Question

Unfortunately this is all the information in the problem. Financial Accounting: The Impact On Decision Makers 9th edition Need some guidance in answering the following

Unfortunately this is all the information in the problem.

Financial Accounting: The Impact On Decision Makers 9th edition

Need some guidance in answering the following question: Chapter 2, Problem 12MCP

Cash Flow

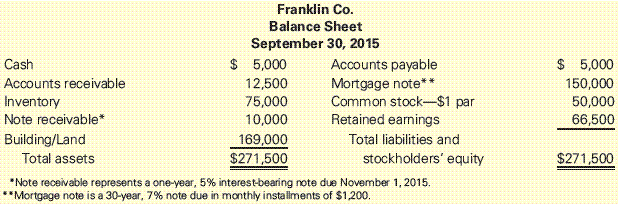

Franklin Co., a specialty retailer, has a history of paying quarterly dividends of $0.50 per share. Management is trying to determine whether the company will have adequate cash on December 31, 2015, to pay a dividend if one is declared by the board of directors. The following additional information is available:

All sales are on account, and accounts receivable are collected one month after the sale. Sales volume has been increasing 5% each month.

All purchases of merchandise are on account, and accounts payable are paid one month after the purchase. Cost of sales is 40% of the sales price. Inventory levels are maintained at $75,000.

Operating expenses in addition to the mortgage are paid in cash. They amount to $3,000 per month and are paid as they are incurred.

Required:

Determine the cash that Franklin will have available to pay a dividend on December 31, 2015. Round intermediate calculations and final answer to the nearest dollar.

Check My Work Feedback

1) Determine accounts receivable collections. 2) Determine cash paid for purchases. Note that inventory levels are maintained at $75,000, purchases are equal to 40% of sales each month. 3) Determine cash balance. Beginning cash balance + Incoming cash - Outgoing cash = Ending cash balance 4) Determine dividend payment. Outstanding shares multiplied by per share dividend.

Franklin Co Balance Sheet September 30, 2015 Cash Accounts receivable Inventory Note receivable* Building/Land $ 5,000 12,500 75,000 10,000 169,000 $271,500 Accounts payable Mortgage note* Common stock $1 par Retained eanings S 5,000 150,000 50,000 66,500 Total liabilities and Total assets stockholders' equity "Note receivable represents a one-year, 5% interes tbearing note due November 1, 2015. Mortgage note is a 30-year, 7% note due in monthly installments of $1,200

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started