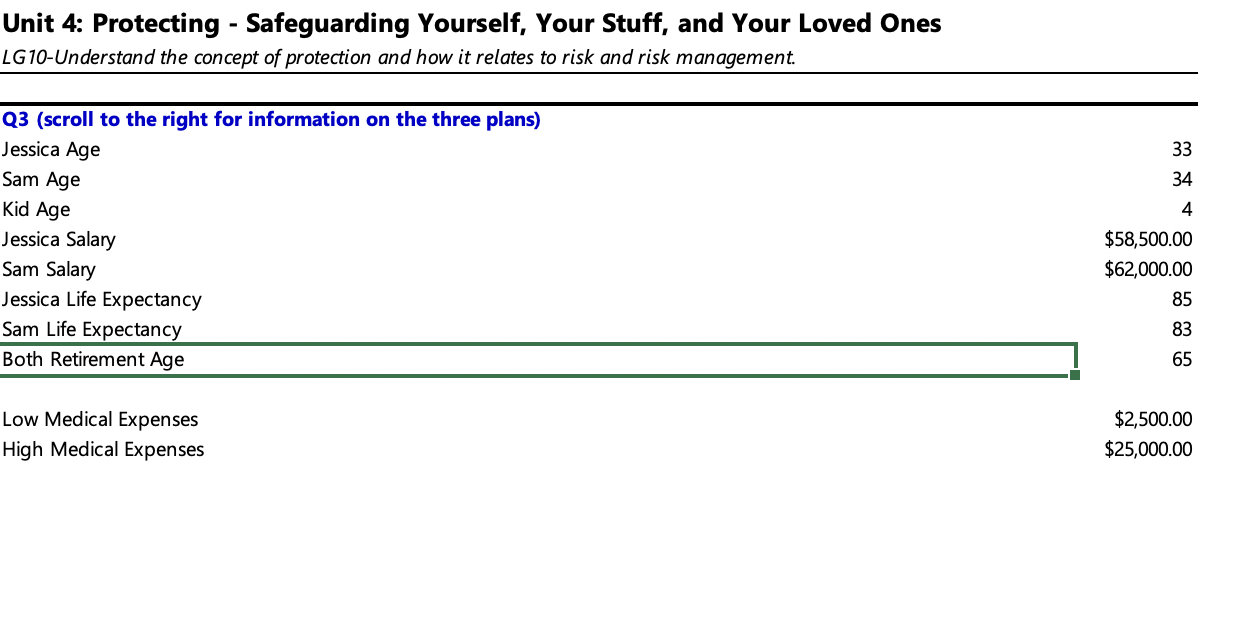

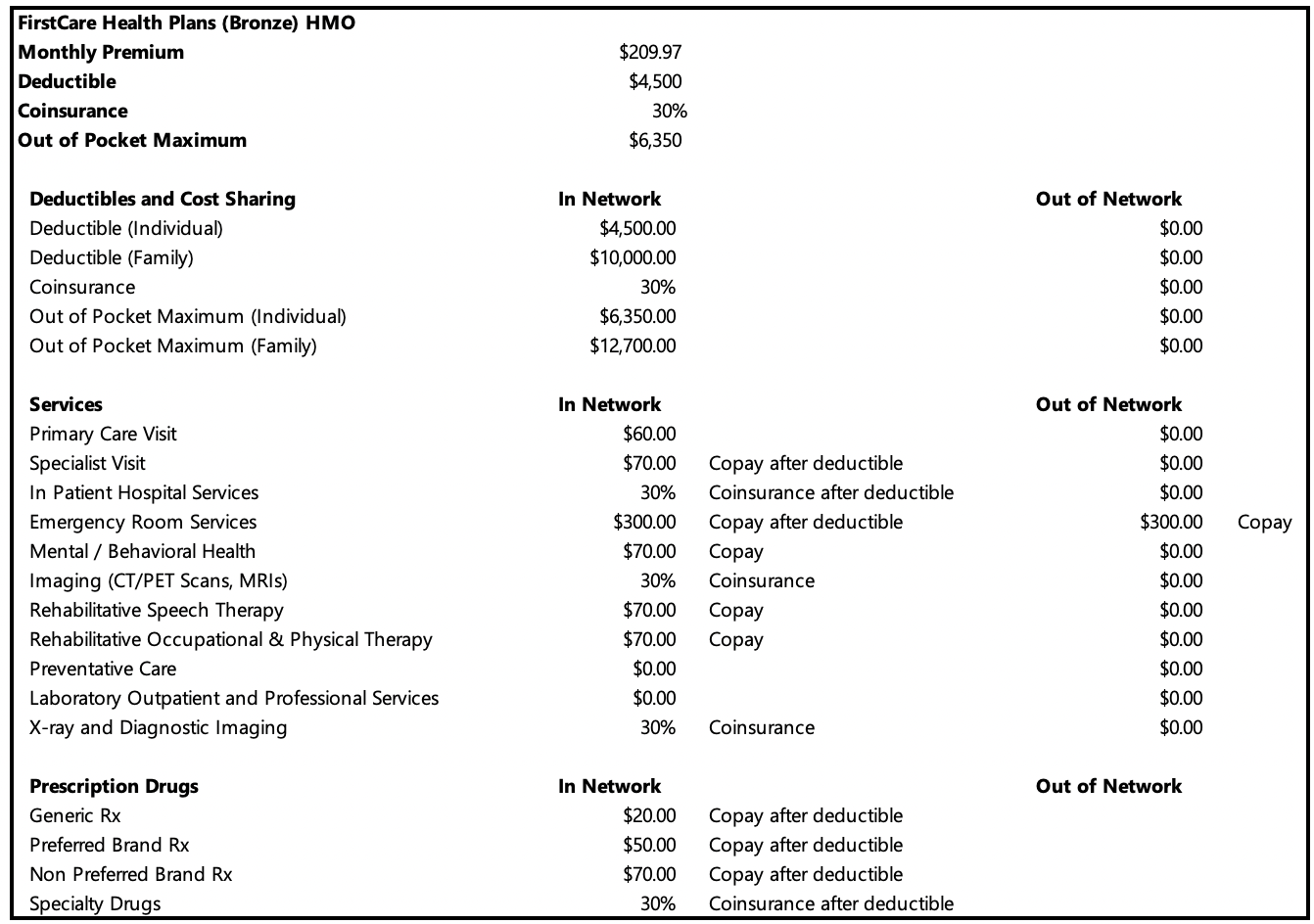

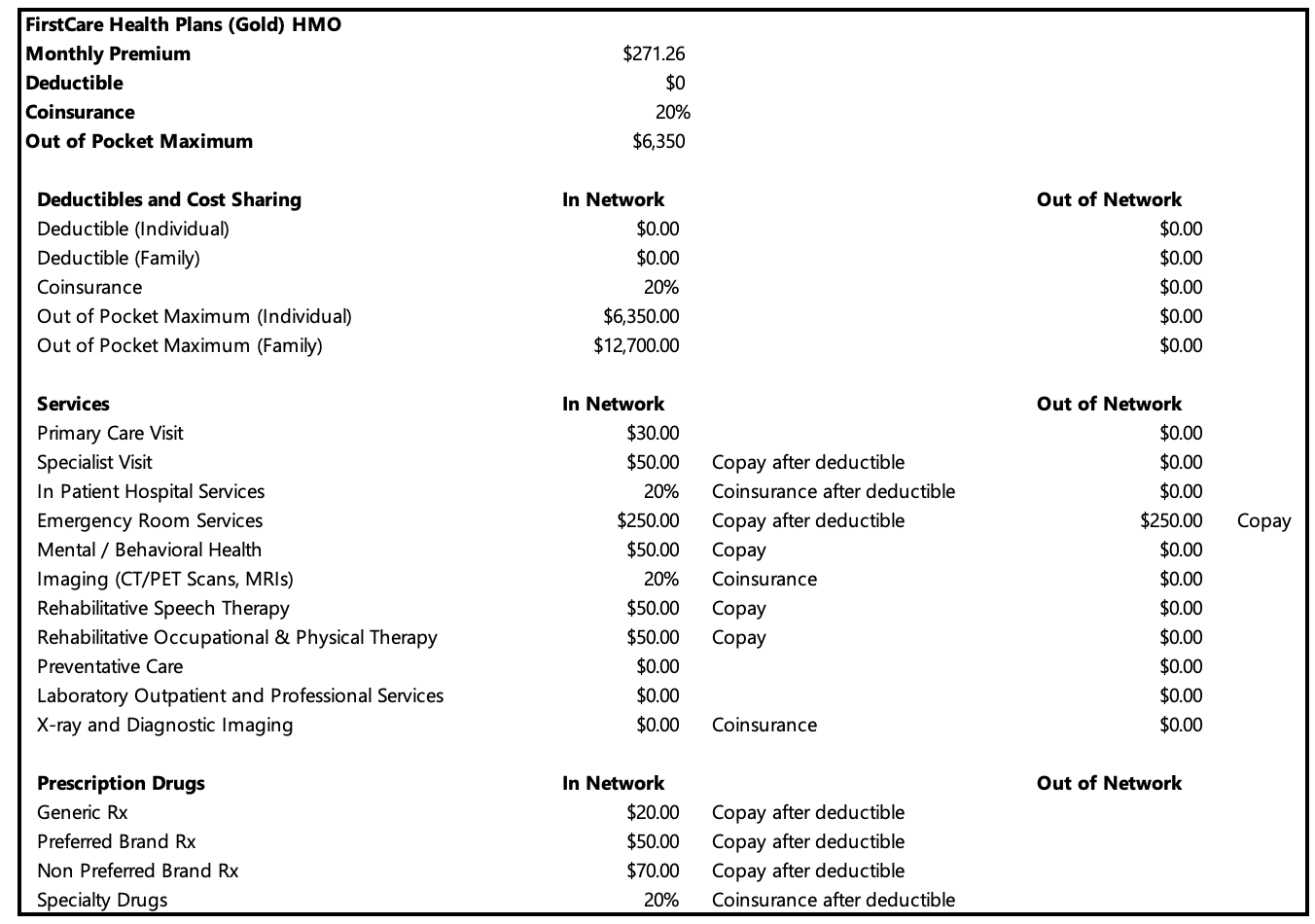

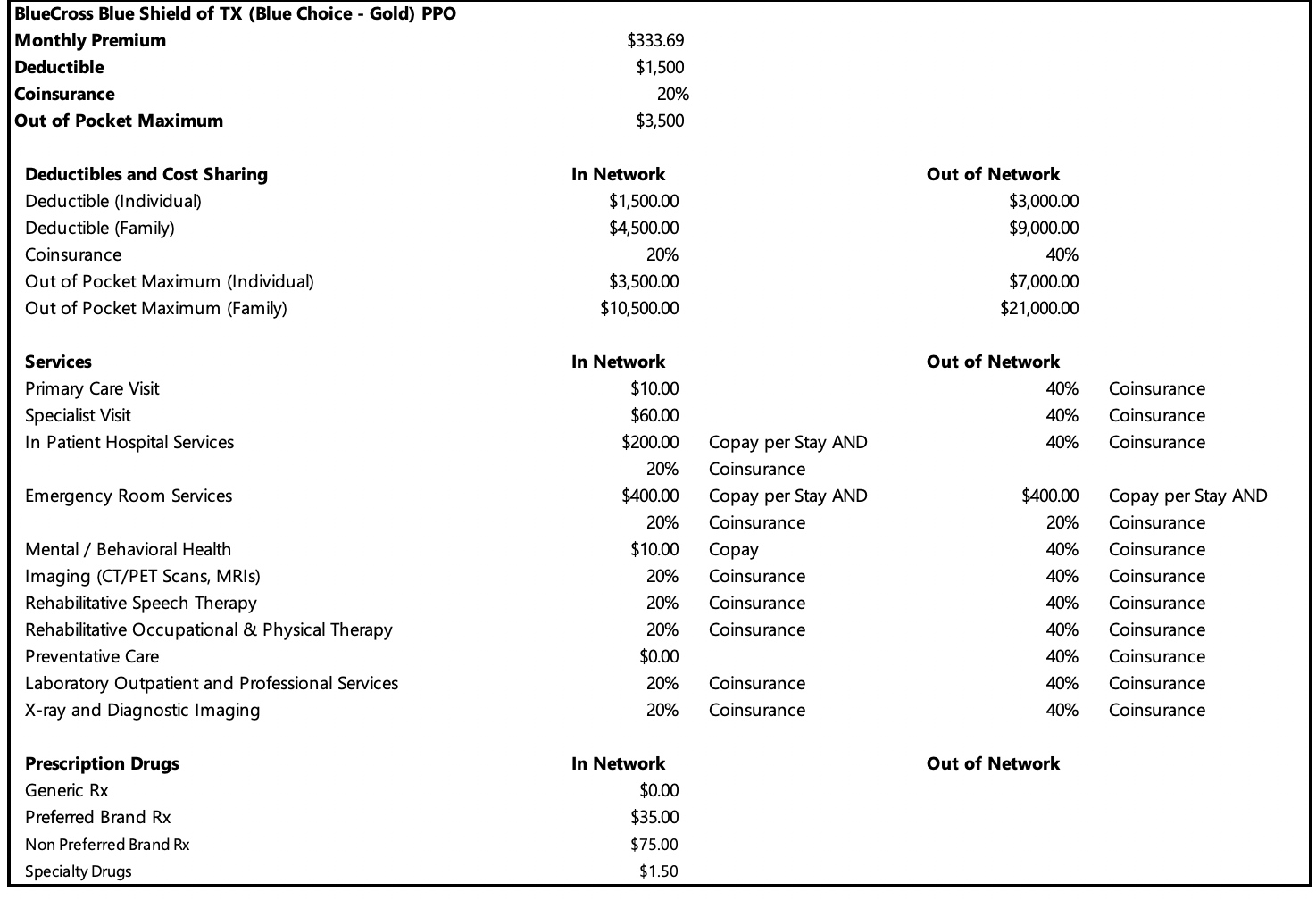

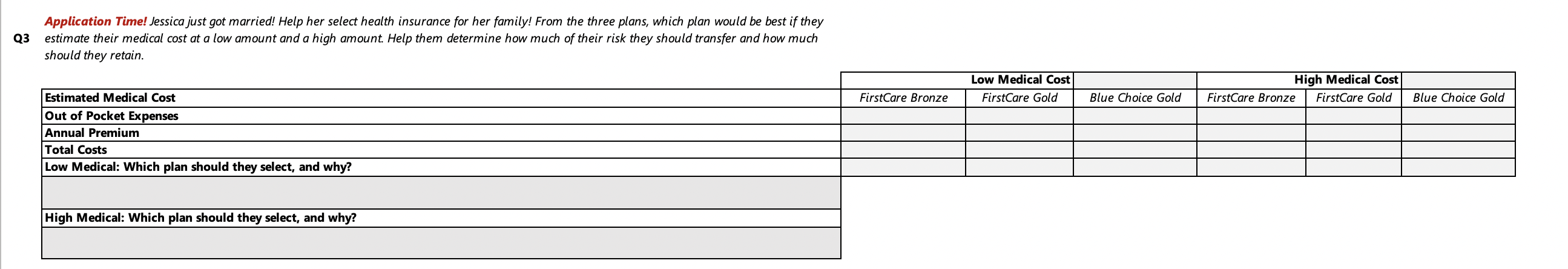

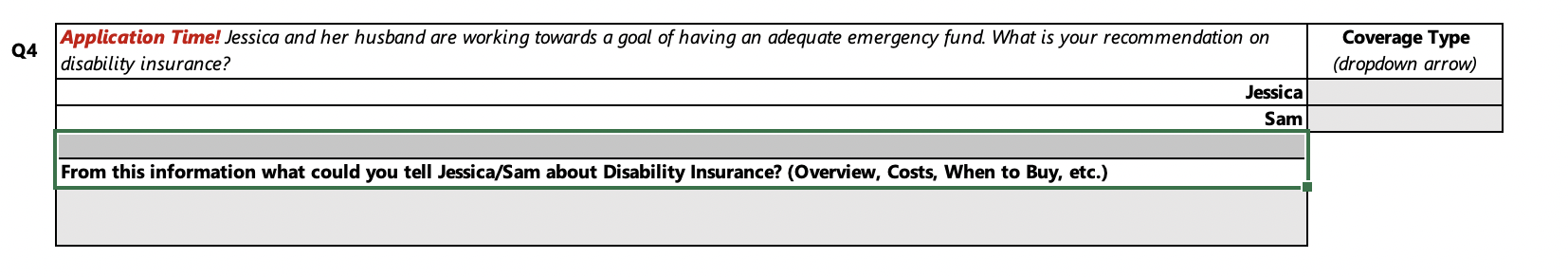

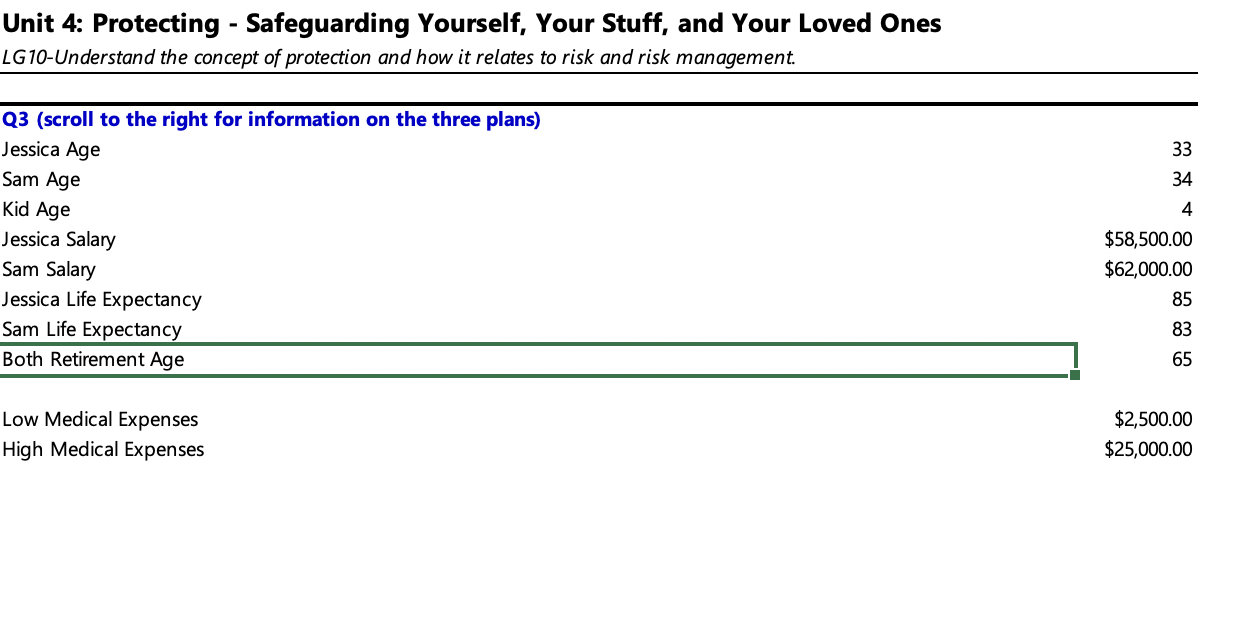

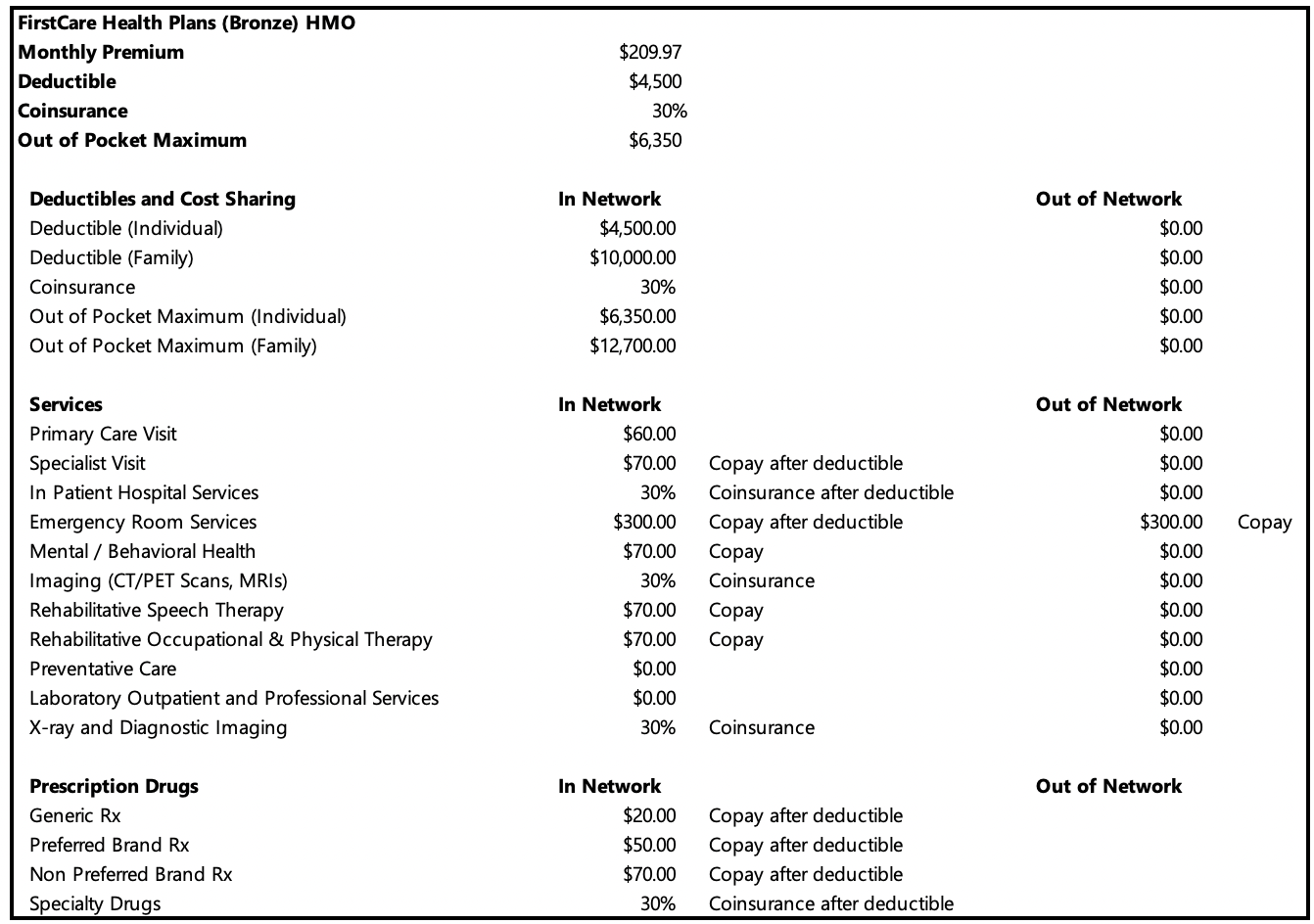

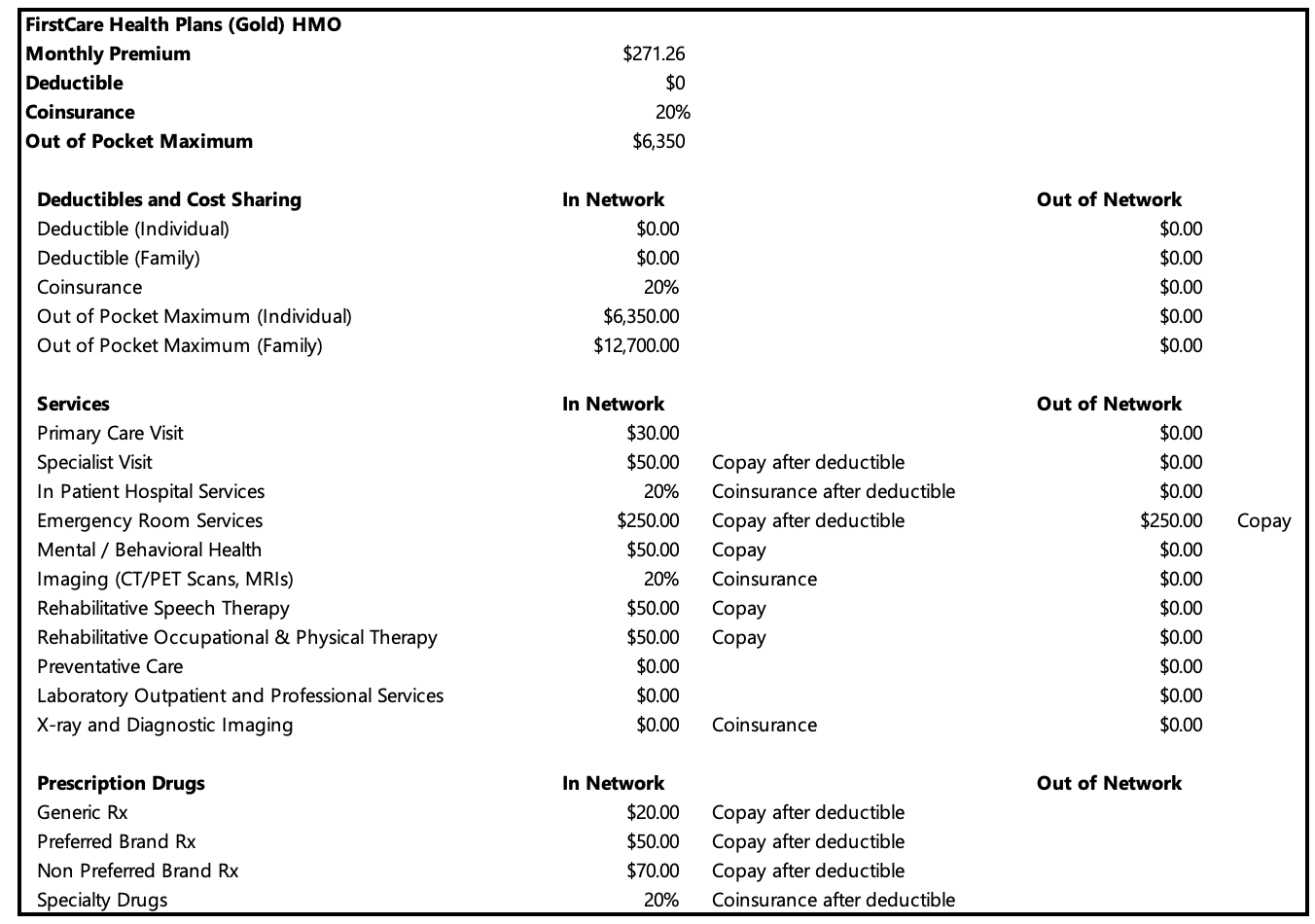

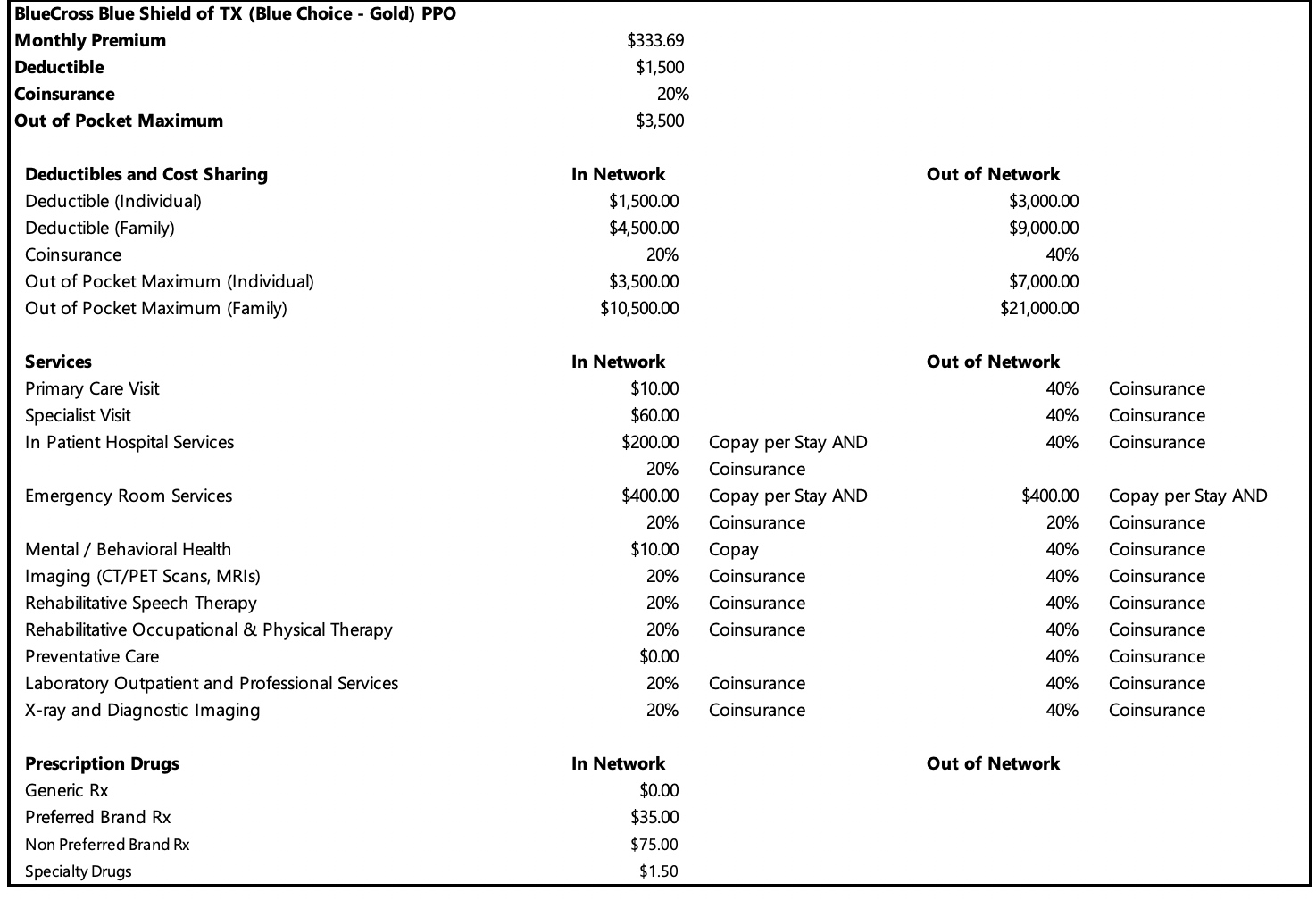

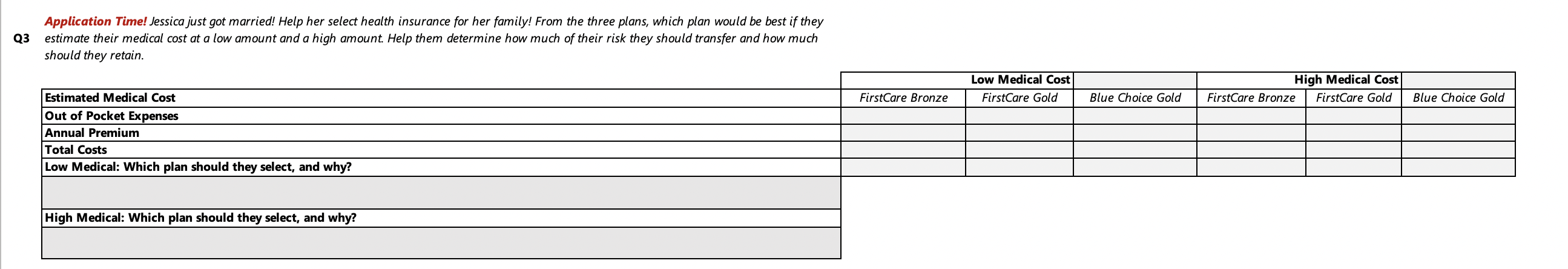

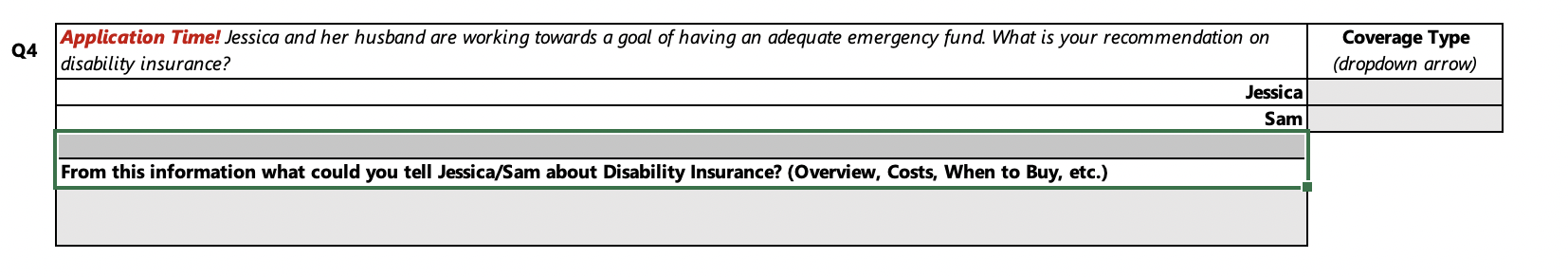

Unit 4: Protecting - Safeguarding Yourself, Your Stuff, and Your Loved Ones LG10-Understand the concept of protection and how it relates to risk and risk management. Q3 (scroll to the right for information on the three plans) Jessica Age Sam Age Kid Age Jessica Salary Sam Salary Jessica Life Expectancy Sam Life Expectancy Both Retirement Age Low Medical Expenses High Medical Expenses 33 34 4 $58,500.00 $62,000.00 85 83 65 $2,500.00 $25,000.00 FirstCare Health Plans (Bronze) HMO Monthly Premium Deductible Coinsurance Out of Pocket Maximum Deductibles and Cost Sharing Deductible (Individual) Deductible (Family) Coinsurance Out of Pocket Maximum (Individual) Out of Pocket Maximum (Family) Services Primary Care Visit Specialist Visit In Patient Hospital Services Emergency Room Services Mental / Behavioral Health Imaging (CT/PET Scans, MRIs) Rehabilitative Speech Therapy Rehabilitative Occupational & Physical Therapy Preventative Care Laboratory Outpatient and Professional Services X-ray and Diagnostic Imaging Prescription Drugs Generic Rx Preferred Brand Rx Non Preferred Brand Rx Specialty Drugs $209.97 $4,500 30% $6,350 In Network $4,500.00 $10,000.00 30% $6,350.00 $12,700.00 In Network $60.00 $70.00 30% $300.00 $70.00 30% $70.00 $70.00 $0.00 $0.00 30% In Network $20.00 $50.00 $70.00 30% Copay after deductible Coinsurance after deductible Copay after deductible Copay Coinsurance Copay Copay Coinsurance Copay after deductible Copay after deductible Copay after deductible Coinsurance after deductible Out of Network Out of Network $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $300.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 Out of Network Copay FirstCare Health Plans (Gold) HMO Monthly Premium Deductible Coinsurance Out of Pocket Maximum Deductibles and Cost Sharing Deductible (Individual) Deductible (Family) Coinsurance Out of Pocket Maximum (Individual) Out of Pocket Maximum (Family) Services Primary Care Visit Specialist Visit In Patient Hospital Services Emergency Room Services Mental / Behavioral Health Imaging (CT/PET Scans, MRIs) Rehabilitative Speech Therapy Rehabilitative Occupational & Physical Therapy Preventative Care Laboratory Outpatient and Professional Services X-ray and Diagnostic Imaging Prescription Drugs Generic Rx Preferred Brand Rx Non Preferred Brand Rx Specialty Drugs $271.26 $0 20% $6,350 In Network $0.00 $0.00 20% $6,350.00 $12,700.00 In Network $30.00 $50.00 20% $250.00 $50.00 20% $50.00 Copay $50.00 Copay $0.00 $0.00 $0.00 Coinsurance Copay after deductible Copay after deductible Copay after deductible Coinsurance after deductible In Network $20.00 $50.00 $70.00 20% Copay after deductible Coinsurance after deductible Copay after deductible Copay Coinsurance Out of Network Out of Network $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $250.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 Out of Network Copay BlueCross Blue Shield of TX (Blue Choice - Gold) PPO Monthly Premium Deductible Coinsurance Out of Pocket Maximum Deductibles and Cost Sharing Deductible (Individual) Deductible (Family) Coinsurance Out of Pocket Maximum (Individual) Out of Pocket Maximum (Family) Services Primary Care Visit Specialist Visit In Patient Hospital Services Emergency Room Services Mental / Behavioral Health Imaging (CT/PET Scans, MRIs) Rehabilitative Speech Therapy Rehabilitative Occupational & Physical Therapy Preventative Care Laboratory Outpatient and Professional Services X-ray and Diagnostic Imaging Prescription Drugs Generic Rx Preferred Brand Rx Non Preferred Brand Rx Specialty Drugs $333.69 $1,500 20% $3,500 In Network $1,500.00 $4,500.00 20% $3,500.00 $10,500.00 In Network $10.00 $60.00 $200.00 20% $400.00 20% $10.00 20% 20% 20% $0.00 20% 20% In Network $0.00 $35.00 $75.00 $1.50 Copay per Stay AND Coinsurance Copay per Stay AND Coinsurance Copay Coinsurance Coinsurance Coinsurance Coinsurance Coinsurance Out of Network $3,000.00 $9,000.00 40% $7,000.00 $21,000.00 Out of Network 40% 40% 40% $400.00 20% 40% 40% 40% 40% 40% 40% 40% Out of Network Coinsurance Coinsurance Coinsurance Copay per Stay AND Coinsurance Coinsurance Coinsurance Coinsurance Coinsurance Coinsurance Coinsurance Coinsurance Application Time! Jessica just got married! Help her select health insurance for her family! From the three plans, which plan would be best if they Q3 estimate their medical cost at a low amount and a high amount. Help them determine how much of their risk they should transfer and how much should they retain. Estimated Medical Cost Out of Pocket Expenses Annual Premium Total Costs Low Medical: Which plan should they select, and why? High Medical: Which plan should they select, and why? FirstCare Bronze Low Medical Cost FirstCare Gold High Medical Cost Blue Choice Gold FirstCare Bronze FirstCare Gold Blue Choice Gold Q4 Application Time! Jessica and her husband are working towards a goal of having an adequate emergency fund. What is your recommendation on disability insurance? Jessica Sam From this information what could you tell Jessica/Sam about Disability Insurance? (Overview, Costs, When to Buy, etc.) Coverage Type (dropdown arrow) Unit 4: Protecting - Safeguarding Yourself, Your Stuff, and Your Loved Ones LG10-Understand the concept of protection and how it relates to risk and risk management. Q3 (scroll to the right for information on the three plans) Jessica Age Sam Age Kid Age Jessica Salary Sam Salary Jessica Life Expectancy Sam Life Expectancy Both Retirement Age Low Medical Expenses High Medical Expenses 33 34 4 $58,500.00 $62,000.00 85 83 65 $2,500.00 $25,000.00 FirstCare Health Plans (Bronze) HMO Monthly Premium Deductible Coinsurance Out of Pocket Maximum Deductibles and Cost Sharing Deductible (Individual) Deductible (Family) Coinsurance Out of Pocket Maximum (Individual) Out of Pocket Maximum (Family) Services Primary Care Visit Specialist Visit In Patient Hospital Services Emergency Room Services Mental / Behavioral Health Imaging (CT/PET Scans, MRIs) Rehabilitative Speech Therapy Rehabilitative Occupational & Physical Therapy Preventative Care Laboratory Outpatient and Professional Services X-ray and Diagnostic Imaging Prescription Drugs Generic Rx Preferred Brand Rx Non Preferred Brand Rx Specialty Drugs $209.97 $4,500 30% $6,350 In Network $4,500.00 $10,000.00 30% $6,350.00 $12,700.00 In Network $60.00 $70.00 30% $300.00 $70.00 30% $70.00 $70.00 $0.00 $0.00 30% In Network $20.00 $50.00 $70.00 30% Copay after deductible Coinsurance after deductible Copay after deductible Copay Coinsurance Copay Copay Coinsurance Copay after deductible Copay after deductible Copay after deductible Coinsurance after deductible Out of Network Out of Network $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $300.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 Out of Network Copay FirstCare Health Plans (Gold) HMO Monthly Premium Deductible Coinsurance Out of Pocket Maximum Deductibles and Cost Sharing Deductible (Individual) Deductible (Family) Coinsurance Out of Pocket Maximum (Individual) Out of Pocket Maximum (Family) Services Primary Care Visit Specialist Visit In Patient Hospital Services Emergency Room Services Mental / Behavioral Health Imaging (CT/PET Scans, MRIs) Rehabilitative Speech Therapy Rehabilitative Occupational & Physical Therapy Preventative Care Laboratory Outpatient and Professional Services X-ray and Diagnostic Imaging Prescription Drugs Generic Rx Preferred Brand Rx Non Preferred Brand Rx Specialty Drugs $271.26 $0 20% $6,350 In Network $0.00 $0.00 20% $6,350.00 $12,700.00 In Network $30.00 $50.00 20% $250.00 $50.00 20% $50.00 Copay $50.00 Copay $0.00 $0.00 $0.00 Coinsurance Copay after deductible Copay after deductible Copay after deductible Coinsurance after deductible In Network $20.00 $50.00 $70.00 20% Copay after deductible Coinsurance after deductible Copay after deductible Copay Coinsurance Out of Network Out of Network $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $250.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 Out of Network Copay BlueCross Blue Shield of TX (Blue Choice - Gold) PPO Monthly Premium Deductible Coinsurance Out of Pocket Maximum Deductibles and Cost Sharing Deductible (Individual) Deductible (Family) Coinsurance Out of Pocket Maximum (Individual) Out of Pocket Maximum (Family) Services Primary Care Visit Specialist Visit In Patient Hospital Services Emergency Room Services Mental / Behavioral Health Imaging (CT/PET Scans, MRIs) Rehabilitative Speech Therapy Rehabilitative Occupational & Physical Therapy Preventative Care Laboratory Outpatient and Professional Services X-ray and Diagnostic Imaging Prescription Drugs Generic Rx Preferred Brand Rx Non Preferred Brand Rx Specialty Drugs $333.69 $1,500 20% $3,500 In Network $1,500.00 $4,500.00 20% $3,500.00 $10,500.00 In Network $10.00 $60.00 $200.00 20% $400.00 20% $10.00 20% 20% 20% $0.00 20% 20% In Network $0.00 $35.00 $75.00 $1.50 Copay per Stay AND Coinsurance Copay per Stay AND Coinsurance Copay Coinsurance Coinsurance Coinsurance Coinsurance Coinsurance Out of Network $3,000.00 $9,000.00 40% $7,000.00 $21,000.00 Out of Network 40% 40% 40% $400.00 20% 40% 40% 40% 40% 40% 40% 40% Out of Network Coinsurance Coinsurance Coinsurance Copay per Stay AND Coinsurance Coinsurance Coinsurance Coinsurance Coinsurance Coinsurance Coinsurance Coinsurance Application Time! Jessica just got married! Help her select health insurance for her family! From the three plans, which plan would be best if they Q3 estimate their medical cost at a low amount and a high amount. Help them determine how much of their risk they should transfer and how much should they retain. Estimated Medical Cost Out of Pocket Expenses Annual Premium Total Costs Low Medical: Which plan should they select, and why? High Medical: Which plan should they select, and why? FirstCare Bronze Low Medical Cost FirstCare Gold High Medical Cost Blue Choice Gold FirstCare Bronze FirstCare Gold Blue Choice Gold Q4 Application Time! Jessica and her husband are working towards a goal of having an adequate emergency fund. What is your recommendation on disability insurance? Jessica Sam From this information what could you tell Jessica/Sam about Disability Insurance? (Overview, Costs, When to Buy, etc.) Coverage Type (dropdown arrow)