undefined

undefined

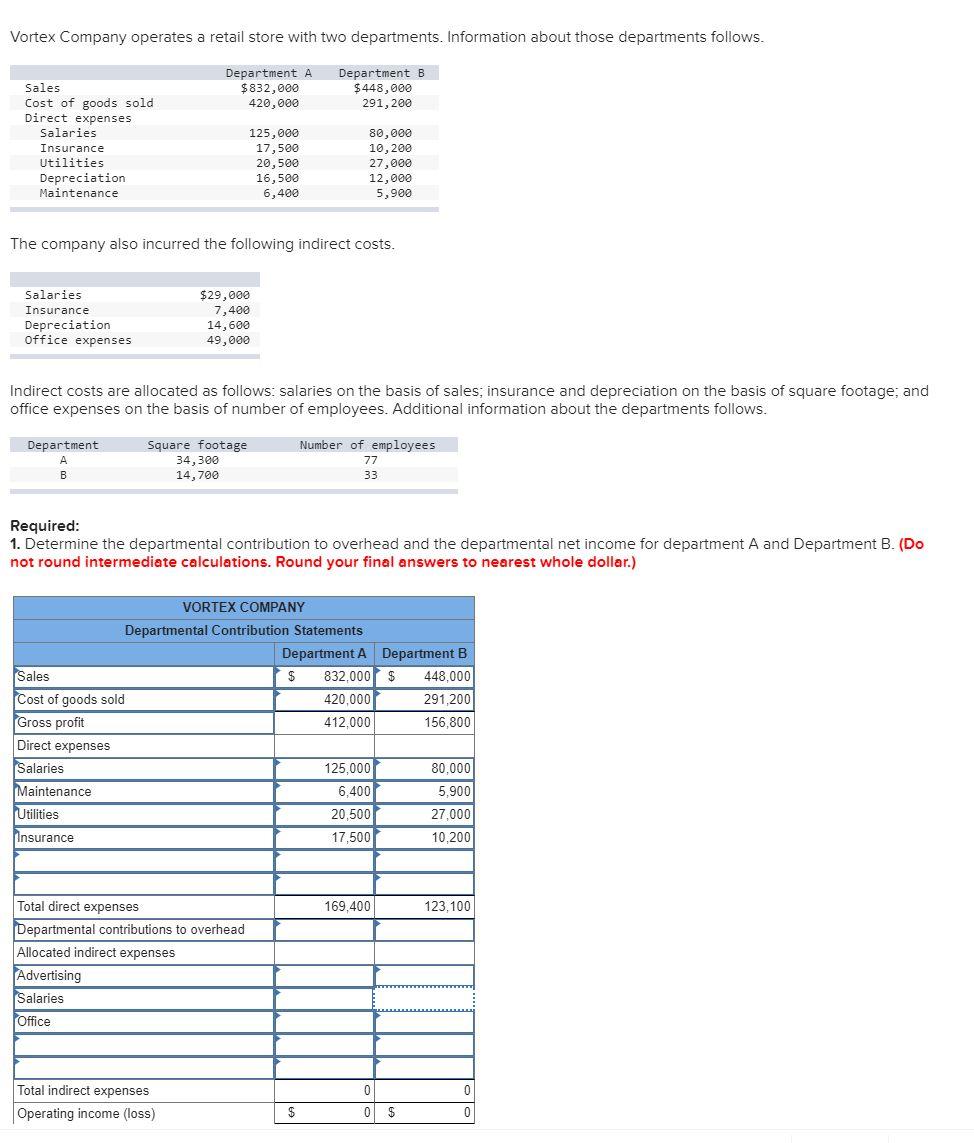

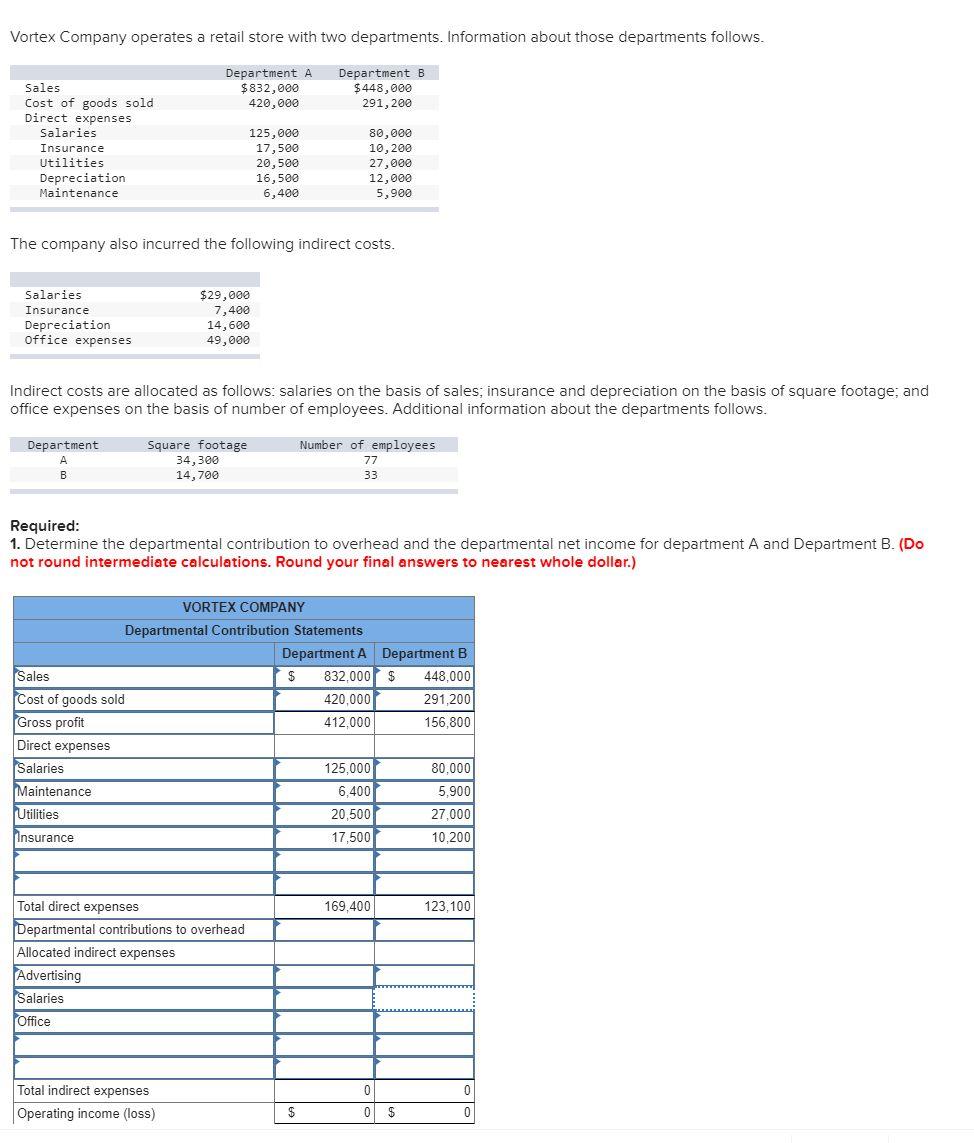

Vortex Company operates a retail store with two departments. Information about those departments follows. Department A $832,000 420,000 Department B $448,000 291,200 Sales Cost of goods sold Direct expenses Salaries Insurance Utilities Depreciation Maintenance 80,000 10,200 125,000 17,500 20,500 16,500 6,400 27,000 12,000 5,900 The company also incurred the following indirect costs. Salaries Insurance Depreciation Office expenses $29,000 7,400 14,600 49,000 Indirect costs are allocated as follows: salaries on the basis of sales; insurance and depreciation on the basis of square footage, and office expenses on the basis of number of employees. Additional information about the departments follows. Department Square footage 34,300 14,700 Number of employees 77 33 B Required: 1. Determine the departmental contribution to overhead and the departmental net income for department A and Department B. (Do not round intermediate calculations. Round your final answers to nearest whole dollar.) VORTEX COMPANY Departmental Contribution Statements Department A Department B Sales $ 832,000 $ 448,000 Cost of goods sold 420,000 291,200 Gross profit 412,000 156,800 Direct expenses Salaries 125,000 80,000 Maintenance 6,400 5,900 Utilities 20,500 27,000 Insurance 17,500 10,200 169,400 123,100 Total direct expenses Departmental contributions to overhead Allocated indirect expenses Advertising Salaries Office 0 Total indirect expenses Operating income (loss) $ 0 $ 0 Vortex Company operates a retail store with two departments. Information about those departments follows. Department A $832,000 420,000 Department B $448,000 291,200 Sales Cost of goods sold Direct expenses Salaries Insurance Utilities Depreciation Maintenance 80,000 10,200 125,000 17,500 20,500 16,500 6,400 27,000 12,000 5,900 The company also incurred the following indirect costs. Salaries Insurance Depreciation Office expenses $29,000 7,400 14,600 49,000 Indirect costs are allocated as follows: salaries on the basis of sales; insurance and depreciation on the basis of square footage, and office expenses on the basis of number of employees. Additional information about the departments follows. Department Square footage 34,300 14,700 Number of employees 77 33 B Required: 1. Determine the departmental contribution to overhead and the departmental net income for department A and Department B. (Do not round intermediate calculations. Round your final answers to nearest whole dollar.) VORTEX COMPANY Departmental Contribution Statements Department A Department B Sales $ 832,000 $ 448,000 Cost of goods sold 420,000 291,200 Gross profit 412,000 156,800 Direct expenses Salaries 125,000 80,000 Maintenance 6,400 5,900 Utilities 20,500 27,000 Insurance 17,500 10,200 169,400 123,100 Total direct expenses Departmental contributions to overhead Allocated indirect expenses Advertising Salaries Office 0 Total indirect expenses Operating income (loss) $ 0 $ 0

undefined

undefined