Answered step by step

Verified Expert Solution

Question

1 Approved Answer

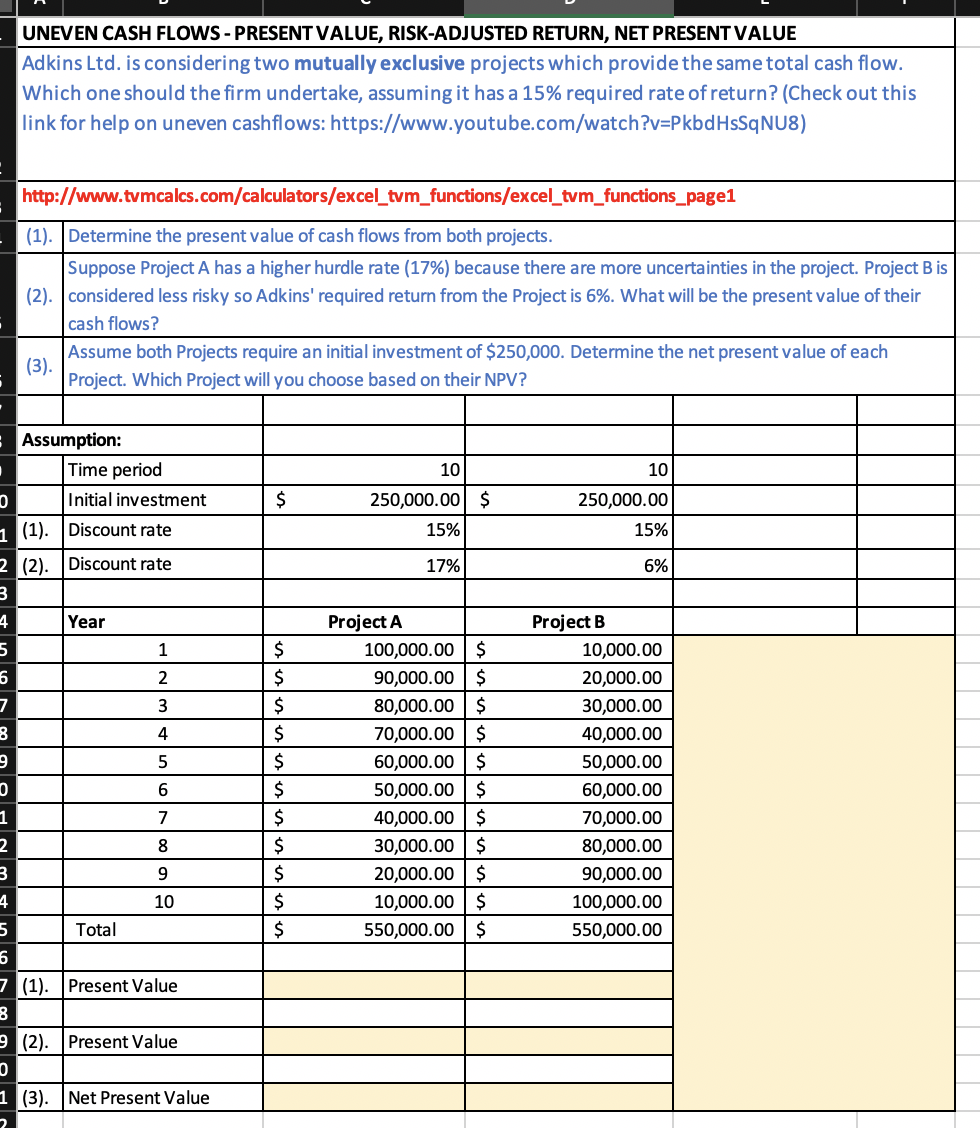

UNEVEN CASH FLOWS - PRESENT VALUE, RISK-ADJUSTED RETURN, NET PRESENT VALUE Adkins Ltd. is considering two mutually exclusive projects which provide the same total

UNEVEN CASH FLOWS - PRESENT VALUE, RISK-ADJUSTED RETURN, NET PRESENT VALUE Adkins Ltd. is considering two mutually exclusive projects which provide the same total cash flow. Which one should the firm undertake, assuming it has a 15% required rate of return? (Check out this link for help on uneven cashflows: https://www.youtube.com/watch?v=PkbdHsSqNU8) http://www.tvmcalcs.com/calculators/excel_tvm_functions/excel_tvm_functions_page1 (1). Determine the present value of cash flows from both projects. Suppose Project A has a higher hurdle rate (17%) because there are more uncertainties in the project. Project B is (2). considered less risky so Adkins' required return from the Project is 6%. What will be the present value of their cash flows? (3). Assume both Projects require an initial investment of $250,000. Determine the net present value of each Project. Which Project will you choose based on their NPV? Assumption: Time period 10 10 0 Initial investment $ 250,000.00 $ 250,000.00 1 (1). Discount rate 15% 15% 2 (2). Discount rate 17% 6% 3 4 Year Project A Project B 5 1 $ 100,000.00 $ 10,000.00 6 2 $ 90,000.00 $ 20,000.00 7 3 $ 80,000.00 $ 30,000.00 B 4 $ 70,000.00 $ 40,000.00 9 5 $ 60,000.00 $ 50,000.00 0 6 $ 50,000.00 $ 60,000.00 1 7 $ 40,000.00 $ 70,000.00 2 8 $ 30,000.00 $ 80,000.00 3 9 $ 20,000.00 $ 90,000.00 4 10 $ 10,000.00 $ 100,000.00 5 Total $ 550,000.00 $ 550,000.00 6 7 (1). Present Value 8 (2). Present Value 0 1 (3). Net Present Value 2

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started