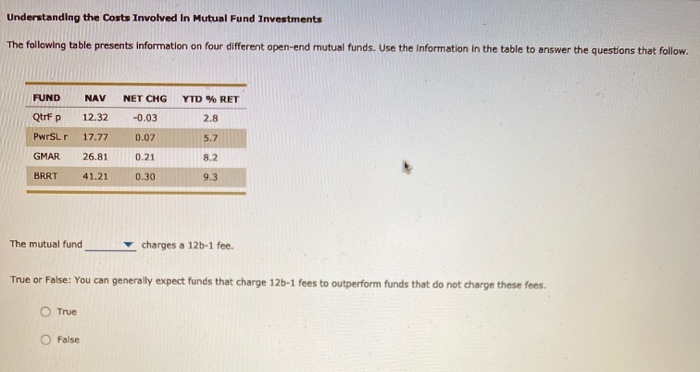

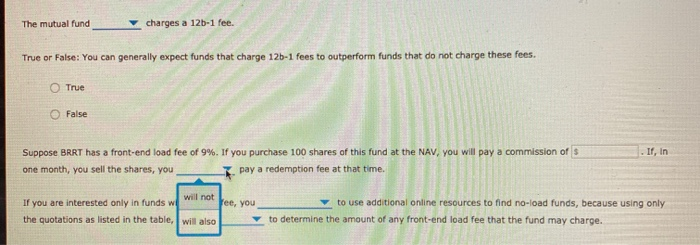

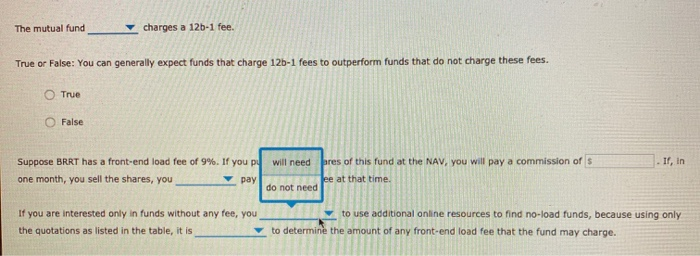

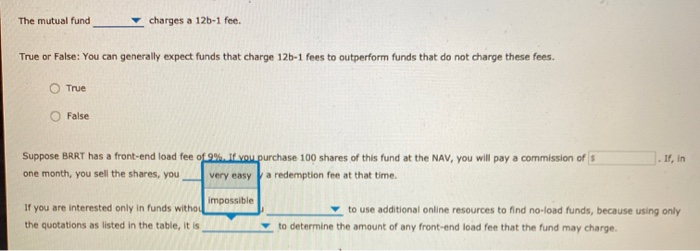

Understanding the Costs Involved in Mutual Fund Investments The following table presents Information on four different open-end mutual funds. Use the information in the table to answer the questions that follow. YTD % RET 2.8 FUND Qurfp PwrsLr GMAR BRRT NAV NET CHG 12.32 -0.03 17.77 0.07 26.81 0.21 41.210.30 5.7 9.3 The mutual fund charges a 12b-1 fee. True or False: You can generally expect funds that charge 12b-1 fees to outperform funds that do not charge these fees. True False The mutual fund charges a 12b-1 fee. True or False: You can generally expect funds that charge 12b-1 fees to outperform funds that do not charge these fees. O True False It, in Suppose BRRT has a front-end load fee of 9%. If you purchase 100 shares of this fund at the NAV, you will pay a commission of $ one month, you sell the shares, you K pay a redemption fee at that time. If you are interested only in funds we will not Yee, you the quotations as listed in the table, will also to use additional online resources to find no-load funds, because using only to determine the amount of any front-end load fee that the fund may charge. The mutual fund charges a 126-1 fee. True or False: You can generally expect funds that charge 125-1 fees to outperform funds that do not charge these fees. O True False If, in Suppose BRRT has a front-end load fee of 9%. If you one month, you sell the shares, you will need pres of this fund at the NAV, you will pay a commission of s Jee at that time. do not need If you are interested only in funds without any fee, you the quotations as listed in the table, it is to use additional online resources to find no-load funds, because using only to determine the amount of any front-end load fee that the fund may charge. The mutual fund charges a 12b-1 fee. True or False: You can generally expect funds that charge 125-1 fees to outperform funds that do not charge these fees. O True False If, in Suppose BRRT has a front-end load fee of 9% You purchase 100 shares of this fund at the NAV, you will pay a commission of s one month, you sell the shares, you very easy a redemption fee at that time. impossible If you are interested only in funds withou the quotations as listed in the table, it is to use additional online resources to find no-load funds, because using only to determine the amount of any front-end load fee that the fund may charge