Answered step by step

Verified Expert Solution

Question

1 Approved Answer

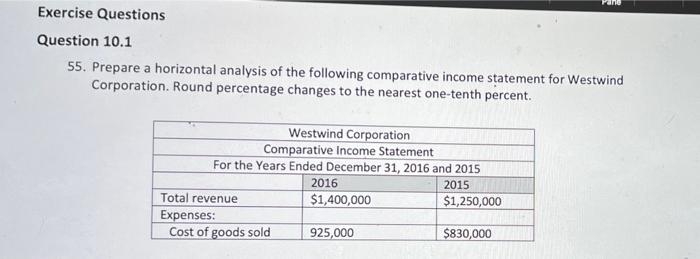

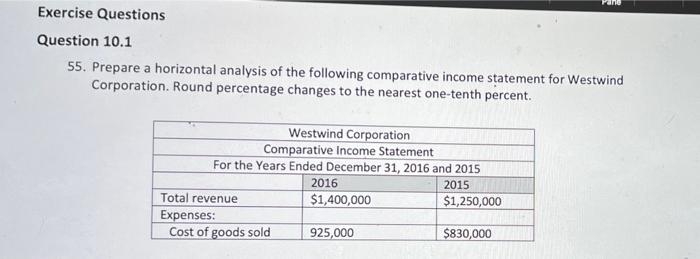

unit 10 Fane Exercise Questions Question 10.1 55. Prepare a horizontal analysis of the following comparative income statement for Westwind Corporation. Round percentage changes to

unit 10

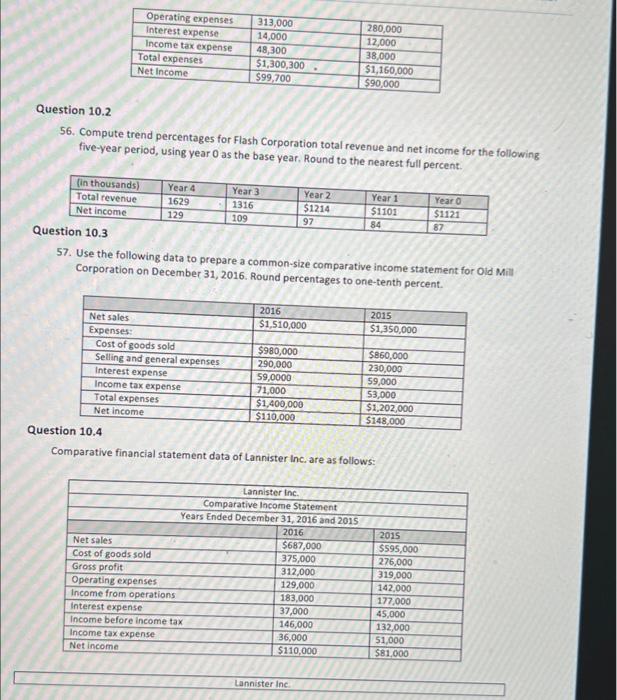

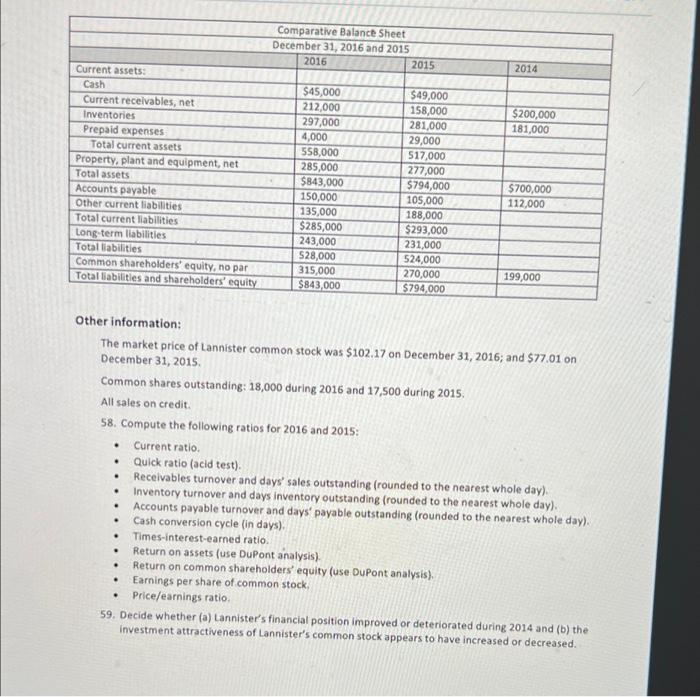

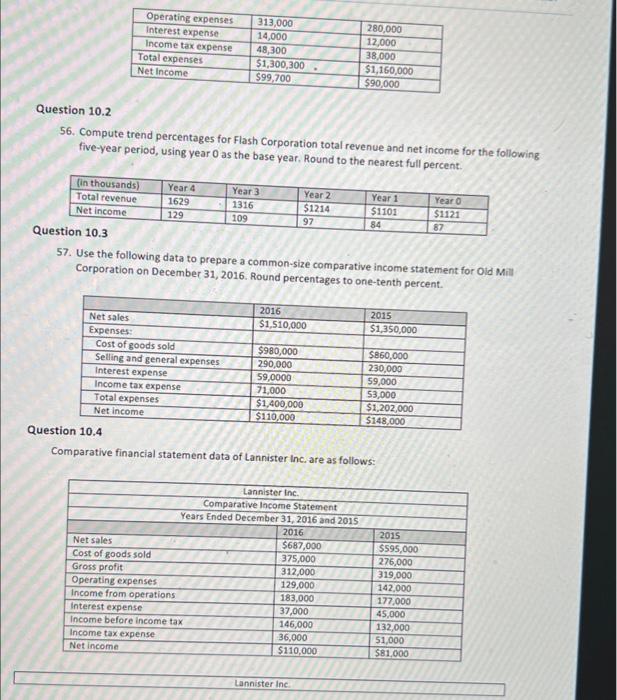

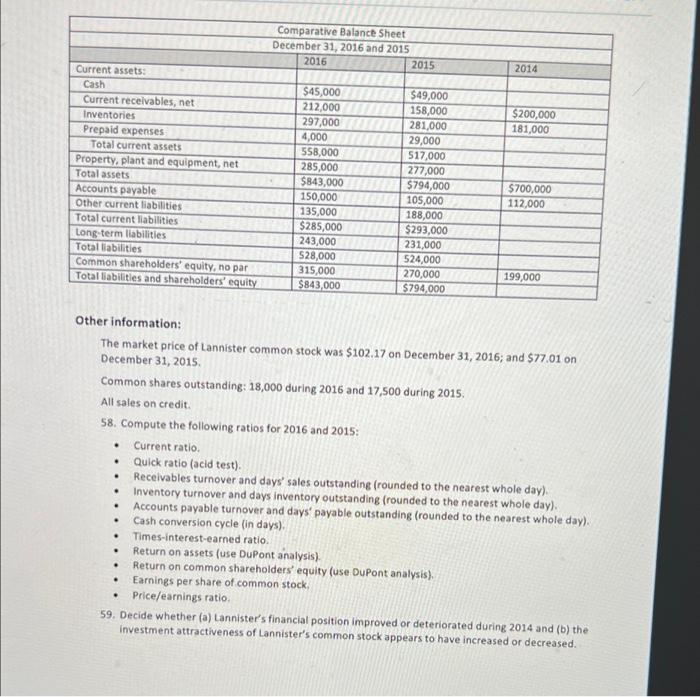

Fane Exercise Questions Question 10.1 55. Prepare a horizontal analysis of the following comparative income statement for Westwind Corporation. Round percentage changes to the nearest one-tenth percent. Westwind Corporation Comparative Income Statement For the Years Ended December 31, 2016 and 2015 2016 2015 Total revenue $1,400,000 $1,250,000 Expenses: Cost of goods sold 925,000 $830,000 Operating expenses Interest expense Income tax expense Total expenses Net Income 313,000 14,000 48,300 $1,300,300 $99,700 280,000 12,000 38,000 $1,160,000 $90,000 Question 10.2 56. Compute trend percentages for Flash Corporation total revenue and net income for the following five-year period, using year as the base year. Round to the nearest full percent. (in thousands) Year 4 Year 3 Year 2 Year 1 Year Total revenue 1629 1316 $1214 $1101 $1121 Net income 129 109 97 84 87 Question 10.3 57. Use the following data to prepare a common-size comparative income statement for Old Mill Corporation on December 31, 2016. Round percentages to one-tenth percent. 2016 2015 Net sales $1,510,000 $1,350,000 Expenses Cost of goods sold $980,000 $860,000 Selling and general expenses 290,000 230,000 Interest expense 59,0000 59,000 Income tax expense 71,000 53,000 Total expenses $1,400,000 $1,202,000 Net Income $110,000 $148,000 Question 10.4 Comparative financial statement data of Lannister Inc. are as follows: Lannister Inc. Comparative Income Statement Years Ended December 31, 2016 and 2015 2016 Net sales $687,000 Cost of goods sold 375,000 Gross profit 312,000 Operating expenses 129,000 Income from operations 183,000 Interest expense 37,000 Income before income tax 146,000 Income tax expense 36,000 Net Income $110,000 2015 $595,000 276,000 319,000 142,000 177.000 45,000 132,000 51,000 $81.000 Lannister Inc Comparative Balance Sheet December 31, 2016 and 2015 2016 2015 2014 $200,000 181,000 Current assets: Cash Current receivables, net Inventories Prepaid expenses Total current assets Property, plant and equipment, net Total assets Accounts payable Other current liabilities Total current liabilities long-term liabilities Total abilities Common shareholders' equity, no par Total liabilities and shareholders' equity $45,000 212,000 297,000 4,000 558,000 285,000 $843,000 150,000 135,000 $285,000 243,000 528,000 315,000 $843,000 549,000 158,000 281,000 29,000 517,000 277,000 $794,000 105,000 188,000 $293,000 231,000 524,000 270,000 $794,000 $700,000 112,000 199,000 Other information: The market price of Lannister common stock was $102.17 on December 31, 2016; and $77.01 on December 31, 2015 Common shares outstanding: 18,000 during 2016 and 17,500 during 2015, All sales on credit. 58. Compute the following ratios for 2016 and 2015: Current ratio. Quick ratio (acid test). Receivables turnover and days' sales outstanding (rounded to the nearest whole day). Inventory turnover and days inventory outstanding (rounded to the nearest whole day). Accounts payable turnover and days payable outstanding (rounded to the nearest whole day). Cash conversion cycle (in days) Times-interest-earned ratio. Return on assets (use DuPont analysis) Return on common shareholders' equity (use DuPont analysis) Earnings per share of common stock, Price/earnings ratio 59. Decide whether (a) Lannister's financial position improved or deteriorated during 2014 and (b) the Investment attractiveness of Lannister's common stock appears to have increased or decreased

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started