Answered step by step

Verified Expert Solution

Question

1 Approved Answer

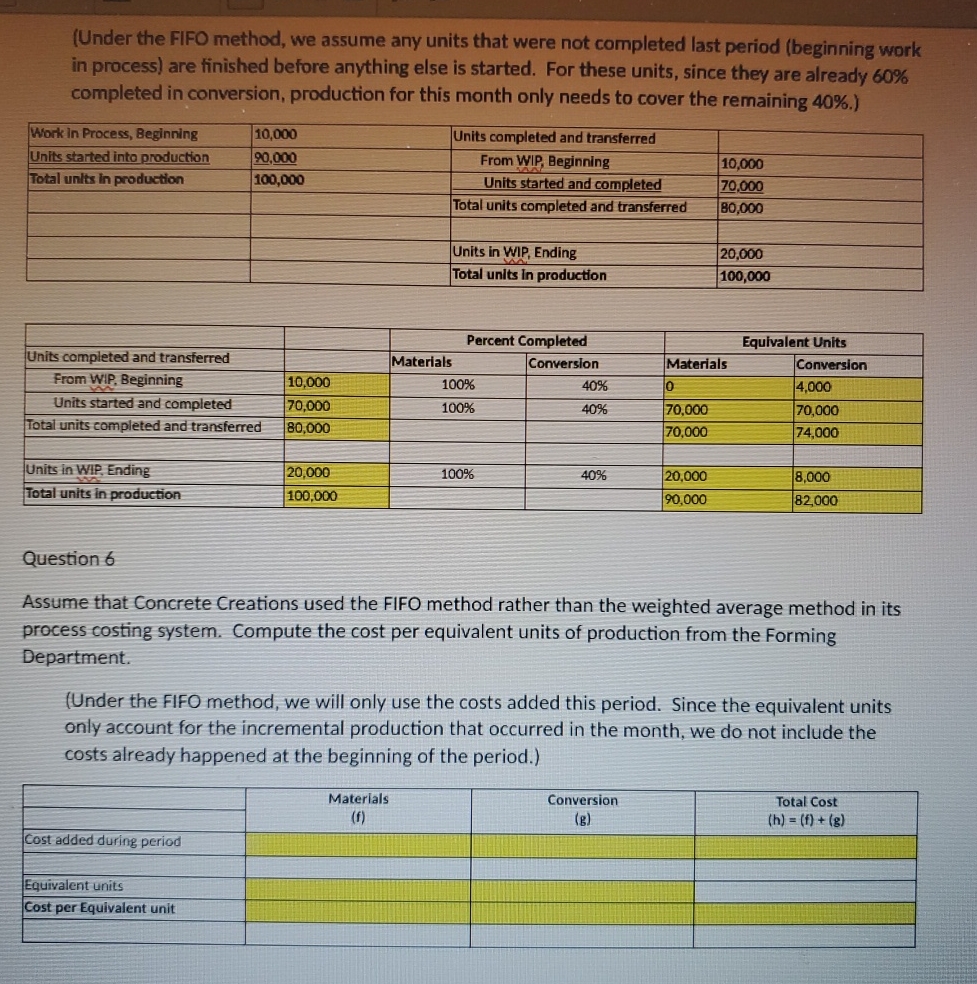

(Under the FIFO method, we assume any units that were not completed last period (beginning work in process) are finished before anything else is

(Under the FIFO method, we assume any units that were not completed last period (beginning work in process) are finished before anything else is started. For these units, since they are already 60% completed in conversion, production for this month only needs to cover the remaining 40%.) Work in Process, Beginning Units started into production 10,000 90,000 Units completed and transferred From WIP, Beginning 10,000 Total units in production 100,000 Units started and completed 70,000 Total units completed and transferred 80,000 Units in WIP, Ending Total units in production 20,000 100,000 Percent Completed Equivalent Units Units completed and transferred Materials Conversion Materials Conversion From WIP, Beginning 10,000 100% 40% 0 4,000 Units started and completed 70,000 100% 40% 70,000 70,000 Total units completed and transferred 80,000 70,000 74,000 Units in WIP, Ending 20,000 100% 40% 20,000 8,000 Total units in production 100,000 90,000 82,000 Question 6 Assume that Concrete Creations used the FIFO method rather than the weighted average method in its process costing system. Compute the cost per equivalent units of production from the Forming Department. (Under the FIFO method, we will only use the costs added this period. Since the equivalent units only account for the incremental production that occurred in the month, we do not include the costs already happened at the beginning of the period.) Cost added during period Equivalent units Cost per Equivalent unit Materials (f) Conversion (g) Total Cost (h) = (f)+(g)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started