Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Understanding cash flow is a critical concept that you must get comfortable with. Please use the following F / S in answering the next few

Understanding cash flow is a critical concept that you must get comfortable with. Please use the following FS in answering the next few questions.

What was the Net Cash Flow to the Debtholders in

Panda Corp

Income Statement

$ Millions

Net Sales

$

Cost of Goods Sold

$

Depreciation

$

Earnings before Interest & Taxes EBIT

$

Interest Paid

Flagquestion

A company had sales of $ and costs of $ Depreciation was an additional $ and interest paid was $ Taxes were of pretax income.

Dividends were $ Beginning net fixed assets were $ and ending net fixed assets were $ Net new borrowing is $ The company started the

year with a net working capital of $ and ended with $ No shares of stock were issued that year.

A Calculate net income nearest dollar without dollar sign $ or comma, eg Negative cash flow is :

B Calculate operating cash flow nearest dollar without dollar sign $ or comma, eg Negative cash flow is :

C Calculate net capital spending nearest dollar without dollar sign $ or comma, eg Negative cash flow is :

D Calculate change in net working capital nearest dollar without dollar sign $ or comma, eg Negative cash flow is :

E Calculate cash flow from assets nearest dollar without dollar sign $ or comma, eg Negative cash flow is :

F Calculate cash flow to shareholders nearest dollar without dollar sign $ or comma, eg Negative cash flow is :

G Calculate cash flow to bondholders nearest dollar without dollar sign $ or comma, eg Negative cash flow is :

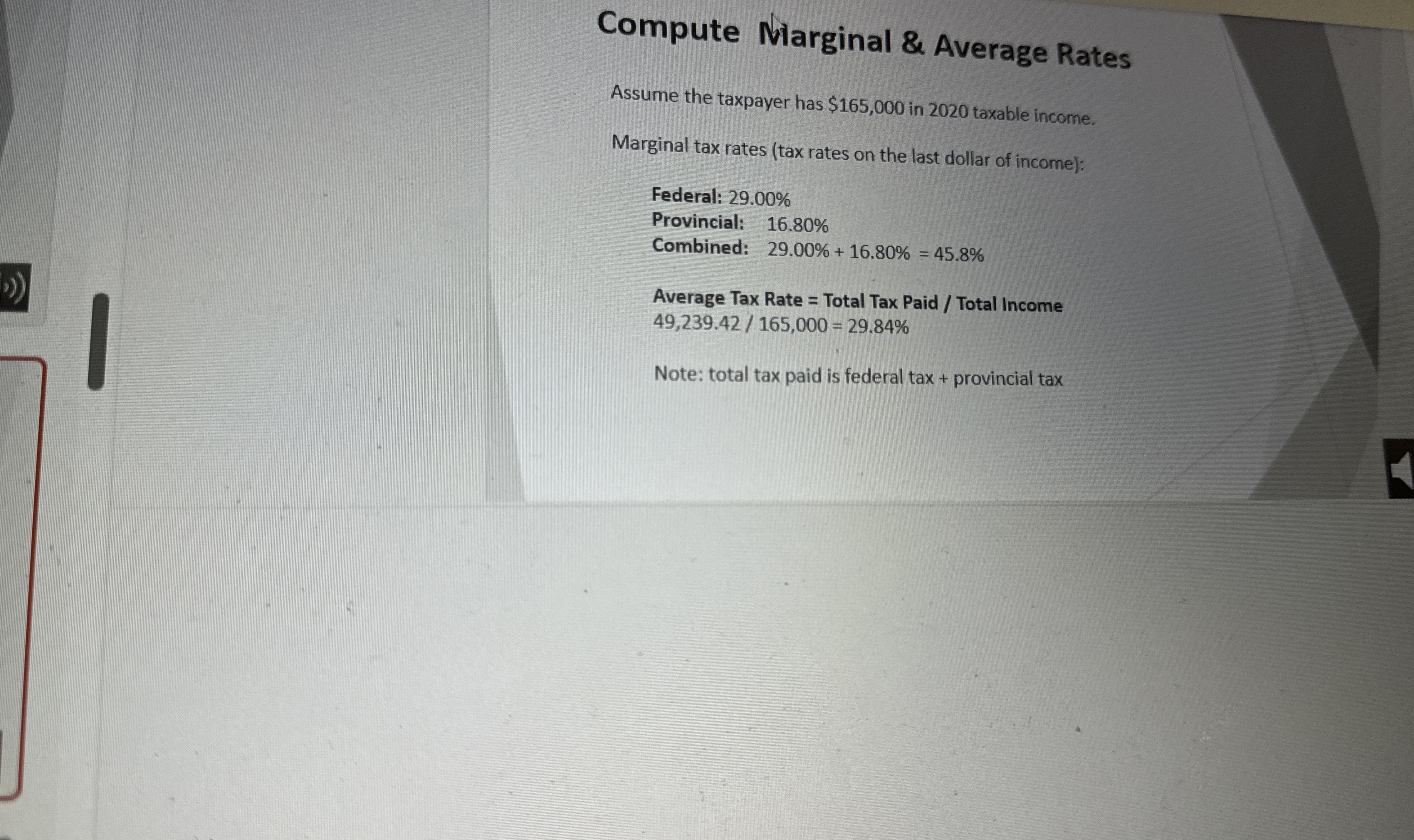

Compute Nlarginal & Average Rates

Assume the taxpayer has $ in taxable income.

Marginal tax rates tax rates on the last dollar of income:

Federal:

Provincial:

Combined:

Average Tax Rate Total Tax Paid Total Income

Note: total tax paid is federal tax provincial tax

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started