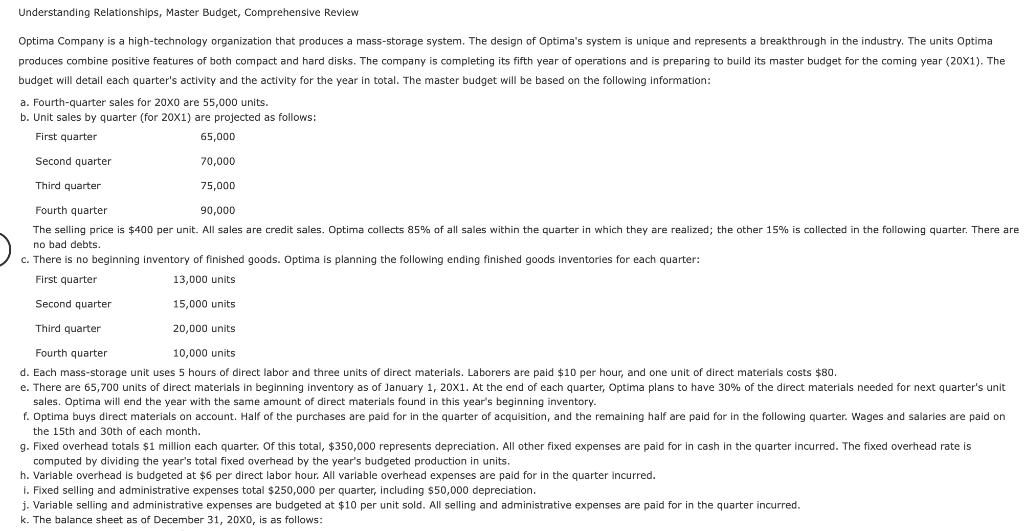

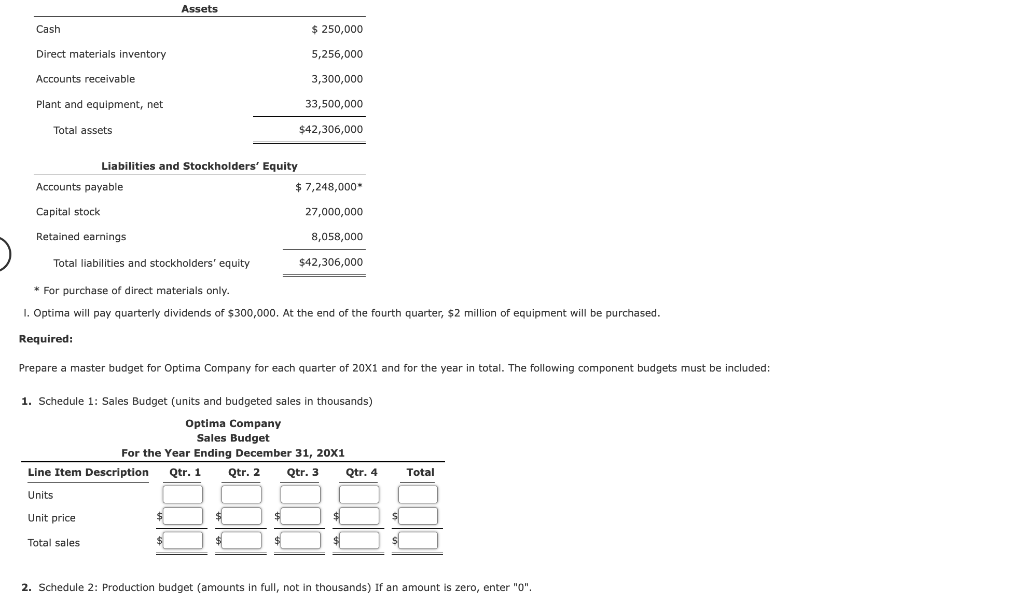

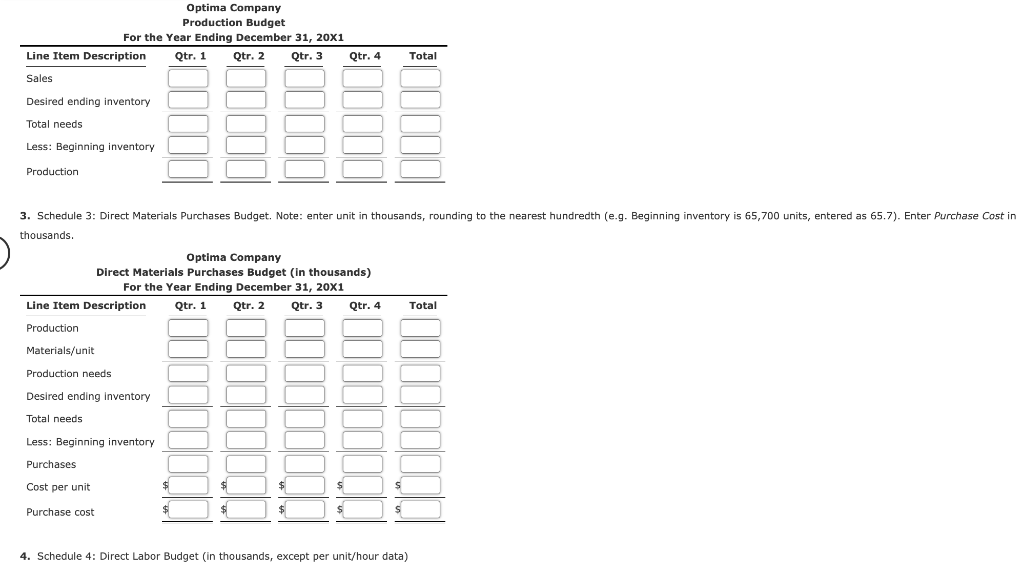

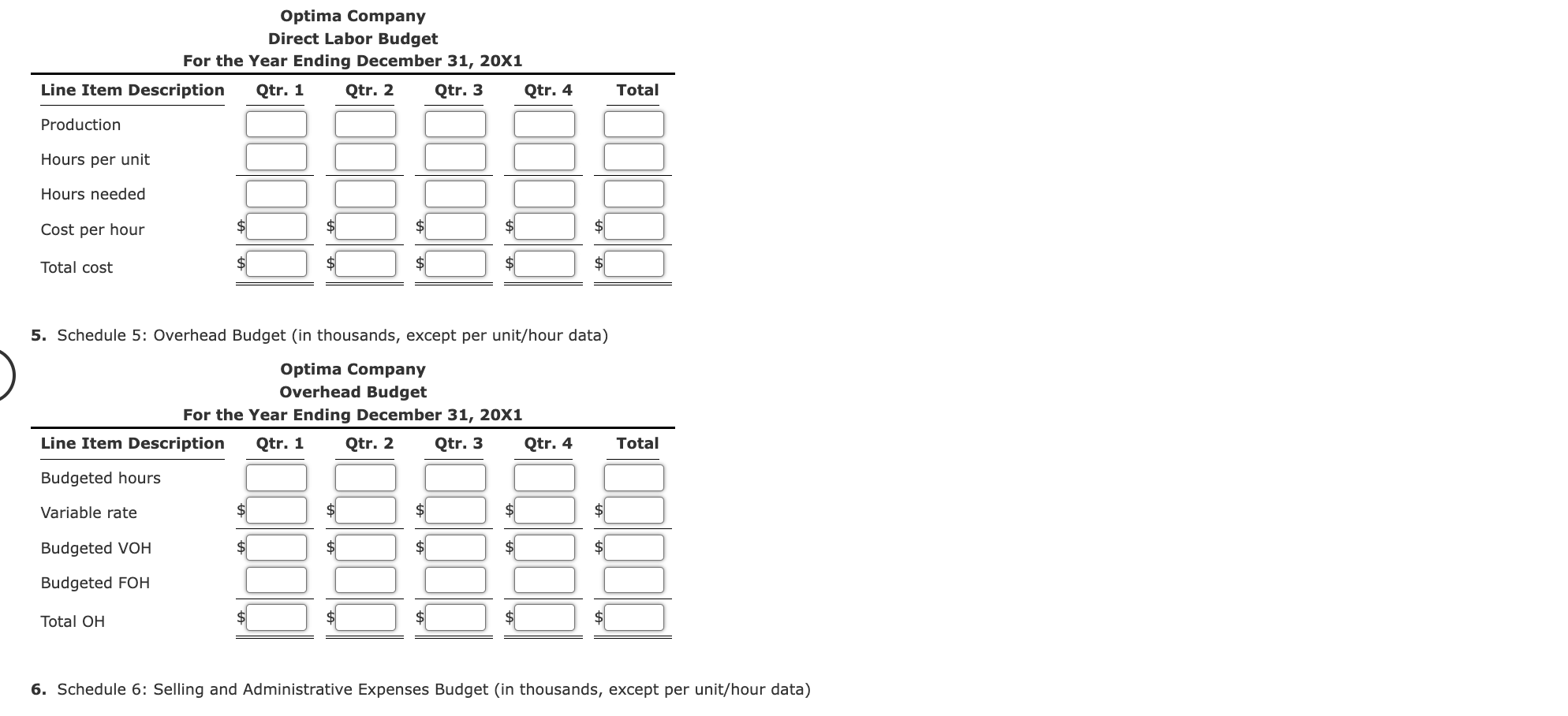

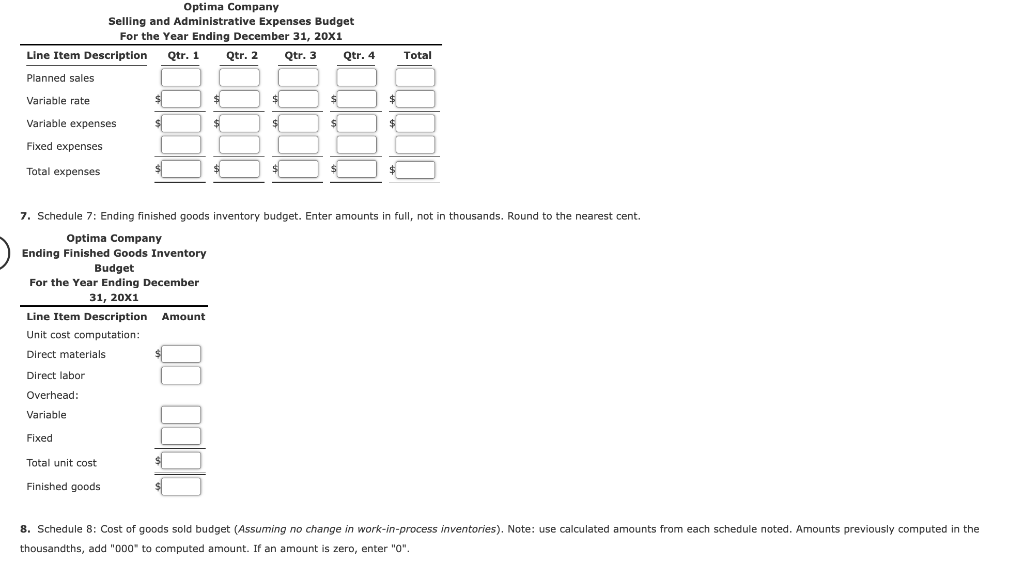

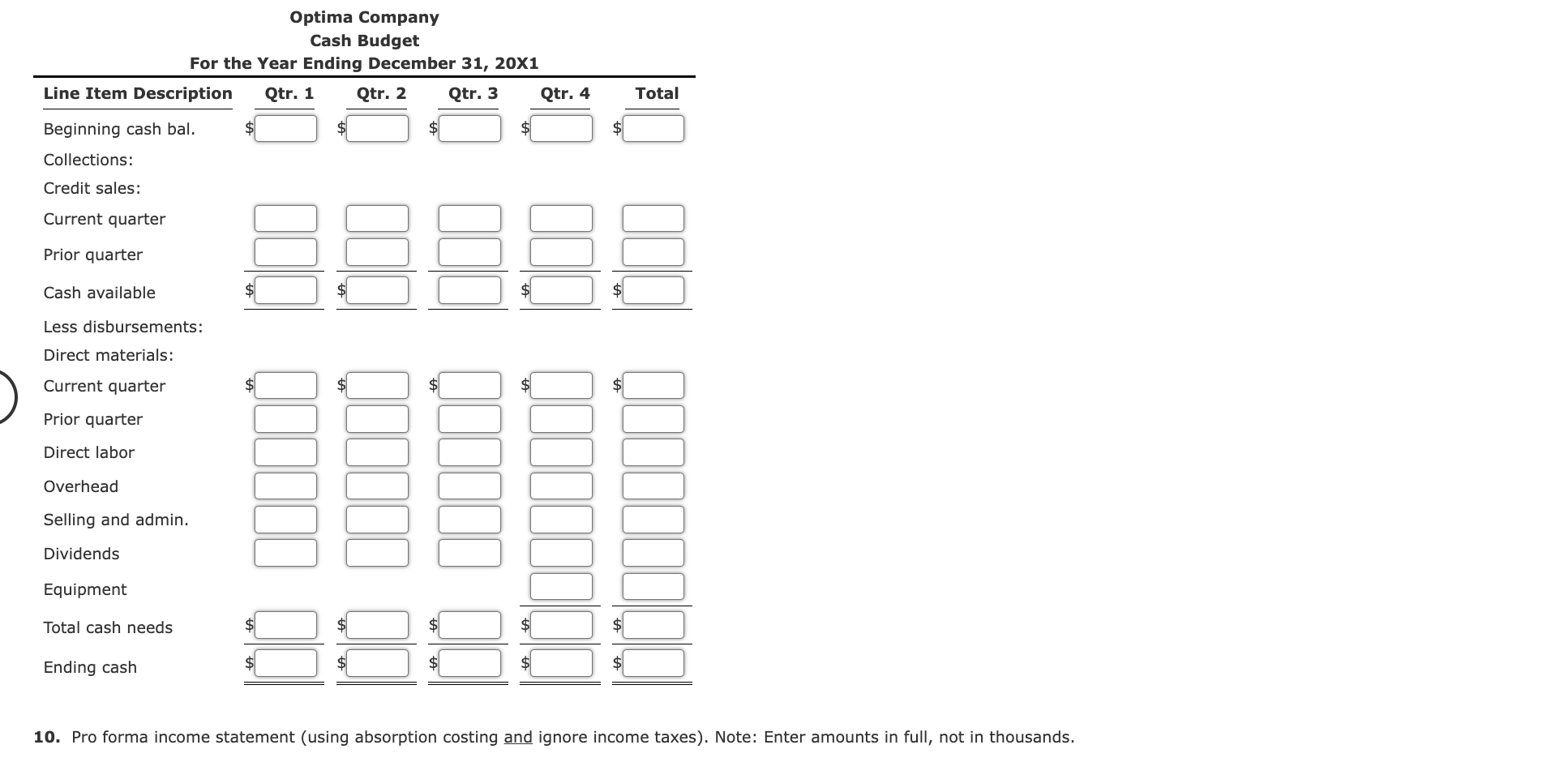

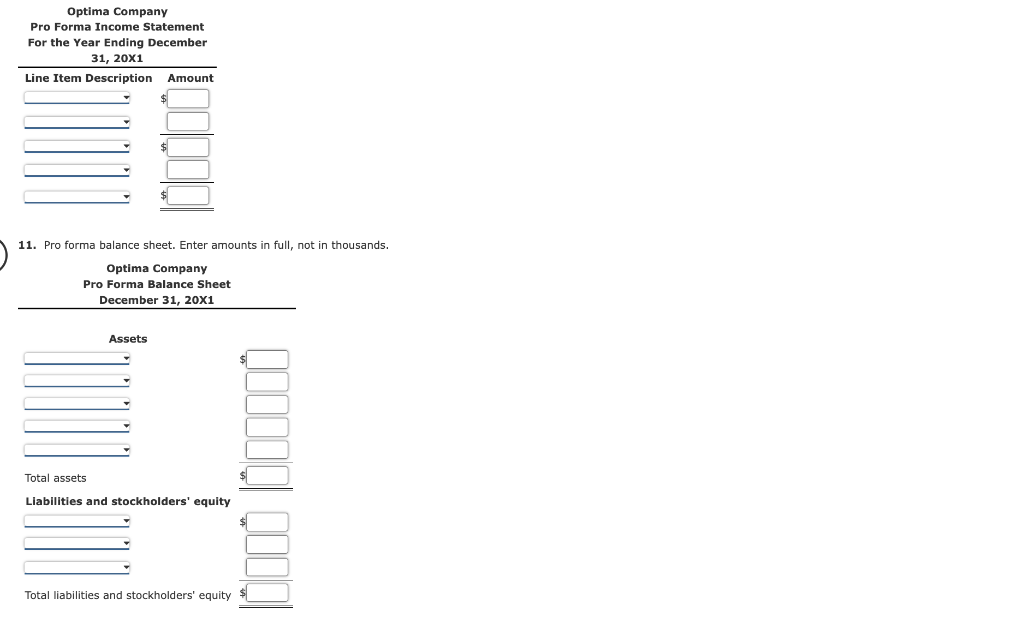

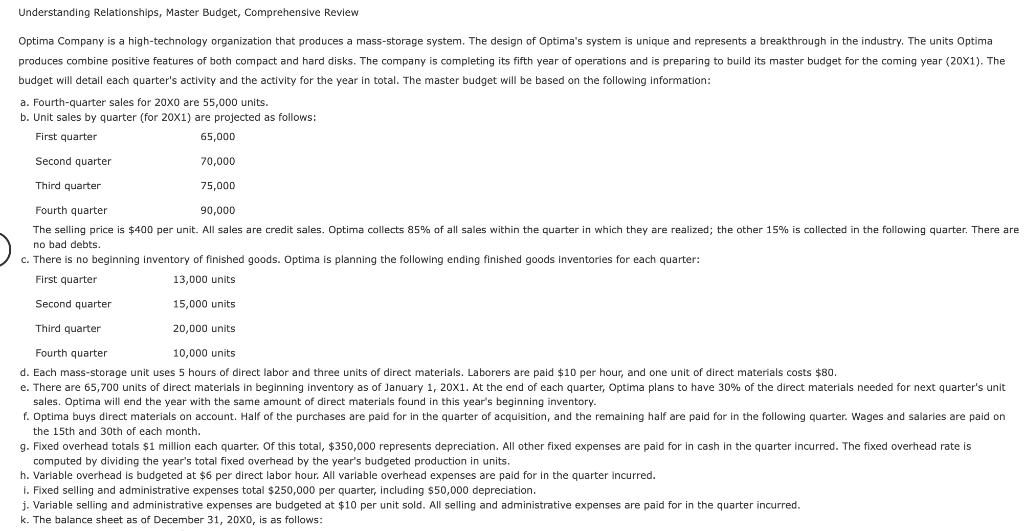

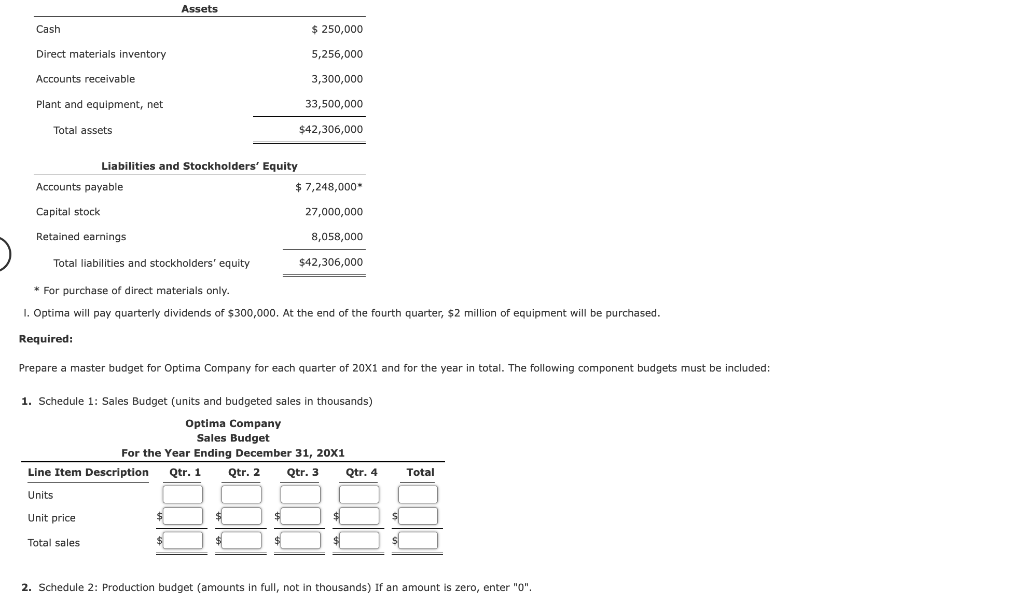

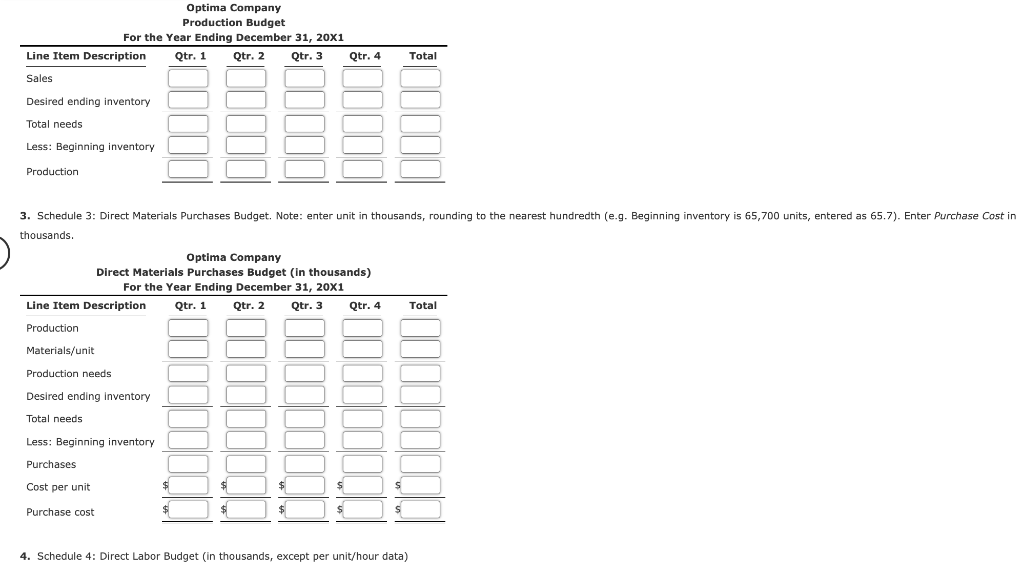

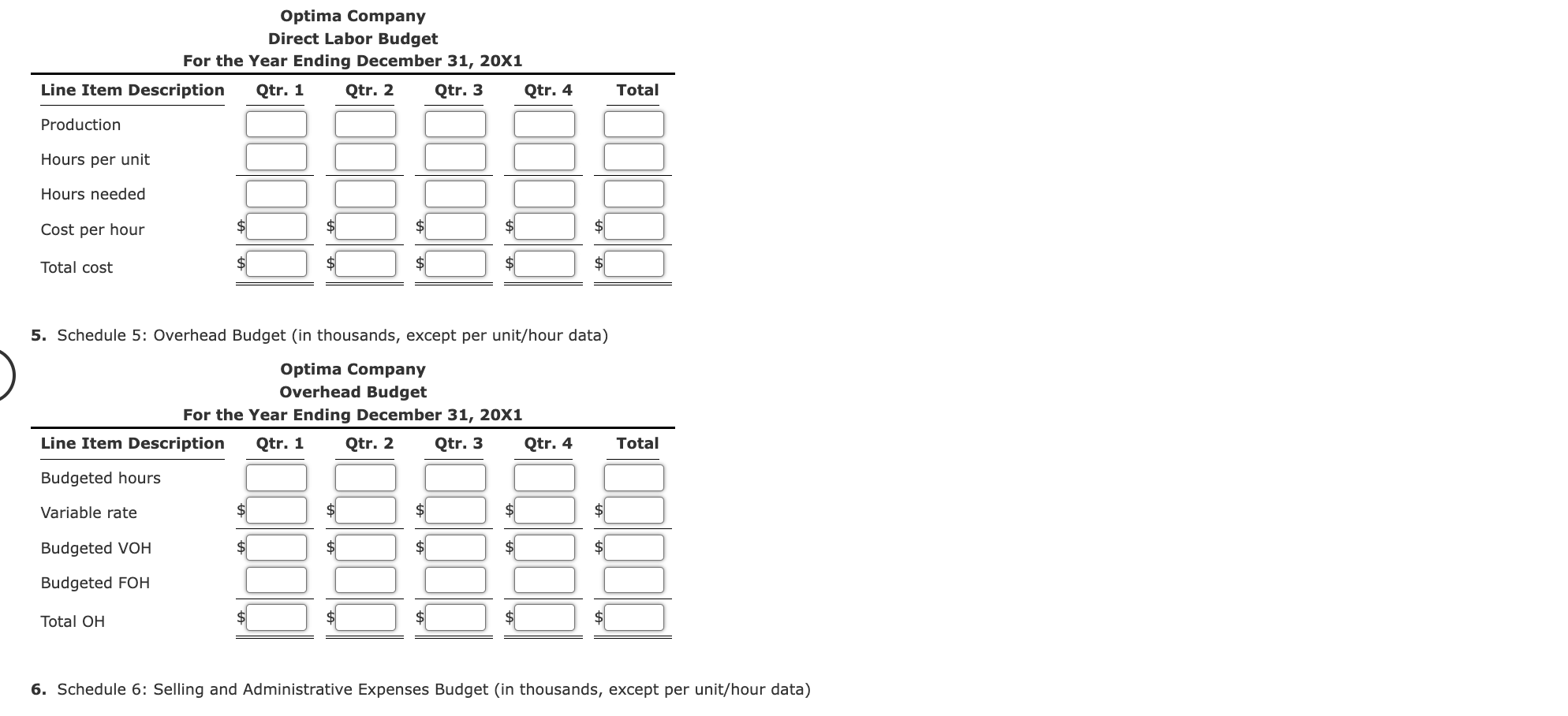

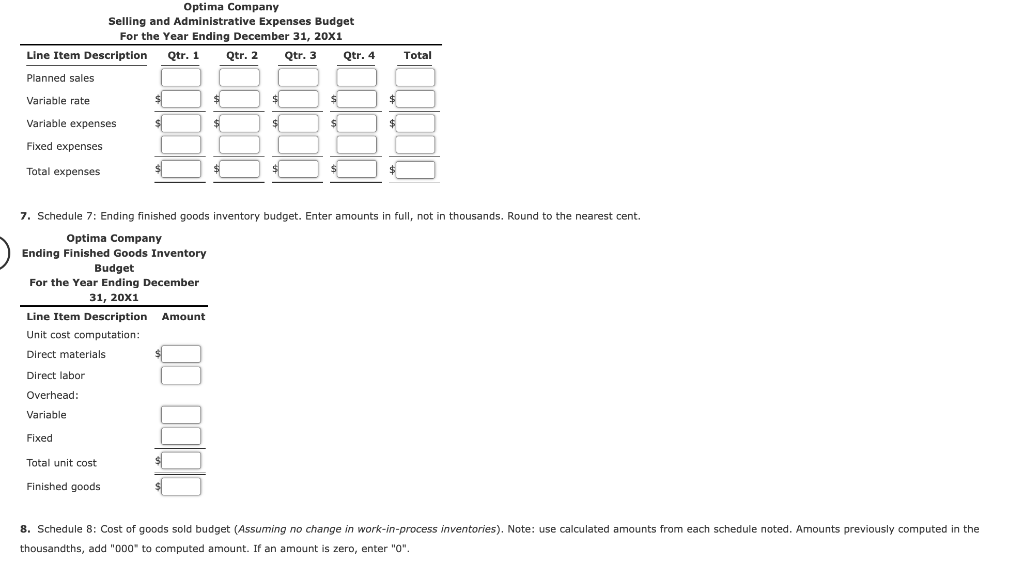

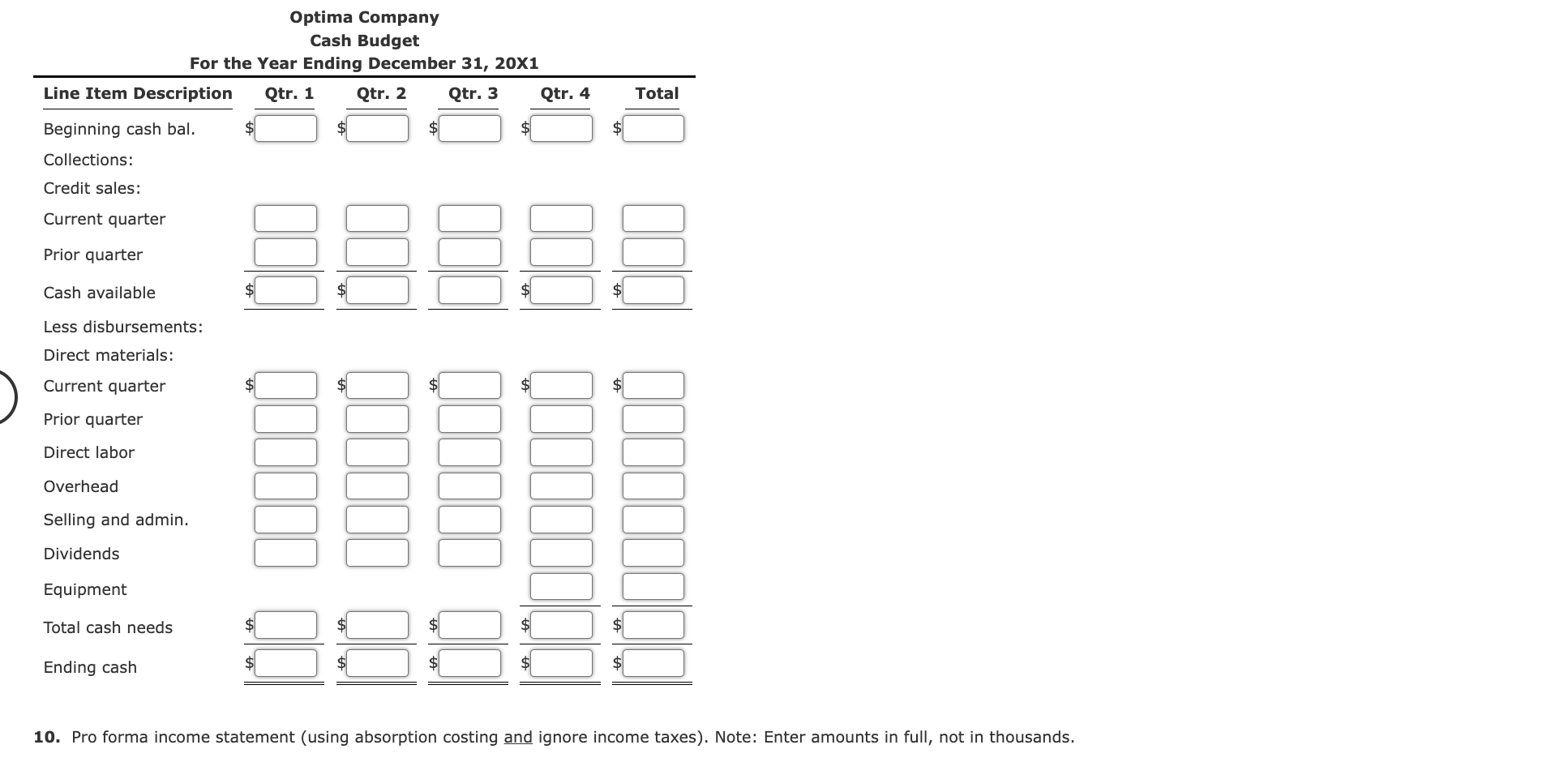

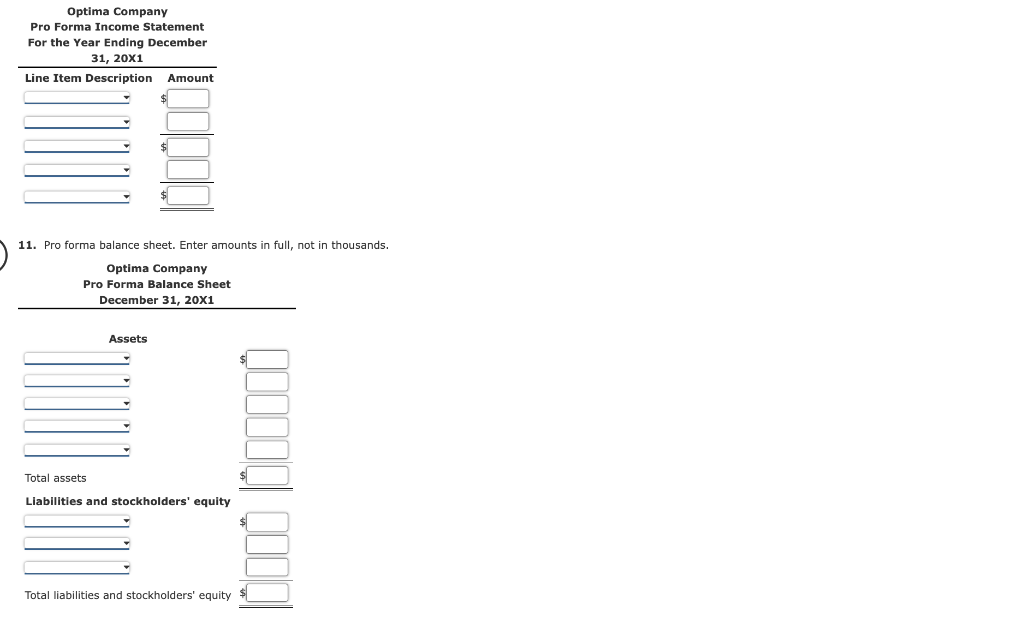

Understanding Relationships, Master Budget, Comprehensive Review budget will detail each quarter's activity and the activity for the year in total. The master budget will be based on the following information: a. Fourth-quarter sales for 200 are 55,000 units. b. Unit sales by quarter (for 201 ) are projected as follows: no bad debts. c. There is no beginning inventory of finished goods. Optima is planning the following ending finished goods inventories for each quarter: d. Each mass-storage unit uses 5 hours of direct labor and three units of direct materials. Laborers are paid $10 per hour, and one unit of direct materials costs $80. sales. Optima will end the year with the same amount of direct materials found in this year's beginning inventory. the 15 th and 30 th of each month. computed by dividing the year's total fixed overhead by the year's budgeted production in units. h. Variable overhead is budgeted at $6 per direct labor hour. All variable overhead expenses are paid for in the quarter incurred. i. Fixed selling and administrative expenses total $250,000 per quarter, including $50,000 depreciation. j. Variable selling and administrative expenses are budgeted at $10 per unit sold. All selling and administrative expenses are paid for in the quarter incurred. k. The balance sheet as of December 31,200, is as follows: I. Optima will pay quarterly dividends of $300,000. At the end of the fourth quarter, $2 million of equipment will be purchased. Required: Prepare a master budget for Optima Company for each quarter of 201 and for the year in total. The following component budgets must be included 1. Schedule 1: Sales Budget (units and budgeted sales in thousands) 2. Schedule 2: Production budget (amounts in full, not in thousands) If an amount is zero, enter "0". Optima Company Production Budget 3. Schedule 3: Direct Materials Purchases Budget. Note: enter unit in thousands, rounding to the nearest hundredth (e.g. Beginning inventory is 65,700 units, entered as 65.7 ). Enter Purchase Cost in thousands. 4. Schedule 4: Direct Labor Budget (in thousands, except per unit/hour data) Optima Company Direct Labor Budget For the Year Endina December 31. 201 5. Schedule 5: Overhead Budget (in thousands, except per unit/hour data) 6. Schedule 6: Selling and Administrative Expenses Budget (in thousands, except per unit/hour data) Optima Company Selling and Administrative Expenses Budget For the Year Endina December 31. 20X1 7. Schedule 7: Ending finished goods inventory budget. Enter amounts in full, not in thousands. Round to the nearest cent. 8. Schedule 8: Cost of goods sold budget (Assuming no change in work-in-process inventories). Note: use calculated amounts from each schedule noted. Amounts previously computed in the thousandths, add "000" to computed amount. If an amount is zero, enter "0". Optima Company Cost of Goods Sold Budget For the Year Ending December 31, 20X1 \begin{tabular}{l} \hline Line Item Description \\ Direct materials used (Schedule 3) \\ Direct labor used (Schedule 4) \\ Overhead (Schedule 5) \\ Budgeted manufacturing costs \\ Add: Beginning finished goods inventory (Schedule 7) \\ Cost of goods available for sale \\ Less: Ending finished goods inventory (Schedule 7) \\ Budgeted cost of goods sold \end{tabular} 9. Cash Budget (in thousands) Optima Company Cash Budget For the Year Ending December 31, 20X1 Collections: Credit sales: Current quarter Prior quarter Cash available Less disbursements: Direct materials: Current quarter Prior quarter Direct labor Overhead Selling and admin. Dividends Equipment Total cash needs Ending cash 10. Pro forma income statement (using absorption costing and ignore income taxes). Note: Enter amounts in full, not in thousands. 11. Pro forma balance sheet. Enter amounts in full, not in thousands