Answered step by step

Verified Expert Solution

Question

1 Approved Answer

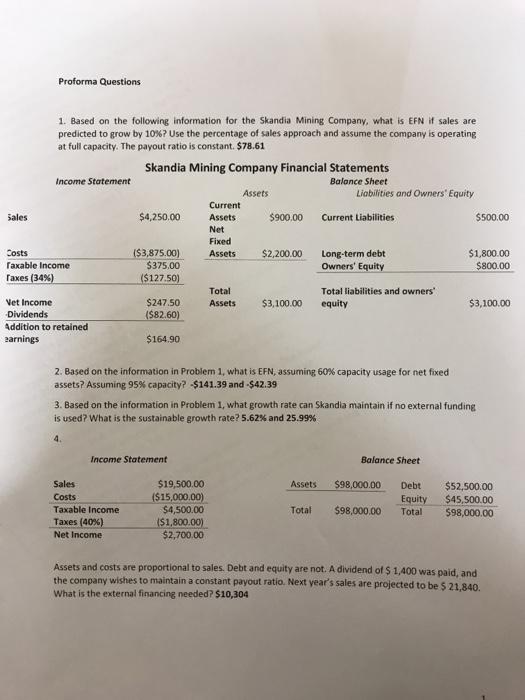

Proforma Questions 1. Based on the following information for the Skandia Mining Company, what is EFN if sales are predicted to grow by 10%?

Proforma Questions 1. Based on the following information for the Skandia Mining Company, what is EFN if sales are predicted to grow by 10%? Use the percentage of sales approach and assume the company is operating at full capacity. The payout ratio is constant. $78.61 Skandia Mining Company Financial Statements Income Statement Balance Sheet Assets Liabilities and Owners' Equity Current Sales $4,250.00 Assets $900.00 Current Liabilities $500.00 Net Fixed Costs (S3,875.00) $375,00 Assets $2,200.00 Long-term debt $1,800.00 Owners' Equity Taxable Income $800.00 Faxes (34%) ($127.50) Total Total liabilities and owners Vet Income $247.50 Assets $3,100.00 equity $3,100.00 Dividends Addition to retained zarnings (S82.60) $164.90 2. Based on the information in Problem 1, what is EFN, assuming 60% capacity usage for net fixed assets? Assuming 95% capacity? -$141.39 and -$42.39 3. Based on the information in Problem 1, what growth rate can Skandia maintain if no external funding is used? What is the sustainable growth rate? 5.62% and 25.99% 4. Income Statement Balance Sheet Sales $19,500.00 Assets $98,000.00 $52,500.00 $45,500.00 Debt ($15,000.00) $4,500.00 Costs Equity Total Taxable Income Total $98,000.00 $98,000.00 Taxes (40%) (S1,800.00) $2,700.00 Net Income Assets and costs are proportional to sales. Debt and equity are not. A dividend of $ 1,400 was paid, and the company wishes to maintain a constant payout ratio. Next year's sales are projected to be $ 21,840. What is the external financing needed? $10,304

Step by Step Solution

★★★★★

3.49 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Answer 1 Sales growth 10 Sales 10 4250 425 Forecasted sales 4250 1 10 4675 Profit Margin Net Income ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started