Answered step by step

Verified Expert Solution

Question

1 Approved Answer

under Australian Law Question 5 (7 marks) Benjamin is an artist. He sold some assets last week. He requests you to calculate the Capital Gain

under Australian Law

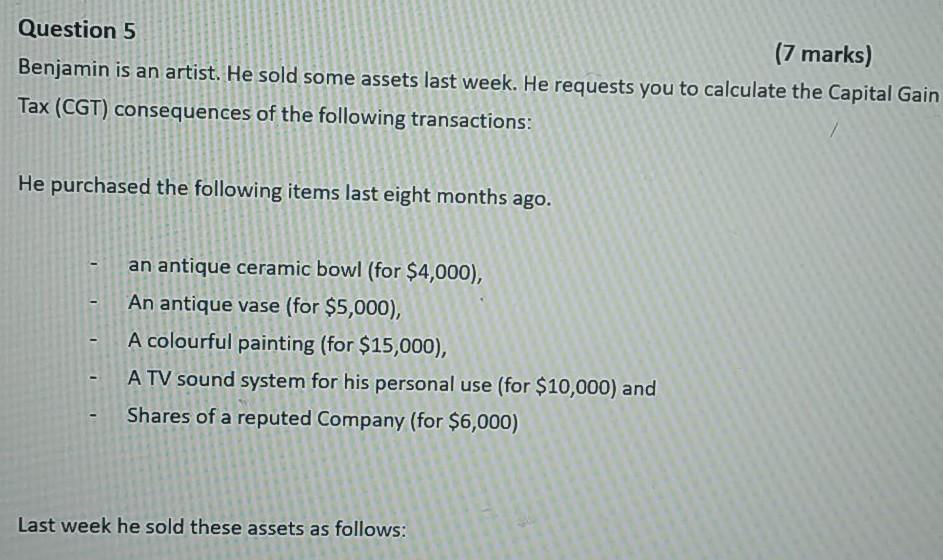

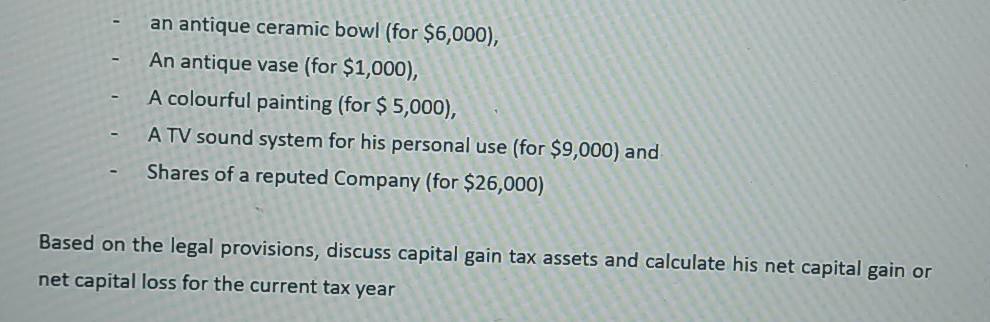

Question 5 (7 marks) Benjamin is an artist. He sold some assets last week. He requests you to calculate the Capital Gain Tax (CGT) consequences of the following transactions: He purchased the following items last eight months ago. an antique ceramic bowl (for $4,000), An antique vase (for $5,000), A colourful painting (for $15,000), A TV sound system for his personal use (for $10,000) and Shares of a reputed Company (for $6,000) Last week he sold these assets as follows: an antique ceramic bowl (for $6,000), An antique vase (for $1,000), A colourful painting (for $5,000), A TV sound system for his personal use (for $9,000) and Shares of a reputed Company (for $26,000) Based on the legal provisions, discuss capital gain tax assets and calculate his net capital gain or net capital loss for the current tax yearStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started