Question

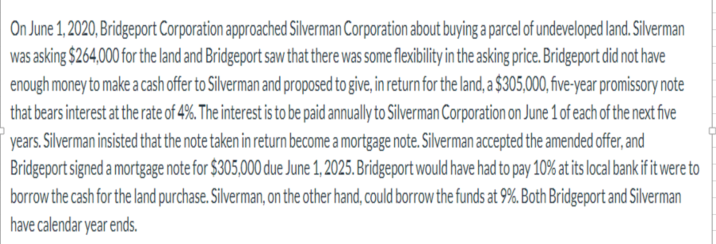

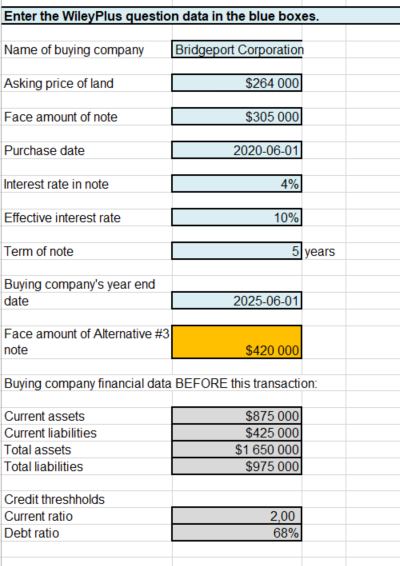

(under Alternative 1), record the purchase of the land and prepare any journal entries that are required for the three years (up to December 31,

-

(under Alternative 1), record the purchase of the land and prepare any journal entries that are required for the three years (up to December 31, 2022)

-

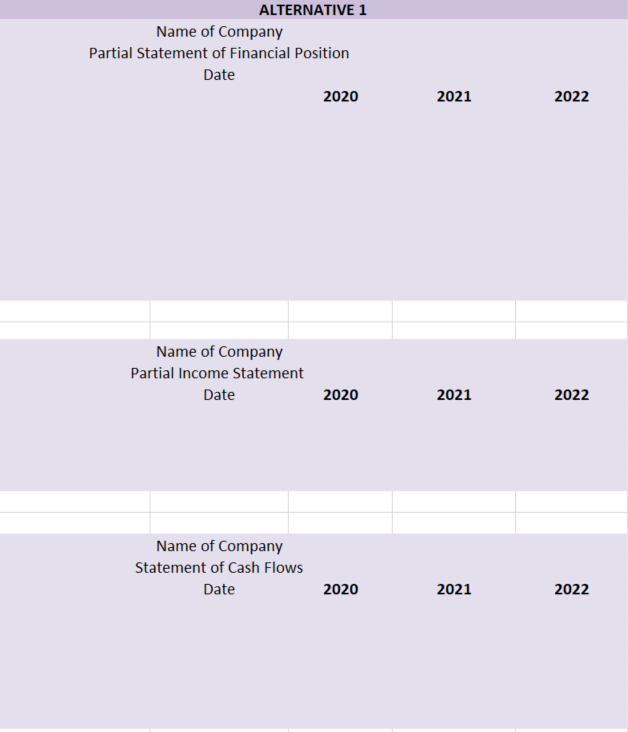

Prepare the statement of financial position presentation at the companys year-end (include both the current and long-term portions). Show the results for 3 years side-by-side.

-

prepare the income statement presentation at year-end for 3 consecutive years, side-by-side

-

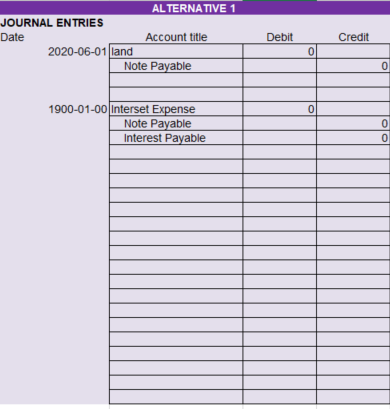

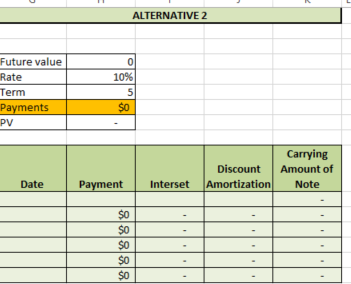

2) and using Excel functions, calculate the amount of the instalment payments that would be required for a five-year instalment note. Use the cost of the land that you determined for the mortgage note in part (b). Use also the same interest rate and term for the note.

-

Prepare an effective-interest amortization table for the five-year term of the instalment note.

-

-

Repeat the same steps of alternative 1( Journal entries, Financial postition, income statement, Cash Flows)

-

ALTERNATIVE 3: This alternative consists of a non-interest bearing note. The face amount of the note is included in your template and is calculated from your question data.

-

On the Calculations worksheet (under Alternative 3) and using Excel functions, calculate the rate applied to this note. Use the cost of the land that you determined for the mortgage note in part (b). Use also the same term for the note.

-

Prepare an effective-interest amortization table for the five-year term of the non-interest bearing note.

-

4)

-

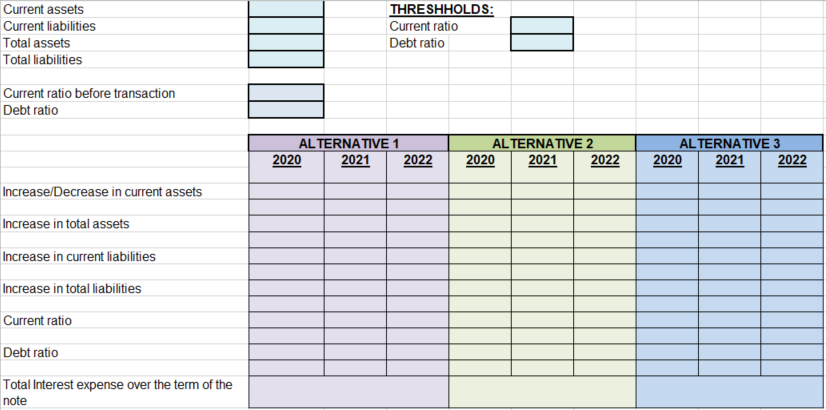

You are asked to help the purchasing company decide which option is best amongst the three alternatives. The company has the following constraints:

-

The company has other pre-existing loan arrangements that have covenants that require it to maintain a current ratio of 2.0 and a debt ratio of less than 68%. These other loan arrangements are long-term liabilities that will be outstanding for the full term of the three alternative notes. You can assume that everything else will stay the same for the purchasing company over the term of the new loan.

-

The purchasing company is currently short on cash, so maintaining cash is an important goal for them.

-

The companys pre-existing current assets, current liabilities, total assets and total liabilities have been included in the Data worksheet.

-

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started