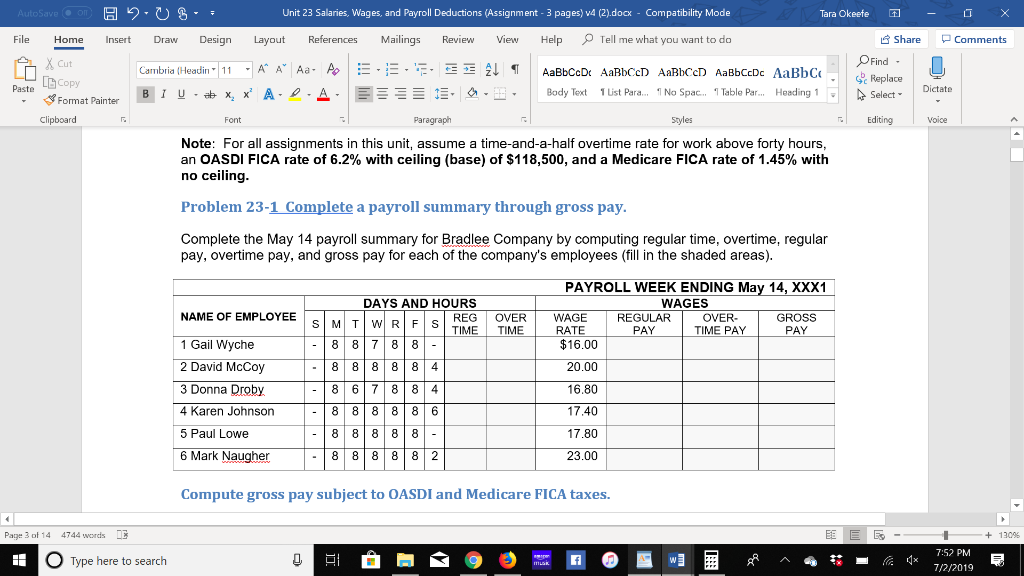

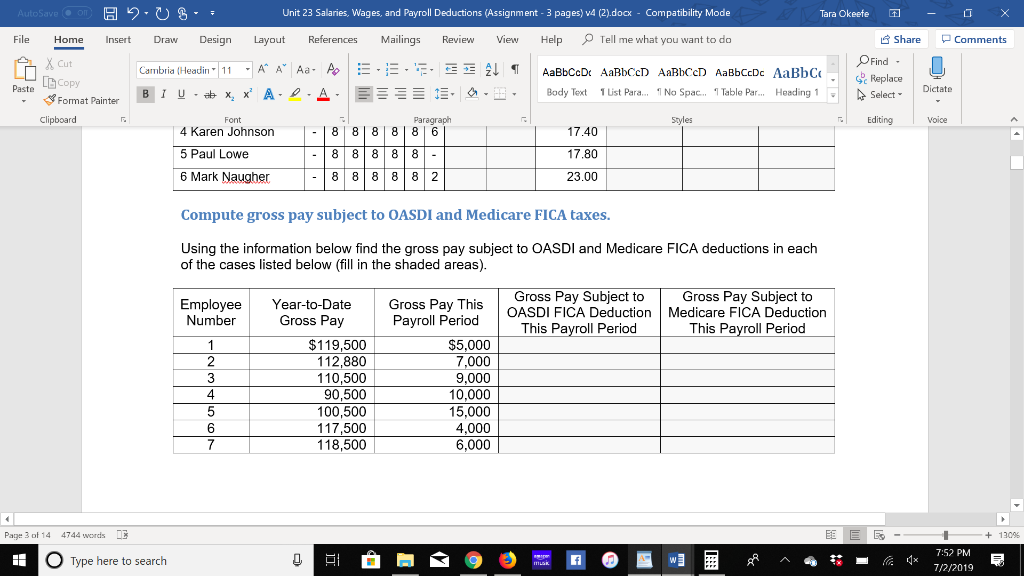

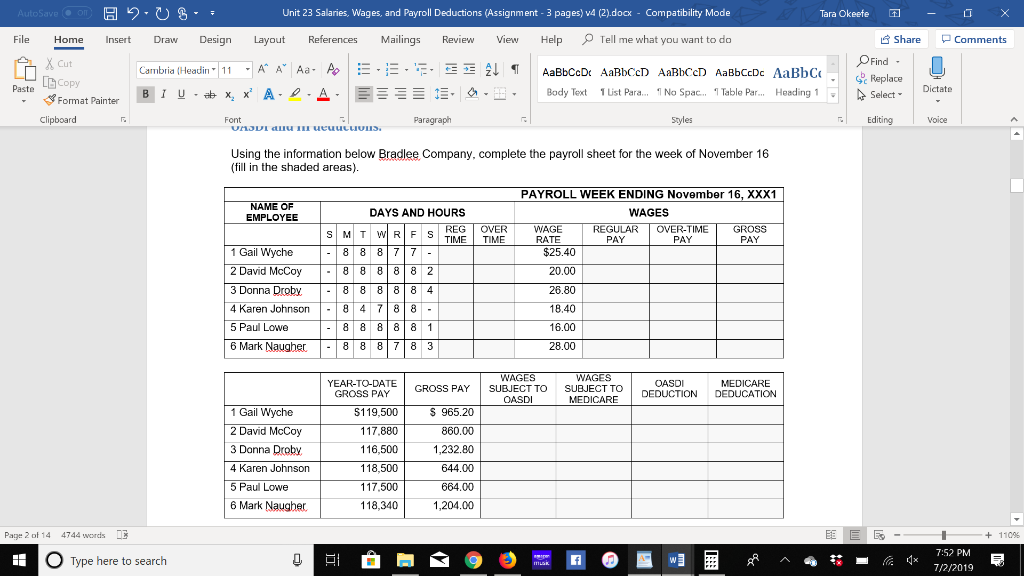

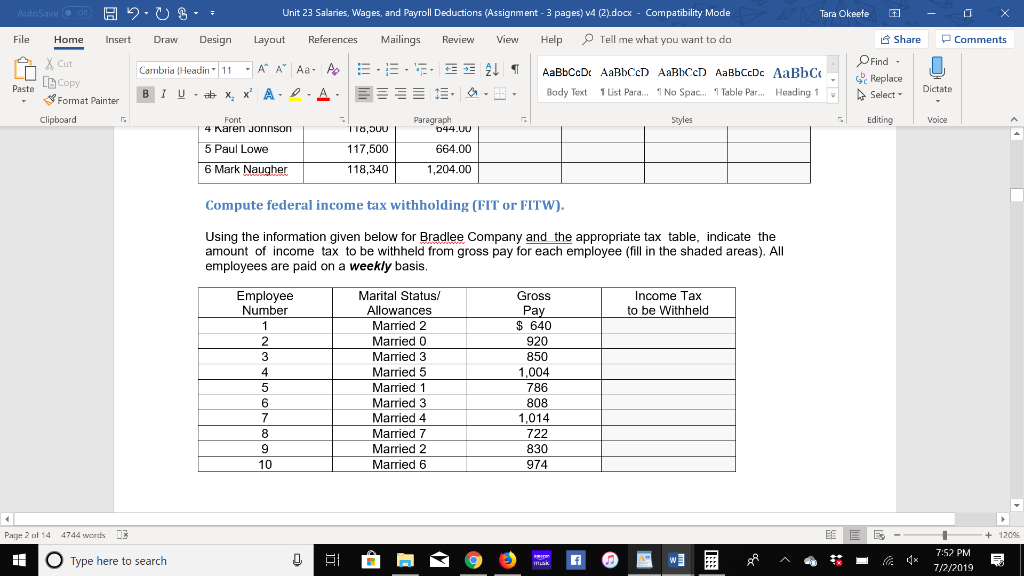

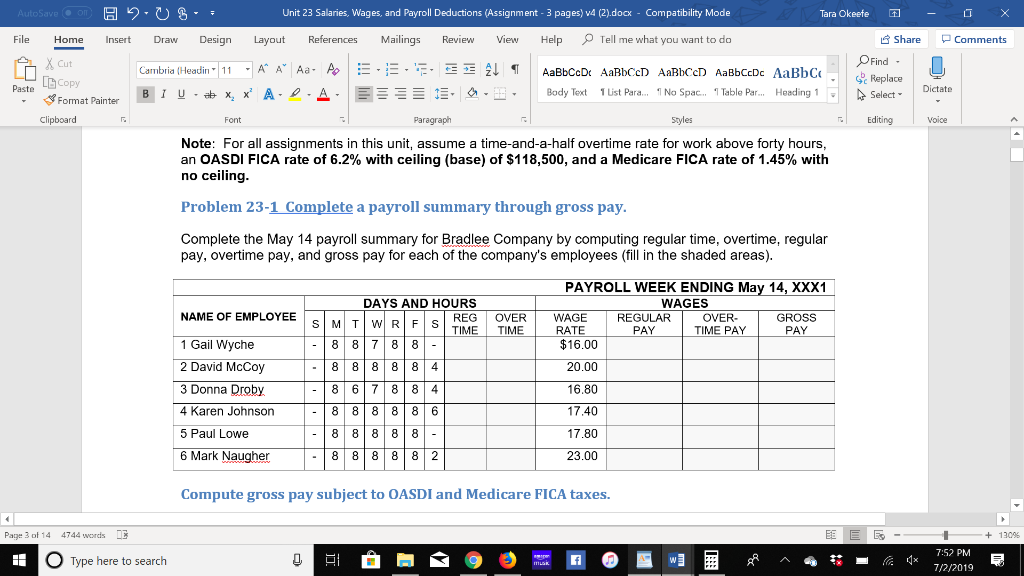

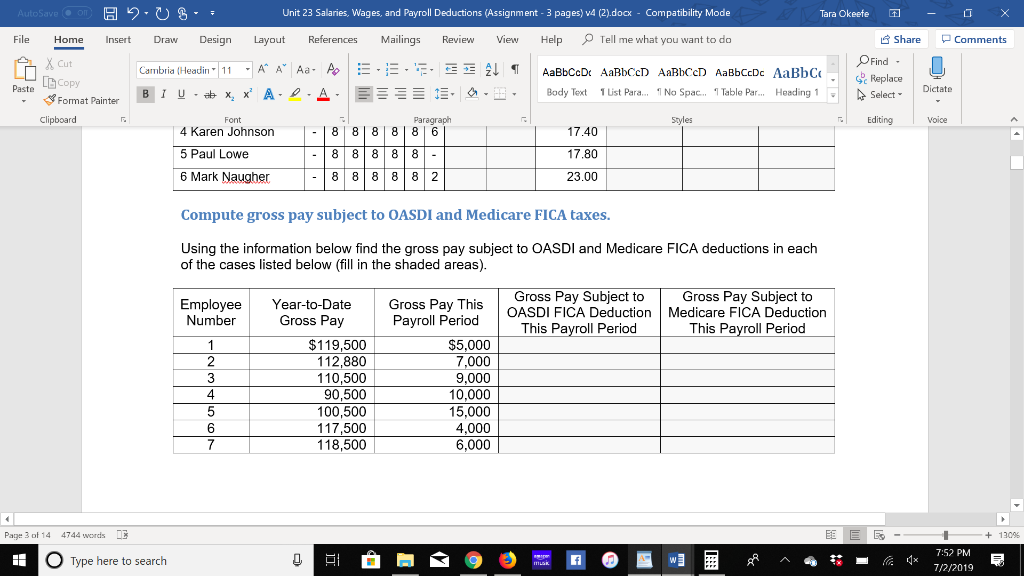

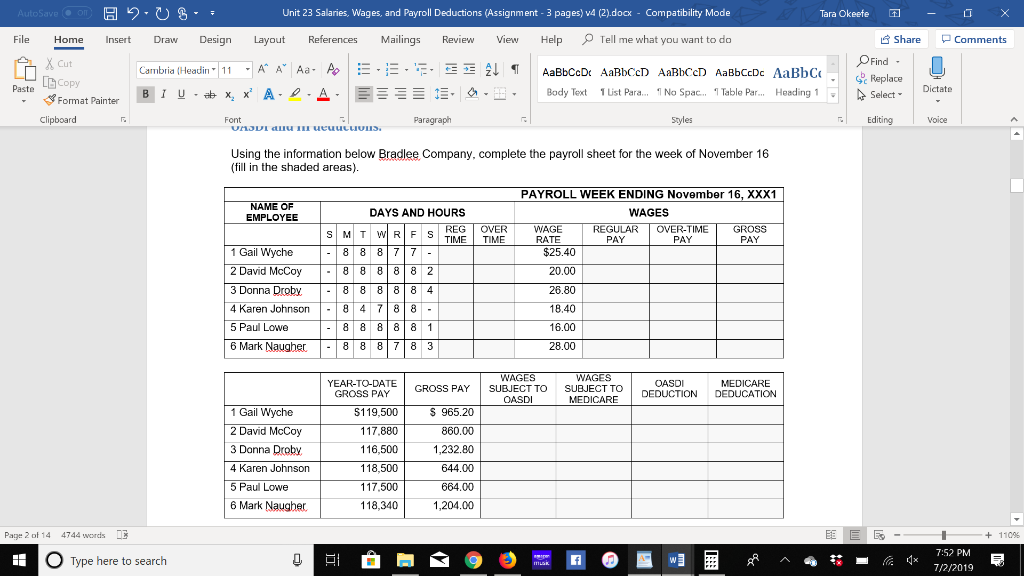

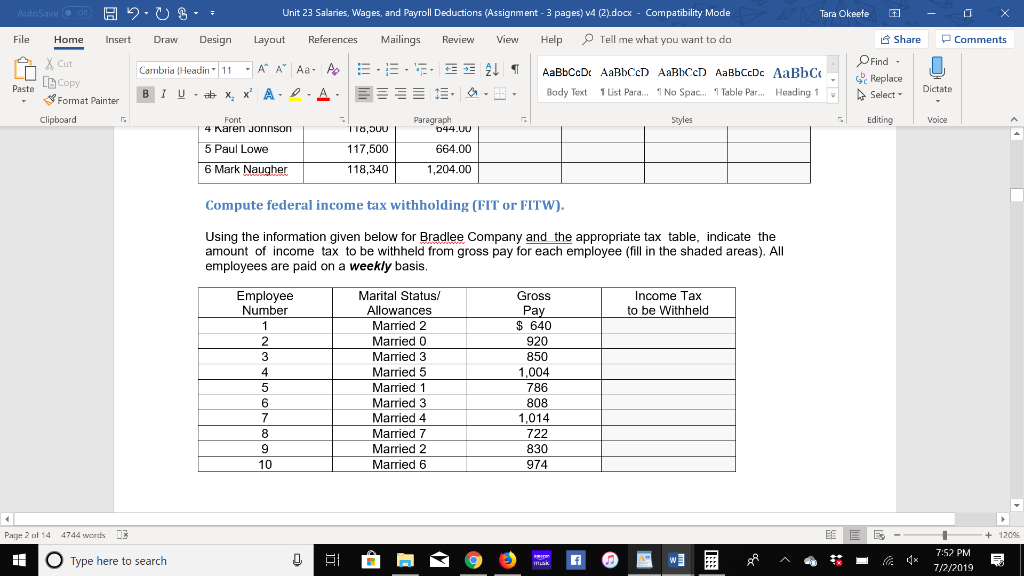

Unit (2).dock Salaries, Wages, and Payroll Deductions (Assignment - 3 pages) Compatibility Mode Tara Okeefe Tell me what you want to do Comments File Design References Mailings Review View Help Share Home Insert Draw Layout OFind Cut Cambria (Headi 11 A A Aa Ao AaBbCcD AaBbCcD AaBbCcD AaBbCcDc AaBbC Replace Select Paste LCopy Format Painter Dictate T List Para. I U x x A A 1No Spac.. Table Par Heading Bady Text Clipboard Paragraph Styles Editing Voice Fom Note: For all assignments in this unit, assume a time-and-a-half overtime rate for work above forty hours, an OASDI FICA rate of 6.2% with ceiling (base) of $118,500, and a Medicare FICA rate of 1.45% with no ceiling Problem 23-1 Complete a payroll summary through gross pay. Complete the May 14 payroll summary for Bradlee Company by computing regular time, overtime, regular pay, overtime pay, and gross pay for each of the company's employees (fill in the shaded areas) PAYROLL WEEK ENDING May 14, XXX1 WAGES OVER TIME PAY DAYS AND HOURS REG REGULAR PAY GROSS PAY NAME OF EMPLOYEE S OVER TIME WAGE RATE WR M TIME 8 8 $16.00 1 Gail Wyche - 2 David McCoy 20.00 8 8 8 4 3 Donna Droby 8 4 7 16.80 -8 4 Karen Johnson 17.40 8 8 8 6 8 8 5 Paul Lowe 17,80 8 8 8 8 8 6 Mark Naugher 8 2 8 8 8 23.00 Compute gross pay subject to OASDI and Medicare FICA taxes. , 1300 Page 3 of 14 4744 words 7:52 PM Type here to search muak 7/2/2019 Unit (2).dock Salaries, Wages, and Payroll Deductions (Assignment - 3 pages) Compatibility Mode Tara Okeefe Comments File Design References Mailings Review View Help Tell me what you want to do Share Home Insert Draw Layout OFind Cut Cambria (Headin 11 A A Aa Ao AaBbCcD AaBbCcD AaBbCcD AaBbCcDc AaBbC Replace Paste LCopy Format Painter Dictate T List Para. Heading 1 x, x A- - A Bady Text 1No Spac.. Table Par. Select IU Clipboard Paragraph 8 886 Styles Editing Voice Font 4 Karen Johnson 8 17.40 17.80 8 8 5 Paul Lowe 8 8 8 88 8 82 6 Mark Naugher 23.00 Compute gross pay subject to OASDI and Medicare FICA taxes. Using the information below find the gross pay subject to OASDI and Medicare FICA deductions in each of the cases listed below (fill in the shaded areas). Gross Pay Subject to OASDI FICA Deduction This Payroll Period Gross Pay Subject to Employee Number Year-to-Date Gross Pay Gross Pay This Payroll Period Medicare FICA Deduction This Payroll Period $5,000 7,000 $119,500 112,880 1 3 110,500 9,000 10,000 90,500 100,500 117,500 118,500 5 15,000 4,000 6,000 , 1300 Page 3 of 14 4744 words 7:52 PM Type here to search muak 7/2/2019 (2).dock Unit Salaries, Wages, and Payroll Deductions (Assignment - 3 pages) Compatibility Mode Tara Okeefe Tell me what you want to do Comments File Design References Mailings Review View Help Share Home Insert Draw Layout OFind Cut Cambria (Headin 11 A A Aa Ao AaBbCcD AaBbCcD AaBbCcD AaBbCcDc AaBbC Replace Paste Copy Format Painter Dictate BIU x, x A A T List Para. Heading 1 Bady Text 1No Spac.. Table Par. Select Clipboard Paragraph Styles Editing Voice Using the information below Bradlee Company, complete the payroll sheet for the week of November 16 (fill in the shaded areas). PAYROLL WEEK ENDING November 16, XXX1 NAME OF DAYS AND HOURS WAGES MPLOY REGULAR OV ME AY WAGE sMTW RESE DAY 1 Gail Wyche 2 David McCoy $25.40 8 8 8 7 7 20,00 8 8 8 8 2 3 Donna Droby 8 8 26.80 18.40 4 Karen Johnson -8 4 7 5 Paul Lowe 16.00 8 8 8 8 8 7 6 Mark Naugher 28.00 -8 8 WAGES WAGES YEAR-TO-DATE GROSS PAY OASDI MEDICARE GROSS PAY SUBJI TC DEDUCTION DEDUCATION 1 Gail Wyche 2 David McCoy 965.20 S119,500 860.00 117,880 3 Danna Droby 1,232.80 116,500 4 Karen Johnson 118.500 644.00 5 Paul Lowe 117,500 664.00 6 Mark Naugher 1,204.00 118.340 Page 2 of 14 4744 words 1400 7:52 PM O Type here to search 7/2/2019 (2).dock Unit Salaries, Wages, and Payroll Deductions (Assignment - 3 pages) Compatibility Mode Tara Okeefe Tell me what you want to do Comments File Design References Mailings Review View Help Share Home Insert Draw Layout OFind Cut Cambria (Headin 11 A A Aa Ao AaBbCcD AaBbCcD AaBbCcD AaBbCcDc AaBbC Replace Paste LCopy Format Painter Dictate 1 List Para. Heading 1 x, x' A- - A 1No Spac.. Table Par. Bady Text Select BIU Clipboard Styles Paragraph b44.UU Editing Voice ront 4 naren Jonnson 117.500 664.00 5 Paul Lowe 1,204.00 6 Mark Naugher 118,340 Compute federal income tax withholding (FIT or FITW). Using the information given below for Bradlee Company and the appropriate tax table, indicate the amount of income tax to be withheld from gross pay for each employee (fill in the shaded areas). All employees are paid on a weekly basis. Income Tax to be Withheld Employee Number Marital Status/ Gross Allowances Pav 1 Maried 2 640 2 Married 0 920 Married 3 850 4 Married 5 1,004 5 Married 1 786 Married 3 6 808 Married 4 1,014 8 Mamed7 aeu Married 6 974 10 E Page 2 of 14 4744 words 100 7:52 PM Type here to search 7/2/2019 Unit (2).dock Salaries, Wages, and Payroll Deductions (Assignment - 3 pages) Compatibility Mode Tara Okeefe Tell me what you want to do Comments File Design References Mailings Review View Help Share Home Insert Draw Layout OFind Cut Cambria (Headi 11 A A Aa Ao AaBbCcD AaBbCcD AaBbCcD AaBbCcDc AaBbC Replace Select Paste LCopy Format Painter Dictate T List Para. I U x x A A 1No Spac.. Table Par Heading Bady Text Clipboard Paragraph Styles Editing Voice Fom Note: For all assignments in this unit, assume a time-and-a-half overtime rate for work above forty hours, an OASDI FICA rate of 6.2% with ceiling (base) of $118,500, and a Medicare FICA rate of 1.45% with no ceiling Problem 23-1 Complete a payroll summary through gross pay. Complete the May 14 payroll summary for Bradlee Company by computing regular time, overtime, regular pay, overtime pay, and gross pay for each of the company's employees (fill in the shaded areas) PAYROLL WEEK ENDING May 14, XXX1 WAGES OVER TIME PAY DAYS AND HOURS REG REGULAR PAY GROSS PAY NAME OF EMPLOYEE S OVER TIME WAGE RATE WR M TIME 8 8 $16.00 1 Gail Wyche - 2 David McCoy 20.00 8 8 8 4 3 Donna Droby 8 4 7 16.80 -8 4 Karen Johnson 17.40 8 8 8 6 8 8 5 Paul Lowe 17,80 8 8 8 8 8 6 Mark Naugher 8 2 8 8 8 23.00 Compute gross pay subject to OASDI and Medicare FICA taxes. , 1300 Page 3 of 14 4744 words 7:52 PM Type here to search muak 7/2/2019 Unit (2).dock Salaries, Wages, and Payroll Deductions (Assignment - 3 pages) Compatibility Mode Tara Okeefe Comments File Design References Mailings Review View Help Tell me what you want to do Share Home Insert Draw Layout OFind Cut Cambria (Headin 11 A A Aa Ao AaBbCcD AaBbCcD AaBbCcD AaBbCcDc AaBbC Replace Paste LCopy Format Painter Dictate T List Para. Heading 1 x, x A- - A Bady Text 1No Spac.. Table Par. Select IU Clipboard Paragraph 8 886 Styles Editing Voice Font 4 Karen Johnson 8 17.40 17.80 8 8 5 Paul Lowe 8 8 8 88 8 82 6 Mark Naugher 23.00 Compute gross pay subject to OASDI and Medicare FICA taxes. Using the information below find the gross pay subject to OASDI and Medicare FICA deductions in each of the cases listed below (fill in the shaded areas). Gross Pay Subject to OASDI FICA Deduction This Payroll Period Gross Pay Subject to Employee Number Year-to-Date Gross Pay Gross Pay This Payroll Period Medicare FICA Deduction This Payroll Period $5,000 7,000 $119,500 112,880 1 3 110,500 9,000 10,000 90,500 100,500 117,500 118,500 5 15,000 4,000 6,000 , 1300 Page 3 of 14 4744 words 7:52 PM Type here to search muak 7/2/2019 (2).dock Unit Salaries, Wages, and Payroll Deductions (Assignment - 3 pages) Compatibility Mode Tara Okeefe Tell me what you want to do Comments File Design References Mailings Review View Help Share Home Insert Draw Layout OFind Cut Cambria (Headin 11 A A Aa Ao AaBbCcD AaBbCcD AaBbCcD AaBbCcDc AaBbC Replace Paste Copy Format Painter Dictate BIU x, x A A T List Para. Heading 1 Bady Text 1No Spac.. Table Par. Select Clipboard Paragraph Styles Editing Voice Using the information below Bradlee Company, complete the payroll sheet for the week of November 16 (fill in the shaded areas). PAYROLL WEEK ENDING November 16, XXX1 NAME OF DAYS AND HOURS WAGES MPLOY REGULAR OV ME AY WAGE sMTW RESE DAY 1 Gail Wyche 2 David McCoy $25.40 8 8 8 7 7 20,00 8 8 8 8 2 3 Donna Droby 8 8 26.80 18.40 4 Karen Johnson -8 4 7 5 Paul Lowe 16.00 8 8 8 8 8 7 6 Mark Naugher 28.00 -8 8 WAGES WAGES YEAR-TO-DATE GROSS PAY OASDI MEDICARE GROSS PAY SUBJI TC DEDUCTION DEDUCATION 1 Gail Wyche 2 David McCoy 965.20 S119,500 860.00 117,880 3 Danna Droby 1,232.80 116,500 4 Karen Johnson 118.500 644.00 5 Paul Lowe 117,500 664.00 6 Mark Naugher 1,204.00 118.340 Page 2 of 14 4744 words 1400 7:52 PM O Type here to search 7/2/2019 (2).dock Unit Salaries, Wages, and Payroll Deductions (Assignment - 3 pages) Compatibility Mode Tara Okeefe Tell me what you want to do Comments File Design References Mailings Review View Help Share Home Insert Draw Layout OFind Cut Cambria (Headin 11 A A Aa Ao AaBbCcD AaBbCcD AaBbCcD AaBbCcDc AaBbC Replace Paste LCopy Format Painter Dictate 1 List Para. Heading 1 x, x' A- - A 1No Spac.. Table Par. Bady Text Select BIU Clipboard Styles Paragraph b44.UU Editing Voice ront 4 naren Jonnson 117.500 664.00 5 Paul Lowe 1,204.00 6 Mark Naugher 118,340 Compute federal income tax withholding (FIT or FITW). Using the information given below for Bradlee Company and the appropriate tax table, indicate the amount of income tax to be withheld from gross pay for each employee (fill in the shaded areas). All employees are paid on a weekly basis. Income Tax to be Withheld Employee Number Marital Status/ Gross Allowances Pav 1 Maried 2 640 2 Married 0 920 Married 3 850 4 Married 5 1,004 5 Married 1 786 Married 3 6 808 Married 4 1,014 8 Mamed7 aeu Married 6 974 10 E Page 2 of 14 4744 words 100 7:52 PM Type here to search 7/2/2019