Question

Under Armour reported the following stockholders equity section of the balance sheet for the fiscal year ended December 31, 2018. Under Armour reports additional information

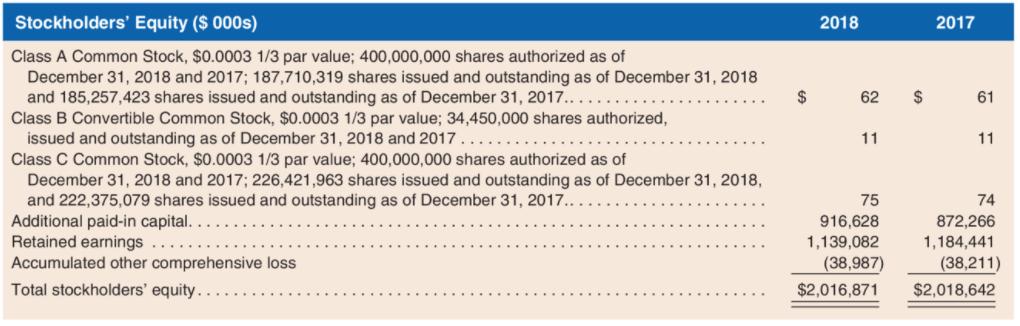

Under Armour reported the following stockholders’ equity section of the balance sheet for the fiscal year ended December 31, 2018.

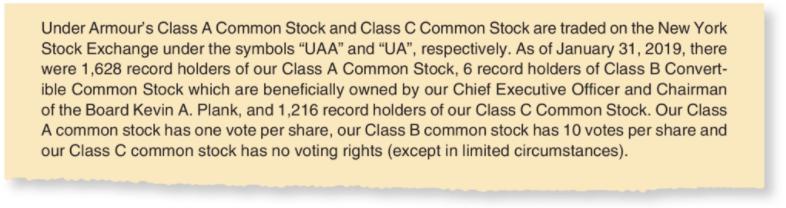

Under Armour reports additional information related to the three classes of stock in its 10-K.

Required

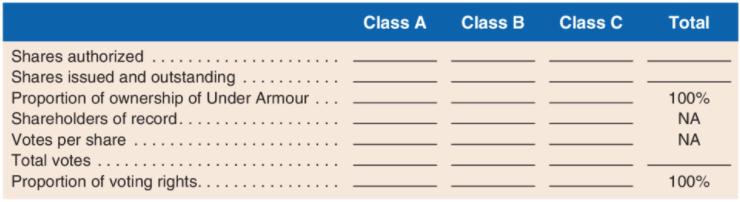

a. Complete the following table to determine the % ownership and voting power for each class of stock.

b. Class B Convertible Common Stock can be converted on a 1-for-1 basis into Class A stock. Explain the balance sheet effect if all outstanding shares were converted. What repercussions would this have for the CEO, Kevin Plank?

c. In June 2015, the company created nonvoting Class C common stock and issued Class C shares primarily for employee share-based compensation plans. Explain the incentives such compensation plans create. Why would Under Armour create another class of stock for this purpose?

d. During the year, foreign currency translation losses increased by $23,576 and unrealized losses on cash flow hedges (derivatives) decreased by $22,800. Use this information to reconcile the accumulated other comprehensive loss account. What can you conclude about changes in $US against currencies of countries where Under Armour has subsidiaries?

Stockholders' Equity ($ 000s) 2018 2017 Class A Common Stock, $0.0003 1/3 par value; 400,000,000 shares authorized as of December 31, 2018 and 2017; 187,710,319 shares issued and outstanding as of December 31, 2018 and 185,257,423 shares issued and outstanding as of December 31, 2017.... Class B Convertible Common Stock, $0.0003 1/3 par value; 34,450,000 shares authorized, issued and outstanding as of December 31, 2018 and 2017... Class C Common Stock, $0.0003 1/3 par value; 400,000,000 shares authorized as of December 31, 2018 and 2017; 226,421,963 shares issued and outstanding as of December 31, 2018, and 222,375,079 shares issued and outstanding as of December 31, 2017.. Additional paid-in capital. . Retained earnings Accumulated other comprehensive loss 2$ 62 2$ 61 11 11 75 74 916,628 1,139,082 872,266 1,184,441 (38,987) (38,211) Total stockholders' equity. $2,016,871 $2,018,642

Step by Step Solution

3.45 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

a Class A Class B Class C Total Shares authorized 400000000 34450000 400000000 834450000 Shares issu...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started