Question: Understanding the optimal capital structure Review this situation: Universal Exports Inc. is trying to identify its optimal capital structure. Universal Exports Inc, has gathered the

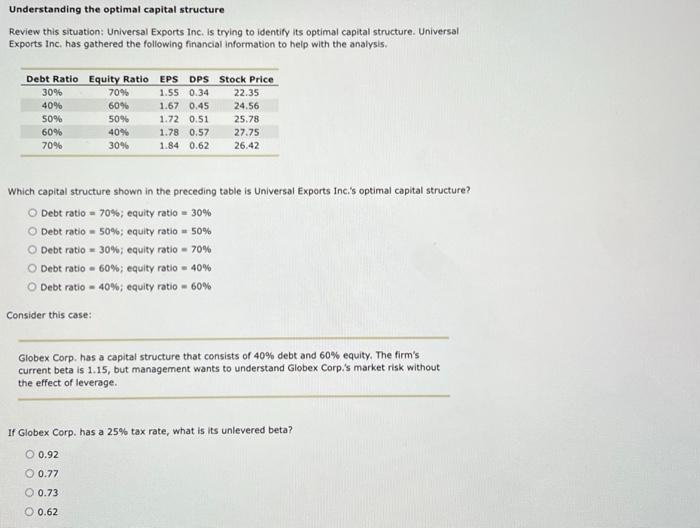

Understanding the optimal capital structure Review this situation: Universal Exports Inc. is trying to identify its optimal capital structure. Universal Exports Inc, has gathered the following financial information to help with the analysis. Which capital structure shown in the preceding table is Universal Exports Inc.'s optimal capital structure? Debt ratio =70%; equity ratio =30% Debt ratio =50%; equity ratio =50% Debt ratio =30%; equity ratio =70% Debt ratio =60%; equity ratio =40% Debt ratio =40%; equity ratio =60% Consider this case: Globex Corp. has a capital structure that consists of 40% debt and 60% equity. The firm's current beta is 1.15 , but management wants to understand Globex Corp.'s market risk without the effect of leverage. If Globex Corp. has a 25% tax rate, what is its unlevered beta? 0.92 0.77 0.73 0.62

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts