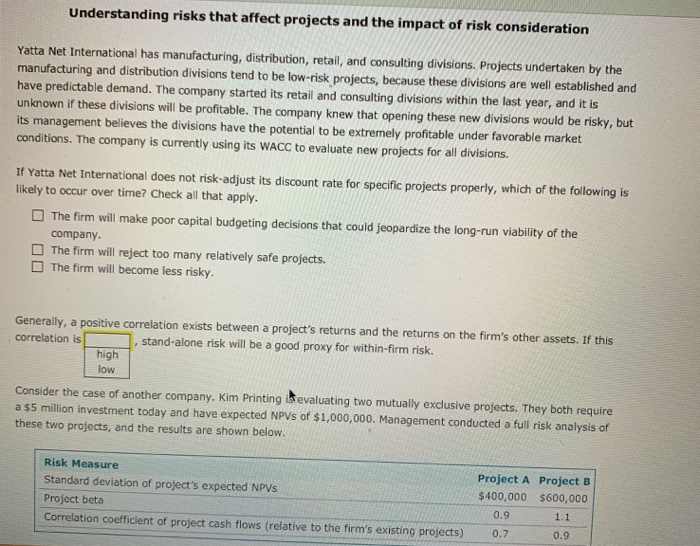

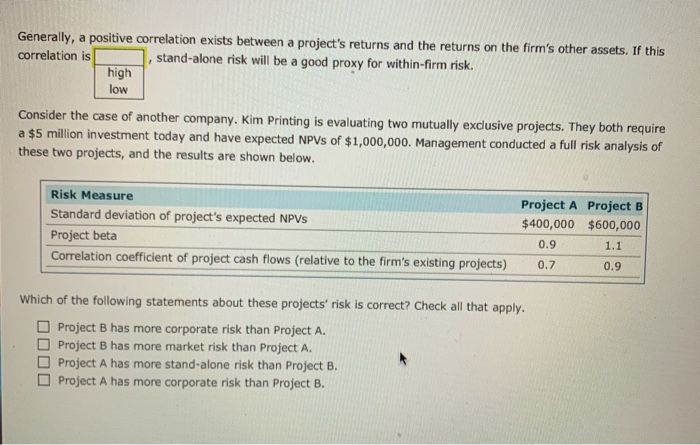

Understanding risks that affect projects and the impact of risk consideration Yatta Net International has manufacturing, distribution, retail, and consulting divisions. Projects undertaken by the manufacturing and distribution divisions tend to be low-risk projects, because these divisions are well established and have predictable demand. The company started its retail and consulting divisions within the last year, and it is unknown if these divisions will be profitable. The company knew that opening these new divisions would be risky, but its management believes the divisions have the potential to be extremely profitable under favorable market conditions. The company is currently using its WACC to evaluate new projects for all divisions. If Yatta Net International does not risk-adjust its discount rate for specific projects properly, which of the following is likely to occur over time? Check all that apply. The firm will make poor capital budgeting decisions that could jeopardize the long-run viability of the company. The firm will reject too many relatively safe projects. The firm will become less risky. Generally, a positive correlation exists between a project's returns and the returns on the firm's other assets. If this correlation is stand-alone risk will be a good proxy for within-firm risk. high low Consider the case of another company. Kim Printing is evaluating two mutually exclusive projects. They both require a $5 million investment today and have expected NPVs of $1,000,000. Management conducted a full risk analysis of these two projects, and the results are shown below. Risk Measure Standard deviation of project's expected NPVS Project beta Correlation coefficient of project cash flows (relative to the firm's existing projects) Project A Project B $400,000 $600,000 0.9 1.1 0.7 0.9 Generally, a positive correlation exists between a project's returns and the returns on the firm's other assets. If this correlation is stand-alone risk will be a good proxy for within-firm risk. high low Consider the case of another company. Kim Printing is evaluating two mutually exclusive projects. They both require a $5 million investment today and have expected NPVs of $1,000,000. Management conducted a full risk analysis of these two projects, and the results are shown below. Risk Measure Standard deviation of project's expected NPVS Project beta Correlation coefficient of project cash flows (relative to the firm's existing projects) Project A Project B $400,000 $600,000 0.9 1.1 0.7 0.9 Which of the following statements about these projects' risk is correct? Check all that apply. Project B has more corporate risk than Project A. Project B has more market risk than Project A. Project A has more stand-alone risk than Project B. Project A has more corporate risk than Project B