Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Under Plan A, If the firm reinvests all income for the next four years (through 2022-2025), what would be the value of the firm at

Under Plan A, If the firm reinvests all income for the next four years (through 2022-2025), what would be the value of the firm at the end of 2025. What would be the5 value of the firm and value of each share as of 2021 (present value of year 2025 amount)? g=15%

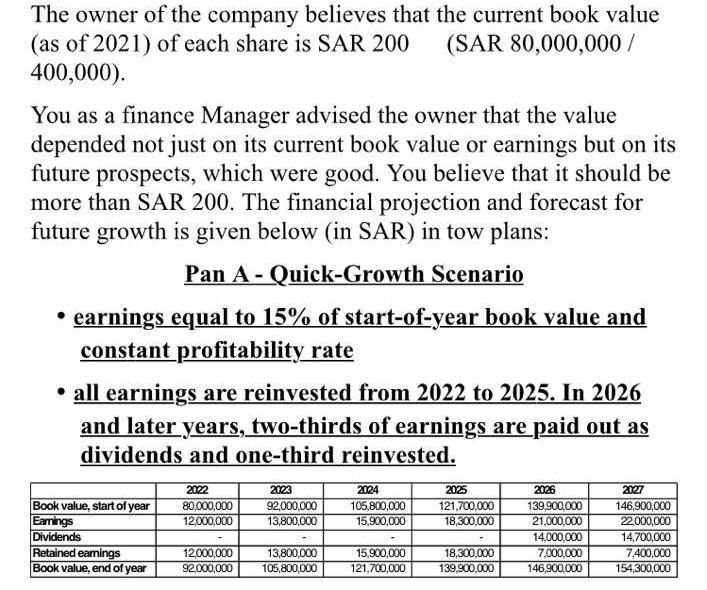

The owner of the company believes that the current book value (as of 2021) of each share is SAR 200 (SAR 80,000,000 / 400,000). You as a finance Manager advised the owner that the value depended not just on its current book value or earnings but on its future prospects, which were good. You believe that it should be more than SAR 200. The financial projection and forecast for future growth is given below (in SAR) in tow plans: Pan A - Quick-Growth Scenario earnings equal to 15% of start-of-year book value and constant profitability rate . all earnings are reinvested from 2022 to 2025. In 2026 and later years, two-thirds of earnings are paid out as dividends and one-third reinvested. - 2022 80,000,000 12,000,000 2003 92.000.000 13,800,000 2024 105,800,000 15,900,000 2025 121,700.000 18,300,000 Book value, start of year Earnings Dividends Retained earnings Book value, end of year 2026 139,900,000 21,000,000 14,000,000 7,000,000 146,900,000 2027 146,900,000 22,000,000 14,700,000 7,400,000 154,300,000 12,000,000 92,000,000 13,800,000 105,800.000 15,900,000 121,700,000 18,300.000 139,900,000 The owner of the company believes that the current book value (as of 2021) of each share is SAR 200 (SAR 80,000,000 / 400,000). You as a finance Manager advised the owner that the value depended not just on its current book value or earnings but on its future prospects, which were good. You believe that it should be more than SAR 200. The financial projection and forecast for future growth is given below (in SAR) in tow plans: Pan A - Quick-Growth Scenario earnings equal to 15% of start-of-year book value and constant profitability rate . all earnings are reinvested from 2022 to 2025. In 2026 and later years, two-thirds of earnings are paid out as dividends and one-third reinvested. - 2022 80,000,000 12,000,000 2003 92.000.000 13,800,000 2024 105,800,000 15,900,000 2025 121,700.000 18,300,000 Book value, start of year Earnings Dividends Retained earnings Book value, end of year 2026 139,900,000 21,000,000 14,000,000 7,000,000 146,900,000 2027 146,900,000 22,000,000 14,700,000 7,400,000 154,300,000 12,000,000 92,000,000 13,800,000 105,800.000 15,900,000 121,700,000 18,300.000 139,900,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started