undefined

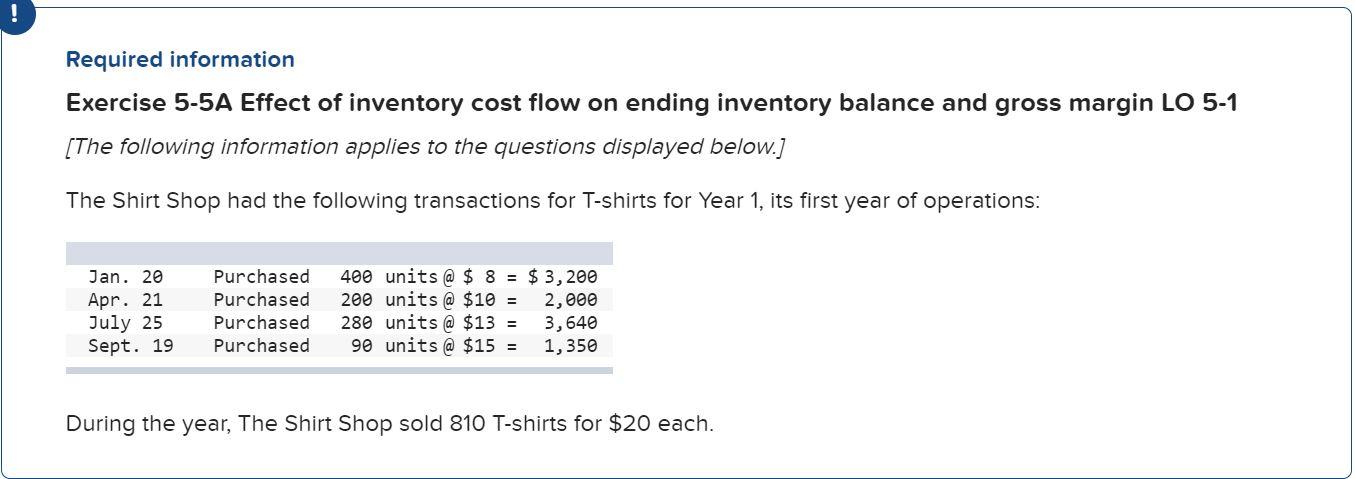

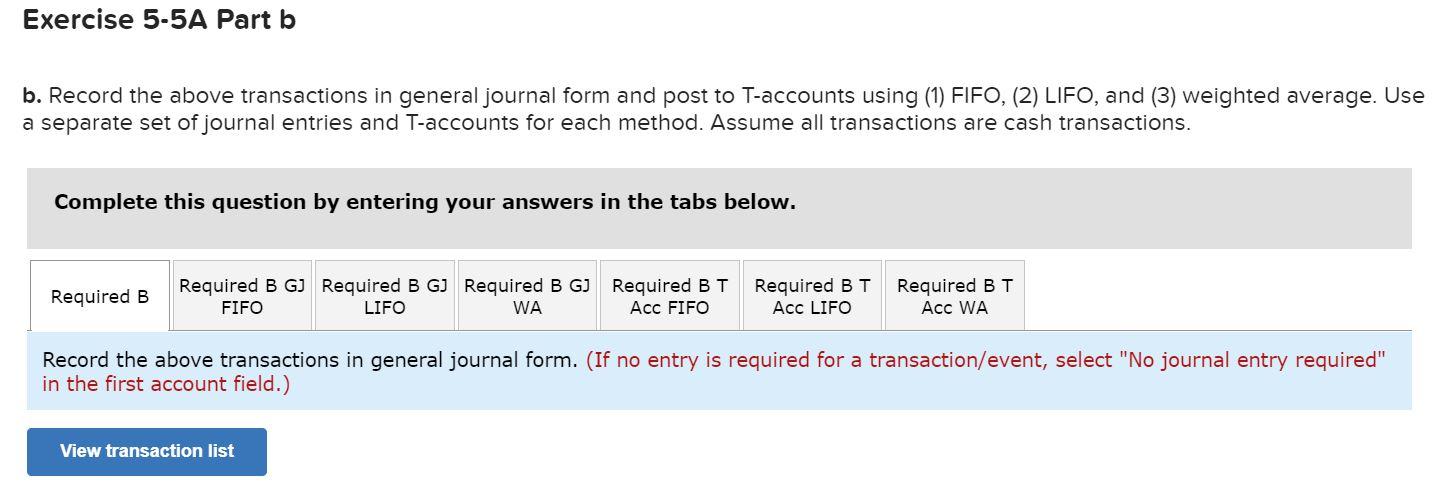

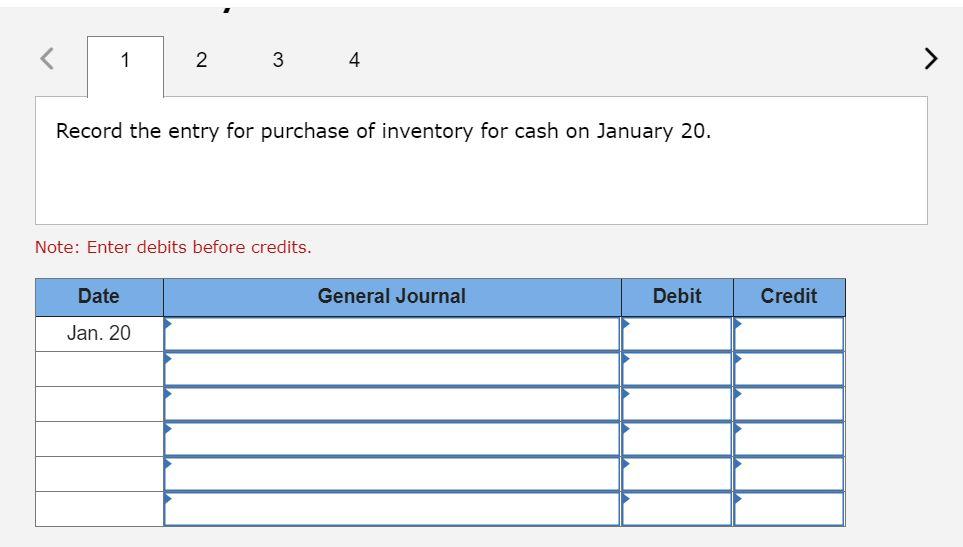

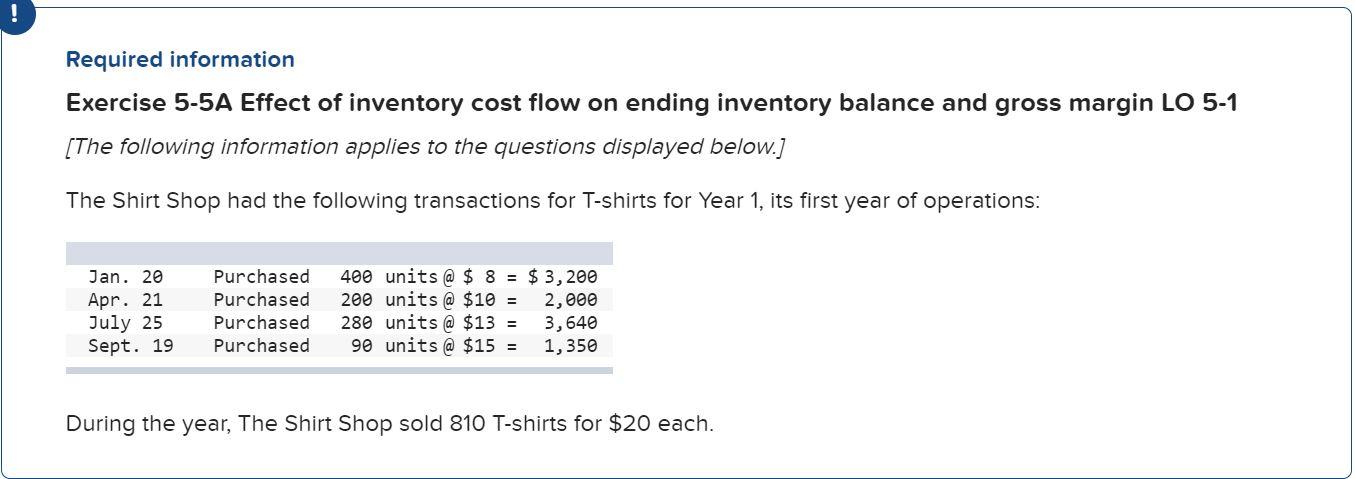

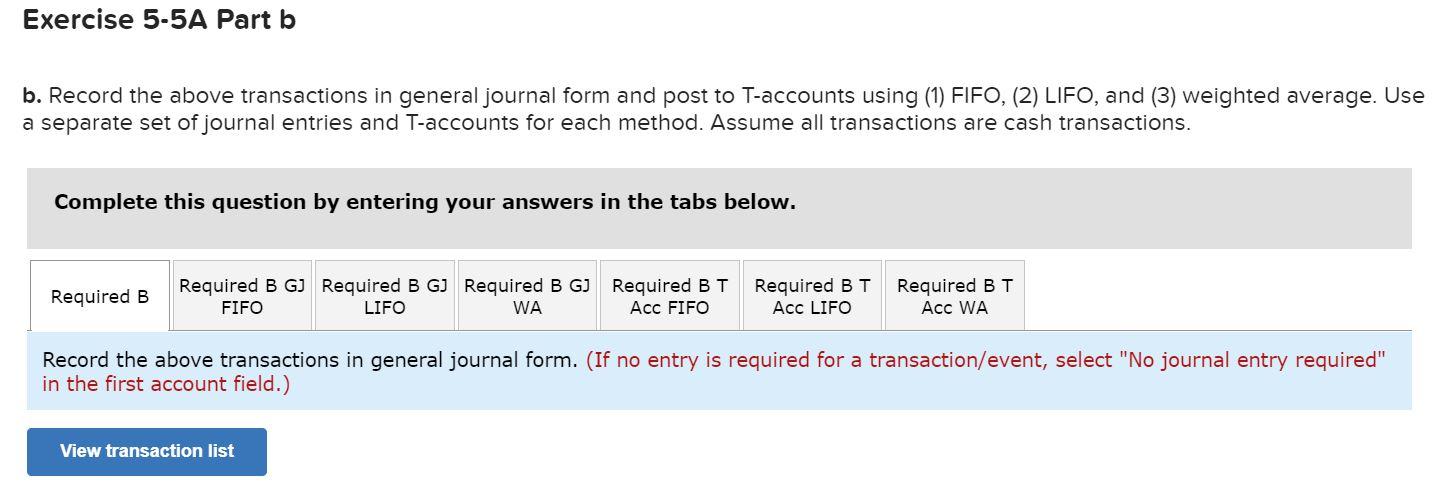

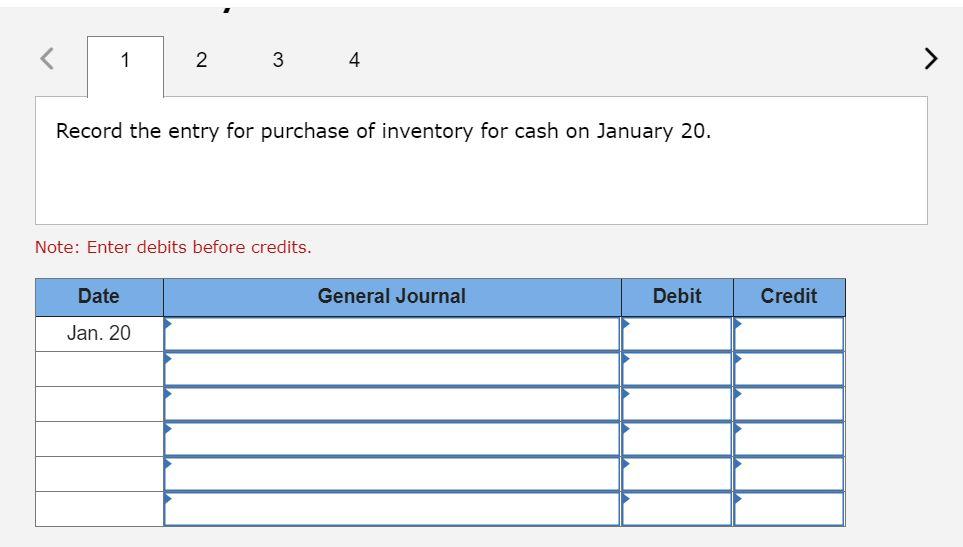

Required information Exercise 5-5A Effect of inventory cost flow on ending inventory balance and gross margin LO 5-1 [The following information applies to the questions displayed below.] The Shirt Shop had the following transactions for T-shirts for Year 1, its first year of operations: Jan. 20 Apr. 21 July 25 Sept. 19 Purchased Purchased Purchased Purchased 400 units @ $ 8 = $ 3,200 200 units @ $10 = 2,000 280 units @ $13 = 3,640 90 units @ $15 = 1,350 During the year, The Shirt Shop sold 810 T-shirts for $20 each. Exercise 5-5A Part b b. Record the above transactions in general journal form and post to T-accounts using (1) FIFO, (2) LIFO, and (3) weighted average. Use a separate set of journal entries and T-accounts for each method. Assume all transactions are cash transactions. Complete this question by entering your answers in the tabs below. Required B Required B GJ Required B GJ Required B GJ Required BT FIFO LIFO WA Acc FIFO Required BT Acc LIFO Required BT Acc WA Record the above transactions in general journal form. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list 1 2 3 4 Record the entry for purchase of inventory for cash on January 20. Note: Enter debits before credits. Date General Journal Debit Credit Jan. 20 Required information Exercise 5-5A Effect of inventory cost flow on ending inventory balance and gross margin LO 5-1 [The following information applies to the questions displayed below.] The Shirt Shop had the following transactions for T-shirts for Year 1, its first year of operations: Jan. 20 Apr. 21 July 25 Sept. 19 Purchased Purchased Purchased Purchased 400 units @ $ 8 = $ 3,200 200 units @ $10 = 2,000 280 units @ $13 = 3,640 90 units @ $15 = 1,350 During the year, The Shirt Shop sold 810 T-shirts for $20 each. Exercise 5-5A Part b b. Record the above transactions in general journal form and post to T-accounts using (1) FIFO, (2) LIFO, and (3) weighted average. Use a separate set of journal entries and T-accounts for each method. Assume all transactions are cash transactions. Complete this question by entering your answers in the tabs below. Required B Required B GJ Required B GJ Required B GJ Required BT FIFO LIFO WA Acc FIFO Required BT Acc LIFO Required BT Acc WA Record the above transactions in general journal form. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list 1 2 3 4 Record the entry for purchase of inventory for cash on January 20. Note: Enter debits before credits. Date General Journal Debit Credit Jan. 20