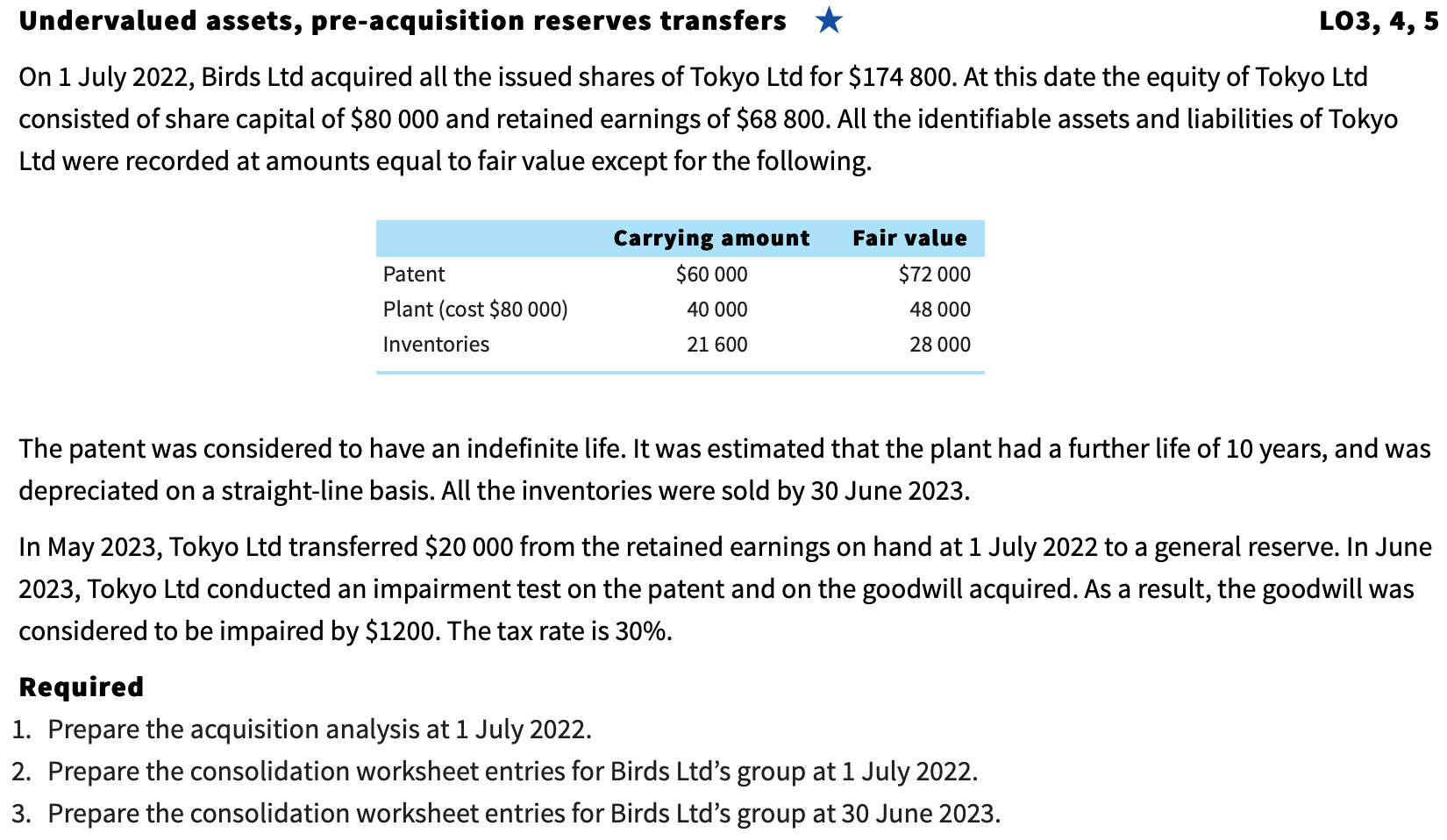

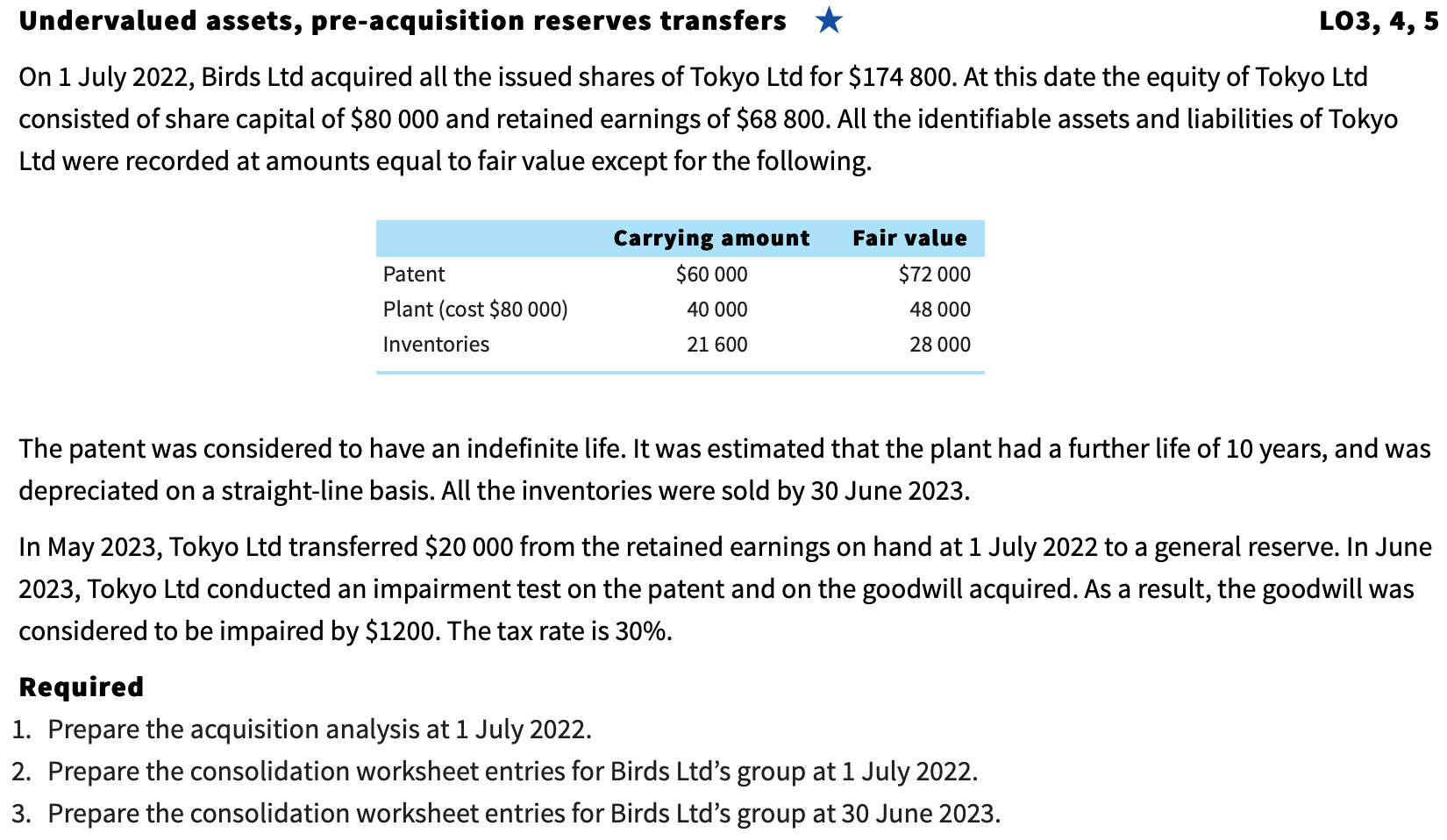

Undervalued assets, pre-acquisition reserves transfers * LO3, 4, 5 On 1 July 2022, Birds Ltd acquired all the issued shares of Tokyo Ltd for $174 800. At this date the equity of Tokyo Ltd consisted of share capital of $80 000 and retained earnings of $68 800. All the identifiable assets and liabilities of Tokyo Ltd were recorded at amounts equal to fair value except for the following. Patent Plant (cost $80 000) Inventories Carrying amount $60 000 40 000 21 600 Fair value $72 000 48 000 28 000 The patent was considered to have an indefinite life. It was estimated that the plant had a further life of 10 years, and was depreciated on a straight-line basis. All the inventories were sold by 30 June 2023. In May 2023, Tokyo Ltd transferred $20 000 from the retained earnings on hand at 1 July 2022 to a general reserve. In June 2023, Tokyo Ltd conducted an impairment test on the patent and on the goodwill acquired. As a result, the goodwill was considered to be impaired by $1200. The tax rate is 30%. Required 1. Prepare the acquisition analysis at 1 July 2022. 2. Prepare the consolidation worksheet entries for Birds Ltd's group at 1 July 2022. 3. Prepare the consolidation worksheet entries for Birds Ltd's group at 30 June 2023. Undervalued assets, pre-acquisition reserves transfers * LO3, 4, 5 On 1 July 2022, Birds Ltd acquired all the issued shares of Tokyo Ltd for $174 800. At this date the equity of Tokyo Ltd consisted of share capital of $80 000 and retained earnings of $68 800. All the identifiable assets and liabilities of Tokyo Ltd were recorded at amounts equal to fair value except for the following. Patent Plant (cost $80 000) Inventories Carrying amount $60 000 40 000 21 600 Fair value $72 000 48 000 28 000 The patent was considered to have an indefinite life. It was estimated that the plant had a further life of 10 years, and was depreciated on a straight-line basis. All the inventories were sold by 30 June 2023. In May 2023, Tokyo Ltd transferred $20 000 from the retained earnings on hand at 1 July 2022 to a general reserve. In June 2023, Tokyo Ltd conducted an impairment test on the patent and on the goodwill acquired. As a result, the goodwill was considered to be impaired by $1200. The tax rate is 30%. Required 1. Prepare the acquisition analysis at 1 July 2022. 2. Prepare the consolidation worksheet entries for Birds Ltd's group at 1 July 2022. 3. Prepare the consolidation worksheet entries for Birds Ltd's group at 30 June 2023