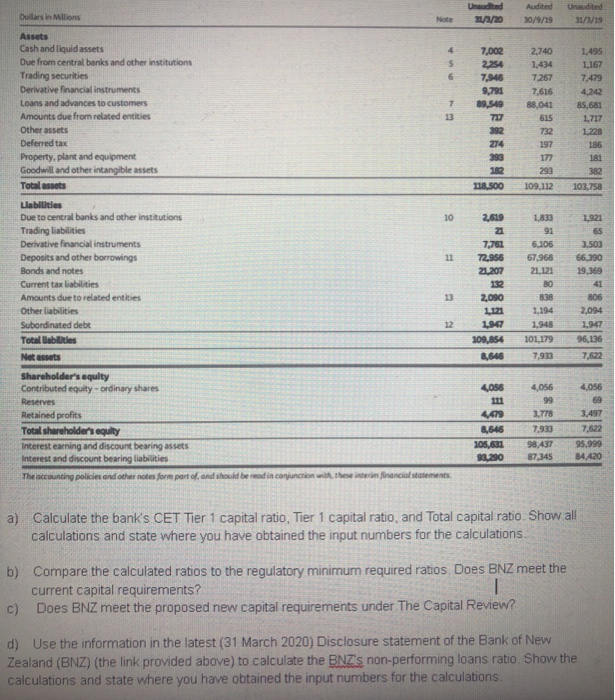

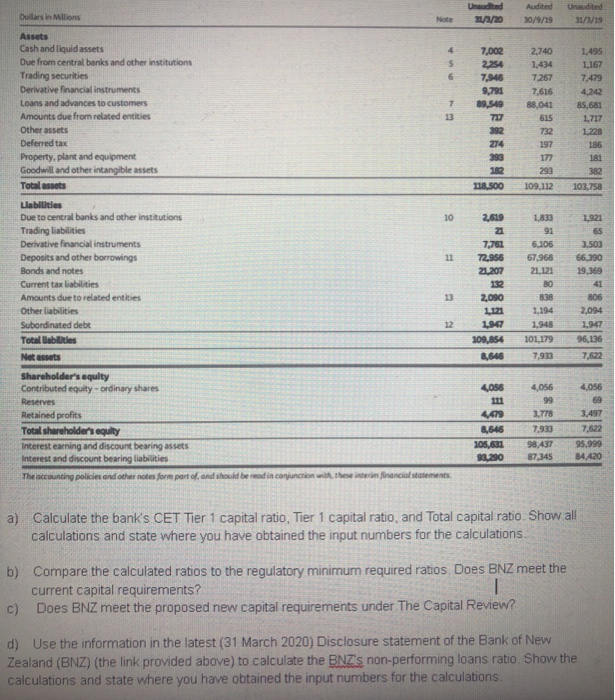

Unedited Dollars in Millions Audited 30/9/19 United 31/3/19 Note 2,740 7,002 2,254 7,945 9,791 89,549 717 392 274 393 182 118.500 7.267 7,616 88,041 515 732 197 177 293 109,112 1.495 1,167 7,479 4,242 85,681 1,717 1.228 186 181 382 103,758 2.619 Assets Cash and liquid assets 4 Due from central banks and other institutions 5 Trading securities 6 Derivative financial instruments Loans and advances to customers 7 Amounts due from related entities 13 Other assets Deferred tax Property, plant and equipment Goodwill and other intangible assets Total assets Labilities Due to central banks and other institutions 10 Trading liabilities Derivative financial instruments Deposits and other borrowings 11 Bonds and notes Current tax liabilities Amounts due to related entities 13 Other liabilities Subordinated debt 12 Total abilities Net ass Shareholder's equity Contributed equity-ordinary shares Reserves Retained profits Total shareholder's equilty Interest earning and discount bearing assets Interest and discount bearing liabilities The accounting policies and other notes form part of and should be read in conjunction with the interim financial statements 7,761 72.956 21.207 132 2,090 1121 1947 109,854 8,646 1,833 91 5,106 67,968 21.121 80 838 1.194 1,948 101,179 7,933 1,921 65 3,503 66,390 19,369 41 806 2,094 1,947 96.136 7.622 4,056 4,056 99 3.778 7,933 98,437 87,345 4,056 69 3,497 7,622 95.999 84.420 8,646 105,631 93,290 a) Calculate the bank's CET Tier 1 capital ratio, Tier 1 capital ratio, and Total capital ratio. Show all calculations and state where you have obtained the input numbers for the calculations. b) Compare the calculated ratios to the regulatory minimum required ratios Does BNZ meet the current capital requirements? c) Does BNZ meet the proposed new capital requirements under The Capital Review? d) Use the information in the latest (31 March 2020) Disclosure statement of the Bank of New Zealand (BNZ) (the link provided above) to calculate the BNZ's non-performing loans ratio Show the calculations and state where you have obtained the input numbers for the calculations. Unedited Dollars in Millions Audited 30/9/19 United 31/3/19 Note 2,740 7,002 2,254 7,945 9,791 89,549 717 392 274 393 182 118.500 7.267 7,616 88,041 515 732 197 177 293 109,112 1.495 1,167 7,479 4,242 85,681 1,717 1.228 186 181 382 103,758 2.619 Assets Cash and liquid assets 4 Due from central banks and other institutions 5 Trading securities 6 Derivative financial instruments Loans and advances to customers 7 Amounts due from related entities 13 Other assets Deferred tax Property, plant and equipment Goodwill and other intangible assets Total assets Labilities Due to central banks and other institutions 10 Trading liabilities Derivative financial instruments Deposits and other borrowings 11 Bonds and notes Current tax liabilities Amounts due to related entities 13 Other liabilities Subordinated debt 12 Total abilities Net ass Shareholder's equity Contributed equity-ordinary shares Reserves Retained profits Total shareholder's equilty Interest earning and discount bearing assets Interest and discount bearing liabilities The accounting policies and other notes form part of and should be read in conjunction with the interim financial statements 7,761 72.956 21.207 132 2,090 1121 1947 109,854 8,646 1,833 91 5,106 67,968 21.121 80 838 1.194 1,948 101,179 7,933 1,921 65 3,503 66,390 19,369 41 806 2,094 1,947 96.136 7.622 4,056 4,056 99 3.778 7,933 98,437 87,345 4,056 69 3,497 7,622 95.999 84.420 8,646 105,631 93,290 a) Calculate the bank's CET Tier 1 capital ratio, Tier 1 capital ratio, and Total capital ratio. Show all calculations and state where you have obtained the input numbers for the calculations. b) Compare the calculated ratios to the regulatory minimum required ratios Does BNZ meet the current capital requirements? c) Does BNZ meet the proposed new capital requirements under The Capital Review? d) Use the information in the latest (31 March 2020) Disclosure statement of the Bank of New Zealand (BNZ) (the link provided above) to calculate the BNZ's non-performing loans ratio Show the calculations and state where you have obtained the input numbers for the calculations