Question

undefinedMargaret Geller is a widow and does not work. Her main source of income has been from two rental properties and investment income. Margarets birthday

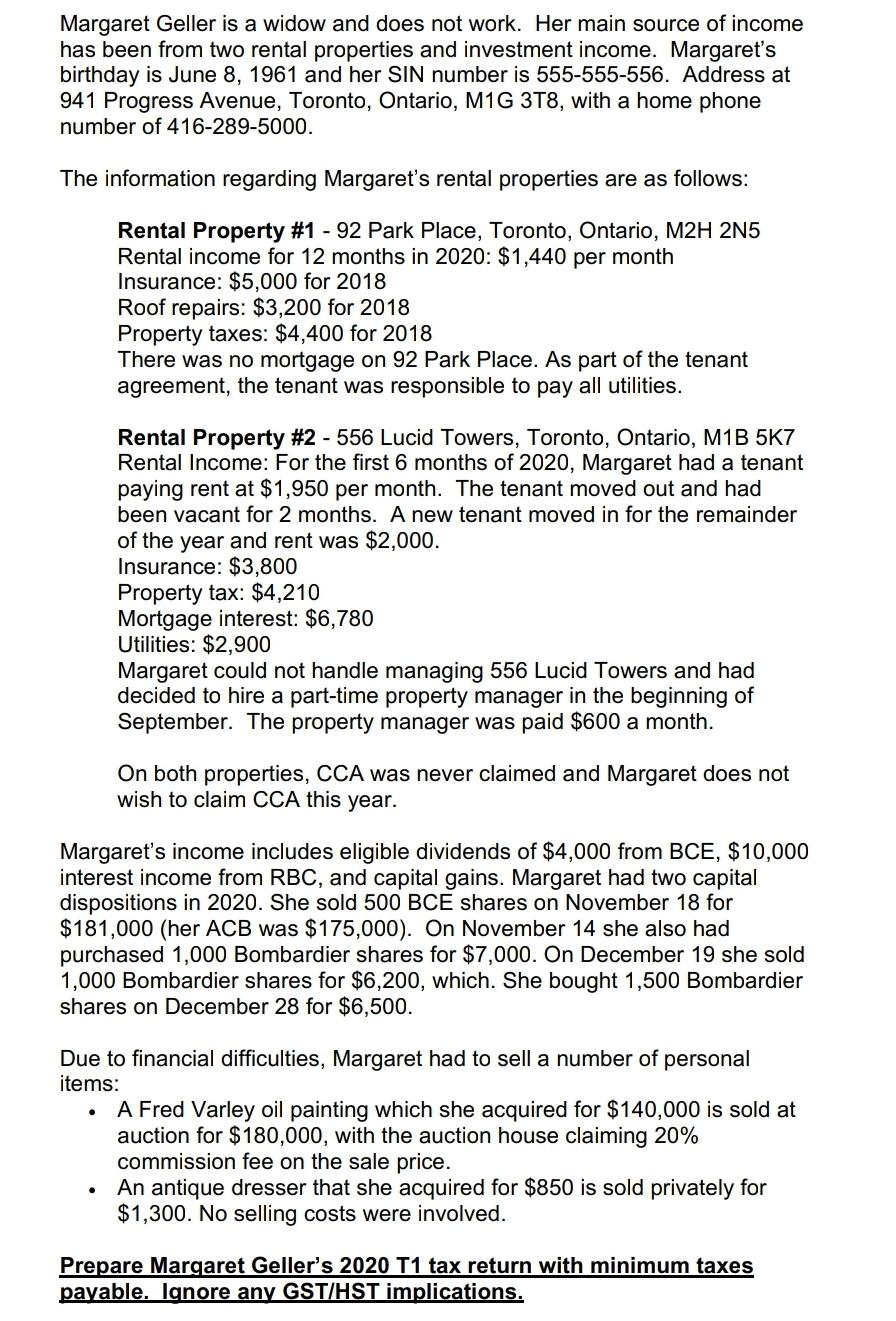

undefinedMargaret Geller is a widow and does not work. Her main source of income has been from two rental properties and investment income. Margarets birthday is June 8, 1961 and her SIN number is 555-555-556. Address at 941 Progress Avenue, Toronto, Ontario, M1G 3T8, with a home phone number of 416-289-5000. The information regarding Margarets rental properties are as follows: Rental Property #1 - 92 Park Place, Toronto, Ontario, M2H 2N5 Rental income for 12 months in 2020: $1,440 per month Insurance: $5,000 for 2018 Roof repairs: $3,200 for 2018 Property taxes: $4,400 for 2018 There was no mortgage on 92 Park Place. As part of the tenant agreement, the tenant was responsible to pay all utilities. Rental Property #2 - 556 Lucid Towers, Toronto, Ontario, M1B 5K7 Rental Income: For the first 6 months of 2020, Margaret had a tenant paying rent at $1,950 per month. The tenant moved out and had been vacant for 2 months. A new tenant moved in for the remainder of the year and rent was $2,000. Insurance: $3,800 Property tax: $4,210 Mortgage interest: $6,780 Utilities: $2,900 Margaret could not handle managing 556 Lucid Towers and had decided to hire a part-time property manager in the beginning of September. The property manager was paid $600 a month. On both properties, CCA was never claimed and Margaret does not wish to claim CCA this year. Margarets income includes eligible dividends of $4,000 from BCE, $10,000 interest income from RBC, and capital gains. Margaret had two capital dispositions in 2020. She sold 500 BCE shares on November 18 for $181,000 (her ACB was $175,000). On November 14 she also had purchased 1,000 Bombardier shares for $7,000. On December 19 she sold 1,000 Bombardier shares for $6,200, which. She bought 1,500 Bombardier shares on December 28 for $6,500. Due to financial difficulties, Margaret had to sell a number of personal items: A Fred Varley oil painting which she acquired for $140,000 is sold at auction for $180,000, with the auction house claiming 20% commission fee on the sale price. An antique dresser that she acquired for $850 is sold privately for $1,300. No selling costs were involved. Prepare Margaret Gellers 2020 T1 tax return with minimum taxes payable. Ignore any GST/HST implications.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started