Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Under a system of fixed exchange rates, a nation can try to remedy its balance of payments deficit by: (2 points) A. Applying expansionary macroeconomic

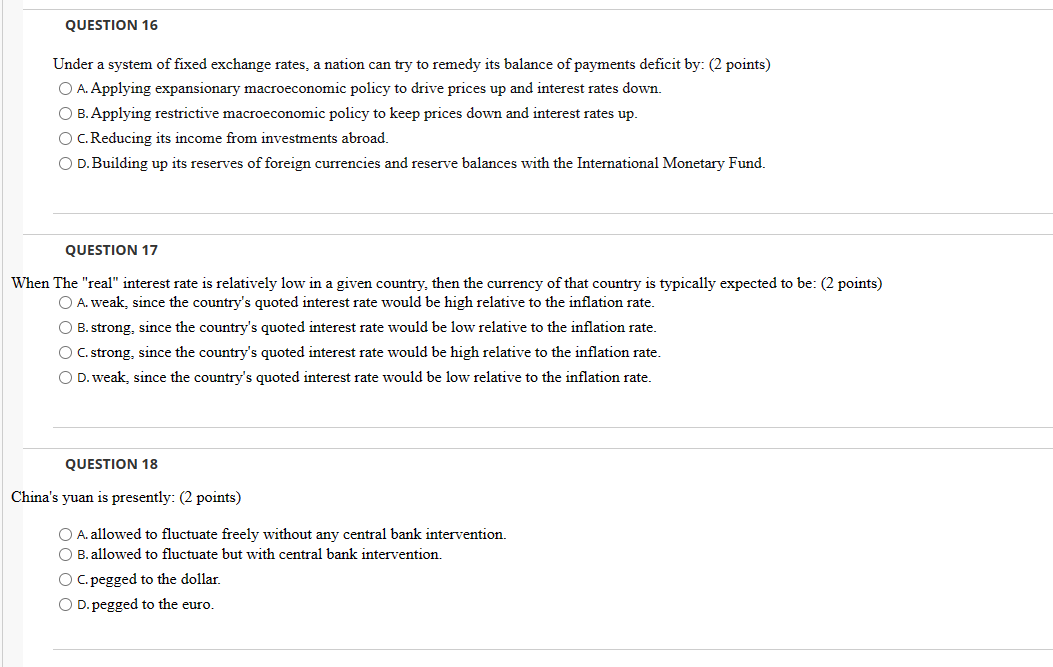

Under a system of fixed exchange rates, a nation can try to remedy its balance of payments deficit by: (2 points) A. Applying expansionary macroeconomic policy to drive prices up and interest rates down. B. Applying restrictive macroeconomic policy to keep prices down and interest rates up. C. Reducing its income from investments abroad. D. Building up its reserves of foreign currencies and reserve balances with the International Monetary Fund. QUESTION 17 When The "real" interest rate is relatively low in a given country, then the currency of that country is typically expected to be: ( 2 points) A. weak, since the country's quoted interest rate would be high relative to the inflation rate. B. strong, since the country's quoted interest rate would be low relative to the inflation rate. C. strong, since the country's quoted interest rate would be high relative to the inflation rate. D. weak, since the country's quoted interest rate would be low relative to the inflation rate. QUESTION 18 China's yuan is presently: ( 2 points) A. allowed to fluctuate freely without any central bank intervention. B. allowed to fluctuate but with central bank intervention. C. pegged to the dollar. D. pegged to the euro

Under a system of fixed exchange rates, a nation can try to remedy its balance of payments deficit by: (2 points) A. Applying expansionary macroeconomic policy to drive prices up and interest rates down. B. Applying restrictive macroeconomic policy to keep prices down and interest rates up. C. Reducing its income from investments abroad. D. Building up its reserves of foreign currencies and reserve balances with the International Monetary Fund. QUESTION 17 When The "real" interest rate is relatively low in a given country, then the currency of that country is typically expected to be: ( 2 points) A. weak, since the country's quoted interest rate would be high relative to the inflation rate. B. strong, since the country's quoted interest rate would be low relative to the inflation rate. C. strong, since the country's quoted interest rate would be high relative to the inflation rate. D. weak, since the country's quoted interest rate would be low relative to the inflation rate. QUESTION 18 China's yuan is presently: ( 2 points) A. allowed to fluctuate freely without any central bank intervention. B. allowed to fluctuate but with central bank intervention. C. pegged to the dollar. D. pegged to the euro Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started