Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Under the Black-Scholes framework, suppose a non-dividend-paying stock has a current price of $100, and furthermore that the expected continuously compounded rate of return

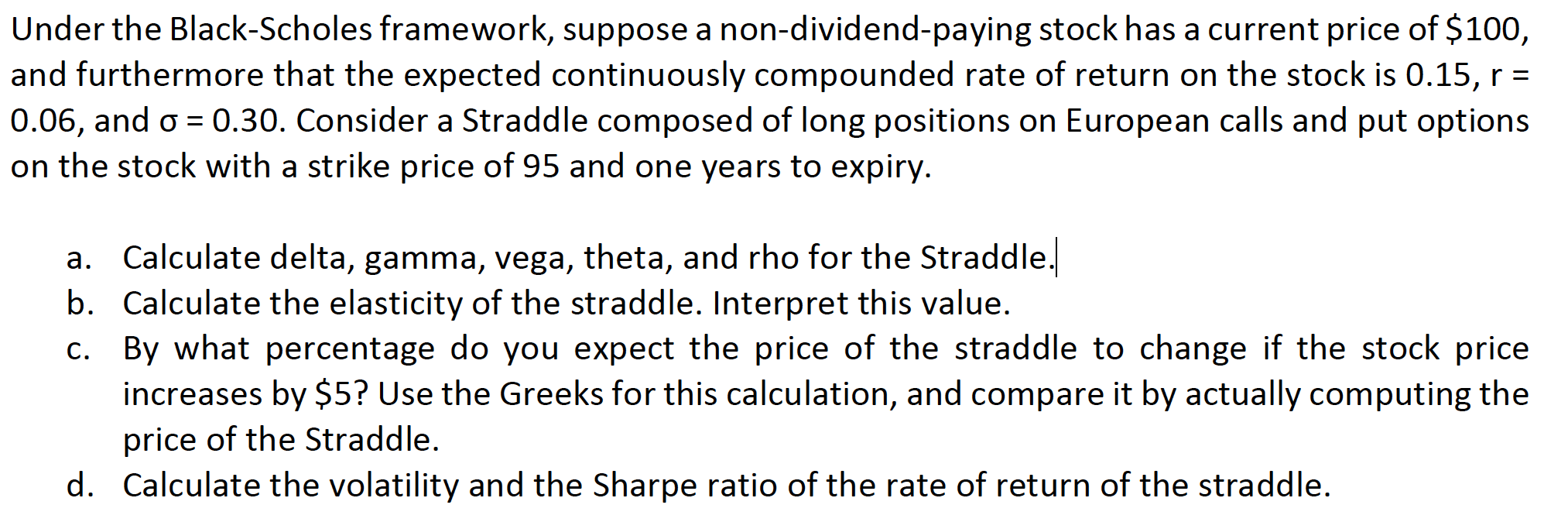

Under the Black-Scholes framework, suppose a non-dividend-paying stock has a current price of $100, and furthermore that the expected continuously compounded rate of return on the stock is 0.15, r = 0.06, and o = 0.30. Consider a Straddle composed of long positions on European calls and put options on the stock with a strike price of 95 and one years to expiry. a. Calculate delta, gamma, vega, theta, and rho for the Straddle. b. Calculate the elasticity of the straddle. Interpret this value. c. By what percentage do you expect the price of the straddle to change if the stock price increases by $5? Use the Greeks for this calculation, and compare it by actually computing the price of the Straddle. d. Calculate the volatility and the Sharpe ratio of the rate of return of the straddle.

Step by Step Solution

★★★★★

3.45 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

a Delta 0 Gamma 00108 Vega 06255 Theta 02073 Rho 01793 Delta The delta of a straddle is zero since long positions on both calls and puts are held Gamma The gamma of a straddle is calculated using the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started