Uning your solutions to Exercise 16 - 16, 16 - 17 , and 16 - 18 , explain the difference between the physical measures, split off pointand value methods used to allocate joint costs

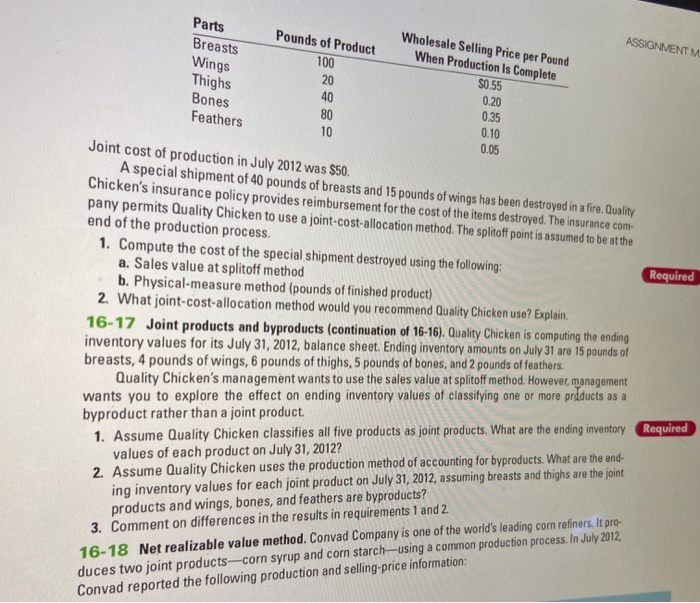

Parts Pounds of Product Wholesale Selling Price per Pound When Production Is Complete ASSIGNMENT Breasts Wings Thighs Bones Feathers $0.55 0.20 0.35 0.10 0.05 Joint cost of production in July 2012 was $50. A special shipment of 40 pounds of breasts and 15 pounds of wings has been destroyed in a fire. Quality Chicken's insurance policy provides reimbursement for the cost of the items destroyed. The insurance com pany permits Quality Chicken to use a joint-cost-allocation method. The splitoff point is assumed to be at the end of the production process. 1. Compute the cost of the special shipment destroyed using the following: a. Sales value at splitoff method b. Physical-measure method (pounds of finished product) 2. What joint-cost-allocation method would you recommend Quality Chicken use? Explain. 16-17 Joint products and byproducts (continuation of 16-16). Quality Chicken is computing the ending inventory values for its July 31, 2012, balance sheet. Ending inventory amounts on July 31 are 15 pounds of breasts, 4 pounds of wings, 6 pounds of thighs, 5 pounds of bones, and 2 pounds of feathers. Quality Chicken's management wants to use the sales value at splitoff method. However, management wants you to explore the effect on ending inventory values of classifying one or more prdducts as a Required Required byproduct rather than a joint product 1. Assume Quality Chicken classifies all five products as joint products. What are the ending inventory values of each product on July 31, 2012? 2. Assume Quality Chicken uses the production method of accounting for byproducts. What are the end ing inventory values for each joint product on July 31, 2012, assuming breasts and thighs are the joint products and wings, bones, and feathers are byproducts? 3. Comment on differences in the results in requirements 1 and 2. 16-18 Net realizable value method. Convad Company is one of the world's leading corn refiners. It pro- duces two joint products-corn syrup and corn starch--using a common production process. In July 2012, Convad reported the following production and selling price information: Parts Pounds of Product Wholesale Selling Price per Pound When Production Is Complete ASSIGNMENT Breasts Wings Thighs Bones Feathers $0.55 0.20 0.35 0.10 0.05 Joint cost of production in July 2012 was $50. A special shipment of 40 pounds of breasts and 15 pounds of wings has been destroyed in a fire. Quality Chicken's insurance policy provides reimbursement for the cost of the items destroyed. The insurance com pany permits Quality Chicken to use a joint-cost-allocation method. The splitoff point is assumed to be at the end of the production process. 1. Compute the cost of the special shipment destroyed using the following: a. Sales value at splitoff method b. Physical-measure method (pounds of finished product) 2. What joint-cost-allocation method would you recommend Quality Chicken use? Explain. 16-17 Joint products and byproducts (continuation of 16-16). Quality Chicken is computing the ending inventory values for its July 31, 2012, balance sheet. Ending inventory amounts on July 31 are 15 pounds of breasts, 4 pounds of wings, 6 pounds of thighs, 5 pounds of bones, and 2 pounds of feathers. Quality Chicken's management wants to use the sales value at splitoff method. However, management wants you to explore the effect on ending inventory values of classifying one or more prdducts as a Required Required byproduct rather than a joint product 1. Assume Quality Chicken classifies all five products as joint products. What are the ending inventory values of each product on July 31, 2012? 2. Assume Quality Chicken uses the production method of accounting for byproducts. What are the end ing inventory values for each joint product on July 31, 2012, assuming breasts and thighs are the joint products and wings, bones, and feathers are byproducts? 3. Comment on differences in the results in requirements 1 and 2. 16-18 Net realizable value method. Convad Company is one of the world's leading corn refiners. It pro- duces two joint products-corn syrup and corn starch--using a common production process. In July 2012, Convad reported the following production and selling price information