Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Analyzing and Interpreting Tax Footnote (Financial Statement Effects Template) Under Armour, Inc. reports total tax expense of $154,112 thousands on its income statement for year

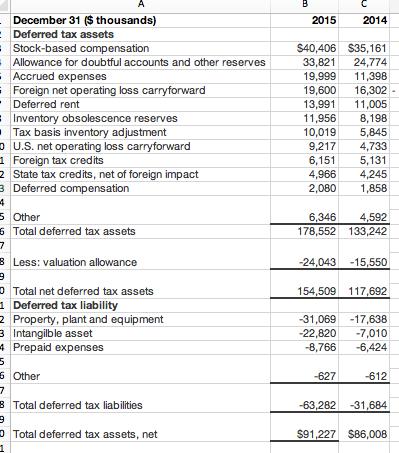

Analyzing and Interpreting Tax Footnote (Financial Statement Effects Template) Under Armour, Inc. reports total tax expense of $154,112 thousands on its income statement for year ended December 31, 2015, and paid cash of $99,708 thousand for taxes. The tax footnote in the company's 10-K filing, reports the following deferred tax assets and liabilities information.

What proportion of the foreign net operating losses does the company believe will likely expire unused?

A December 31 ($ thousands) Deferred tax assets Stock-based compensation Allowance for doubtful accounts and other reserves Accrued expenses Foreign net operating loss carryforward Deferred rent Inventory obsolescence reserves Tax basis inventory adjustment o U.S. net operating loss carryforward Foreign tax credits 2 State tax credits, net of foreign impact 3 Deferred compensation 4 5 Other 6 Total deferred tax assets 7 8 Less: valuation allowance 9 0 Total net deferred tax assets 1 Deferred tax liability 2 Property, plant and equipment 3 Intangilble asset 4 Prepaid expenses 5 6 7 Other B Total deferred tax liabilities 9 1 Total deferred tax assets, net B 2015 2014 $40,406 $35,161 33,821 24,774 19,999 11,398 19,600 16,302 13,991 11,005 11,956 8,198 5,845 4,733 5,131 4,245 1,858 10,019 9,217 6,151 4,966 2,080 6,346 4,592 178,552 133,242 -24,043 -15,550 154,509 117,692 -31,069 -17,638 -22,820 -7,010 -8,766 -6,424 -627 -63,282 -31,684 -612 $91,227 $86,008

Step by Step Solution

★★★★★

3.58 Rating (183 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER The proportion of the foreign net operating losses that the company believes will likely expi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started