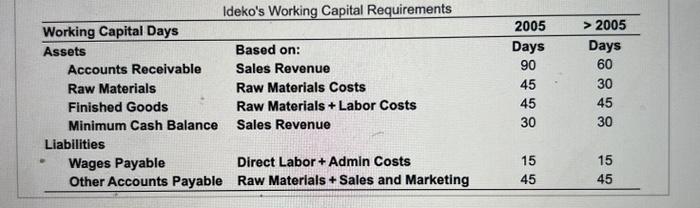

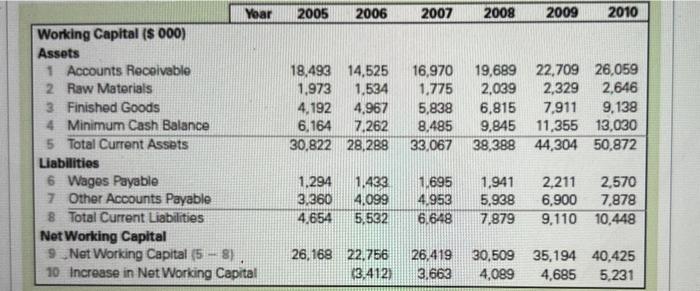

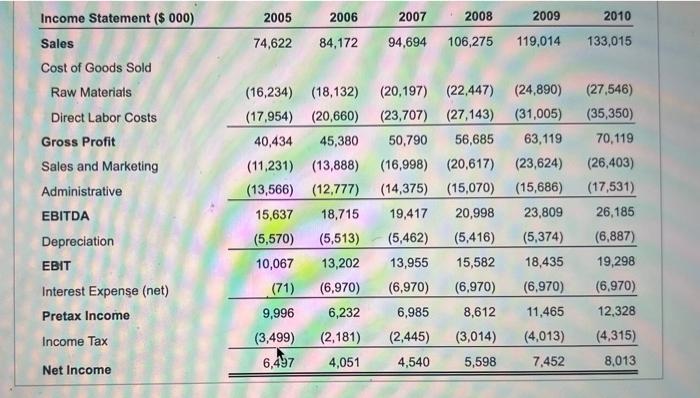

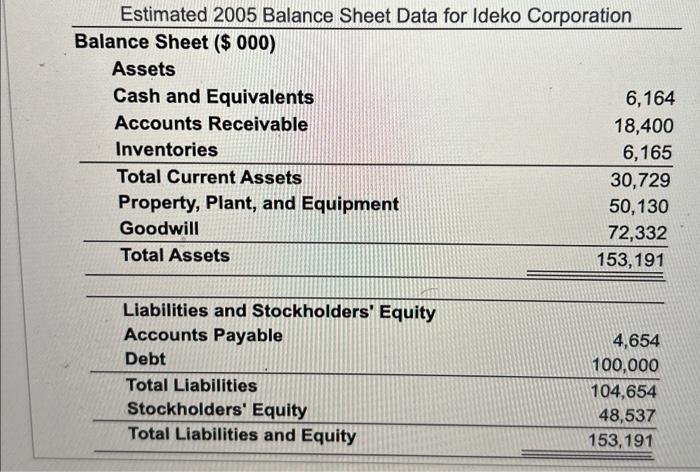

Under the assumptions that Ideko's market share will increase by 0.55 percent per year (enptying that the investment, financing. and dopreciation wil bo adiusted accordingfy) and the following forecasts ( Calculate ldeko's working capilal requirements through 2010 (that is, reproduce Table 19.9 under the new assumptions). ideko's pro-forma income atalements for 20052010 ar shown here while is balance sheot for 2005 is shown here Calculate ldeko's working caplal requirements through 2010 below. (Round to the nearest $600.) Ideko's Working Capital Requirements \begin{tabular}{llcc} \hline Working Capital Days & & 2005 & >2005 \\ \hline Assets & Based on: & Days & Days \\ Accounts Receivable & Sales Revenue & 90 & 60 \\ Raw Materials & Raw Materials Costs & 45 & 30 \\ Finished Goods & Raw Materials + Labor Costs & 45 & 45 \\ Minimum Cash Balance & Sales Revenue & 30 & 30 \\ Liabilities & & 15 & 15 \\ Wages Payable & Direct Labor + Admin Costs & 45 & 45 \\ \hline Other Accounts Payable & Raw Materials + Sales and Marketing & \end{tabular} Estimated 2005 Balance Sheet Data for Ideko Corporation \begin{tabular}{lr} \hline Balance Sheet (\$ 000) & \\ Assets & 6,164 \\ Cash and Equivalents & 18,400 \\ Accounts Receivable & 6,165 \\ Inventories & 30,729 \\ \hline Total Current Assets & 50,130 \\ Property, Plant, and Equipment & 72,332 \\ Goodwill & 153,191 \\ \hline Total Assets & \\ \hline & 4,654 \\ \hline Liabilities and Stockholders' Equity & 100,000 \\ \hline Accounts Payable & 104,654 \\ Debt & 48,537 \\ \hline Total Liabilities & 153,191 \\ \hline Stockholders' Equity & \\ \hline Total Liabilities and Equity & \end{tabular} Under the assumptions that Ideko's market share will increase by 0.55 percent per year (enptying that the investment, financing. and dopreciation wil bo adiusted accordingfy) and the following forecasts ( Calculate ldeko's working capilal requirements through 2010 (that is, reproduce Table 19.9 under the new assumptions). ideko's pro-forma income atalements for 20052010 ar shown here while is balance sheot for 2005 is shown here Calculate ldeko's working caplal requirements through 2010 below. (Round to the nearest $600.) Ideko's Working Capital Requirements \begin{tabular}{llcc} \hline Working Capital Days & & 2005 & >2005 \\ \hline Assets & Based on: & Days & Days \\ Accounts Receivable & Sales Revenue & 90 & 60 \\ Raw Materials & Raw Materials Costs & 45 & 30 \\ Finished Goods & Raw Materials + Labor Costs & 45 & 45 \\ Minimum Cash Balance & Sales Revenue & 30 & 30 \\ Liabilities & & 15 & 15 \\ Wages Payable & Direct Labor + Admin Costs & 45 & 45 \\ \hline Other Accounts Payable & Raw Materials + Sales and Marketing & \end{tabular} Estimated 2005 Balance Sheet Data for Ideko Corporation \begin{tabular}{lr} \hline Balance Sheet (\$ 000) & \\ Assets & 6,164 \\ Cash and Equivalents & 18,400 \\ Accounts Receivable & 6,165 \\ Inventories & 30,729 \\ \hline Total Current Assets & 50,130 \\ Property, Plant, and Equipment & 72,332 \\ Goodwill & 153,191 \\ \hline Total Assets & \\ \hline & 4,654 \\ \hline Liabilities and Stockholders' Equity & 100,000 \\ \hline Accounts Payable & 104,654 \\ Debt & 48,537 \\ \hline Total Liabilities & 153,191 \\ \hline Stockholders' Equity & \\ \hline Total Liabilities and Equity & \end{tabular}