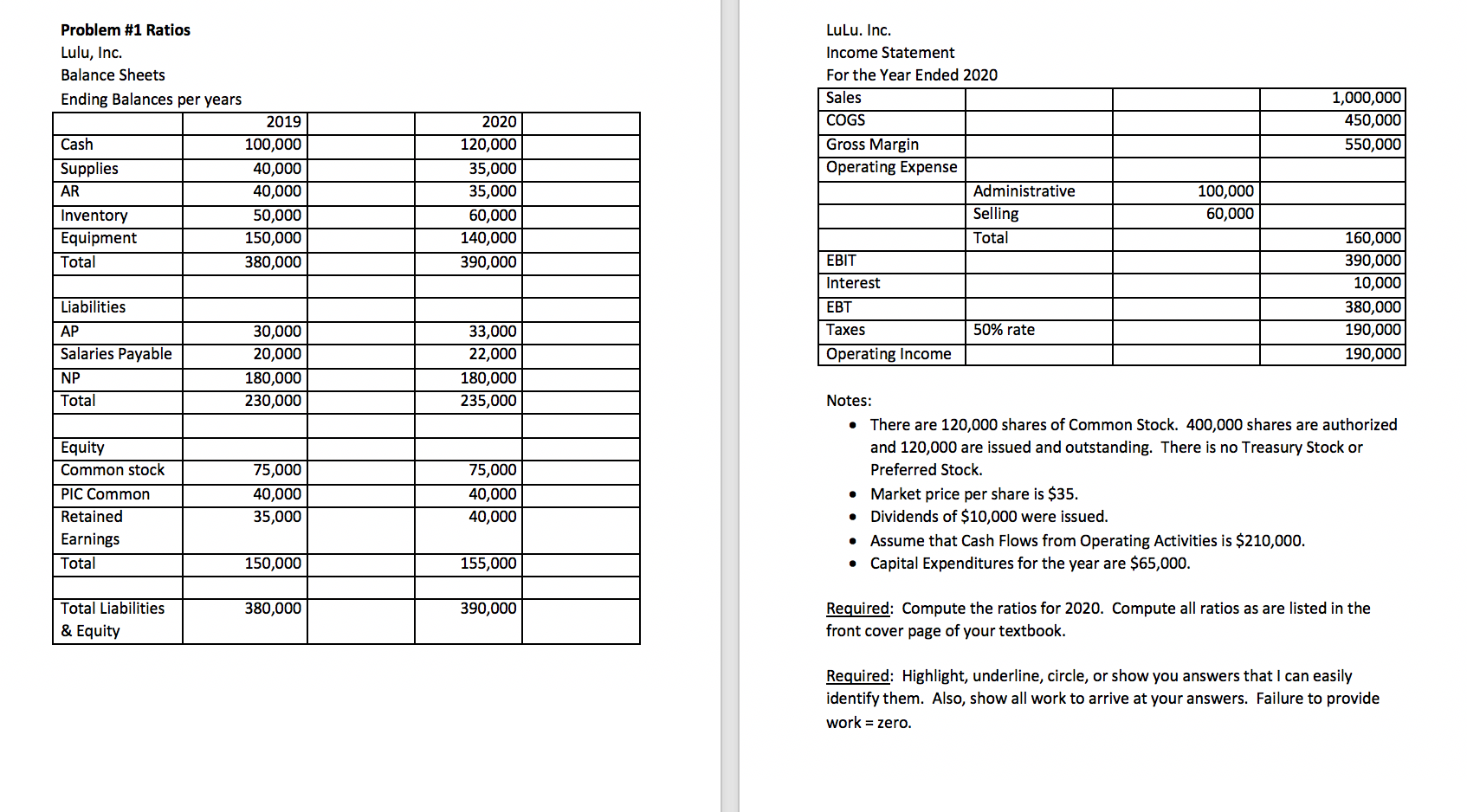

Problem #1 Ratios Lulu, Inc. Balance Sheets Ending Balances per years 2019 Cash 100,000 Supplies 40,000 AR 40,000 Inventory 50,000 Equipment 150,000 Total 380,000 Lulu. Inc. Income Statement For the Year Ended 2020 Sales COGS Gross Margin Operating Expense Administrative Selling Total EBIT 1,000,000 450,000 550,000 2020 120,000 35,000 35,000 60,000 140,000 390,000 100,000 60,000 Interest 160,000 390,000 10,000 380,000 190,000 190,000 EBT 50% rate Liabilities AP Salaries Payable NP Total 30,000 20,000 180,000 230,000 33,000 22,000 180,000 235,000 Taxes Operating Income Equity Common stock PIC Common Retained Earnings Total 75,000 40,000 35,000 75,000 40,000 40,000 Notes: There are 120,000 shares of Common Stock. 400,000 shares are authorized and 120,000 are issued and outstanding. There is no Treasury Stock or Preferred Stock. Market price per share is $35. Dividends of $10,000 were issued. Assume that Cash Flows from Operating Activities is $210,000. Capital Expenditures for the year are $65,000. 150,000 155,000 Total Liabilities 380,000 390,000 Required: Compute the ratios for 2020. Compute all ratios as are listed in the front cover page of your textbook. & Equity Required: Highlight, underline, circle, or show you answers that I can easily identify them. Also, show all work to arrive at your answers. Failure to provide work = zero. Problem #1 Ratios Lulu, Inc. Balance Sheets Ending Balances per years 2019 Cash 100,000 Supplies 40,000 AR 40,000 Inventory 50,000 Equipment 150,000 Total 380,000 Lulu. Inc. Income Statement For the Year Ended 2020 Sales COGS Gross Margin Operating Expense Administrative Selling Total EBIT 1,000,000 450,000 550,000 2020 120,000 35,000 35,000 60,000 140,000 390,000 100,000 60,000 Interest 160,000 390,000 10,000 380,000 190,000 190,000 EBT 50% rate Liabilities AP Salaries Payable NP Total 30,000 20,000 180,000 230,000 33,000 22,000 180,000 235,000 Taxes Operating Income Equity Common stock PIC Common Retained Earnings Total 75,000 40,000 35,000 75,000 40,000 40,000 Notes: There are 120,000 shares of Common Stock. 400,000 shares are authorized and 120,000 are issued and outstanding. There is no Treasury Stock or Preferred Stock. Market price per share is $35. Dividends of $10,000 were issued. Assume that Cash Flows from Operating Activities is $210,000. Capital Expenditures for the year are $65,000. 150,000 155,000 Total Liabilities 380,000 390,000 Required: Compute the ratios for 2020. Compute all ratios as are listed in the front cover page of your textbook. & Equity Required: Highlight, underline, circle, or show you answers that I can easily identify them. Also, show all work to arrive at your answers. Failure to provide work = zero

undefined

undefined