Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Unit 2 Activity 6 Summative Assignment Record your answers for Part A in the spreadsheet template and your answers for Part B in a word

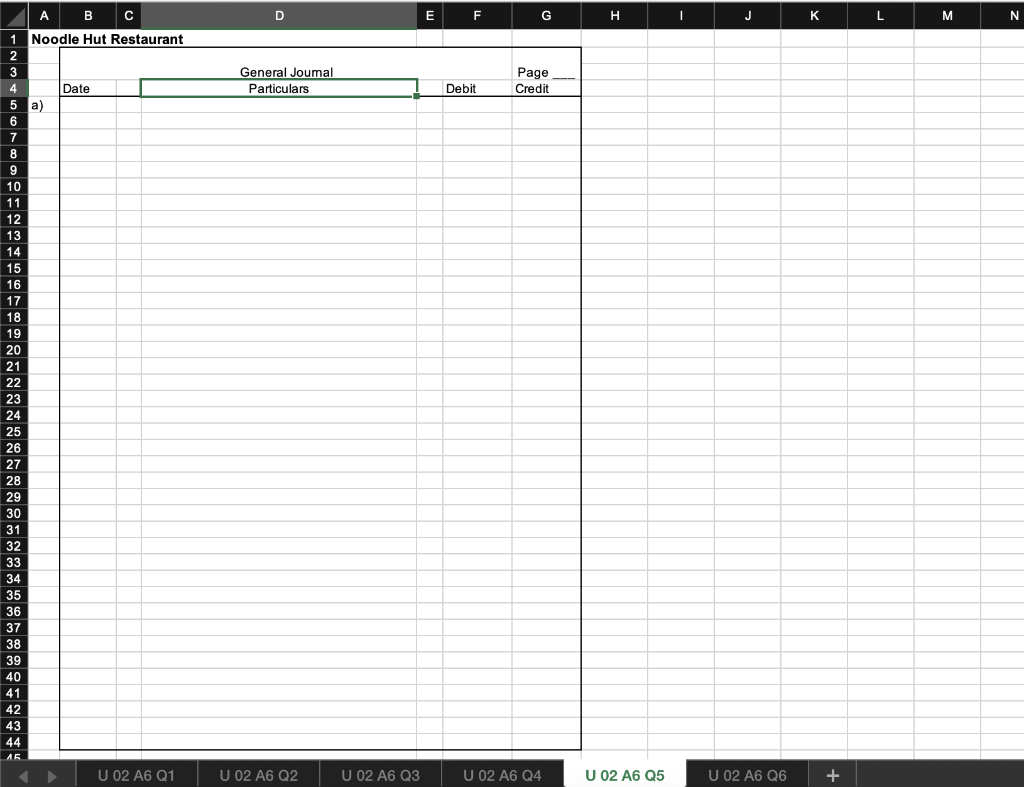

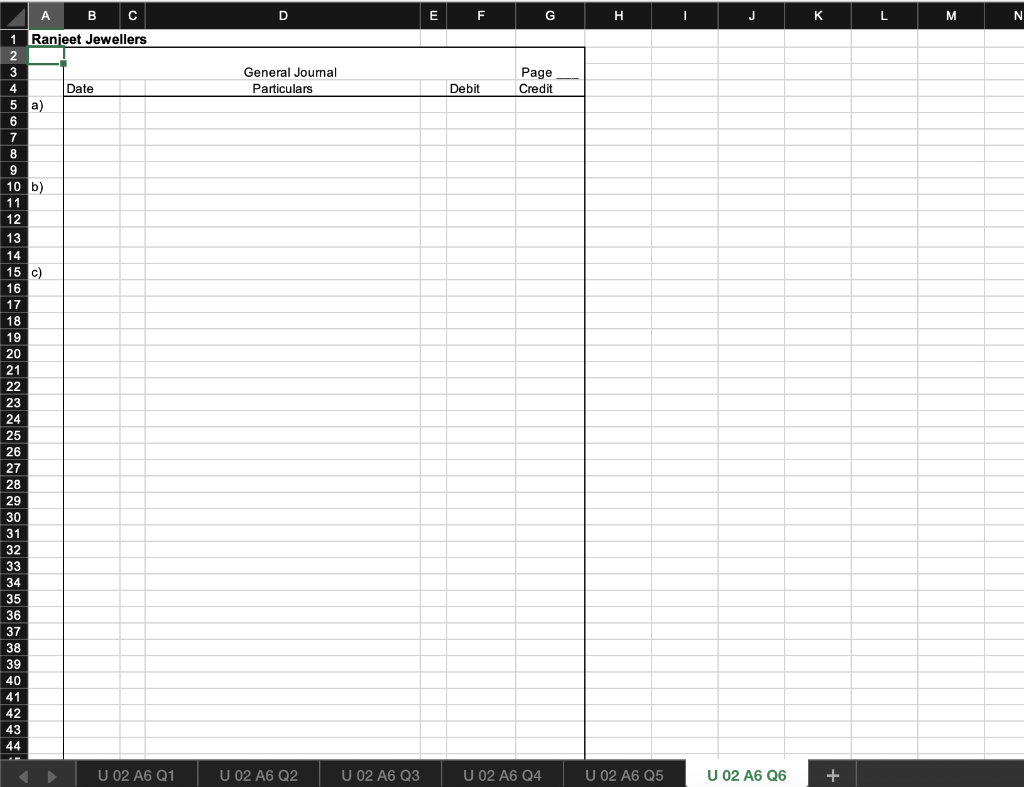

Unit 2 Activity 6 Summative Assignment

Record your answers for Part A in the spreadsheet template and your answers for Part B in a word processing document.

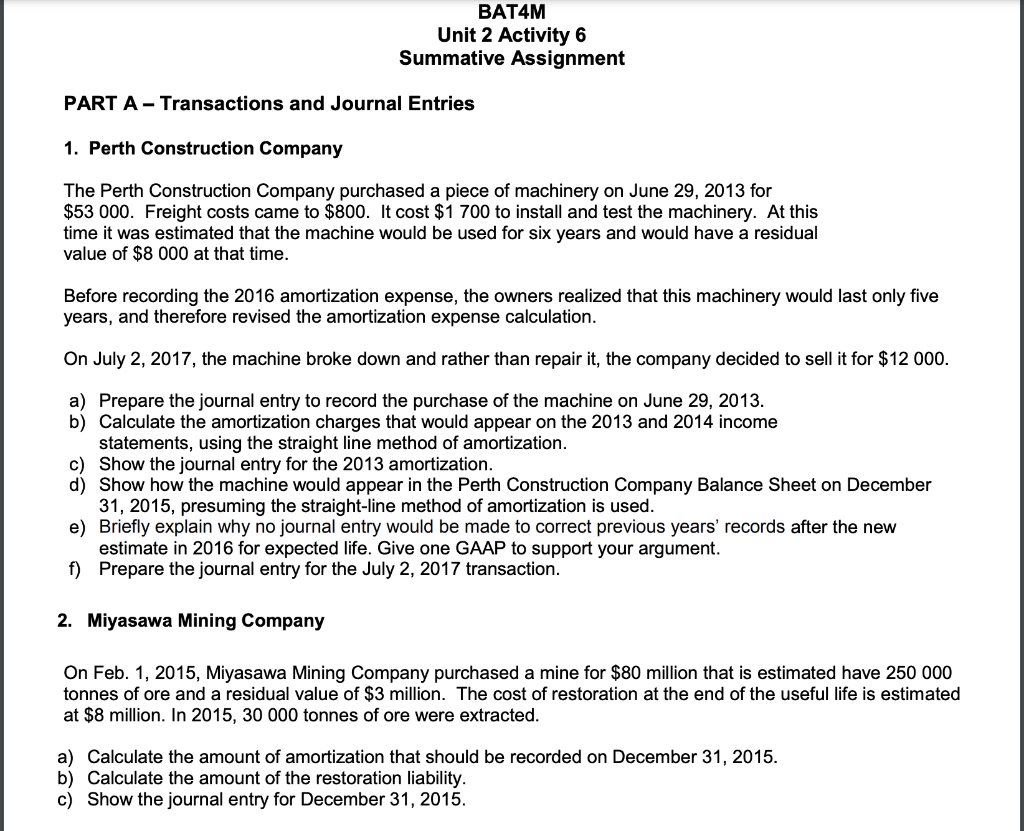

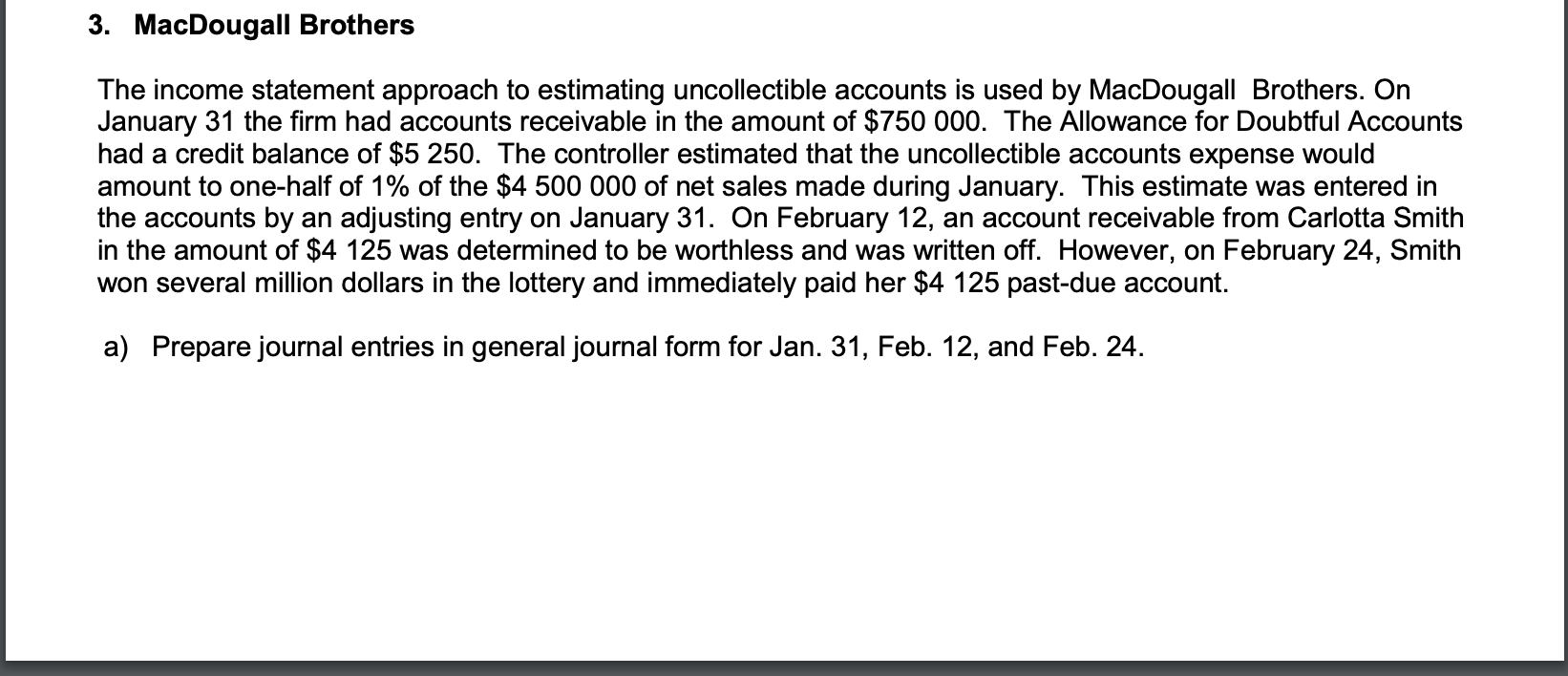

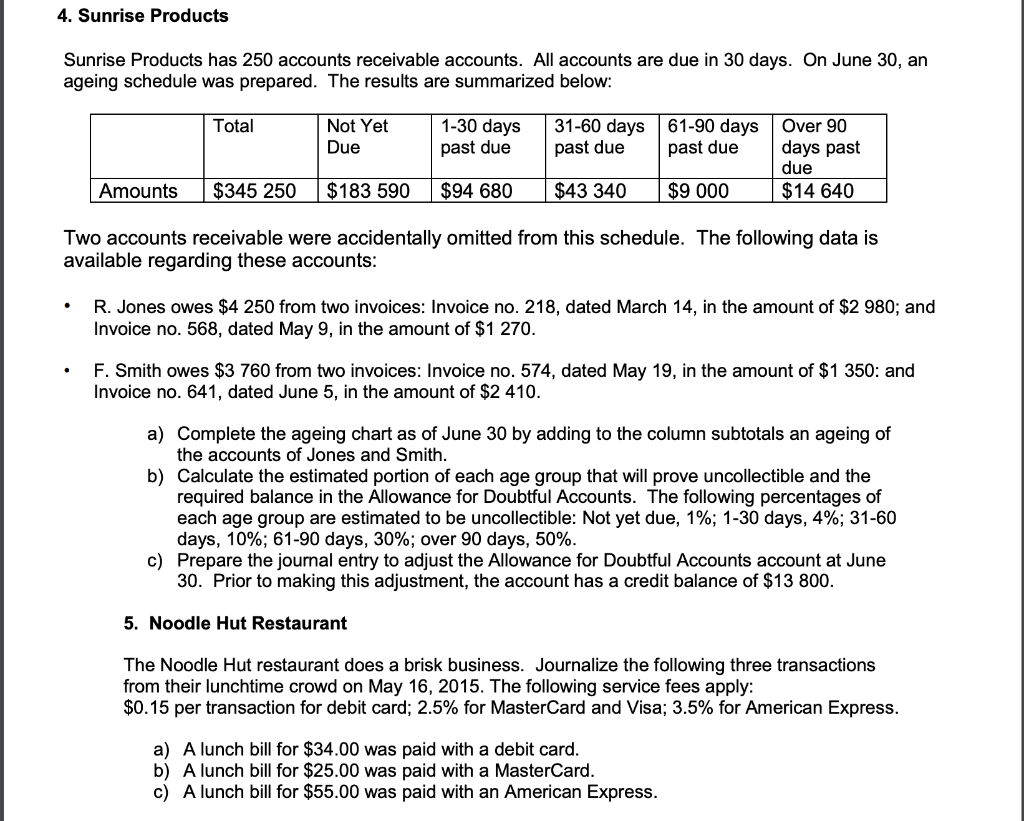

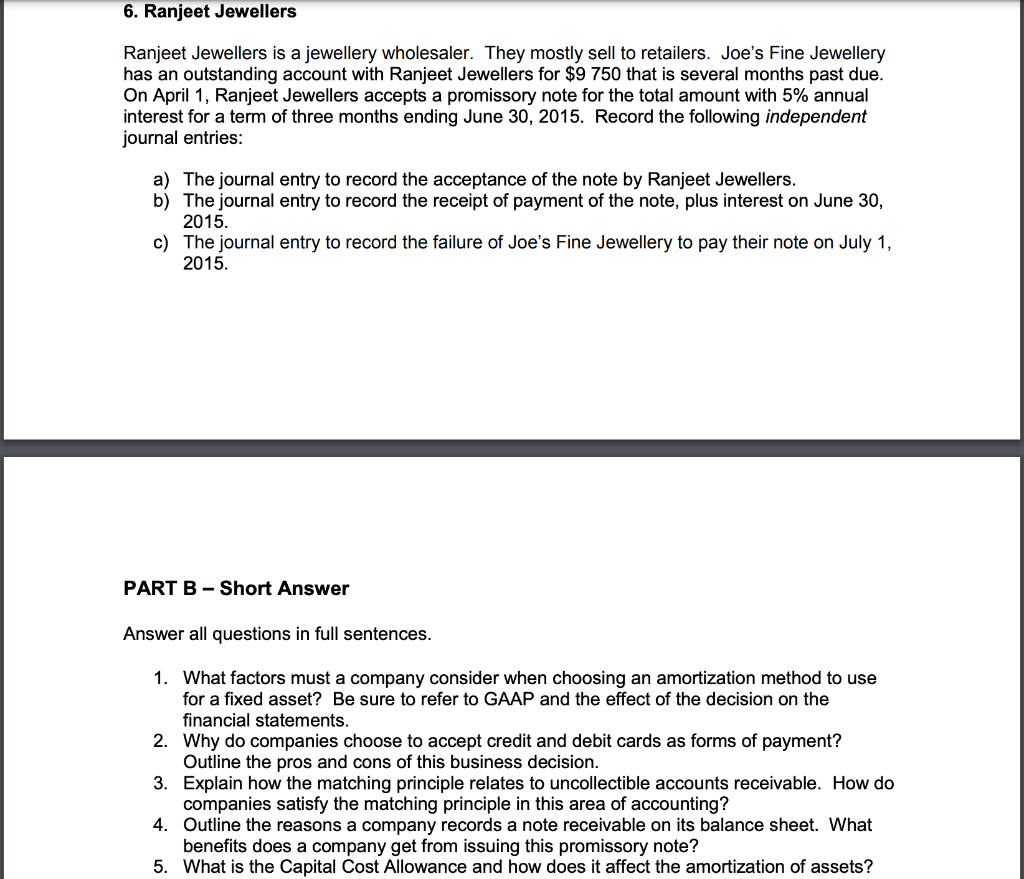

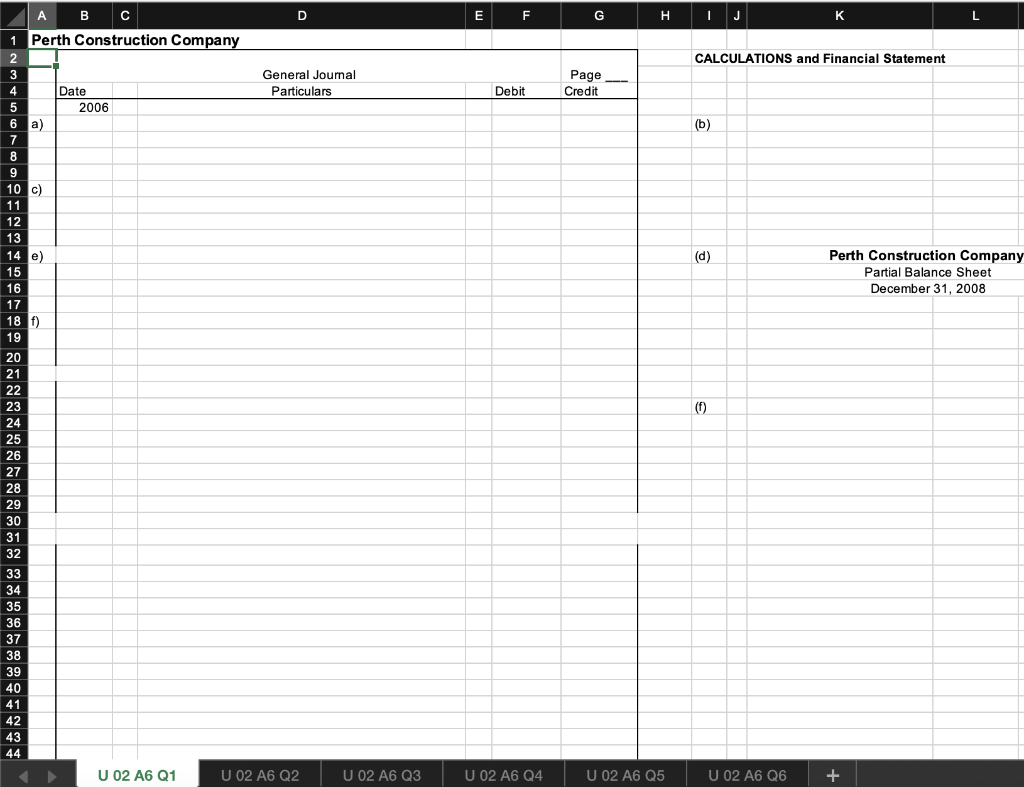

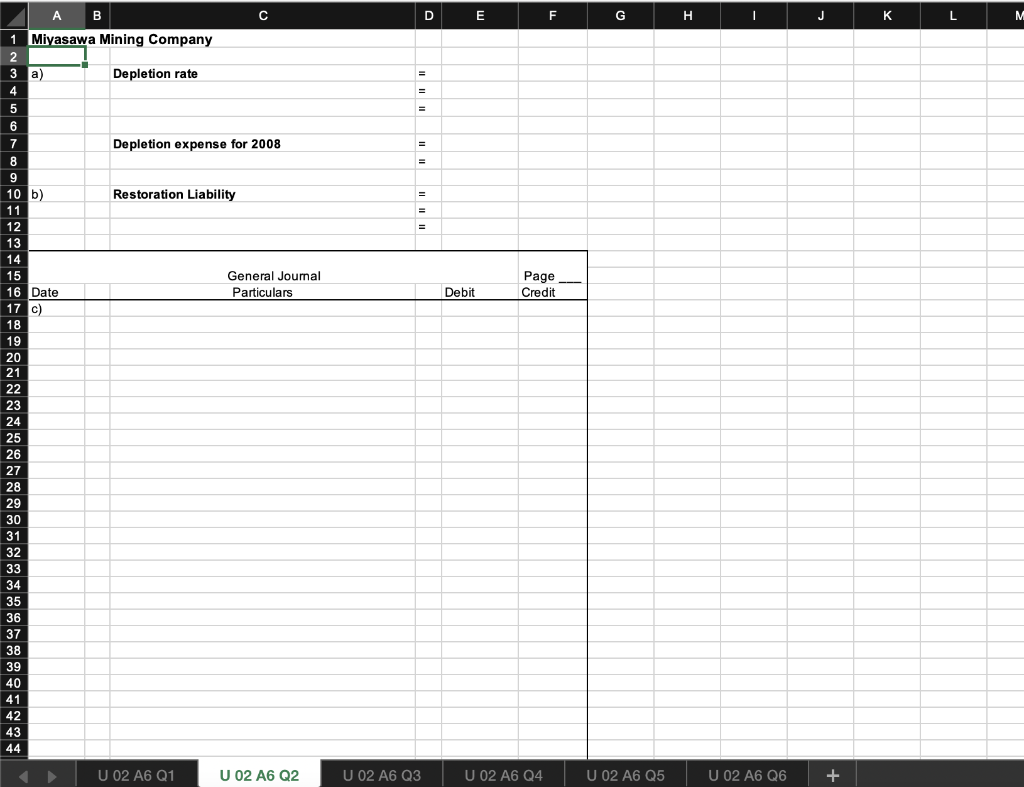

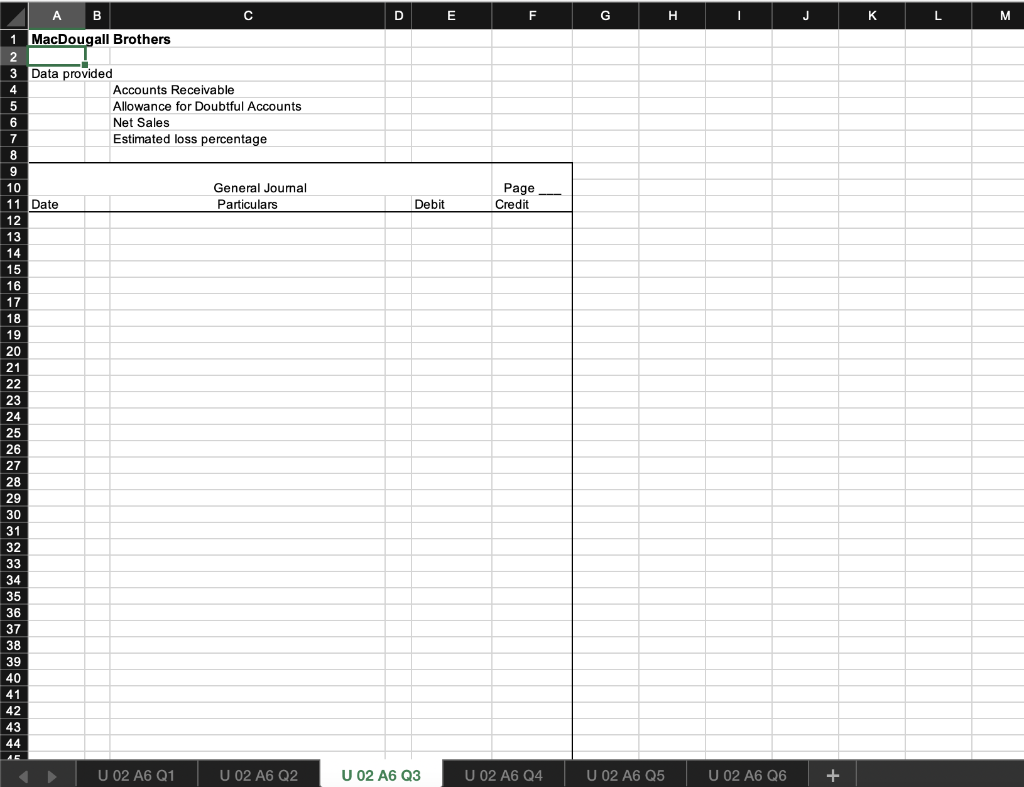

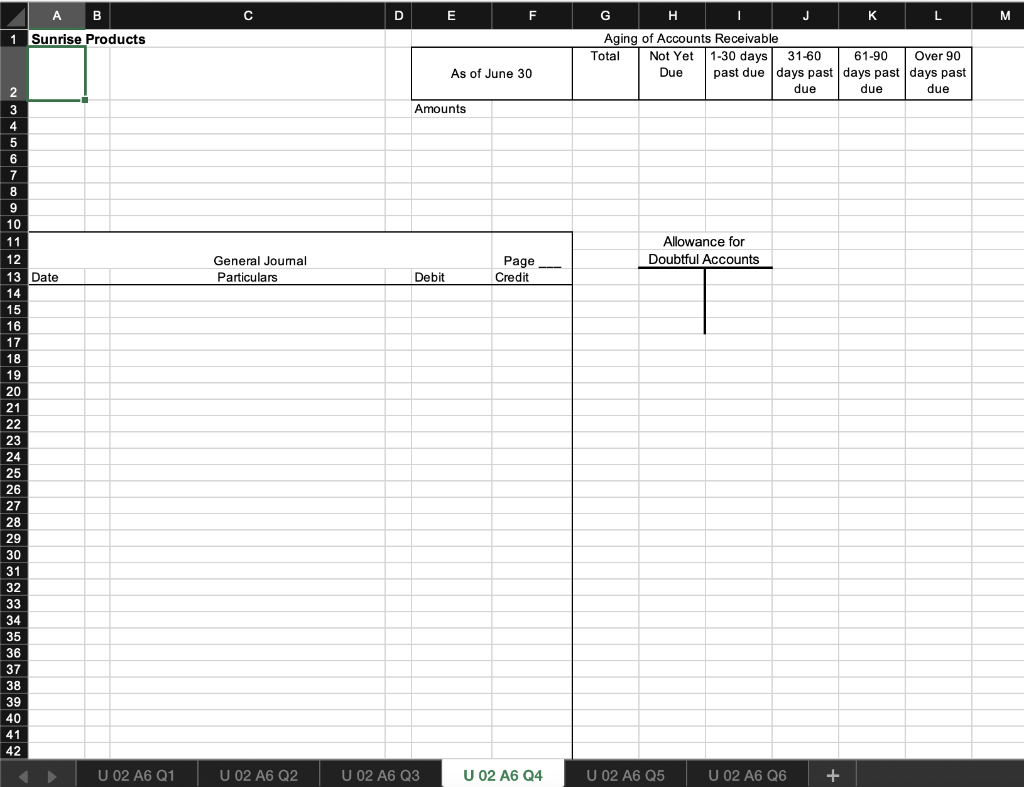

BATAM Unit 2 Activity 6 Summative Assignment PART A-Transactions and Journal Entries 1. Perth Construction Company The Perth Construction Company purchased a piece of machinery on June 29, 2013 for $53 000. Freight costs came to $800. It cost $1 700 to install and test the machinery. At this time it was estimated that the machine would be used for six years and would have a residual value of $8 000 at that time. Before recording the 2016 amortization expense, the owners realized that this machinery would last only five years, and therefore revised the amortization expense calculation. On July 2, 2017, the machine broke down and rather than repair it, the company decided to sell it for $12 000. a) Prepare the journal entry to record the purchase of the machine on June 29, 2013. b) Calculate the amortization charges that would appear on the 2013 and 2014 income statements, using the straight line method of amortization. c) Show the journal entry for the 2013 amortization. d) Show how the machine would appear in the Perth Construction Company Balance Sheet on December 31, 2015, presuming the straight-line method of amortization is used. e) Briefly explain why no journal entry would be made to correct previous years' records after the new estimate in 2016 for expected life. Give one GAAP to support your argument. f) Prepare the journal entry for the July 2, 2017 transaction. 2. Miyasawa Mining Company On Feb. 1, 2015, Miyasawa Mining Company purchased a mine for $80 million that is estimated have 250 000 tonnes of ore and a residual value of $3 million. The cost of restoration at the end of the useful life is estimated at $8 million. In 2015, 30 000 tonnes of ore were extracted. a) Calculate the amount of amortization that should be recorded on December 31, 2015. b) Calculate the amount of the restoration liability. c) Show the journal entry for December 31, 2015. 3. MacDougall Brothers The income statement approach to estimating uncollectible accounts is used by MacDougall Brothers. On January 31 the firm had accounts receivable in the amount of $750 000. The Allowance for Doubtful Accounts had a credit balance of $5 250. The controller estimated that the uncollectible accounts expense would amount to one-half of 1% of the $4 500 000 of net sales made during January. This estimate was entered in the accounts by an adjusting entry on January 31. On February 12, an account receivable from Carlotta Smith in the amount of $4 125 was determined to be worthless and was written off. However, on February 24, Smith won several million dollars in the lottery and immediately paid her $4 125 past-due account. a) Prepare journal entries in general journal form for Jan. 31, Feb. 12, and Feb. 24. 4. Sunrise Products Sunrise Products has 250 accounts receivable accounts. All accounts are due in 30 days. On June 30, an ageing schedule was prepared. The results are summarized below: Total 1-30 days Not Yet Due 31-60 days 61-90 days past due past due past due Over 90 days past due $14 640 Amounts $345 250 $183 590 $94 680 $43 340 $9 000 Two accounts receivable were accidentally omitted from this schedule. The following data is available regarding these accounts: . R. Jones owes $4 250 from two invoices: Invoice no. 218, dated March 14, in the amount of $2 980; and Invoice no. 568, dated May 9, in the amount of $1 270. . F. Smith owes $3 760 from two invoices: Invoice no. 574, dated May 19, in the amount of $1 350: and Invoice no. 641, dated June 5, in the amount of $2 410. a) Complete the ageing chart as of June 30 by adding to the column subtotals an ageing of the accounts of Jones and Smith. b) Calculate the estimated portion of each age group that will prove uncollectible and the required balance in the Allowance for Doubtful Accounts. The following percentages of each age group are estimated to be uncollectible: Not yet due, 1%; 1-30 days, 4%; 31-60 days, 10%; 61-90 days, 30%; over 90 days, 50%. c) Prepare the journal entry to adjust the Allowance for Doubtful Accounts account at June 30. Prior to making this adjustment, the account has a credit balance of $13 800. 5. Noodle Hut Restaurant The Noodle Hut restaurant does a brisk business. Journalize the following three transactions from their lunchtime crowd on May 16, 2015. The following service fees apply: $0.15 per transaction for debit card; 2.5% for MasterCard and Visa; 3.5% for American Express. a) A lunch bill for $34.00 was paid with a debit card. b) A lunch bill for $25.00 was paid with a MasterCard. c) A lunch bill for $55.00 was paid with an American Express. 6. Ranjeet Jewellers Ranjeet Jewellers is a jewellery wholesaler. They mostly sell to retailers. Joe's Fine Jewellery has an outstanding account with Ranjeet Jewellers for $9 750 that is several months past due. On April 1, Ranjeet Jewellers accepts a promissory note for the total amount with 5% annual interest for a term of three months ending June 30, 2015. Record the following independent journal entries: a) The journal entry to record the acceptance of the note by Ranjeet Jewellers. b) The journal entry to record the receipt of payment of the note, plus interest on June 30, 2015. c) The journal entry to record the failure of Joe's Fine Jewellery to pay their note on July 1, 2015. PART B - Short Answer Answer all questions in full sentences. 1. What factors must a company consider when choosing an amortization method to use for a fixed asset? Be sure to refer to GAAP and the effect of the decision on the financial statements. 2. Why do companies choose to accept credit and debit cards as forms of payment? Outline the pros and cons of this business decision. 3. Explain how the matching principle relates to uncollectible accounts receivable. How do companies satisfy the matching principle in this area of accounting? 4. Outline the reasons a company records a note receivable on its balance sheet. What benefits does a company get from issuing this promissory note? 5. What is the Capital Cost Allowance and how does it affect the amortization of assets? D E F G H K L CALCULATIONS and Financial Statement General Journal Particulars Page Credit Debit 1 Perth Construction Company 2 3 4 Date 5 2006 6 a) 7 8 9 10 c) 11 12 13 (b) 14 e) (d) Perth Construction Company Partial Balance Sheet December 31, 2008 15 16 17 18 ) 19 NNNNNN (0) 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 U 02 A6 Q1 U 02 A6 Q2 U 02 A6 Q3 U 02 A6 Q4 U 02 A6 Q5 U 02 A6 Q6 + D E F G H I J K L M = = = = = Debit Page Credit A B C 1 Miyasawa Mining Company 2 3 a) Depletion rate 4 5 6 7 Depletion expense for 2008 8 9 10 b) Restoration Liability 11 12 13 14 15 General Journal 16 Date Particulars 17 c) 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 e 39 40 40 41 41 42 43 44 U 02 A6 Q1 U 02 A6 Q2 U 02 A6 Q3 U 02 A6 Q4 U 02 A6 Q5 U 02 A6 Q6 + D E F G H I J L M Debit Page Credit C 1 MacDougall Brothers 2 3 Data provided 4 Accounts Receivable 5 Allowance for Doubtful Accounts 6 Net Sales 7 Estimated loss percentage 8 9 10 General Journal 11 Date Particulars 12 13 14 15 16 17 18 10 19 10 20 2 21 22 22 23 24 25 25 26 27 28 29 30 31 32 02 33 34 35 35 36 37 38 39 40 41 42 43 44 AC U 02 A6 Q1 U 02 A6 Q2 U 02 A6 Q3 U 02 A6 Q4 U 02 A6 Q5 U 02 A6 Q6 + C D E F M 1 Sunrise Products G H J K L Aging of Accounts Receivable Total Not Yet 1-30 days 31-60 61-90 Over 90 Due past due days past days past days past due due due As of June 30 Amounts Allowance for Doubtful Accounts General Journal Particulars Page Credit Debit 2 3 4 5 6 7 8 B 9 10 11 12 13 Date 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 20 30 31 32 33 34 35 30 36 37 37 38 28 39 40 41 42 U 02 A6 Q1 U 02 A6 Q2 U 02 A6 Q3 U 02 A6 Q4 U 02 A6 Q5 U 02 A6 Q6 + D E F G . I J K L M N Noodle Hut Restaurant 2 3 4 General Joumal Particulars Page Credit Date Debit 5 a) 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 20 21 22 23Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started