Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Uniform Shop (Pty) Ltd manufactures school uniforms for schools all around South Africa. They have two branches in Gauteng and one branch in each

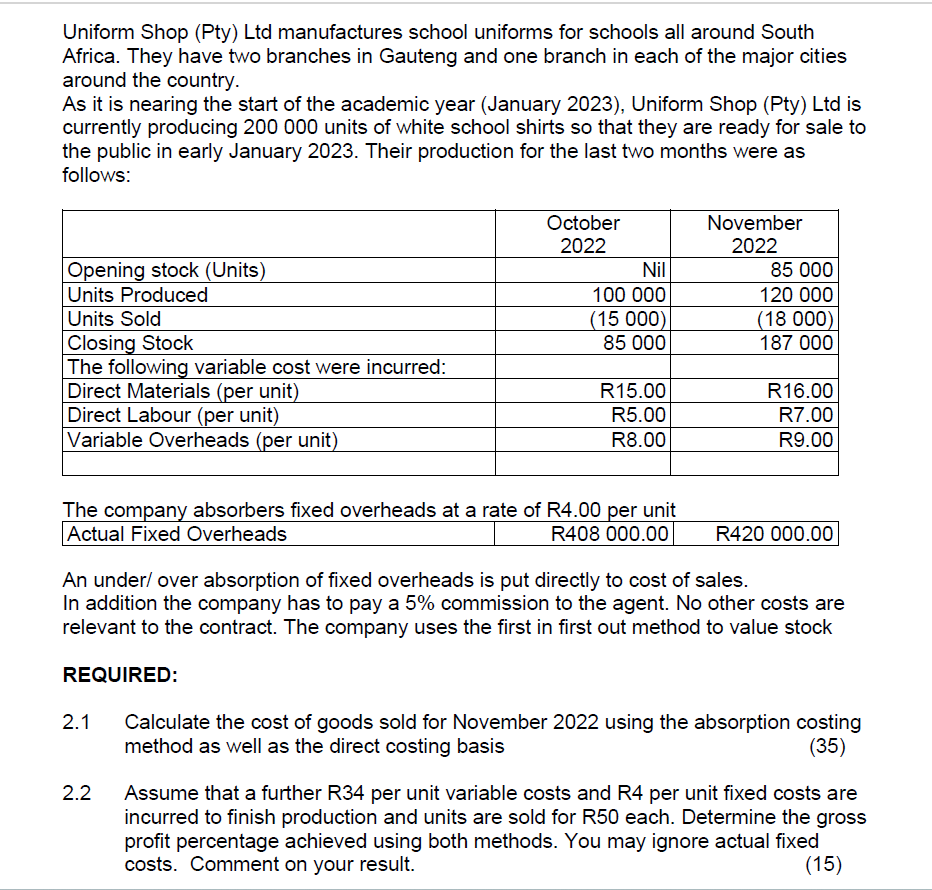

Uniform Shop (Pty) Ltd manufactures school uniforms for schools all around South Africa. They have two branches in Gauteng and one branch in each of the major cities around the country. As it is nearing the start of the academic year (January 2023), Uniform Shop (Pty) Ltd is currently producing 200 000 units of white school shirts so that they are ready for sale to the public in early January 2023. Their production for the last two months were as follows: Opening stock (Units) Units Produced Units Sold Closing Stock The following variable cost were incurred: Direct Materials (per unit) Direct Labour (per unit) Variable Overheads (per unit) REQUIRED: October 2022 The company absorbers fixed overheads at a rate of R4.00 per unit Actual Fixed Overheads R408 000.00 2.1 Nil 100 000 (15 000) 85 000 2.2 R15.00 R5.00 R8.00 November 2022 85 000 120 000 (18 000) 187 000 An under/ over absorption of fixed overheads is put directly to cost of sales. In addition the company has to pay a 5% commission to the agent. No other costs are relevant to the contract. The company uses the first in first out method to value stock R16.00 R7.00 R9.00 R420 000.00 Calculate the cost of goods sold for November 2022 using the absorption costing method as well as the direct costing basis (35) Assume that a further R34 per unit variable costs and R4 per unit fixed costs are incurred to finish production and units are sold for R50 each. Determine the gross profit percentage achieved using both methods. You may ignore actual fixed costs. Comment on your result. (15)

Step by Step Solution

★★★★★

3.50 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Lets calculate the cost of goods sold for November 2022 using both the absorption costing method and the direct costing basis as well as determine the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started