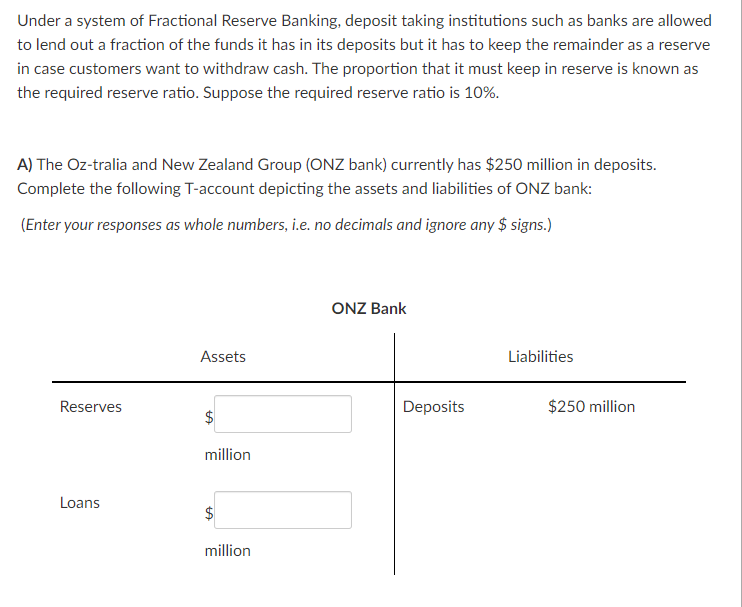

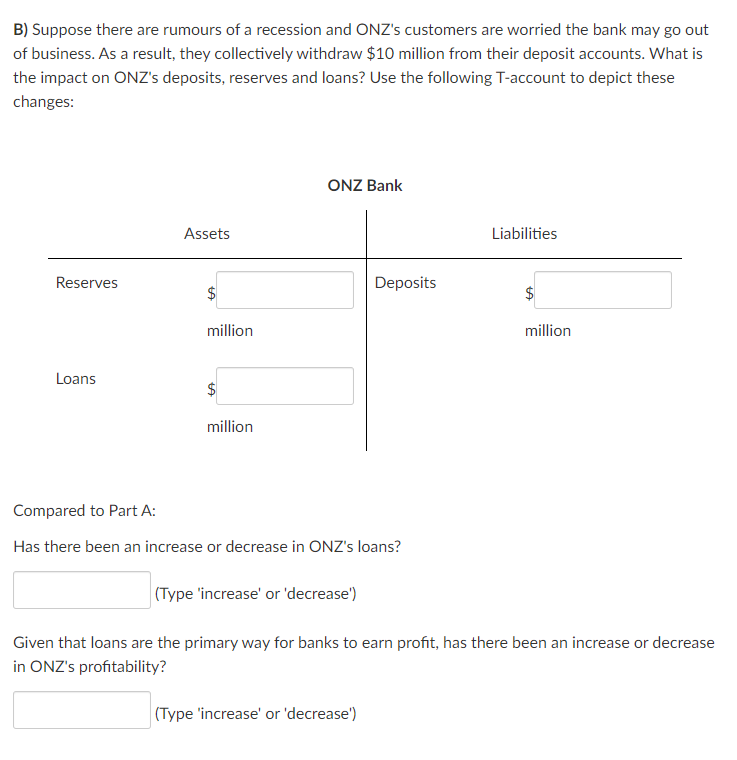

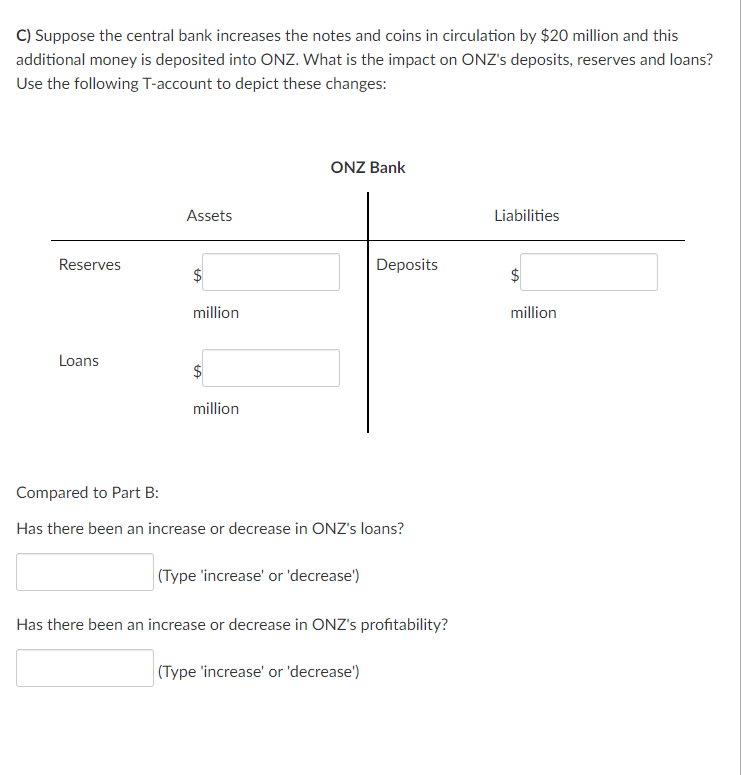

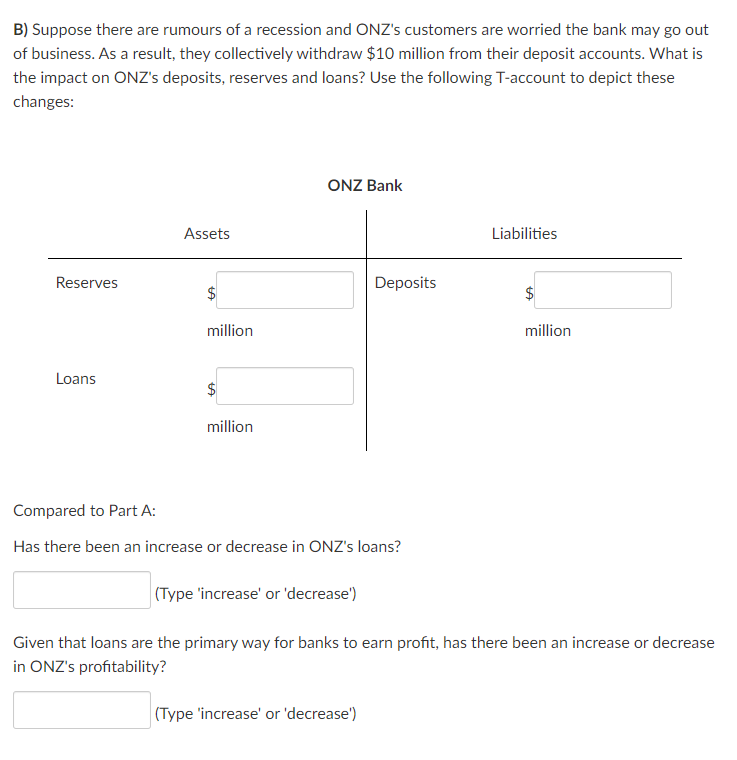

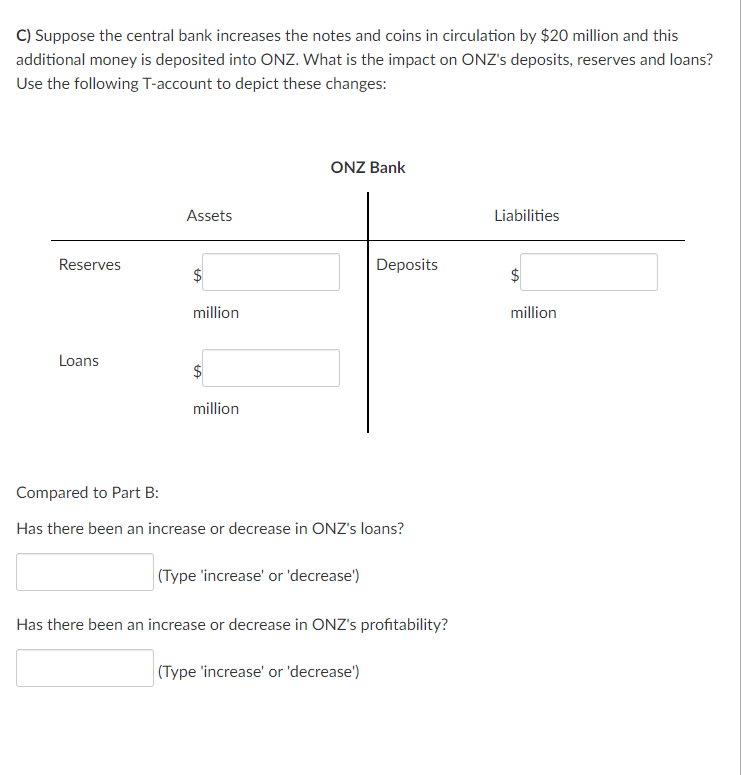

Under a system of Fractional Reserve Banking, deposit taking institutions such as banks are allowed to lend out a fraction of the funds it has in its deposits but it has to keep the remainder as a reserve in case customers want to withdraw cash. The proportion that it must keep in reserve is known as the required reserve ratio. Suppose the required reserve ratio is 10%. A) The Oz-tralia and New Zealand Group (ONZ bank) currently has $250 million in deposits. Complete the following T-account depicting the assets and liabilities of ONZ bank: (Enter your responses as whole numbers, i.e. no decimals and ignore any $ signs.) B) Suppose there are rumours of a recession and ONZ's customers are worried the bank may go out of business. As a result, they collectively withdraw $10 million from their deposit accounts. What is the impact on ONZ's deposits, reserves and loans? Use the following T-account to depict these changes: Compared to Part A: Has there been an increase or decrease in ONZ's loans? (Type 'increase' or 'decrease') Given that loans are the primary way for banks to earn profit, has there been an increase or decrease in ONZ's profitability? (Type 'increase' or 'decrease') C) Suppose the central bank increases the notes and coins in circulation by $20 million and this additional money is deposited into ONZ. What is the impact on ONZ's deposits, reserves and loans? Use the following T-account to depict these changes: Compared to Part B: Has there been an increase or decrease in ONZ's loans? (Type 'increase' or 'decrease') Has there been an increase or decrease in ONZ's profitability? (Type 'increase' or 'decrease') Under a system of Fractional Reserve Banking, deposit taking institutions such as banks are allowed to lend out a fraction of the funds it has in its deposits but it has to keep the remainder as a reserve in case customers want to withdraw cash. The proportion that it must keep in reserve is known as the required reserve ratio. Suppose the required reserve ratio is 10%. A) The Oz-tralia and New Zealand Group (ONZ bank) currently has $250 million in deposits. Complete the following T-account depicting the assets and liabilities of ONZ bank: (Enter your responses as whole numbers, i.e. no decimals and ignore any $ signs.) B) Suppose there are rumours of a recession and ONZ's customers are worried the bank may go out of business. As a result, they collectively withdraw $10 million from their deposit accounts. What is the impact on ONZ's deposits, reserves and loans? Use the following T-account to depict these changes: Compared to Part A: Has there been an increase or decrease in ONZ's loans? (Type 'increase' or 'decrease') Given that loans are the primary way for banks to earn profit, has there been an increase or decrease in ONZ's profitability? (Type 'increase' or 'decrease') C) Suppose the central bank increases the notes and coins in circulation by $20 million and this additional money is deposited into ONZ. What is the impact on ONZ's deposits, reserves and loans? Use the following T-account to depict these changes: Compared to Part B: Has there been an increase or decrease in ONZ's loans? (Type 'increase' or 'decrease') Has there been an increase or decrease in ONZ's profitability? (Type 'increase' or 'decrease')