Answered step by step

Verified Expert Solution

Question

1 Approved Answer

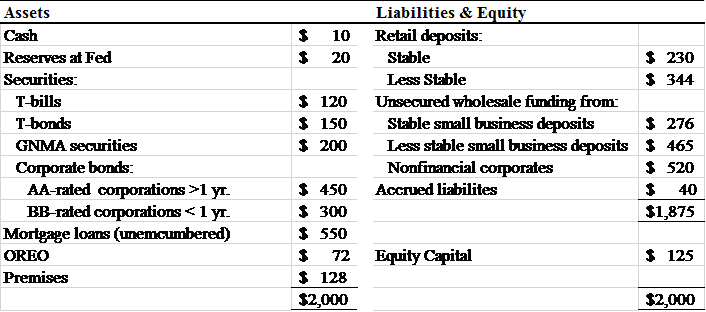

Union Bank has the following balance sheet (in millions of dollars): Cash inflows over the next 30 days from the banks performing assets = $43

Union Bank has the following balance sheet (in millions of dollars):

Cash inflows over the next 30 days from the banks performing assets = $43 million.

Calculate Union Bankss Liquidity Coverage Ratio and show whether or not the bank is in compliance with the regulation?

Calculate Union Bankss Net Stable Funding Ratio and show whether or not the bank is in compliance with the regulation?

Show work and round to three decimal places, thank you.

Assets Cash Reserves at Fed Securities T-bills T-bonds GNMA securities Corporate bonds: AA-rated corporations >1 yTL BB-rated corporations 1 yT Mortgage loans (unemcumbered) OREO Premises Liabilities & Equity 3 10 Retail deposits: 3 20 Stable 230 344 Less Stable 120 Unsecured wholesale funding from: 150 Stable small business deposits 276 3 200 Less stable small business deposits 3 465 Nonfinancial comporates 520 450 Accrued liabilites 3 40 300 31 875 550 72 Equity Capital 125 128 32,000 32,000 Assets Cash Reserves at Fed Securities T-bills T-bonds GNMA securities Corporate bonds: AA-rated corporations >1 yTL BB-rated corporations 1 yT Mortgage loans (unemcumbered) OREO Premises Liabilities & Equity 3 10 Retail deposits: 3 20 Stable 230 344 Less Stable 120 Unsecured wholesale funding from: 150 Stable small business deposits 276 3 200 Less stable small business deposits 3 465 Nonfinancial comporates 520 450 Accrued liabilites 3 40 300 31 875 550 72 Equity Capital 125 128 32,000 32,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started