undefined

undefined

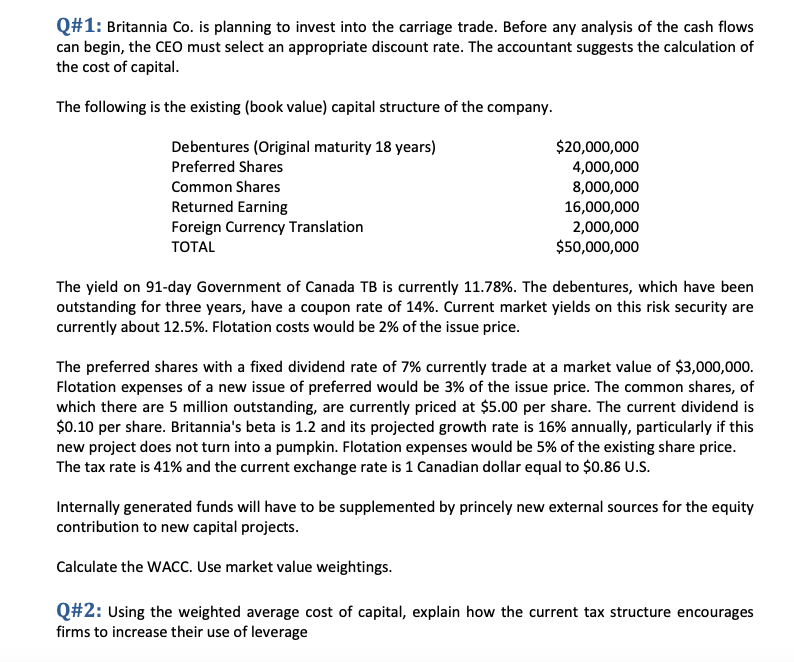

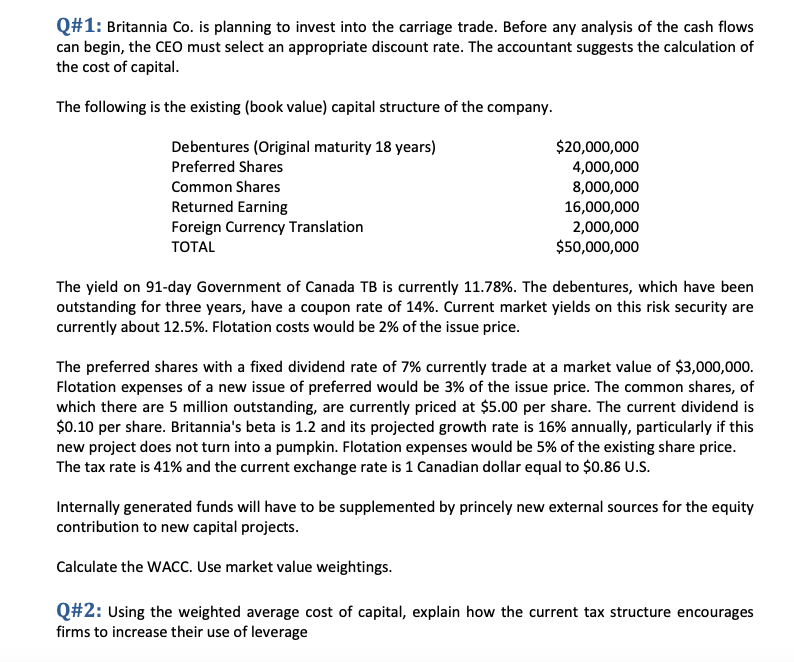

Q#1: Britannia Co. is planning to invest into the carriage trade. Before any analysis of the cash flows can begin, the CEO must select an appropriate discount rate. The accountant suggests the calculation of the cost of capital. The following is the existing (book value) capital structure of the company. Debentures (Original maturity 18 years) Preferred Shares Common Shares Returned Earning Foreign Currency Translation TOTAL $20,000,000 4,000,000 8,000,000 16,000,000 2,000,000 $50,000,000 The yield on 91-day Government of Canada TB is currently 11.78%. The debentures, which have been outstanding for three years, have a coupon rate of 14%. Current market yields on this risk security are currently about 12.5%. Flotation costs would be 2% of the issue price. The preferred shares with a fixed dividend rate of 7% currently trade at a market value of $3,000,000. Flotation expenses of a new issue of preferred would be 3% of the issue price. The common shares, of which there are 5 million outstanding, are currently priced at $5.00 per share. The current dividend is $0.10 per share. Britannia's beta is 1.2 and its projected growth rate is 16% annually, particularly if this new project does not turn into a pumpkin. Flotation expenses would be 5% of the existing share price. The tax rate is 41% and the current exchange rate is 1 Canadian dollar equal to $0.86 U.S. Internally generated funds will have to be supplemented by princely new external sources for the equity contribution to new capital projects. Calculate the WACC. Use market value weightings. Q#2: Using the weighted average cost of capital, explain how the current tax structure encourages firms to increase their use of leverage Q#1: Britannia Co. is planning to invest into the carriage trade. Before any analysis of the cash flows can begin, the CEO must select an appropriate discount rate. The accountant suggests the calculation of the cost of capital. The following is the existing (book value) capital structure of the company. Debentures (Original maturity 18 years) Preferred Shares Common Shares Returned Earning Foreign Currency Translation TOTAL $20,000,000 4,000,000 8,000,000 16,000,000 2,000,000 $50,000,000 The yield on 91-day Government of Canada TB is currently 11.78%. The debentures, which have been outstanding for three years, have a coupon rate of 14%. Current market yields on this risk security are currently about 12.5%. Flotation costs would be 2% of the issue price. The preferred shares with a fixed dividend rate of 7% currently trade at a market value of $3,000,000. Flotation expenses of a new issue of preferred would be 3% of the issue price. The common shares, of which there are 5 million outstanding, are currently priced at $5.00 per share. The current dividend is $0.10 per share. Britannia's beta is 1.2 and its projected growth rate is 16% annually, particularly if this new project does not turn into a pumpkin. Flotation expenses would be 5% of the existing share price. The tax rate is 41% and the current exchange rate is 1 Canadian dollar equal to $0.86 U.S. Internally generated funds will have to be supplemented by princely new external sources for the equity contribution to new capital projects. Calculate the WACC. Use market value weightings. Q#2: Using the weighted average cost of capital, explain how the current tax structure encourages firms to increase their use of leverage

undefined

undefined