undefined

undefined

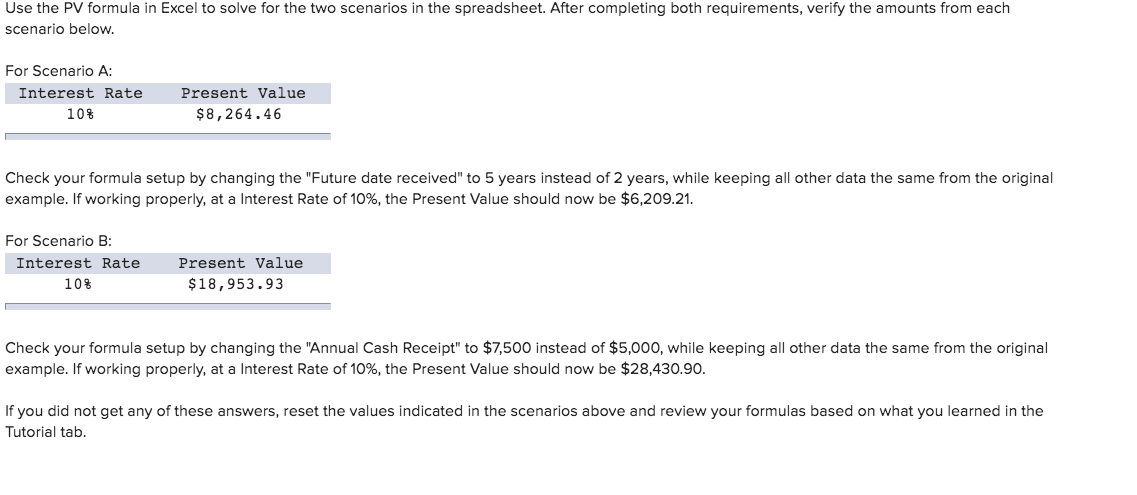

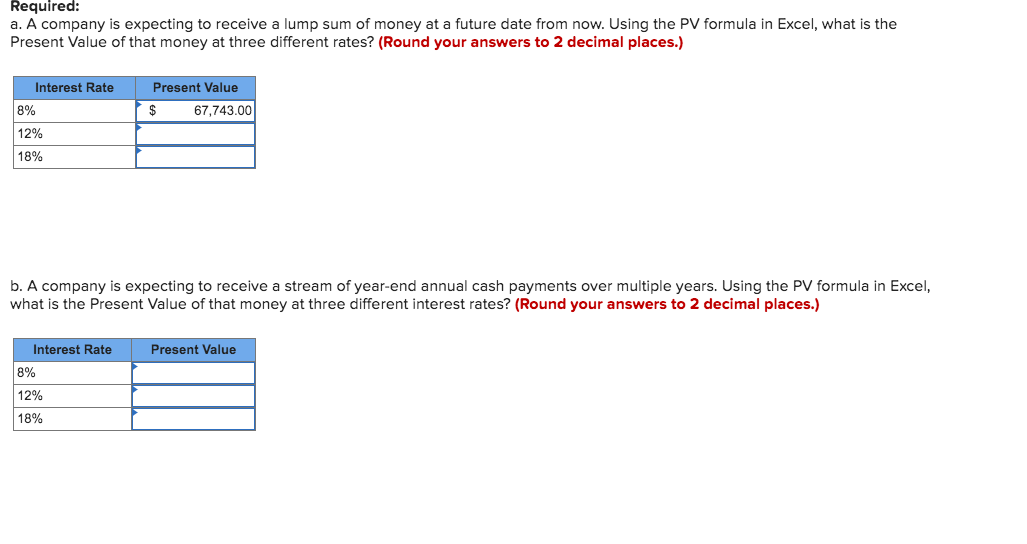

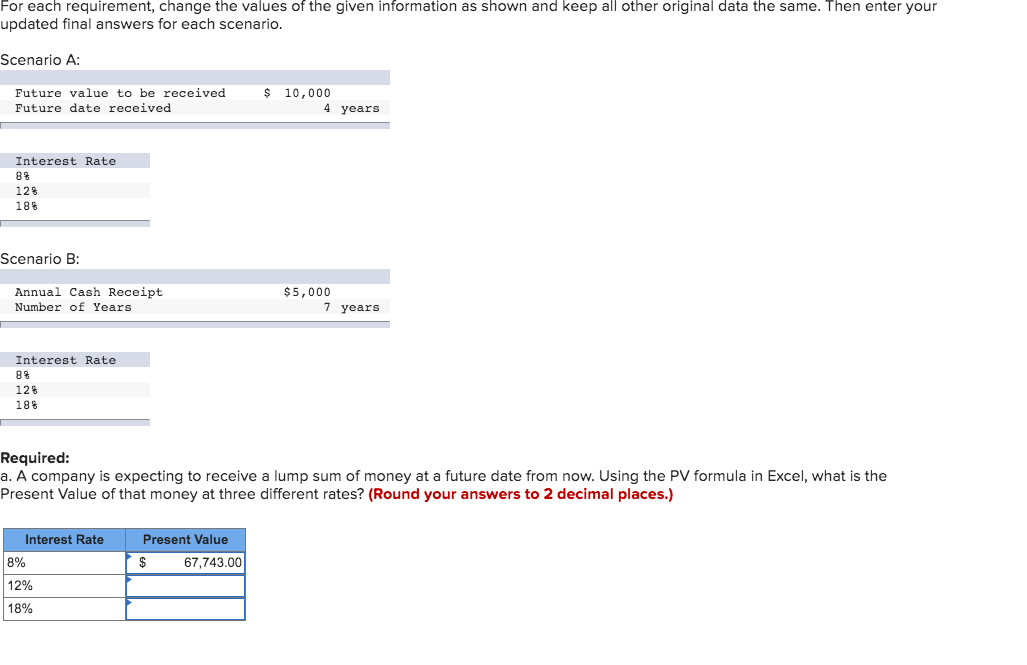

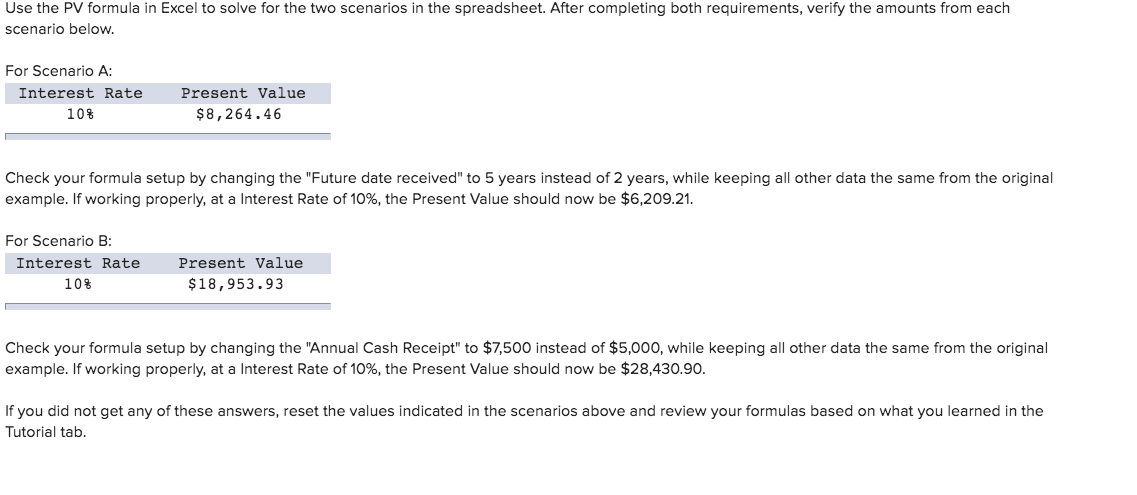

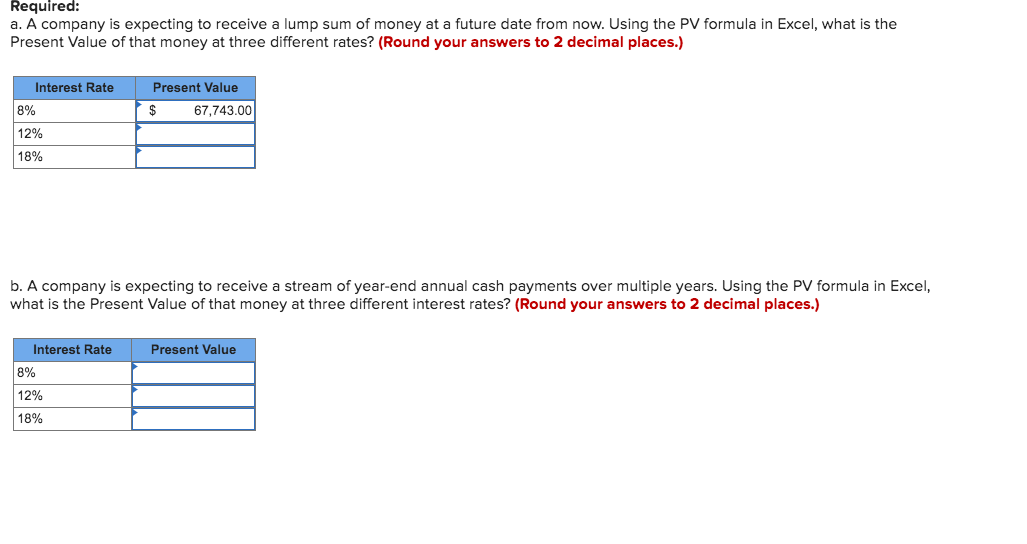

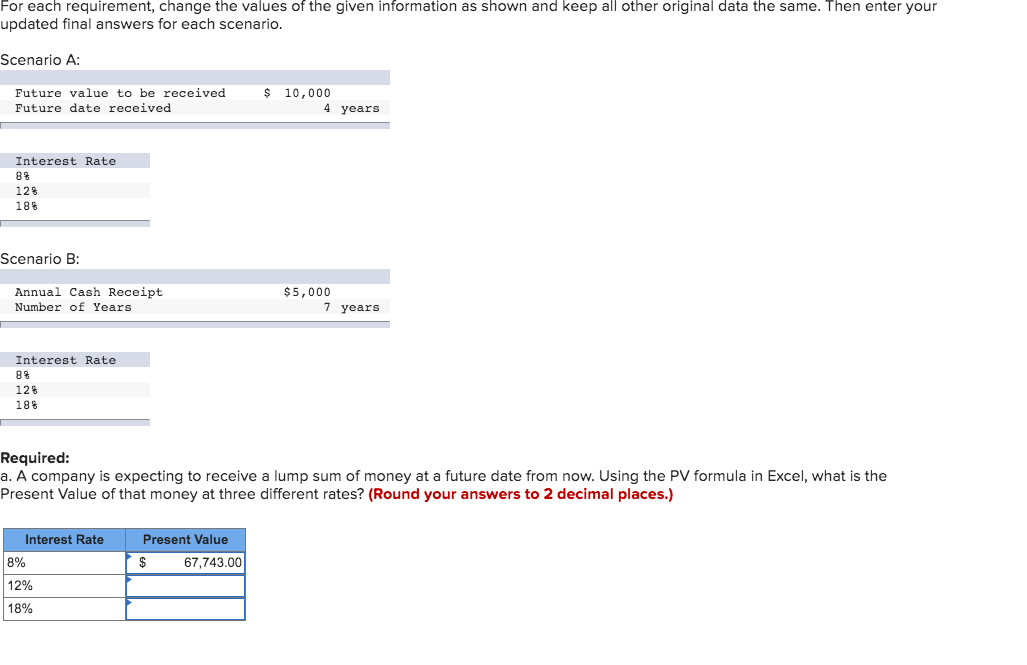

Use the PV formula in Excel to solve for the two scenarios in the spreadsheet. After completing both requirements, verify the amounts from each scenario below. For Scenario A: Interest Rate 10% Present Value $8,264.46 Check your formula setup by changing the "Future date received" to 5 years instead of 2 years, while keeping all other data the same from the original example. If working properly, at a Interest Rate of 10%, the Present Value should now be $6,209.21. For Scenario B: Interest Rate 10% Present Value $18,953.93 Check your formula setup by changing the "Annual Cash Receipt" to $7,500 instead of $5,000, while keeping all other data the same from the original example. If working properly, at a Interest Rate of 10%, the Present Value should now be $28,430.90. If you did not get any of these answers, reset the values indicated in the scenarios above and review your formulas based on what you learned in the Tutorial tab. Required: a. A company is expecting to receive a lump sum of money at a future date from now. Using the PV formula in Excel, what is the Present Value of that money at three different rates? (Round your answers to 2 decimal places.) Interest Rate Present Value $ 67,743.00 8% 12% 18% b. A company is expecting to receive a stream of year-end annual cash payments over multiple years. Using the PV formula in Excel, what is the Present Value of that money at three different interest rates? (Round your answers to 2 decimal places.) Present Value Interest Rate 8% 12% 18% For each requirement, change the values of the given information as shown and keep all other original data the same. Then enter your updated final answers for each scenario. Scenario A: Future value to be received Future date received $ 10,000 4 years Interest Rate 8% 128 188 Scenario B: Annual Cash Receipt Number of Years $5,000 7 years Interest Rate 8% 12% 18% Required: a. A company is expecting to receive a lump sum of money at a future date from now. Using the PV formula in Excel, what is the Present Value of that money at three different rates? (Round your answers to 2 decimal places.) Present Value $ 67,743.00 Interest Rate 8% 12% 18%

undefined

undefined