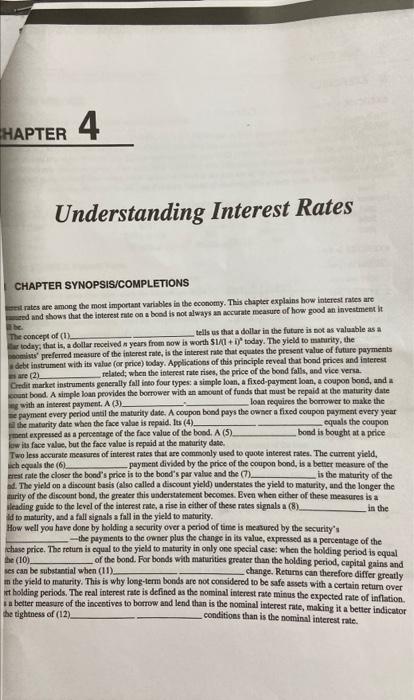

Understanding Interest Rates CHAPTEA SYNOPSIS/COMPLETIONS Ent rates are among the most important variables in the economy. This chaper explains how interest rates are ased and shows that the ibterest fate on a bood is not always an accurate measure of how good an investmeet it a be. The concept of (t). telis us that a dollar in the future is not as valuable as a Far today, that is, a dollar received n years from now is worth 51/1+D todny. The yield to maturity, the poomins' preferrod nneasure of the interest ratc, is the intereat rase that equates the present value of futare payments yebt instrument with its value (or peice) today. Applications of this principle reveal that bond prices and interest mare (2) related; when the intereat rate rises, the price of the bond falls, and vice versa. Credit market instruments generally fall inso four types: a simple loan, a fixed-payment loan, a coupon bond, and a count bood. A simplo loan peovides the borrower with an amount of funds that must be repaid at the maturity date arg with an interest pryment, A(3) loan reguires the borrower to make the ne payment every period unal the mabuity date. A coopon bond pays the owner a fixed coupon payment every year fit the matarity date when the face valae is repaid. Its (4). equals the coupon rment expressed as a peretasuge of the face value of the bood. (5) bood is bought at a price low its face valos, but the face value is repoid at the maturity date. Two less accurate meacures of interest fates that are commonly ased to qooto interest rates. The cument yield, ich equals the (6) payment divided by the price of the coupon bond, is a betier measure of the rrat rate the closce tho bond's price is to the bond's par valoe and the (i) is the maturity of the ad. The yield on a discount basis (also called a dicoount yicld) underitates the yield to maturity, and the longer the turity of the discount bond, the greater this understatement becomes. Even when cither of these measures is a ileading guide to the level of the intertst rate, a rise in cither of these rates signals a 68. in the in to maturity, asd a fall signals a fall in the yield to maturity. How well yoe have dane by holding a securify over a period of time is measured by the security's - the payments to the owner plus the change in its value, expressed as a percentage of the ichase price. The return is equal to the yield to matarity in only one special case: when the holding period is equal the (10). of the bond. For bonds with manarities greater than the bolding period, capital gains and les can be subutantial when (11) change. Returns can therefore differ greatly in the yield to manarity. This is why long-term bonds aro not considered to be safe assets with a certain retum over it holding periods. The real interest rate is defined as the nominal interest rate misus the expected rate of iaflation. I a better measare of the ieceetives to borrow and lend than is the nominal interest rate, making it a better indicator. he rightness of (12) conditions than is the nomainal interest rate