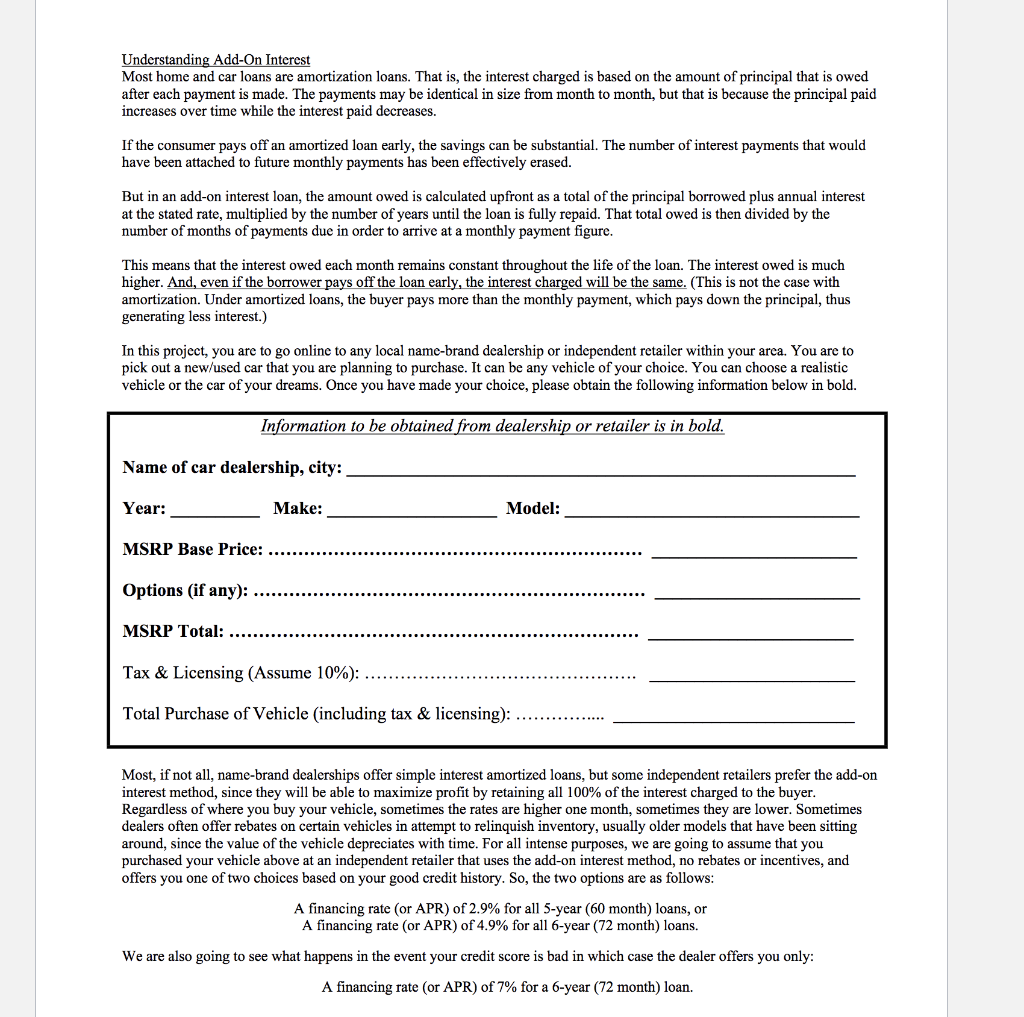

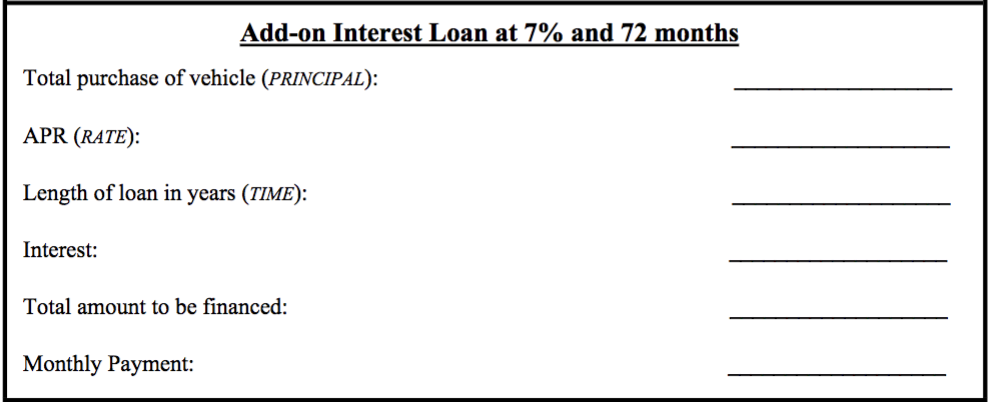

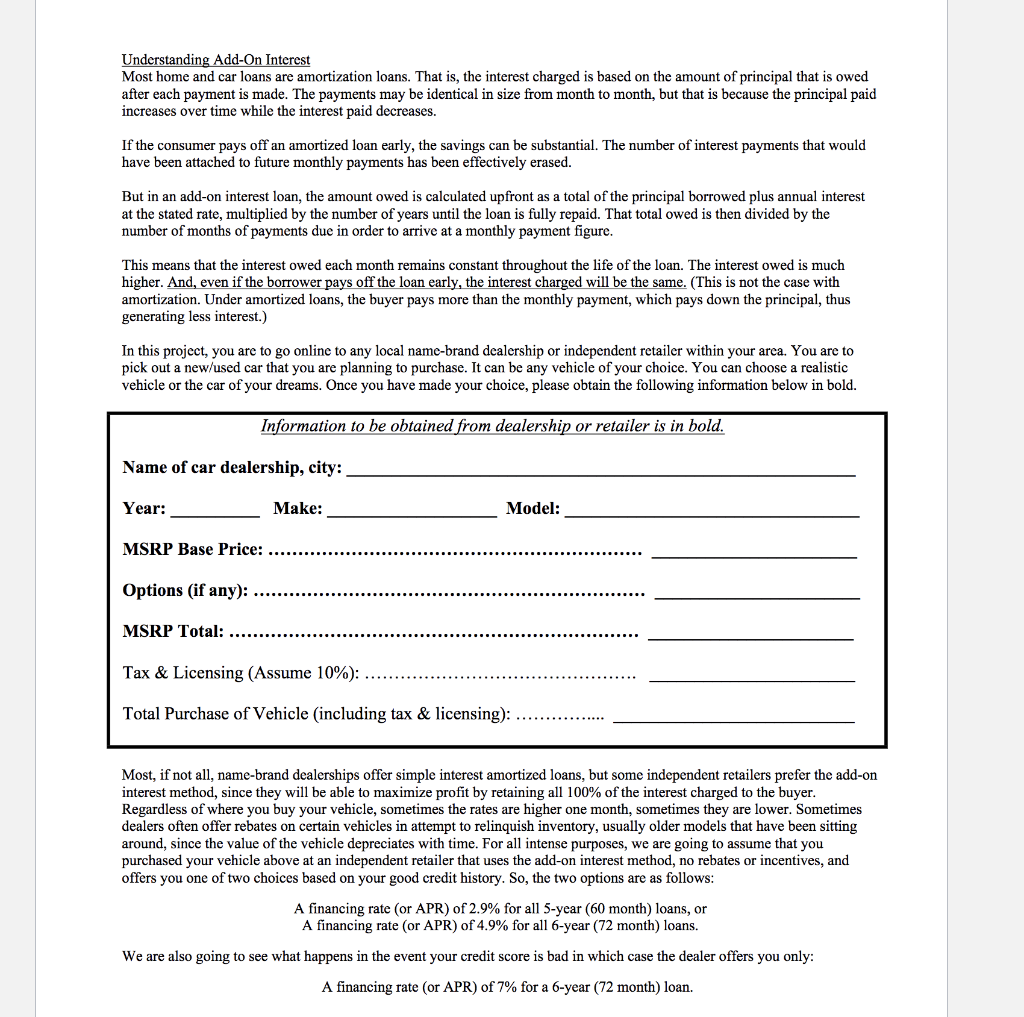

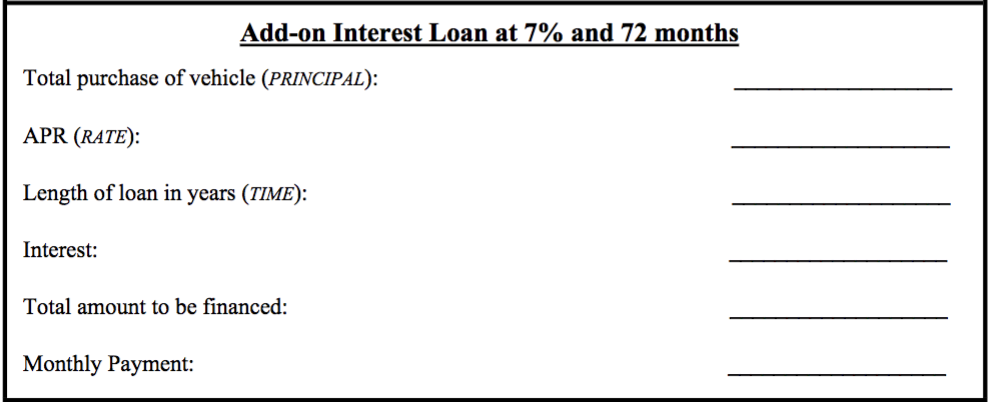

Understanding Add-On Interest Most home and car loans are amortization loans. That is, the interest charged is based on the amount of principal that is owed after each payment is made. The payments may be identical in size from month to month, but that is because the principal paid increases over time while the interest paid decreases. If the consumer pays off an amortized loan early, the savings can be substantial. The number of interest payments that would have been attached to future monthly payments has been effectively erased. But in an add-on interest loan, the amount owed is calculated upfront as a total of the principal borrowed plus annual interest at the stated rate, multiplied by the number of years until the loan is fully repaid. That total owed is then divided by the number of months of payments due in order to arrive at a monthly payment figure. This means that the interest owed each month remains constant throughout the life of the loan. The interest owed is much higher. And, even if the borrower pays off the loan early, the interest charged will be the same. (This is not the case with amortization. Under amortized loans, the buyer pays more than the monthly payment, which pays down the principal, thus generating less interest.) In this project, you are to go online to any local name-brand dealership or independent retailer within your area. You are to pick out a new/used car that you are planning to purchase. It can be any vehicle of your choice. You can choose a realistic vehicle or the car of your dreams. Once you have made your choice, please obtain the following information below in bold. Information to be obtained from dealership or retailer is in bold. Name of car dealership, city: _ Year: _ Make: Model: MSRP Base Price: ........... Options (if any): .......... MSRP Total: ............ Tax & Licensing (Assume 10%): ....... Total Purchase of Vehicle (including tax & licensing): ... Most, if not all, name-brand dealerships offer simple interest amortized loans, but some independent retailers prefer the add-on interest method, since they will be able to maximize profit by retaining all 100% of the interest charged to the buyer. Regardless of where you buy your vehicle, sometimes the rates are higher one month, sometimes they are lower. Sometimes dealers often offer rebates on certain vehicles in attempt to relinquish inventory, usually older models that have been sitting around, since the value of the vehicle depreciates with time. For all intense purposes, we are going to assume that you purchased your vehicle above at an independent retailer that uses the add-on interest method, no rebates or incentives, and offers you one of two choices based on your good credit history. So, the two options are as follows: A financing rate (or APR) of 2.9% for all 5-year (60 month) loans, or A financing rate (or APR) of 4.9% for all 6-year (72 month) loans. We are also going to see what happens in the event your credit score is bad in which case the dealer offers you only: A financing rate (or APR) of 7% for a 6-year (72 month) loan. Add-on Interest Loan at 7% and 72 months Total purchase of vehicle (PRINCIPAL): APR (RATE): Length of loan in years (TIME): Interest: Total amount to be financed: Monthly Payment