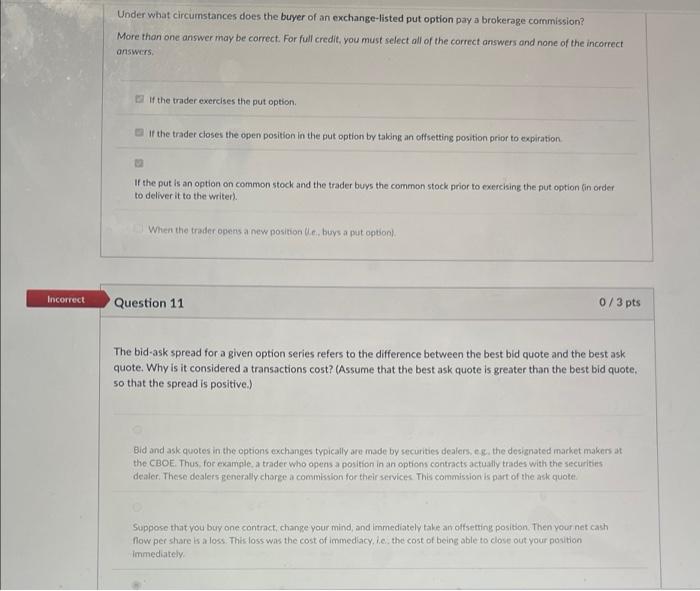

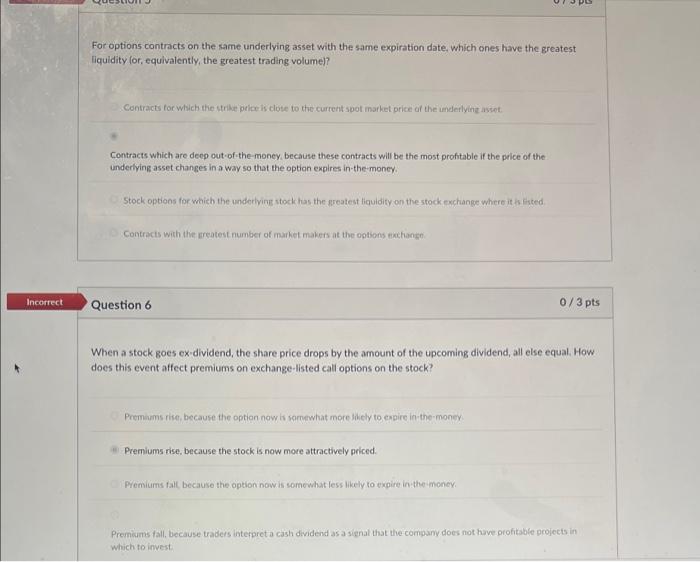

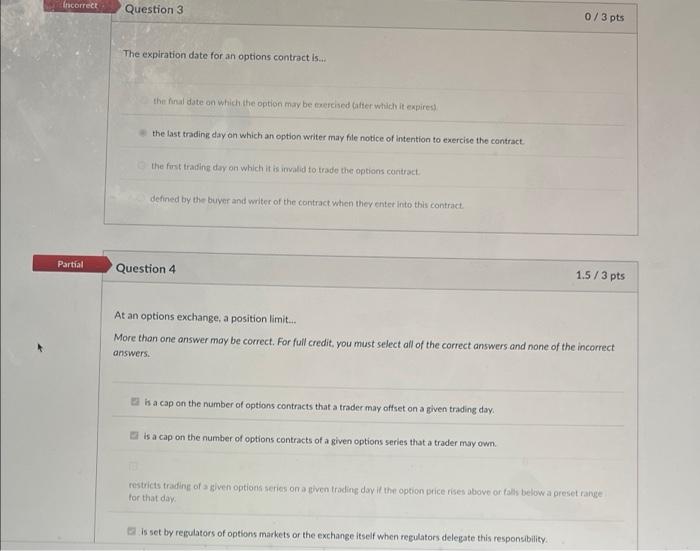

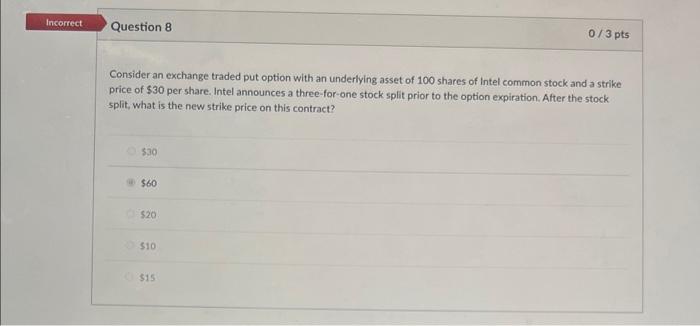

Under what circumstances does the buyer of an exchange-listed put option pay a brokerage commission? More than one answer may be correct. For full credit, you must select all of the correct answers and none of the incorrect answers If the trader exercises the put option But the trader closes the open position in the put option by talong an offsetting position prior to expiration if the put is an option on common stock and the trader buys the common stock prior to exercising the put option in order to deliver it to the writer) When the trader opens a new position .. buys a put option Incorrect Question 11 0/3 pts a The bid-ask spread for a given option series refers to the difference between the best bid quote and the best ask quote. Why is it considered a transactions cost? (Assume that the best ask quote is greater than the best bid quote, so that the spread is positive.) Bid and ask quotes in the options exchanges typically are made by securities dealers eg. the designated market makers at the CBOE Thus, for example, a trader who opens a position in an options contracts actually trades with the securities dealer. These dealers generally charge a commission for their services. This commission is part of the ask quote. Suppose that you buy one contract, change your mind, and immediately take an offsetting position. Then your net cash flow per share is a loss. This loss was the cost of immediacy, ie the cost of being able to close out your position Immediately For options contracts on the same underlying asset with the same expiration date, which ones have the greatest liquidity for, equivalently, the greatest trading volume)? Contracts for which the strike price is close to the current spot market price of the underlying asset Contracts which are deep out of the money, because these contracts will be the most profitable if the price of the underlying asset changes in a way so that the option expires in the money Stock options for which the underlying stock has the greatest liquidity on the stock exchange where it is listed Contracts with the greatest number of market makers at the options exchange Incorrect Question 6 0/3 pts When a stock goes ex dividend, the share price drops by the amount of the upcoming dividend, all else equal. How does this event affect premiums on exchange-listed call options on the stock Premiums rise, because the option now is saruwhat more Skely to capire in the money Premiums rise, because the stock is now more attractively priced. Premium all because the option now is somewhat less likely to expire in the money, Premiums fall, because traders interpreta cash dividend as a senal that the company does not have profitable projects in which to invest Incorrect Question 3 0/3 pts The expiration date for an options contract is... the final date on which the option may be cerised Gifter which it expires the last trading day on which an option weiter may file notice of intention exercise the contract the first trading day on which it is invalid to trade the options contract defined by the buyer and writer of the contract when they enter into this contract Partial Question 4 1.5/3 pts At an options exchange, a position limit... More than one answer may be correct. For full credit, you must select all of the correct answers and none of the incorrect answers. is a cap on the number of options contracts that a trader may offset on a given trading day. is a cap on the number of options contracts of a given options series that a trader may own restricts trading of ven options series on a given trading day if the option price rises above or falls below a preset range for that day is set by regulators of options markets or the exchange itself when regulators delegate this responsibility Incorrect Question 8 0/3 pts Consider an exchange traded put option with an underlying asset of 100 shares of Intel common stock and a strike price of $30 per share. Intel announces a three-for-one stock split prior to the option expiration. After the stock split, what is the new strike price on this contract? 530 $60 $20 $10 $15 Under what circumstances does the buyer of an exchange-listed put option pay a brokerage commission? More than one answer may be correct. For full credit, you must select all of the correct answers and none of the incorrect answers If the trader exercises the put option But the trader closes the open position in the put option by talong an offsetting position prior to expiration if the put is an option on common stock and the trader buys the common stock prior to exercising the put option in order to deliver it to the writer) When the trader opens a new position .. buys a put option Incorrect Question 11 0/3 pts a The bid-ask spread for a given option series refers to the difference between the best bid quote and the best ask quote. Why is it considered a transactions cost? (Assume that the best ask quote is greater than the best bid quote, so that the spread is positive.) Bid and ask quotes in the options exchanges typically are made by securities dealers eg. the designated market makers at the CBOE Thus, for example, a trader who opens a position in an options contracts actually trades with the securities dealer. These dealers generally charge a commission for their services. This commission is part of the ask quote. Suppose that you buy one contract, change your mind, and immediately take an offsetting position. Then your net cash flow per share is a loss. This loss was the cost of immediacy, ie the cost of being able to close out your position Immediately For options contracts on the same underlying asset with the same expiration date, which ones have the greatest liquidity for, equivalently, the greatest trading volume)? Contracts for which the strike price is close to the current spot market price of the underlying asset Contracts which are deep out of the money, because these contracts will be the most profitable if the price of the underlying asset changes in a way so that the option expires in the money Stock options for which the underlying stock has the greatest liquidity on the stock exchange where it is listed Contracts with the greatest number of market makers at the options exchange Incorrect Question 6 0/3 pts When a stock goes ex dividend, the share price drops by the amount of the upcoming dividend, all else equal. How does this event affect premiums on exchange-listed call options on the stock Premiums rise, because the option now is saruwhat more Skely to capire in the money Premiums rise, because the stock is now more attractively priced. Premium all because the option now is somewhat less likely to expire in the money, Premiums fall, because traders interpreta cash dividend as a senal that the company does not have profitable projects in which to invest Incorrect Question 3 0/3 pts The expiration date for an options contract is... the final date on which the option may be cerised Gifter which it expires the last trading day on which an option weiter may file notice of intention exercise the contract the first trading day on which it is invalid to trade the options contract defined by the buyer and writer of the contract when they enter into this contract Partial Question 4 1.5/3 pts At an options exchange, a position limit... More than one answer may be correct. For full credit, you must select all of the correct answers and none of the incorrect answers. is a cap on the number of options contracts that a trader may offset on a given trading day. is a cap on the number of options contracts of a given options series that a trader may own restricts trading of ven options series on a given trading day if the option price rises above or falls below a preset range for that day is set by regulators of options markets or the exchange itself when regulators delegate this responsibility Incorrect Question 8 0/3 pts Consider an exchange traded put option with an underlying asset of 100 shares of Intel common stock and a strike price of $30 per share. Intel announces a three-for-one stock split prior to the option expiration. After the stock split, what is the new strike price on this contract? 530 $60 $20 $10 $15